-

Notcoin’s price rallied, volume hits $4.54 billion, only behind BTC, ETH, and USDT.

The price could drop to $0.015 as indicators showed that the token was overbought.

As an experienced analyst, I’ve closely monitored Notcoin’s (NOT) recent price surge and the subsequent market dynamics. The token’s impressive volume, which surpassed that of Solana (SOL) and Binance Coin (BNB), was a clear sign of significant investor interest. However, I cannot ignore the potential risks that come with such rapid growth.

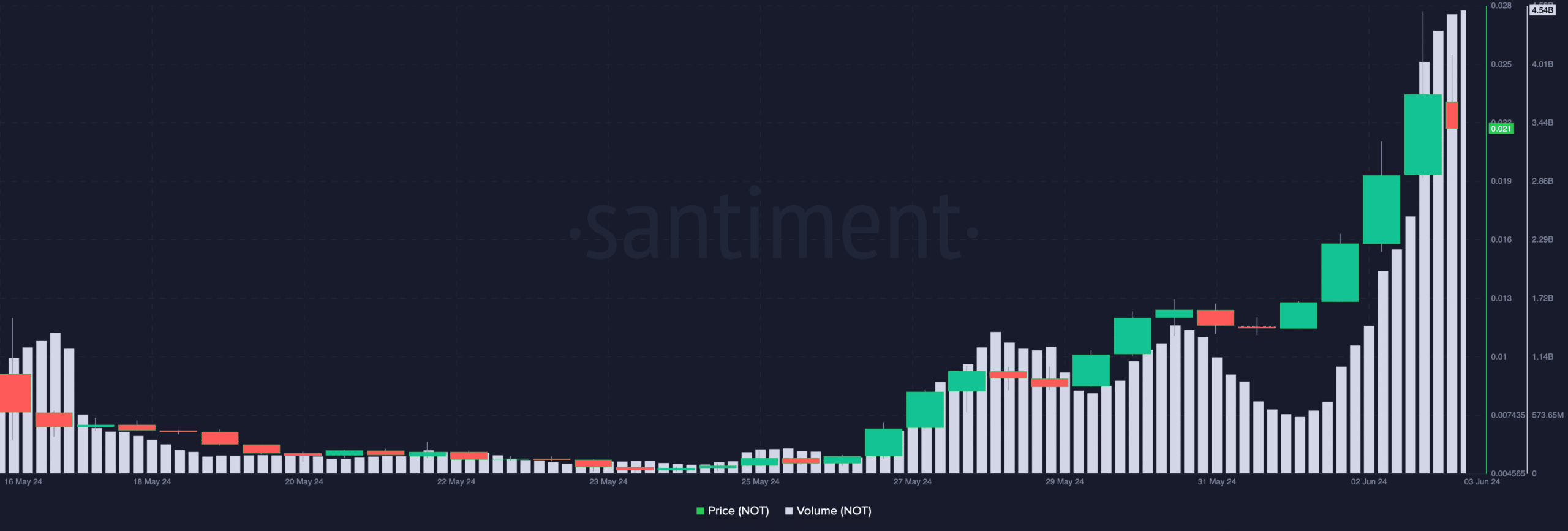

The past 24-hour trading volume for Notcoin (NOT) exceeded both Solana (SOL) and Binance Coin (BNB), largely due to its significant price surge. At present, NOT’s trading volume is reportedly $4.54 billion based on data from Santiment.

Although the price stood at $0.021, marking a significant increase of 287% over the past week, it represented a decrease compared to Notcoin’s prior high of $0.028 reached on June 2nd.

As a crypto investor, I’ve observed that during the same timeframe, BNB and Solana recorded impressive trading volumes of $1.75 billion and $1.72 billion respectively. This volume metric signifies the level of market interest in these tokens. Consequently, the surge in volume for both tokens suggests a significant influx of capital being allocated towards them.

Back-to-back jumps

As a new crypto investor, let me share that I recently came across a digital currency called Notcoin. It was introduced into the market around a month ago. Unfortunately, my fellow cryptocurrency enthusiasts at AMBCrypto previously reported some challenging times for Notcoin during its launch. The selling pressure was quite intense back then.

As a researcher, I came across an article that shed light on the reasons behind NOT‘s price surge and its entry into the top 100 cryptocurrencies by market capitalization. In this particular article, I had made a prediction that NOT would reach a value of $0.01.

As a proud investor in Notcoin, I’ve been thrilled to witness its rapid progress. In just a short time, Notcoin has managed to surpass Bonk [BONK] and join the ranks of the top 60 cryptocurrencies by market capitalization. What an exciting development!

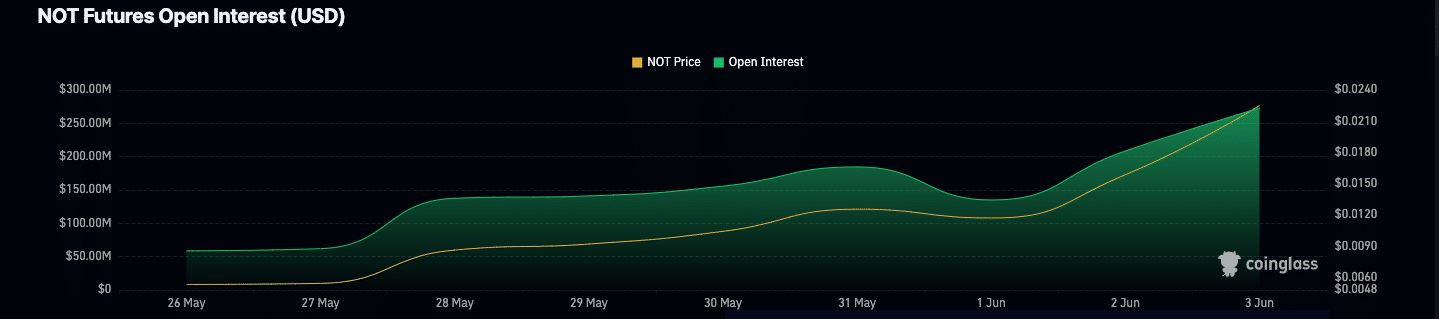

As a crypto investor, I’ve noticed an intriguing development regarding Notcoin over the weekend. The Open Interest (OI) surrounding this token significantly increased. Based on data from Coinglass, the Open Interest reached an impressive figure of $273.02 million.

When the Open Interest (OI) decreases, it indicates that less money is being kept in the market as contracts are getting settled. Conversely, when OI increases, fresh funds are entering the market, introducing new liquidity.

At the given cost, the surge in Open Interest was among the factors preventing NOT from maintaining its upward trajectory. This is due to the fact that escalating Open Interest often bolsters the trend of a cryptocurrency’s price movement.

However, traders, as well as NOT holders might need to be careful.

NOT becomes overbought, hurts traders’ positions

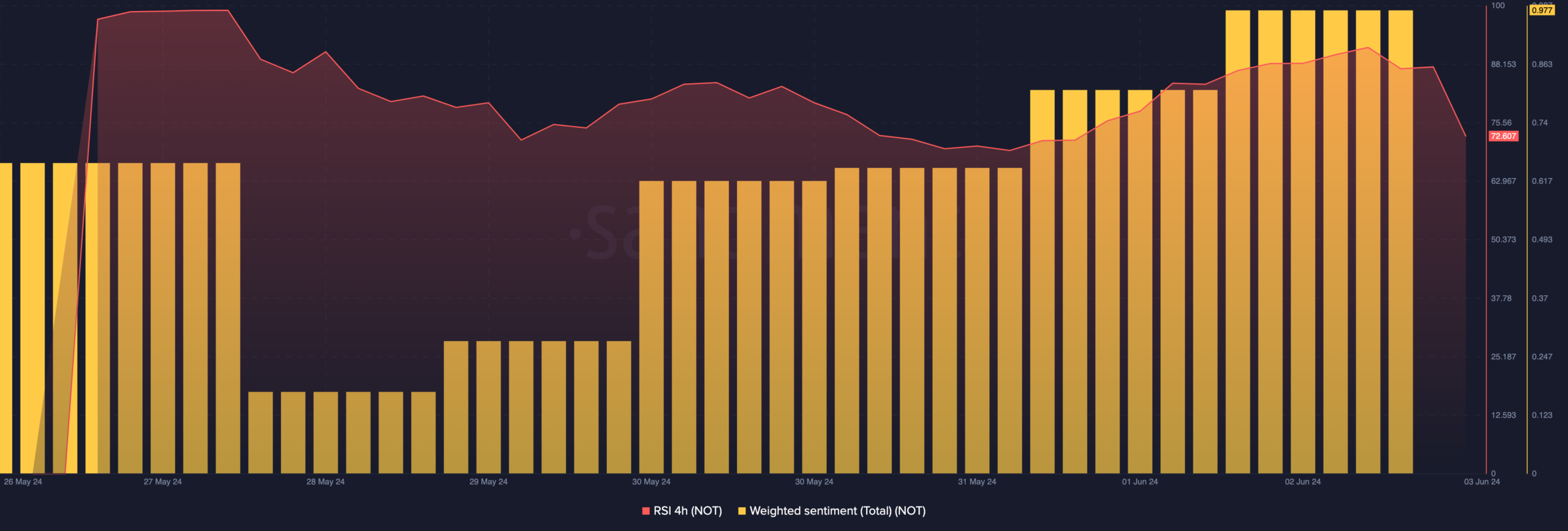

The 4-hour Relative Strength Index (RSI) stood at 72.60. This indicator signifies the asset’s momentum. When the RSI is lower than 30, it suggests that the asset has been oversold.

As a crypto investor, I’ve observed that a reading above 70 on the relative strength index (RSI) for a cryptocurrency suggests it’s overbought. In Notcoin’s case, its RSI was well above this level. Given this situation, I believe there’s a possibility that NOT‘s price might experience a correction and decrease.

Should the downward trend persist, the NOT price may fall as low as $0.015. Conversely, if purchasing interest recovers, the price could rebound and rise again.

As a crypto investor, I’ve noticed that the Weighted Sentiment towards NOT was significantly more positive than usual. This indicates that a large number of market participants were optimistic about the cryptocurrency. However, this level of bullishness seemed unusually high to me. It’s possible that this extreme positivity could be a sign of an impending bear market, validating the bearish prediction I had previously made.

Meanwhile, interesting things were happening with Notcoin in the derivatives market.

Realistic or not, here’s NOT’s market cap in SOL terms

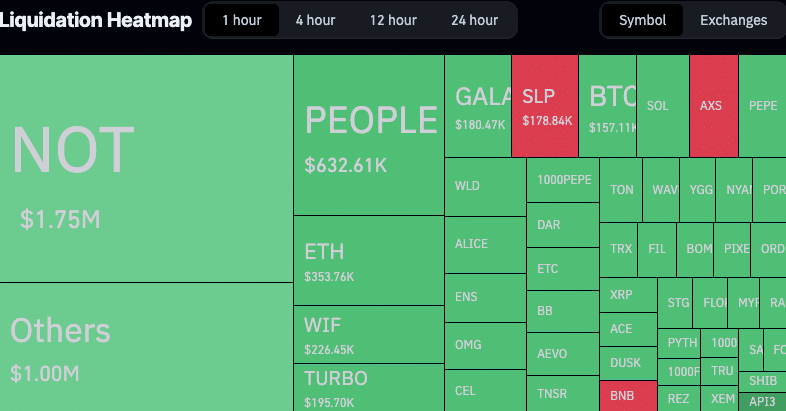

According to Coinglass, NOT was only behind Bitcoin [BTC] in terms of 24-hour liquidation.

During that time frame, I observed significant losses for shorts due to the $23.48 million liquidation. Yet, the situation has shifted within the past hour as the decreasing value of NOT triggered substantial losses of approximately $1.75 million for long positions.

Read More

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Paige DeSorbo’s Sassy Message: A Clear Shade at Craig Conover?

- Discover How Brittany Mahomes Fuels Patrick’s Super Bowl Spirit!

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

2024-06-03 13:11