-

As at press time, Notcoin was among the top gainers in the last 24 hours.

Approximately 70% of addresses holding NOT are profitable.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by Notcoin’s [NOT] recent performance. With over 12% gains in the last 24 hours and a surge in trading volume, it seems that NOT is making a strong statement on the TON blockchain.

In the past 24 hours, Notcoin (NOT) has increased by more than 12%, further cementing its status as the dominant coin on the TON blockchain.

Currently, the price per unit stands at $0.008112, experiencing an impressive 83% increase in trading volume based on data from CoinMarketCap.

The boost in its volume led to a 15% ratio of volume to market capitalization, implying good liquidity, making it a promising cryptocurrency to keep an eye on during the final three months of the year.

At the moment, Notcoin’s price movement is displaying a compact, downward sloping channel formation, known as a falling wedge, which has been in development since its initial phase post-launch.

Four instances have seen the lower trendline serving as a point of resistance rather than support. Yet, in the final descent, the price failed to reach this trendline, suggesting an early spurt of buyers’ activity, potentially signaling an impending price turnaround.

If NOT can break above the upper trendline of this pattern and hold, the price could reclaim the $0.014270 level, representing a potential 153% gain if market conditions improve.

This outburst might signal the beginning of a rebound, as traders expect additional positive movement once the period of stabilization is over.

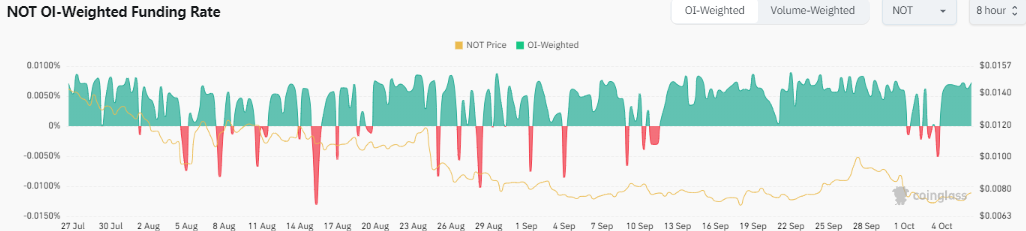

NOT OI-Weighted Funding Rates

Examining further details about Notcoin’s Open Interest (OI) Weighted Funding Rate suggested a change in investor attitudes or opinions.

At the current moment, the reading indicated 0.0072%, suggesting that holders of long positions are prepared to compensate short sellers. This scenario typically strengthens a positive perspective on NOT‘s market trend.

The adjustment in the Funding Rate makes it more likely for Notcoin to burst through the descending triangle pattern, potentially leading to a substantial price surge.

As the Funding Rates turn favorable, bullish momentum may gain traction, driving the price higher.

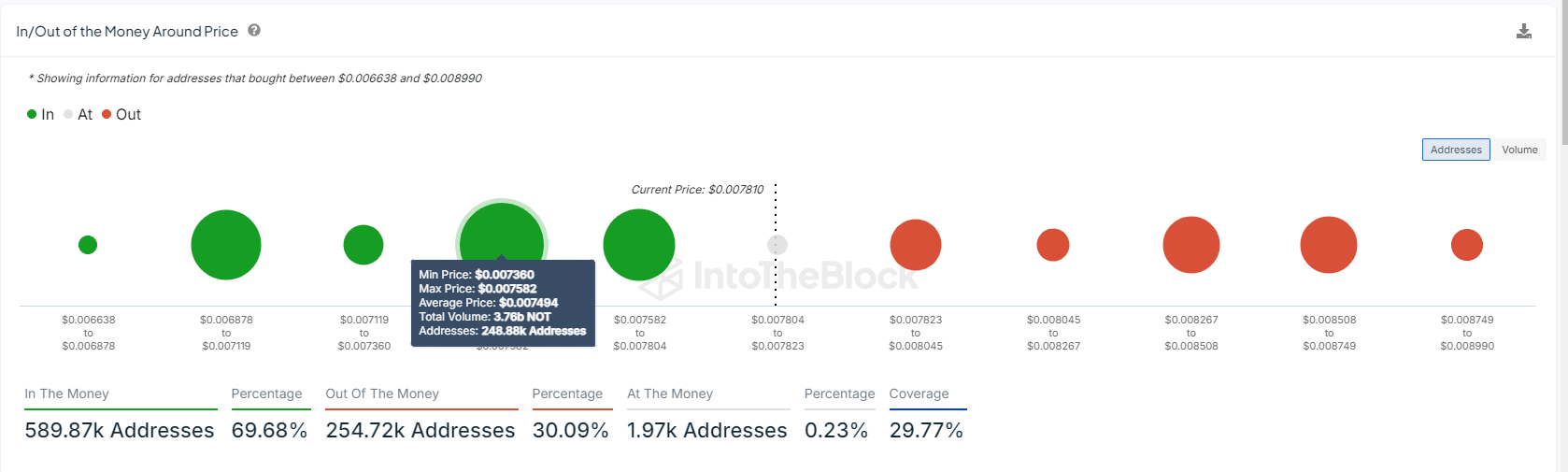

In/Out of the Money around current price

To sum up, we found that about 70% of wallets containing NOT had made a profit, whereas just 30% were in a loss position, given the current price levels.

The proposed ratio implied that traders were probably going to maintain their investments, seeking more gains since optimistic market feelings strengthened during the final three months of the year.

Keep an eye on the crucial range, which lies between approximately $0.007360 and $0.007582. This area is where a large number of profitable transactions tend to occur.

If 248,000 addresses do not fall within the range of 3.76 billion, this situation might offer a strategic opportunity for traders who want to benefit from a potential price surge as the market breaks out of its current limits.

The latest trend in Notcoin’s behavior, coupled with advantageous market situations and robust technical signals, hinted at the potential for it to burst out of its current holding pattern.

Read Notcoin’s [NOT] Price Prediction 2024–2025

If this happens, it’s possible that the price might not regain levels like $0.014270 again.

As a crypto investor, I’m excited about the improving liquidity conditions and the growing optimism in the market. The upcoming weeks are shaping up to be decisive for the potential path of NOT, with bullish momentum potentially setting its course.

Read More

2024-10-07 23:36