This week, NVIDIA temporarily surpassed a market value of four trillion dollars, making it the initial company to reach such a figure. The tech behemoth achieved this milestone after experiencing a 2.5% growth in stock price at its peak on July 9, 2025.

The valuation of NVIDIA has since dropped to around $3.97 trillion.

In the year 2025, NVIDIA found itself lagging behind both Microsoft and Apple. However, consistent progress propelled NVIDIA ahead of other leading tech companies.

It’s anticipated that growth will persist for NVIDIA. This tech giant supplies computational power for numerous significant AI tools, a venture that has turned out to be quite profitable for the manufacturer of graphics processors (GPUs).

How NVIDIA beat Microsoft and Apple

As a tech-savvy individual, I can’t help but marvel at NVIDIA’s meteoric rise to a staggering $4 trillion market cap. This phenomenal growth is primarily fueled by their undisputed leadership in the AI sphere. In today’s competitive landscape where companies are scrambling to embed AI into devices ranging from computers to virtual assistants, the thirst for computational power is insatiable. NVIDIA, with its cutting-edge solutions, seems to be quenching this thirst quite effectively.

These tech giants like Microsoft, Meta (formerly Facebook), OpenAI, Google, among others, frequently launch AI-enhanced products and seamlessly incorporate AI into their pre-existing service offerings.

In the year 2024, it was said that NVIDIA had Microsoft as its most significant client in terms of spending, surpassing companies like Meta, Google, and other major tech firms.

In 2022, ChatGPT was introduced, igniting a competition among companies to advance artificial intelligence (AI). Since the release of OpenAI’s AI-driven tool, NVIDIA’s worth has skyrocketed by a factor of fifteen.

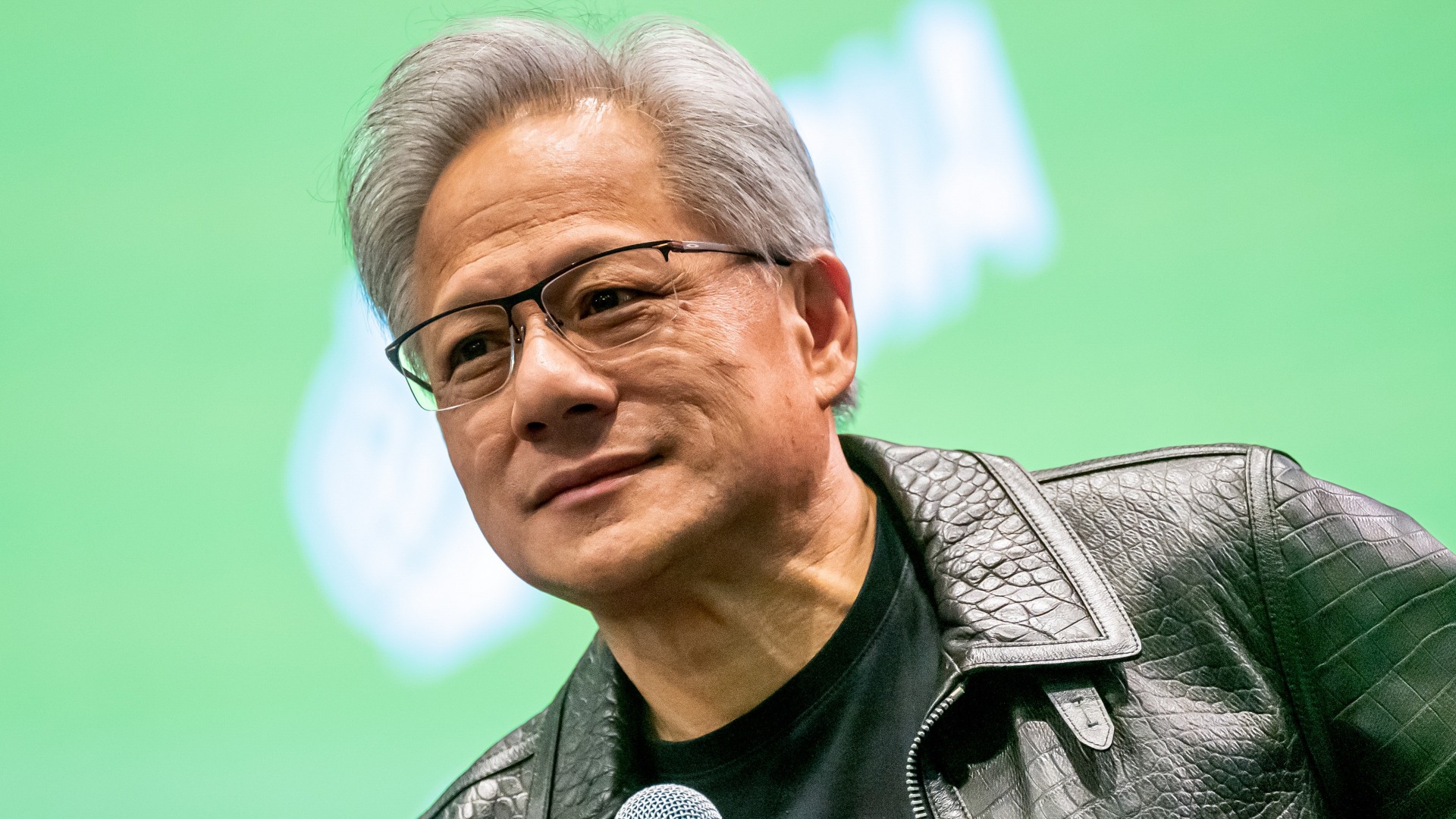

In simple terms, Nvidia’s AI infrastructure is experiencing exceptionally high global demand. The generation of AI inference tokens has increased dramatically, by ten times, within the past year alone. As more and more AI agents become commonplace, the need for AI processing power will increase at an even faster pace, according to NVIDIA CEO Jensen Huang during a discussion on financial results in May 2025.

In simpler terms, NVIDIA not only experienced an early boost but significantly increased its value. By February 2024, it had achieved a market capitalization of $2 trillion, and less than four months later, it surpassed $3 trillion.

Currently, NVIDIA’s share price hovers around $163, but this figure may change daily. This year, NVIDIA shares have experienced a rise of approximately 22%.

The price of NVIDIA shares decreased slightly, reducing the company’s total worth to almost $4 trillion. However, considering current market patterns, there’s a good chance that NVIDIA will surpass this significant threshold once more.

Over the past few years, it’s not just NVIDIA’s stock that has seen growth; the company itself has significantly flourished. In the fiscal quarter concluding in April 2025, NVIDIA reported a revenue of $44.1 billion. This represented a substantial 69% year-on-year rise for this tech titan.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Borderlands 4 Players Get a New Look at Exo-Soldier Vault Hunter

2025-07-10 16:39