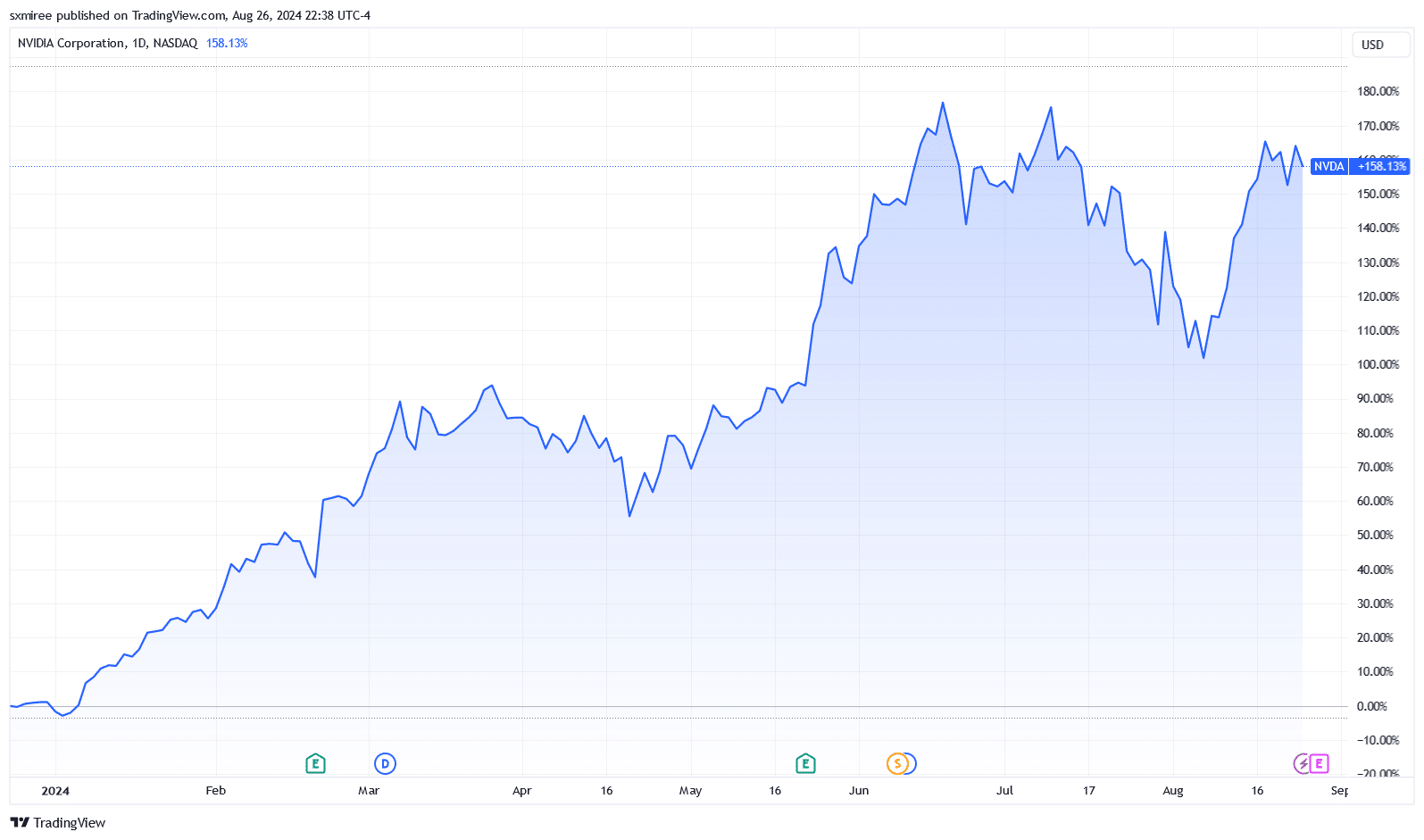

- Nvidia’s success has previously sparked moves in GPU and AI-focused crypto tokens in the spot market.

- Upcoming US economic data could fuel prevailing sentiment and add uncertainty to the broader digital asset landscape.

As a seasoned analyst with a knack for deciphering market trends and a background steeped in economic forecasting, I find myself at the precipice of an intriguing week ahead. The imminent Nvidia Q2 earnings report and critical US economic data releases promise to stir the pot, potentially fueling volatility and uncertainty in the broader digital asset landscape.

This week, investors worldwide are eagerly awaiting significant quarterly earnings reports and essential U.S. economic data disclosures. Meanwhile, cryptocurrency traders keep a keen eye on these outside influences, as they have the potential to stir up market instability during this crucial period, marking the end of August.

Nvidia Q2 earnings

This week, on August 28, we’re anticipating Nvidia to release their quarterly financial summary, wrapping up the period ending July 31. The earnings data could potentially make a significant difference for GPU and AI-related cryptocurrencies, which have primarily been fueled by excitement surrounding their underlying technologies.

A business situated in California specializes in creating, producing, and distributing Graphics Processing Units (GPUs) for cryptocurrency mining as well as other demanding tasks.

It stands out as a key player in advanced computing solutions, where it intersects with fast computing, artificial intelligence, and blockchain technologies.

A strong second-quarter earnings statement from the technology behemoth is expected to spark increased enthusiasm among investors about these technological advancements. Moreover, favorable earnings could be interpreted as evidence of ongoing expansion in industries making use of these technologies, thereby strengthening associated stories and beliefs.

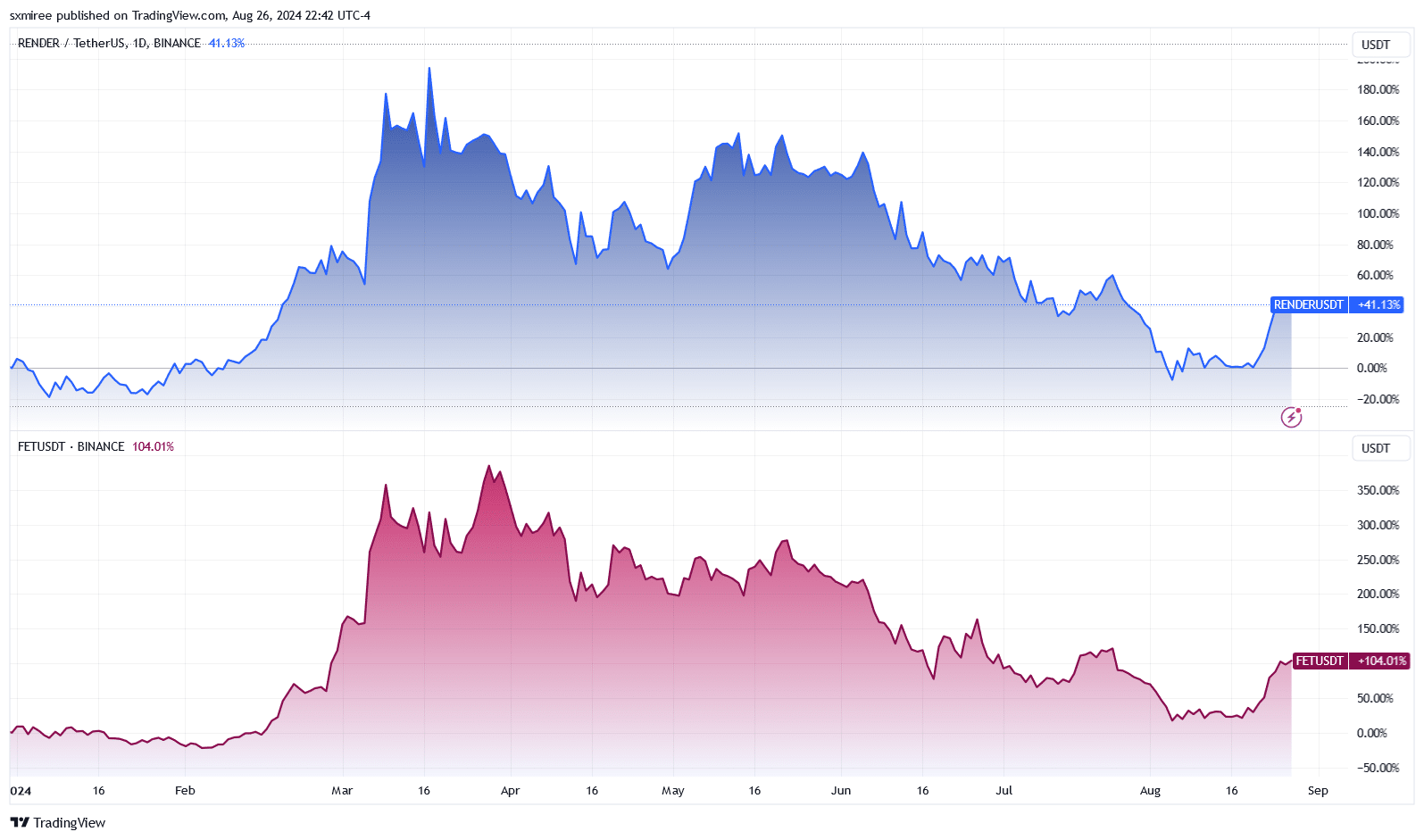

Such positive sentiment would bolster prices of tokens like Artificial Superintelligence Alliance [FET], RENDER and TAO due to increased speculation.

If a report shows lower profits than anticipated, it might instead undermine investors’ trust in Artificial Intelligence’s part in technology’s future. This uncertainty could cause a shift in overall market feelings, possibly triggering a wave of selling not only in tech shares but also in associated cryptocurrencies.

Case for Artificial Superintelligence Alliance, Render

The Artificial Superintelligence Alliance’s token (ASI) has made a strong comeback in August, consistently gaining ground and reaching $1.05 again just last week.

In the past week, the Asian Stock Index (ASI) has surged by an impressive 45%, making it one of the leading performers. Simultaneously, RENDER has also shown significant growth, increasing by approximately 33.81%.

In mid-March, Render price rose from $6.89 to a 2024 high above $13 during a window coinciding with the five-day NVIDIA’s GTC 2024 AI conference, which concluded on March 21.

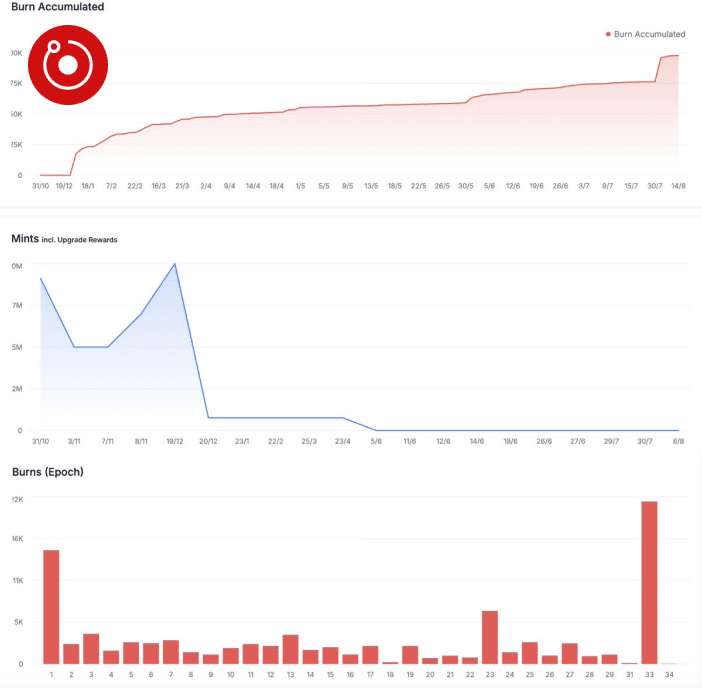

Despite some dip phases experienced by RENDER, the data suggests a positive trend in its usage.

In summary, they’ve kept a strong position in the market and continue to be intriguing, especially for investors who are wagering on the possible advancements of the technology they embody.

US economic data to shape market’s next move

Events on this week’s U.S. economic schedule could potentially spark increased market turbulence, going beyond just the release of corporate earnings reports.

In August, the retail cryptocurrency market has shown vulnerability to both economic strains and political manipulations, a trend that seems likely to persist.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-27 10:16