-

BTC and ETH saw a surge in long liquidation volume with the price drop in the last trading session.

The assets have started the new month with positive moves.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I find myself observing the recent fluctuations of BTC and ETH with cautious optimism. The surge in long liquidation volumes during the last trading session was a reminder of the volatile nature of this market, but the absence of a significant sell-off indicates resilience and potential for recovery.

At the end of September, Bitcoin (BTC) and Ethereum (ETH) showed some turbulence, as both digital currencies experienced drops in value. The market was largely controlled by short sellers, leading to increased long position liquidations.

Even though there have been declines, the lack of a major selling spree suggests a promising outlook for the market.

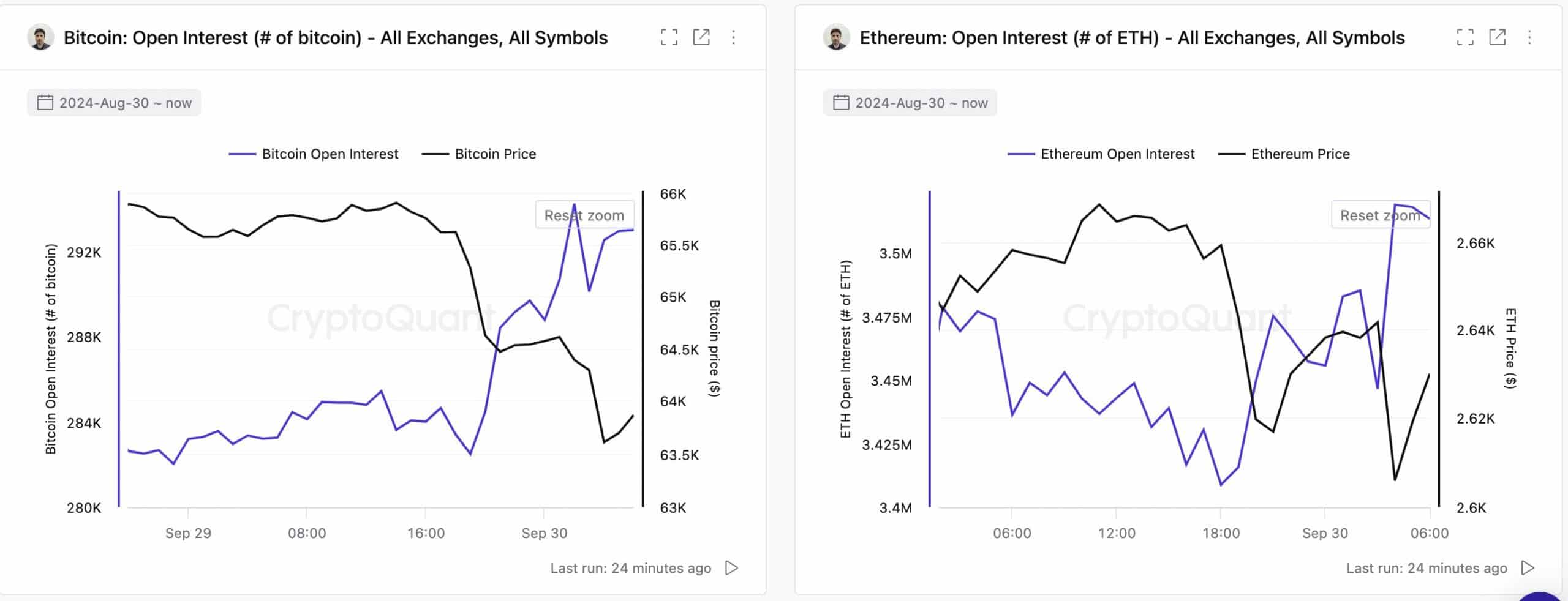

Bitcoin and Ethereum open interest declines

During the most recent trading period, Bitcoin and Ethereum’s open interest (OI) experienced significant decreases, as reported by CryptoQuant. The open interest for Bitcoin specifically dropped from approximately $18.6 billion to $18.1 billion. This reduction suggests that traders were closing their futures contracts, signaling a potential decrease in market activity.

A diminished Open Interest (OI) usually indicates less market liquidity, reduced volatility, and decreased enthusiasm for derivative trades. This situation could possibly result in a scenario where both long and short positions are forced to buy or sell, respectively, due to insufficient counterparties – a potential long/short squeeze.

Just like Ethereum, its open interest experienced a minor decrease, but not as substantial as Bitcoin’s. Currently, Bitcoin’s open interest has recovered to approximately $18.3 billion, while Ethereum’s open interest has climbed to about $9.4 billion, indicating increased market activity once more.

Bitcoin and Ethereum prices follow OI trends

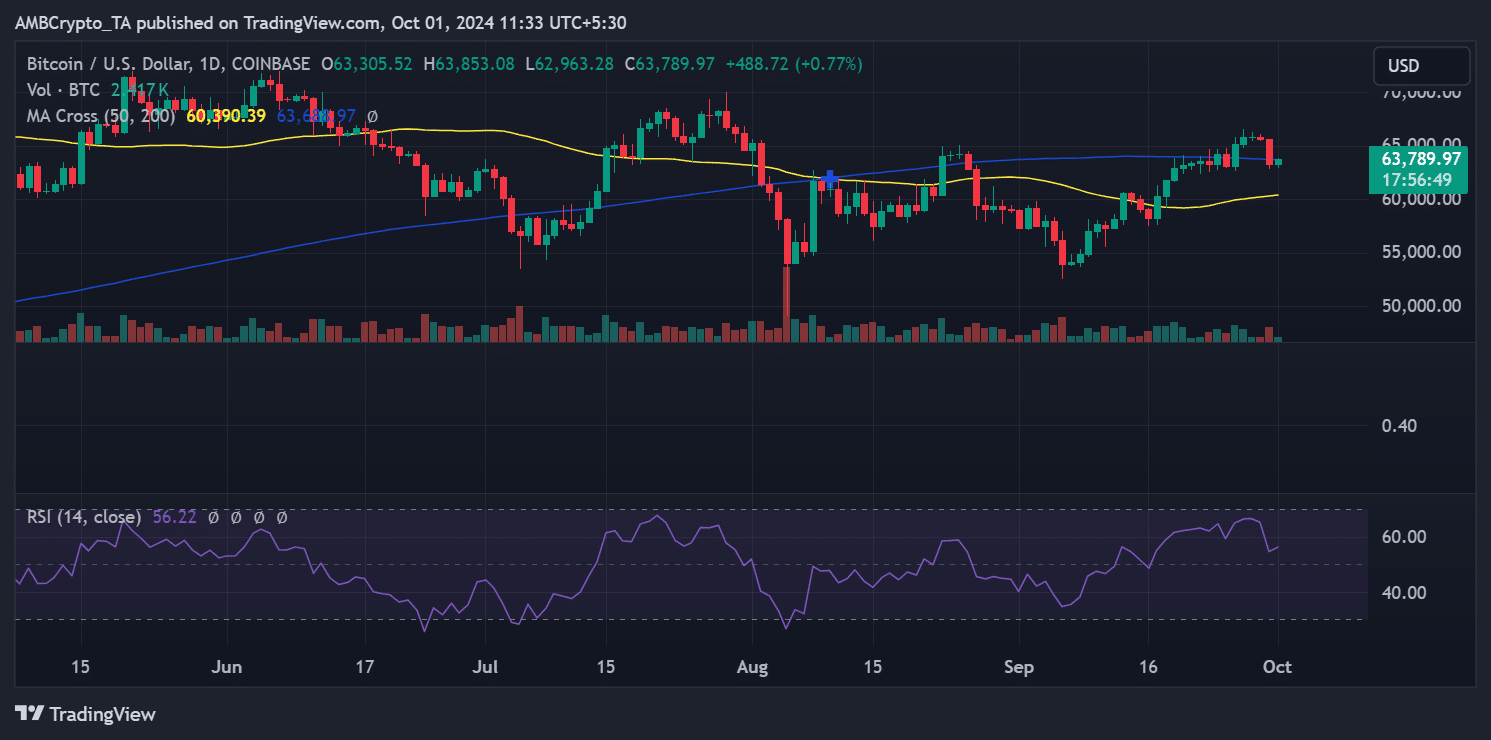

The decrease in open trades significantly influenced the value of both Bitcoin and Ethereum. Specifically, Bitcoin saw a drop of approximately 3.50%, causing it to plummet from $65,600 to $63,301, sliding under its 200-day moving average in the process.

In a similar vein, Ethereum decreased by 2.13%, going from $2,657 to $2,601. Despite this, it remains under its 200-day moving average, yet it’s still above the 50-day moving average.

Currently, both Bitcoin and Ethereum are exhibiting a minor recovery. At the moment, Bitcoin is being traded at approximately $63,789, representing a 0.7% rise, while Ethereum has seen a 1% growth and is being exchanged around $2,639.

Exchange flows remain stable

Although there have been recent decreases, there hasn’t been a major wave of Bitcoin being sold off. The data from CryptoQuant suggests that Bitcoin has experienced a net outflow from exchanges to personal wallets, implying a more even distribution of Bitcoin between these two locations.

Meanwhile, there was a small surge in Ethereum moving towards exchanges, with approximately 14,000 Ether transferred during the recent trading period.

Contrarily, the amount provided didn’t lead to a significant sell-off. At present, there’s a reversal in the trend, showing that more than 23,000 Ether is being removed from exchanges, indicating a decrease in selling pressure.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

Despite experiencing significant drops towards the end of September, Bitcoin and Ethereum’s minimal sell-off and subsequent price recovery indicate a market that remains relatively steady.

It appears that investors are holding onto their investments rather than selling them quickly, suggesting a possible rebound could be on the horizon in the short term, based on the patterns of open interest and trading activity.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-10-01 17:11