In 2025, token supply management strategies-cryptocurrency’s latest obsession with pretending money is a game show-became increasingly important tools to enhance value and investor appeal. OKX, one of the leading cryptocurrency exchanges, demonstrated this through its OKB token burn plan. 🐍

The question is why this burn strategy enabled OKB to outperform other tokens in the past month. The following analysis highlights the core differences. Spoiler: it’s less about math and more about marketing. 🤷♀️

Key Differences in the OKB Token Burn

Data from CryptoBubble shows OKB recorded the highest growth among altcoins in the past month. Because why not? Everyone else was busy crying in their meme coins. 🤡

The token gained nearly 300%, surpassing other strong performers such as LINK, MNT, and AERO. Honestly, those tokens probably just panicked and bought OKB at the bottom. 🚀

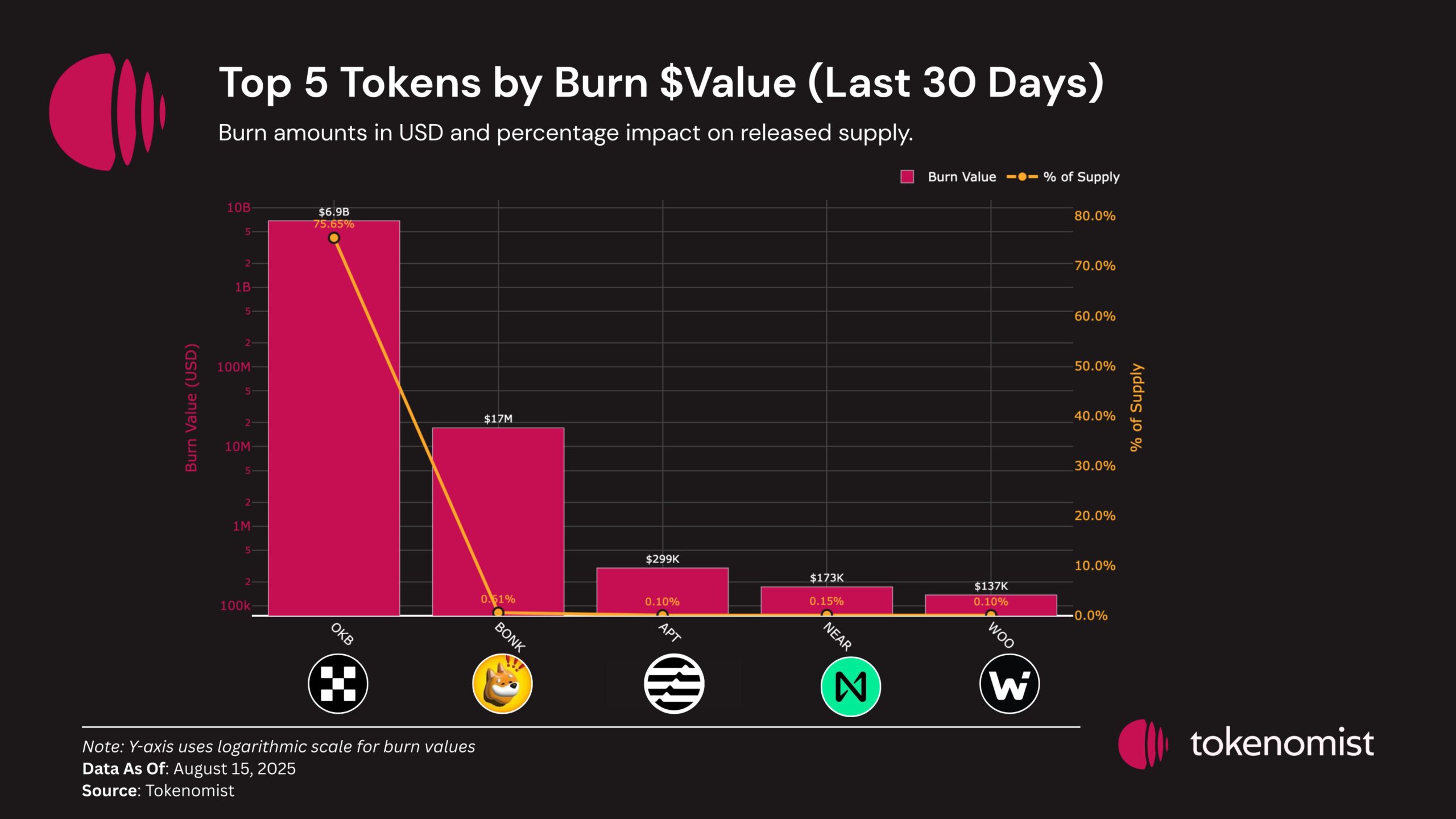

Unlike routine burns, the OKB burn was positioned as a near redefinition of tokenomics. OKX went full Scrooge McDuck and threw 65,256,712 OKB into the crypto equivalent of a bonfire, permanently removing them and reducing the fixed supply to 21 million. 🔥

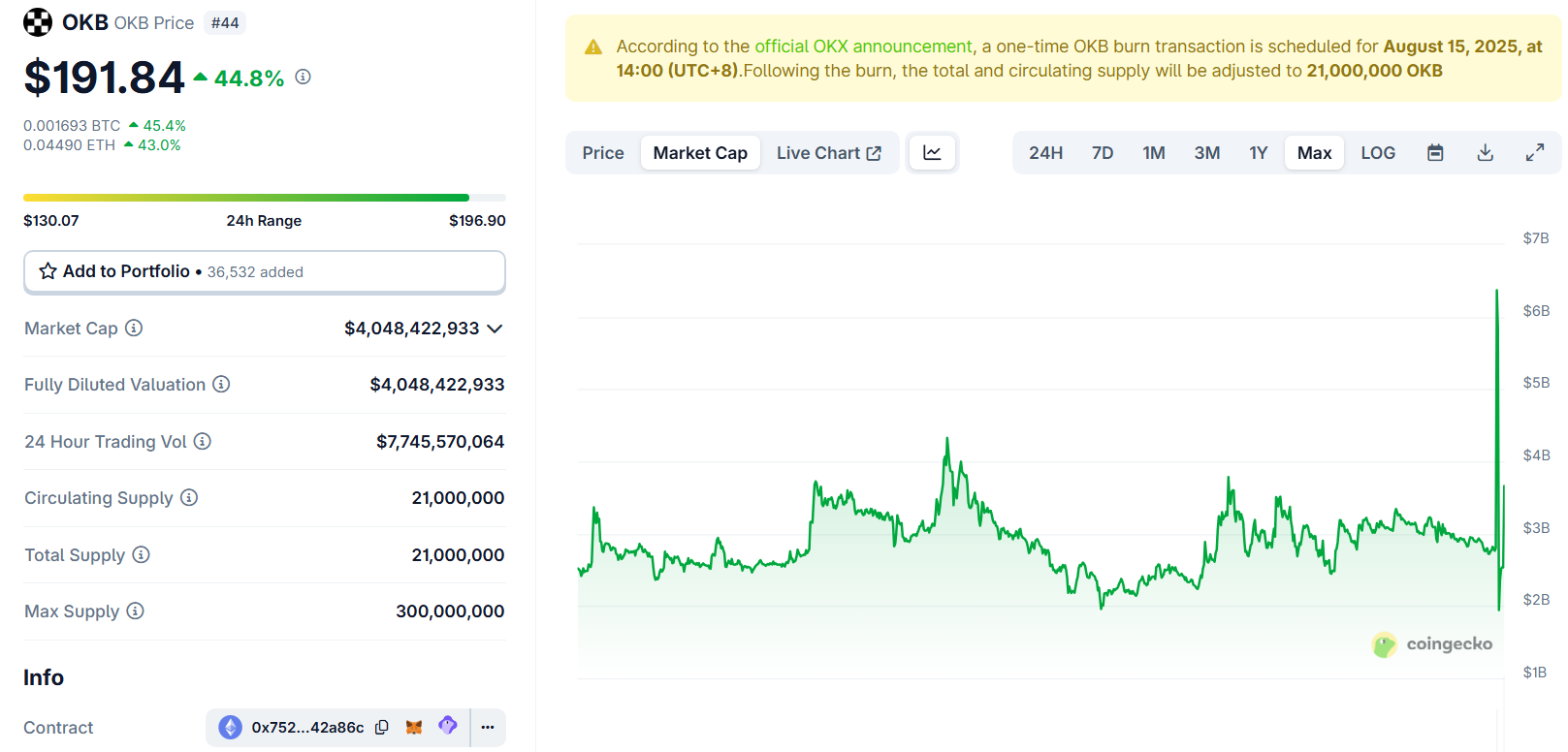

This supply adjustment allowed the market to reprice the token’s capitalization. The timing proved critical, as it coincided with a positive period in August when analysts held high expectations for an altcoin season. Because nothing says “trust us” like burning tokens on a holiday. 🎉

Following the burn, OKB’s supply is now fixed at 21 million. This figure mirrors Bitcoin’s maximum supply, creating a psychological link between OKB and the market’s benchmark asset. The move functions as a marketing factor, encouraging investors to compare OKB to Bitcoin when valuing it. Because who needs innovation when you can just steal Bitcoin’s lookbook? 🕶️

Other projects have adopted buyback-and-burn models, but without a fixed supply cap. For instance, Tron has burned 7.1 billion TRX since launch, including 820 million in 2025 alone, yet TRX does not have a maximum limit. Because of course not-why cap your losses? 💸

Smaller, periodic burns without a capped supply tend to dilute the impact over time. By contrast, OKX’s removal of 65.26 million OKB was decisive, introducing immediate deflationary pressure and driving a sharp price increase. Because nothing says “I’m rich” like making your token artificially scarce. 🎩

These structural differences helped OKB quadruple in value in August. Or maybe it’s just the market’s collective FOMO. Either way, someone’s buying. 🛒

Will OKB Keep Rising?

An assessment of OKB’s potential requires looking beyond price movements to changes in market capitalization. Because prices lie, but market cap tells the truth… or does it? 🤔

After the burn, data from CoinGecko indicates OKB’s current market capitalization equals its fully diluted valuation, at just over $4 billion. Which is either a miracle or a numbers game. 🎲

Historically, capitalization fluctuated around $3-4 billion before and after the burn. This indicates that the price rally did not necessarily reflect a corresponding increase in total value. Because why let facts ruin a good story? 📚

“OKX cut total OKB supply from 300 million to 21 million. The price surged 3x, but history shows token burns don’t automatically create sustainable value or liquidity,” Bitcoin Suisse AG commented. Because nothing says “expertise” like a financial institution reminding you that burning tokens isn’t a magic spell. 🧙♀️

BNB’s long-term gains stemmed not only from burns but also from adoption within the Binance Chain ecosystem. Similarly, TRX maintained long-term growth due to rising demand for USDT transactions. So, maybe OKB needs to stop burning and start building? Or just keep burning. It worked before. 🔥

A key competitive advantage for OKB may lie in OKX’s ecosystem, particularly with X Layer. X Layer, a public zkEVM-based network developed in partnership with Polygon, launched in 2023. OKB remains the sole gas and native token for X Layer. Because nothing says “future of finance” like a token that’s both gas and a stock. 🚀

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Best Werewolf Movies (October 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

- Pride and Prejudice’s latest adaptation has ‘stubborn, vulnerable’ Elizabeth Bennet, reveals BAFTA winner

2025-08-21 23:12