- A 2012-era Bitcoin whale resurfaces, moving $35.8 million in BTC.

- Early adopters’ movements highlight their enduring influence on market dynamics.

As a seasoned analyst with over two decades of experience in financial markets under my belt, I find myself constantly amazed by the enigmatic nature of Bitcoin and its early adopters. The recent activity of the Satoshi Nakamoto-era whale, moving an impressive $35.8 million in BTC, serves as a stark reminder of just how much these pioneers have shaped the cryptocurrency landscape.

As an analyst, I’ve recently observed a significant stir within the Bitcoin community due to the reappearance of a whale from the Satoshi Nakamoto era. This wallet, inactive for over a decade, contains approximately 400 BTC, which at the time of its acquisition was equivalent to $2,091.

Such actions by early Bitcoin adopters bring up concerns regarding their intentions and potential outcomes, as many of them owned Bitcoins during the period when the mysterious inventor of Bitcoin, Satoshi Nakamoto, was still involved.

Satoshi Nakamoto era BTC whale resurfaces

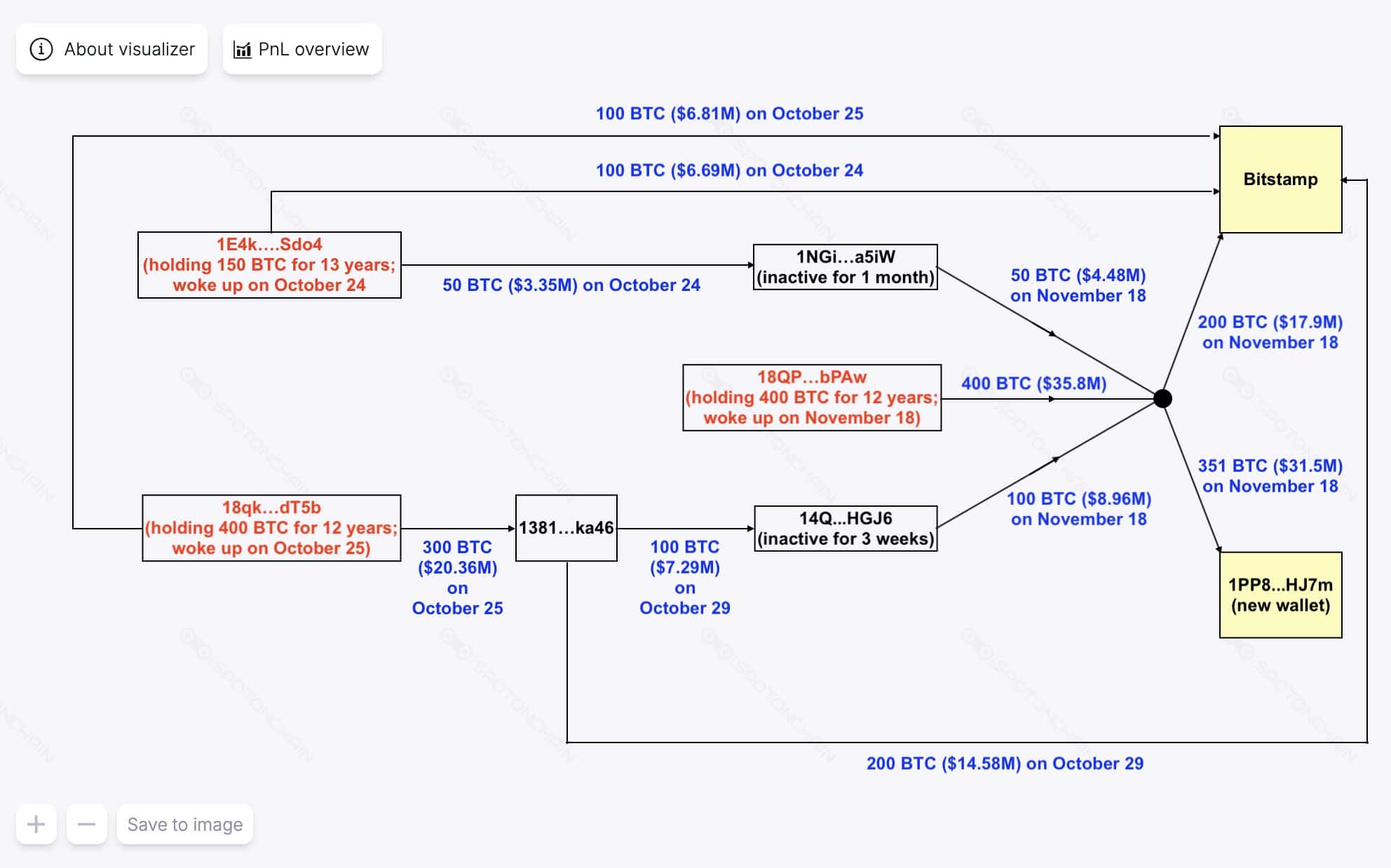

As reported by Spot On Chain, a previously inactive Bitcoin investor recently transferred 400 BTC, which is currently worth approximately $35.8 million. This individual initially purchased these holdings for only $2,091, resulting in an extraordinary profit margin of over 1,712,099%.

As an analyst, I’ve uncovered some intriguing on-chain insights. Specifically, I’ve noticed that a significant player (a whale) moved 200 Bitcoin, equivalent to approximately $17.9 million, into the esteemed cryptocurrency exchange, Bitstamp – one of the industry’s pioneers. Simultaneously, this same entity transferred 351 Bitcoin, roughly $31.5 million, into a newly established digital wallet.

As someone who has been following the cryptocurrency world since its inception, I find it fascinating to see early Bitcoin adopters resurfacing and repositioning their holdings. Having witnessed the early days when Satoshi Nakamoto was still active online, I can attest that this wallet, long inactive for over a decade, takes me back to those exciting times. The resurgence of these early adopters reminds us all of the potential wealth hidden within the digital world and serves as a testament to the enduring appeal of Bitcoin.

Initially, pioneers who embraced Bitcoin early on significantly contributed to its expansion by fostering its acceptance and fortifying the system during its initial development. As they resurface today, their return sparks curiosity and could introduce unpredictability to the current financial landscape.

Dormant wallet movements spark market vigilance

People usually pay close attention and have mixed feelings when wallets that haven’t been active for a long time make moves, like the 200 BTC deposited into Bitstamp. Such big transfers to exchanges can spark worries about possible sell-offs, which might momentarily impact Bitcoin’s price negatively.

Nevertheless, Bitcoin’s price has demonstrated robustness as solid demand has absorbed these incoming funds. Moreover, it’s been observed that when substantial amounts – such as 351 BTC in this instance – are transferred to personal wallets, it might indicate ongoing long-term retention rather than a desire to sell off.

These actions frequently cause increases in on-chain measurements such as transaction count and wallet usage, demonstrating the market’s heightened attention towards these occurrences.

Sell-off risk vs strategic holding

As a crypto investor, I’ve noticed that when dormant “whales” start moving their assets, it usually sets off two main scenarios. If they decide to sell off large quantities, it could flood the market with supply, which might lead to price drops if the demand doesn’t keep pace. But in thriving markets where institutional interest and liquidity are strong, such events tend to be less common due to the constant demand from these institutions.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Instead of moving funds to a different wallet being a sign of immediate selling, it can also indicate strategic positioning or long-term holding, which demonstrates faith in Bitcoin’s future worth. This dual nature highlights the complexity surrounding whale activity – investors need to consider both short-term selling pressure and the potential for further accumulation.

Regardless of the situation, these initial actions by pioneers serve to strengthen their power to shape market directions and sway investor opinions substantially.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-19 16:08