-

ONDO saw 14% gains but faced an overhead hurdle near the $1 level.

Despite the recovery, the overall market sentiment on ONDO was still weak.

As an experienced analyst, I’ve closely monitored Ondo Finance [ONDO] and its recent price movements. Despite the impressive 14% recovery gains since July 8th, ONDO still faces an overhead resistance hurdle near the $1 level.

Ondo Finance (ONDO) experienced a 14% surge in growth, mirroring Bitcoin‘s [BTC] market bounce back, starting from July 8th.

On the 10th of July, Ondo Finance, a prominent player in the tokenized securities market, achieved a 4% return. This success came in conjunction with their integration with Pyth Network.

The partnership allows Ondo’s USDY/USD price feed to be featured across over 60 blockchains.

So, with over 10% gains netted since Monday, could ONDO bulls profit more, or is the steam over?

What’s next for bulls?

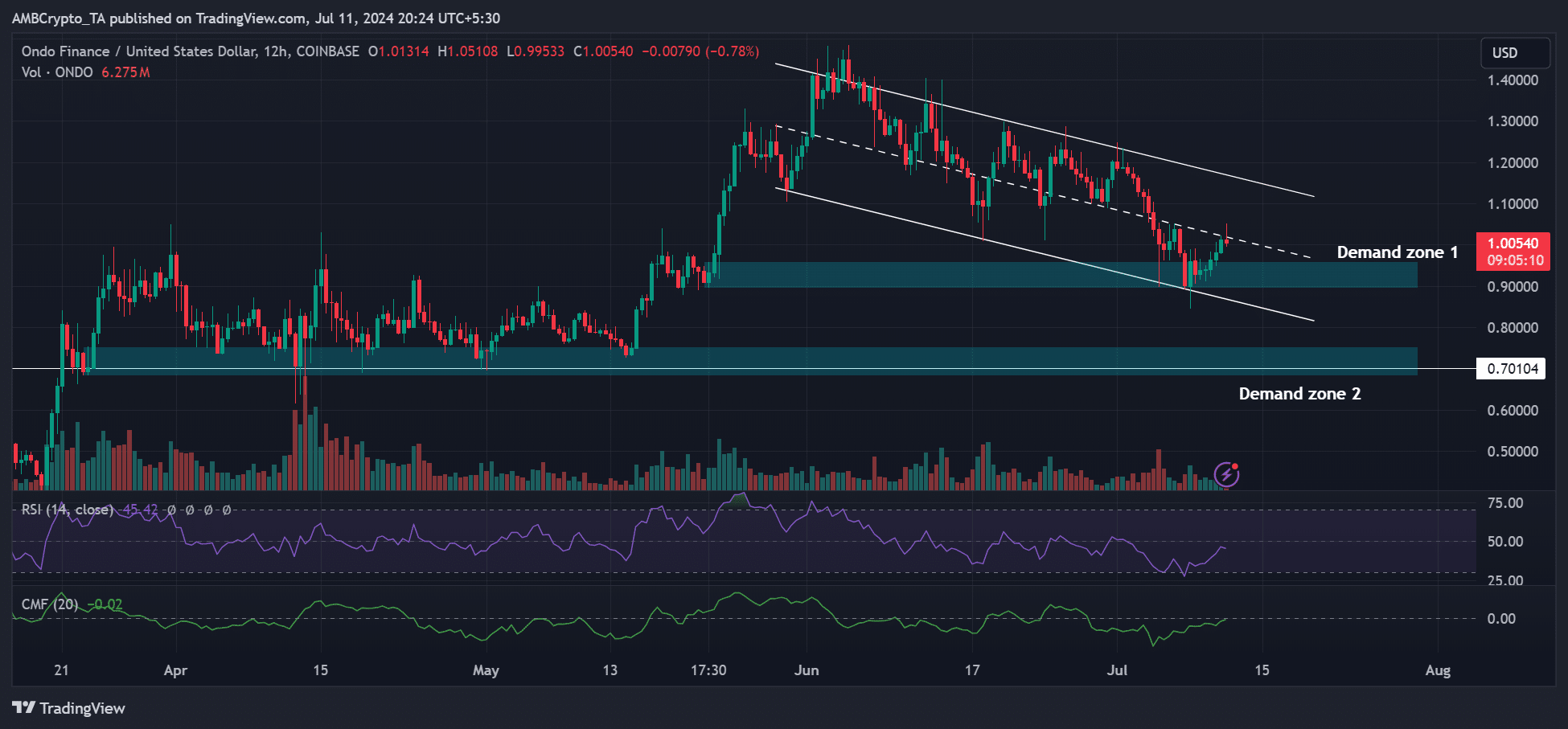

As a crypto investor, I’ve noticed that ONDO has been making a strong comeback since hitting its first support level and key buy area at $0.9. However, it encountered some obstacles and hasn’t yet managed to break through the resistance as of now.

According to the analysis of the price chart indicators at the current moment, the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) show a neutral reading.

The purchasing demand and financial influx grew significantly, fueling additional strength for the price increase.

At the moment of reporting, the price of ONDO had not surpassed the $1 mark on the 12-hour chart. Consequently, based on a larger timeframe perspective, the market structure for ONDO had not transitioned into a bullish trend yet.

As a crypto investor, I’m keeping a close eye on ONDO. If Bitcoin fails to regain the $60,000 mark in the near future, it’s likely that ONDO will revisit its demand zone around 1. This means that the price of ONDO could potentially drop back down to this level before continuing any upward momentum.

As a market analyst, I would interpret this scenario as follows: If ONDO manages to close above the $1 mark, bulls may seize the opportunity to gain additional leverage in the market and aim for a potential price increase of around 10%. Their next target could be the resistance level at the high end of the descending triangle.

Ondo Finance’s weak sentiment

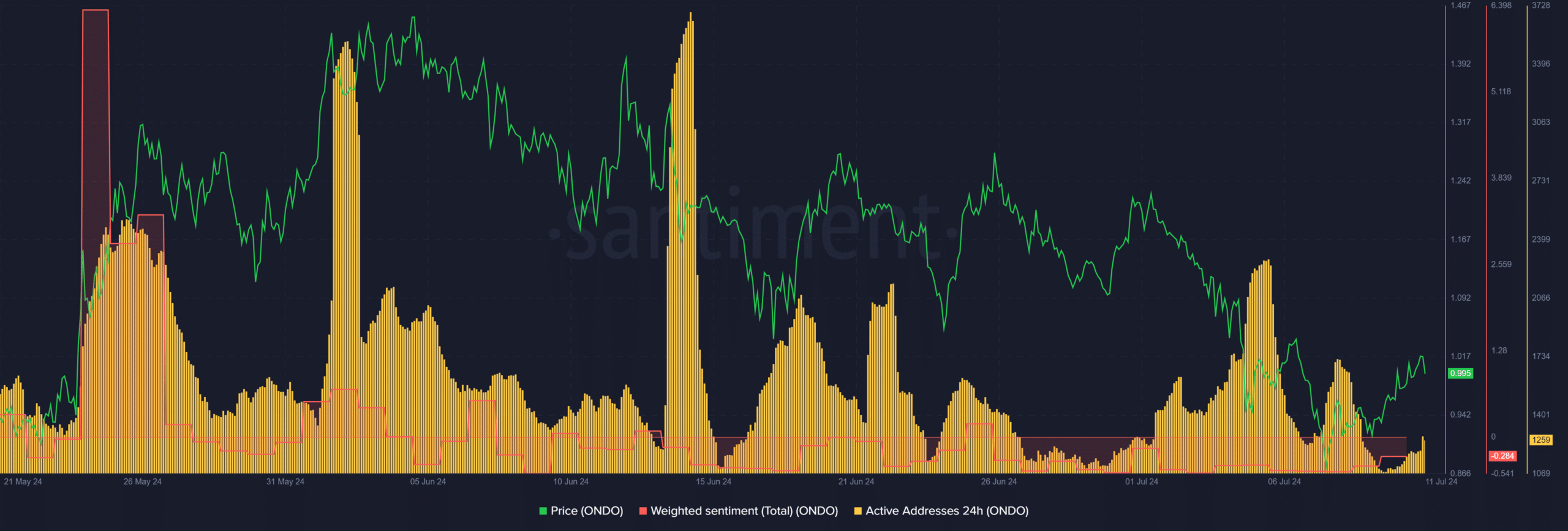

Based on Santiment’s data analysis, the bullish trend for ONDO‘s market could potentially be postponed due to weak investor sentiment indicated by a negative Weighted Sentiment score.

Read Ondo Finance’s [ONDO] Price Prediction 2024-25

As a researcher studying ONDO‘s transaction data, I’ve noticed a substantial decrease in daily active addresses marked by the yellow line on the chart since the 5th of July. This decline implies that fewer users or addresses have been engaged in ONDO transactions recently. Consequently, this trend could potentially hinder the expected upward momentum in ONDO’s transaction activity.

However, a bullish BTC could invalidate the above thesis.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-07-12 10:15