-

ONDO confirmed falling wedge breakout, surging by 4.31% to $0.7122.

Market sentiment seemed cautious as on-chain data flashed mixed signals

As a seasoned crypto investor with a knack for deciphering market trends and an eye for spotting hidden gems, I must say that ONDO‘s falling wedge breakout has piqued my interest. The 4.31% surge to $0.7122 is certainly a promising sign, hinting at a possible shift from downtrend to uptrend. However, the cautious market sentiment and mixed on-chain signals have me treading carefully.

The financial asset Ondo (ONDO) has broken out of a falling wedge on its daily chart, rising by 4.31% to reach $0.7122 at the moment. This pattern suggests a possible transition from a downtrend to an uptrend, implying that ONDO could experience a prolonged price increase.

Is it likely that this surge in ONDO‘s price will persist, potentially leading to even more growth in the near future? Will it pave the way for additional increases over the next few days?

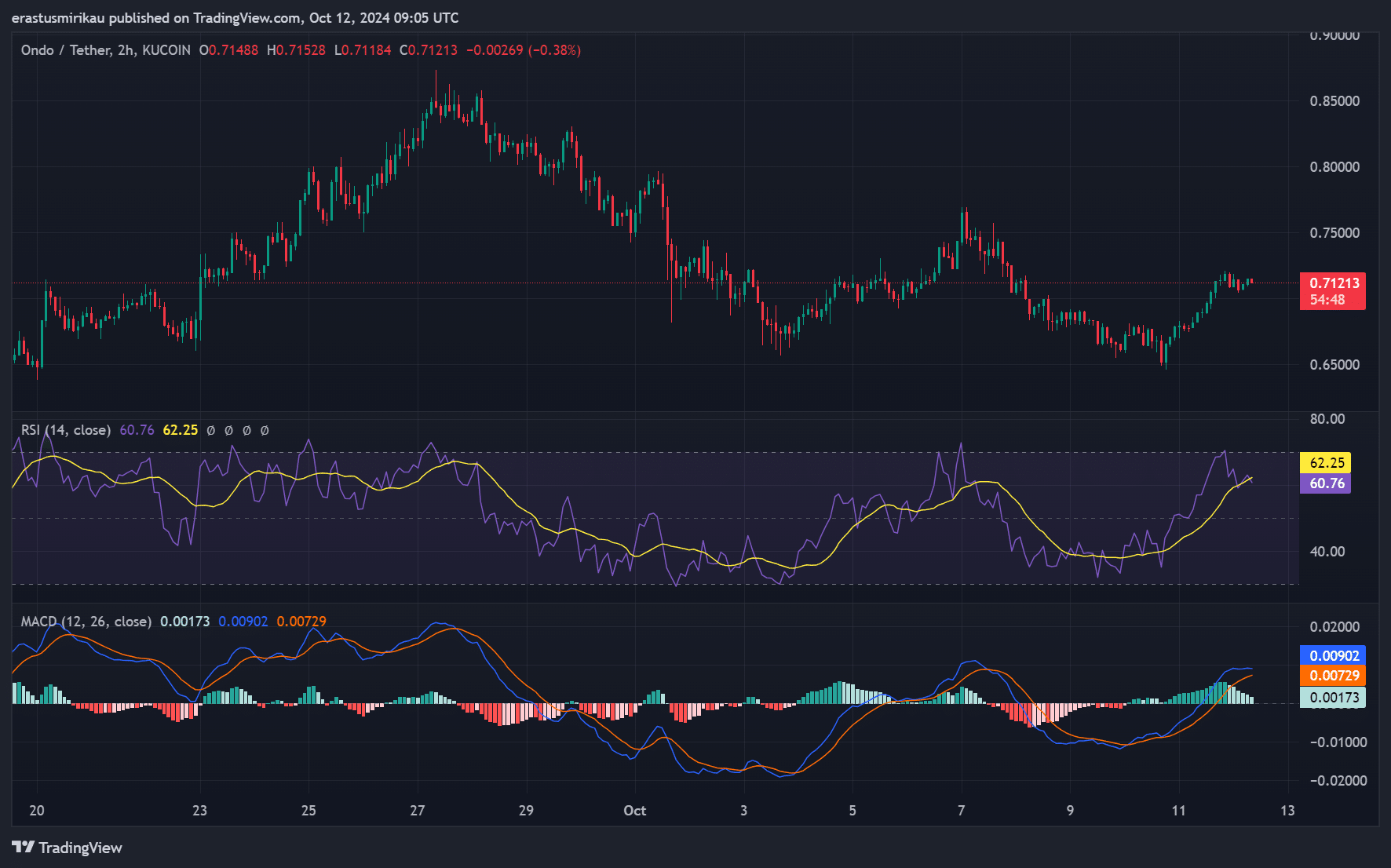

Technical analysis breakdown – RSI and MACD show mixed signals

Regarding the altcoin, its technical signs provided a blend of prospects. The Relative Strength Index (RSI) stood at 62.25, suggesting that the asset could be nearing an overbought state. Yet, there seemed to be potential for further expansion based on the chart’s analysis.

Currently, the Moving Average Convergence Divergence (MACD) is approaching a potential bearish crossover. Although the chart indicates there may be some time left before this occurs, a possible downturn in prices could affect the market once the crossover happens. Therefore, traders should exercise caution, considering the broader market context.

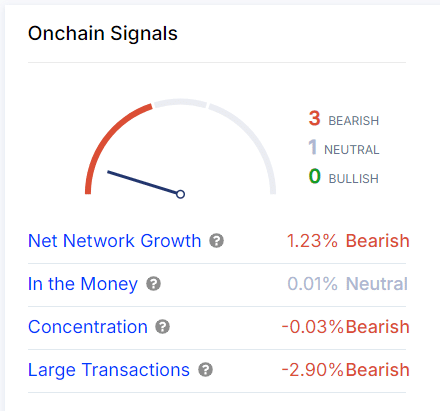

On-chain signals – Can investors expect more gains?

The analysis of on-chain data indicates a somewhat pessimistic mood in the market. For example, according to IntoTheBlock, there was a decline of 1.23% in net network growth – suggesting that fewer individuals are becoming part of the ONDO community.

Furthermore, there was a slight decrease of 0.03% in concentration, suggesting that major investors have not been making substantial investments. A decline of 2.90% in large transactions also occurred, implying a more conservative strategy might be at play.

Despite the “In the Money” metric holding steady at 0.01%, indicating that many investors find themselves at a break-even point currently, this stability appears to have added to the ambiguity surrounding ONDO‘s potential future actions.

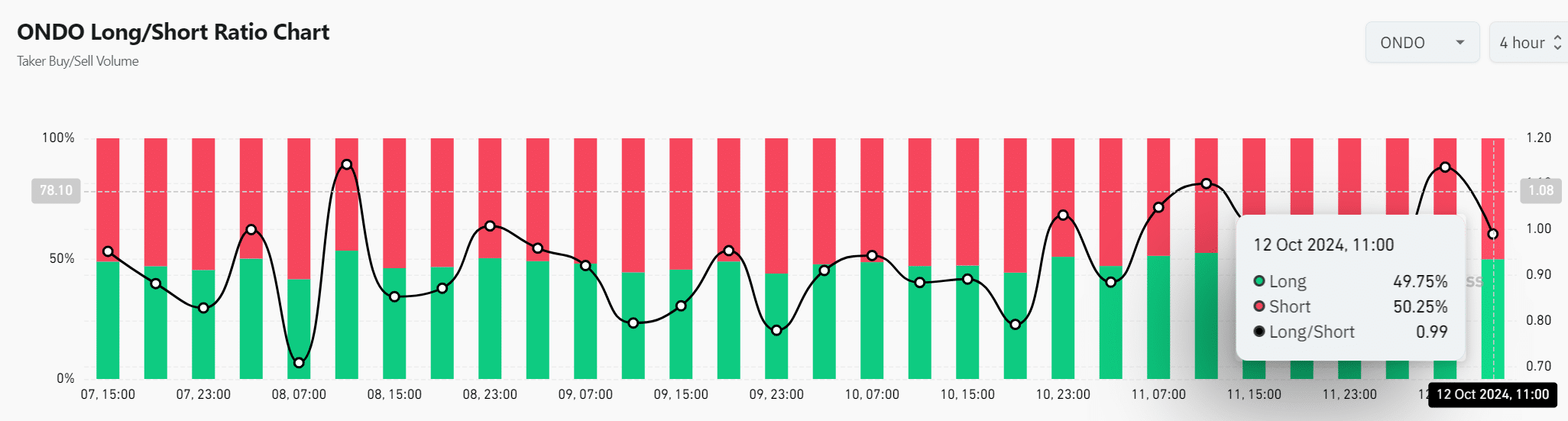

ONDO liquidation and long/short ratios: What are the traders thinking?

Ultimately, the liquidation reports showed that approximately $12,080 worth of short positions were closed out versus around $3,310 for long positions. This suggests a slight inclination towards selling activity, as indicated by the data from Coinglass.

In essence, the long and short positions were nearly equal, with a ratio of approximately 1:1 (0.99), where 50.25% held short positions, while 49.75% were long. This suggests that traders were evenly divided in their prediction about ONDO‘s further price movement, leaning neither towards an increase nor a decrease.

Read Ondo’s [ONDO] Price Prediction 2024–2025

What’s next for ONDO?

In summary, the breakout from ONDO‘s falling wedge pattern has ignited optimism for an upward trend. Yet, mixed technical indicators and on-chain signals advise traders to exercise caution.

Although there’s a possibility for continued growth, the market at present seems balanced. It’s advisable for investors to keep a close eye on crucial signals before taking major steps.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-10-13 08:07