-

ONDO has seen a 7% price increase, with analysts predicting a major rally by Q4 2024.

Whale transactions and Open Interest show mixed signals, suggesting cautious optimism.

As a seasoned crypto investor who has weathered multiple market cycles and seen the rise and fall of various projects, I find the recent performance of ONDO intriguing. The token’s 7% price increase in a week, coupled with Captain Faibik’s bullish prediction for Q4 2024, has certainly sparked my interest.

In simpler terms, the cryptocurrency known as ONDO, which powers a decentralized finance system and provides stable returns through loans secured by income-producing digital assets, appears to be rebounding following a significant drop in value.

Five days ago, on August 5th, the price of ONDO dipped to $0.52, but since then, it’s been on an upward trend. Over the last week, the token has risen by approximately 7%, and in just the last day, there’s been a 4.3% additional increase.

This recuperation is happening as more and more traders and analysts show increased curiosity, suggesting a possible uptrend for ONDO could be on the horizon.

ONDO’s falling wedge signals further rally

Known cryptocurrency expert Captain Faibik has recently expressed a positive forecast for ONDO, indicating that the asset might be preparing for a significant surge by the close of Q4 in the year 2024.

On the platform X, previously known as Twitter, Faibik recently posted an in-depth technical analysis of the ONDO token. His analysis highlighted a potential falling wedge formation on the token’s price graph. In his words, “The ONDO token appears to be exhibiting a falling wedge pattern.

Continue collecting ONDO tokens and hang on to them with patience. You’ll appreciate it later when we reach a new record high in the last quarter of 2024.

The forecast about ONDO has ignited even more curiosity among traders, who are now debating whether it could shatter past price benchmarks.

The upcoming weeks could be crucial in determining whether ONDO will experience a breakout.

What do fundamentals suggest?

However, technical analysis alone does not paint the full picture. It is worth also examining ONDO’s underlying fundamentals to determine if actual market conditions support the bullish outlook.

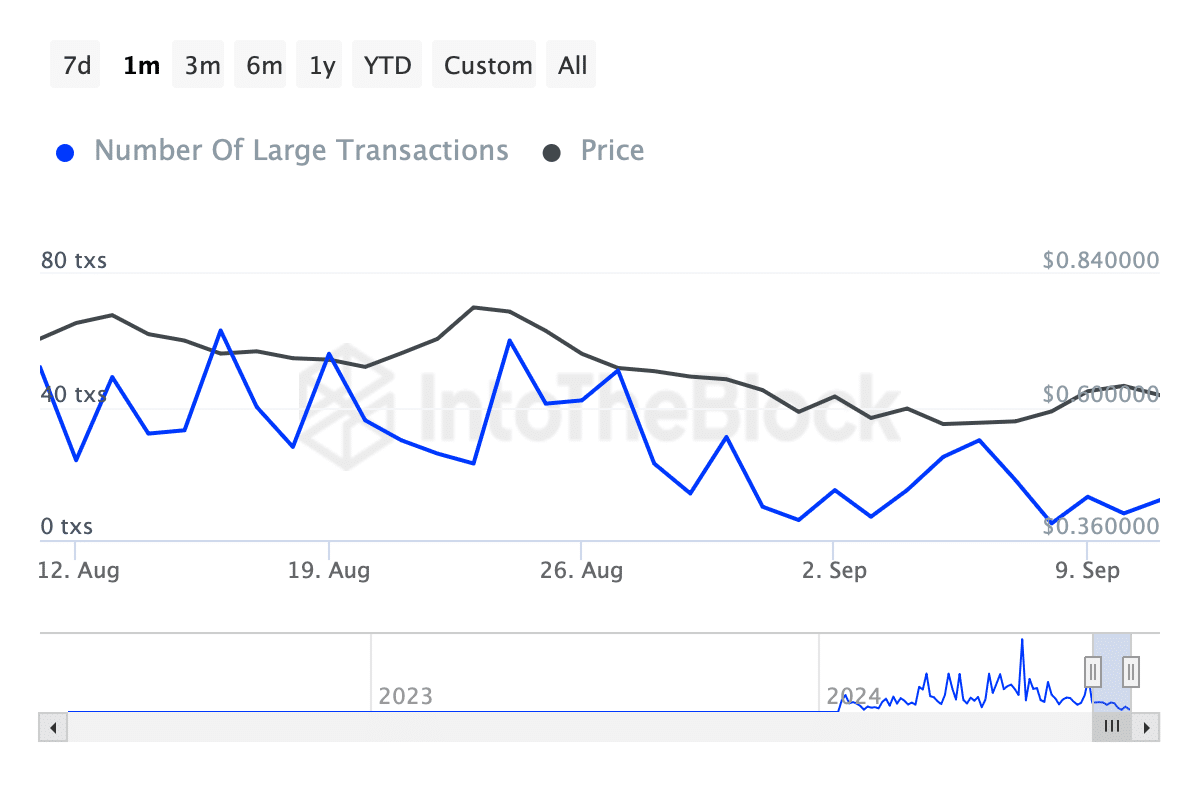

One key dataset to watch is whale activity—transactions involving $100,000 or more. According to data from IntoTheBlock, ONDO’s whale transactions have drastically decreased in recent weeks.

Initially reaching more than 60 transactions by late August, the number has now declined significantly to a mere 12 transactions at this point in time.

This suggests a drop in heavy trading activity, potentially meaning reduced interest among big investors. This could lead to a dampening of anticipation for an imminent market surge.

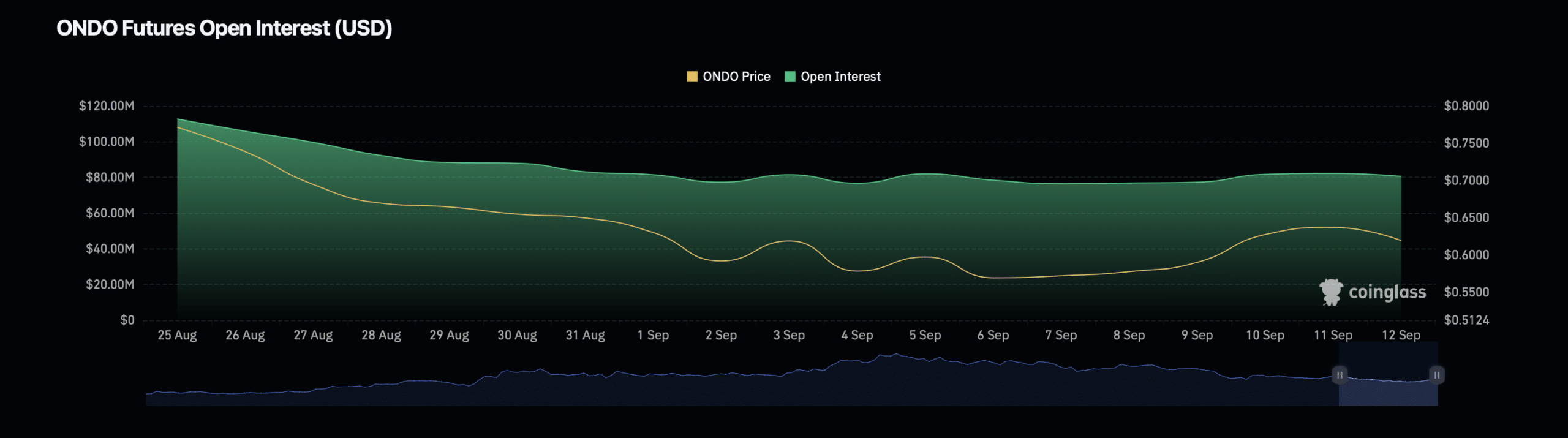

Besides monitoring whale activity, Open Interest is used to gauge market sentiment as well. Open Interest represents the aggregate count of open contracts in both Futures and Options trading. This figure can aid in determining the robustness of a trend.

Based on statistics provided by Coinglass, the Open Interest for ONDO has risen by approximately 4.69%. At the moment of this writing, its value is estimated to be around $83.12 million.

This upward trend could be an indication of increasing curiosity about the token, possibly signaling that investors might be preparing for a potential price hike.

However, there is a counterpoint to this optimistic outlook. While Open Interest increased, its volume saw a 17.91% decline, dropping to $86.67 million at the time of writing.

Read Ondo’s [ONDO] Price Prediction 2024–2025

As a researcher, I observed an interesting trend: while the number of trading contracts was increasing, the volume of these contracts seemed to be shrinking. This could potentially suggest that traders are exhibiting some level of uncertainty or hesitation in their convictions.

The difference in Open Interest and trading volume might indicate conflicting signs within the market, making it challenging to predict with certainty how ONDO‘s price will move ahead.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-13 06:16