-

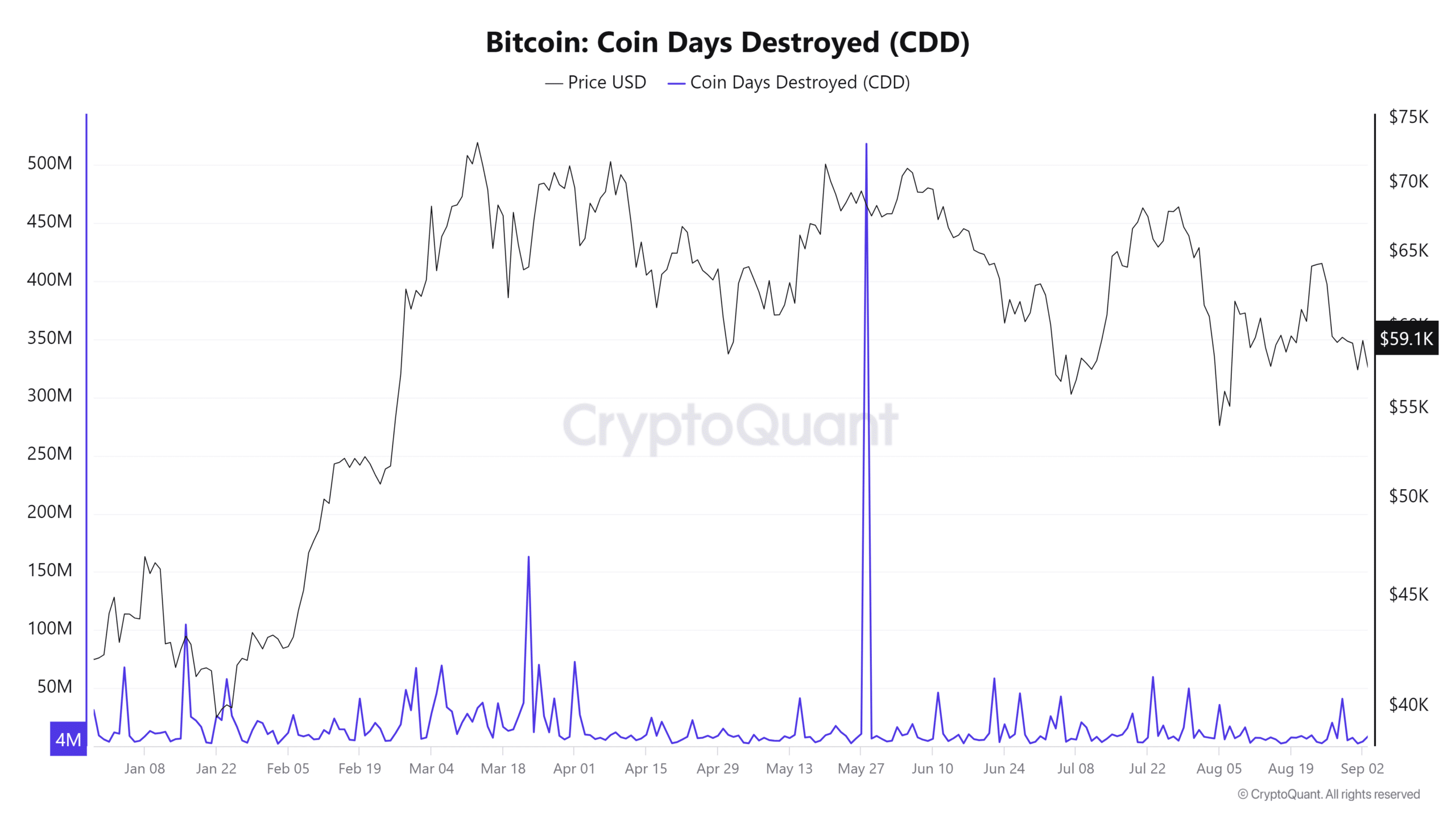

The BTC CDD suggested that the trend was still below critical levels

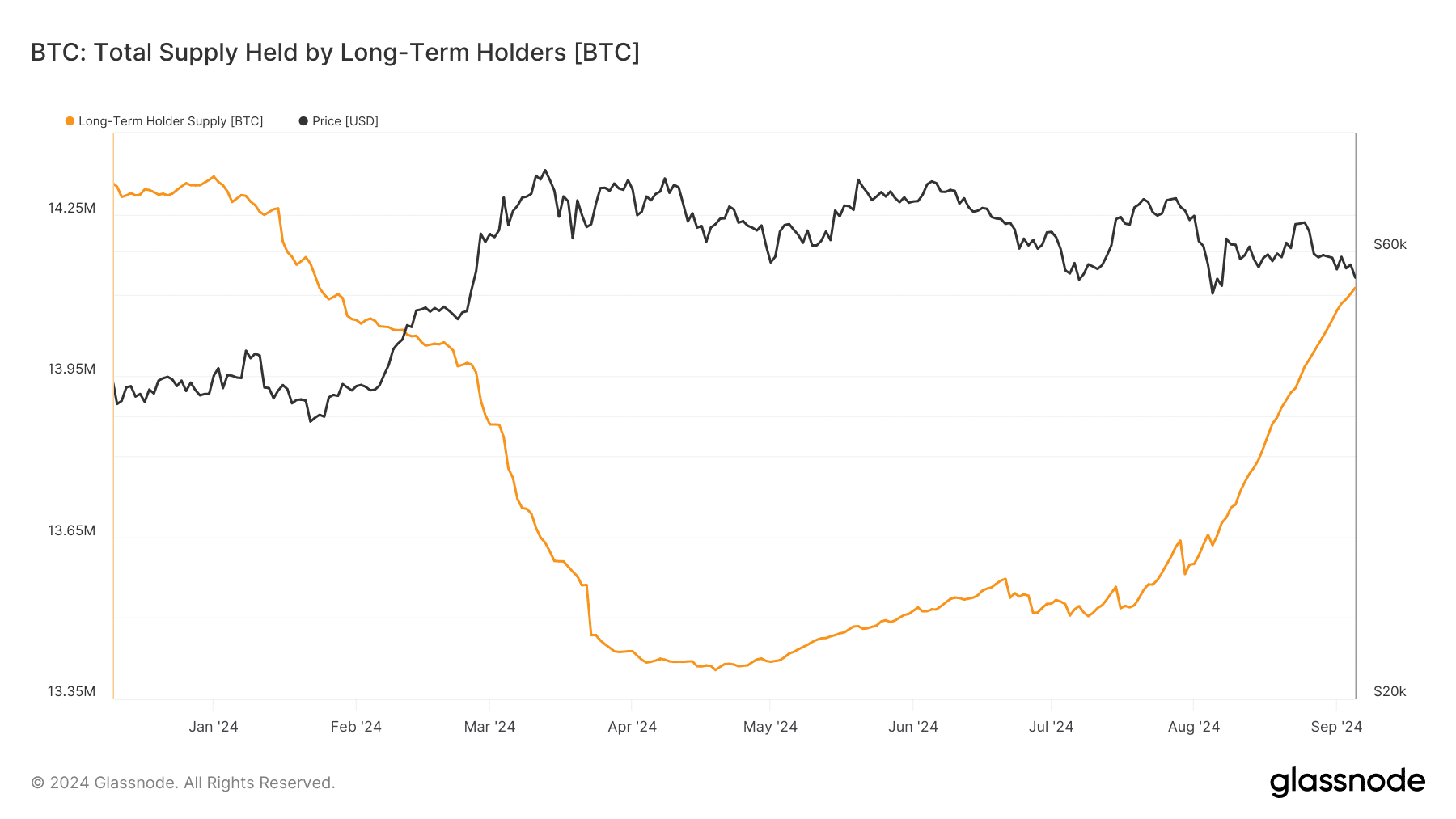

Long-term holders have accumulated around 1 million BTC since July

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find myself intrigued by the current state of Bitcoin. The Coin Days Destroyed (CDD) metric is suggesting that we may not have seen the ultimate peak yet, which aligns with my personal observation that bull markets often defy early predictions of their demise.

In March 2024, Bitcoin reached an unprecedented highest point ever recorded. This event has ignited discussions among financial investors as to whether it signaled the culmination of a bull market or not. However, while some believe this might be the ultimate peak, data from blockchain indicates something different.

Indeed, measurements such as Coin Days Destroyed (CDD) appear to suggest there could be more potential for price increases in the market.

Bitcoin’s top in yet?

In March 2024, Bitcoin experienced a significant increase in its Coin Days Destroyed (CDD) value, indicating that some long-term investors may have cashed out near the record high. Upon closer examination, it was found that the CDD has not yet hit the “red zone” which usually predicts the peak of the market. This “red zone” is a region where the metric typically signals the culmination of market growth.

This implies that although the March peak was a substantial intermediate high, it probably isn’t the maximum peak for this entire cycle. Therefore, the upward trend in the CDD metric suggests that we might expect more price increases in the upcoming months.

CDD is an important on-chain metric that tracks the movement of older, long-held Bitcoin. It provides insights into when long-term holders are selling, giving a clearer picture of the market’s maturity and possible future trends.

If the CDD (Crypto Dealer’s Dashboard, I assume) hasn’t peaked yet, it suggests that the bull market could potentially expand further. This is particularly interesting given that long-term investors seem to be exercising caution, but they haven’t fully sold off their holdings just yet.

Long-term holders continue to accumulate Bitcoin

A study on long-term Bitcoin holder (LTH) supply data from Glassnode, in simpler terms, found a positive outlook similar to the pattern seen in the Coin Days Destroyed (CDD) indicator.

As Bitcoin’s price began dropping in July, these long-term investors started to boost their accumulations instead.

From July 19th up until September 6th, the stockpile of Bitcoin owned by long-term investors has seen a substantial increase. Initially at around 13.5 million BTC, it now exceeds 14.1 million BTC. This continuous buildup indicates that these long-term investors remain optimistic about Bitcoin’s future potential, even amid the recent decline in price, and are choosing not to sell their holdings.

The increasing stockpile indicates that long-term investors are taking advantage of reduced prices, strengthening the conviction that the market has potential for additional growth. Notably, these strategic investors persist in hoarding and amassing, instead of offloading their assets.

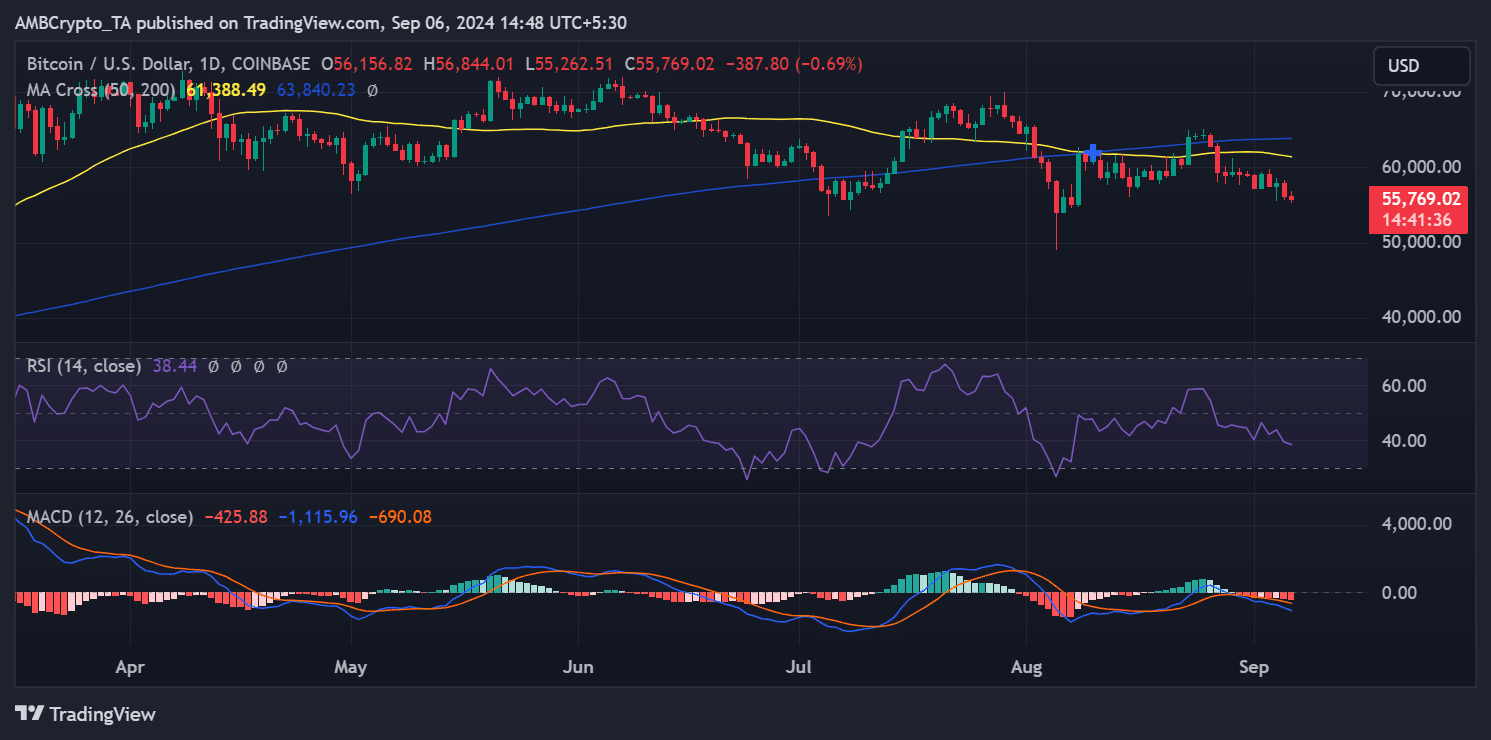

BTC falls further down the charts

Bitcoin’s price battle continues, as AMBCrypto’s examination of its daily chart reveals a decrease exceeding 3% in the most recent trading day. This dip lowered its value to roughly $56,000. As I write this, the trend seems to persist, with a further decrease of about 0.7%, taking its price down to around $55,700.

In simpler terms, when the RSI for Bitcoin dipped just under 40, it moved into an area suggesting high selling activity, or oversold territory. This might mean that the selling pressure has reached its maximum, implying a possible upcoming price increase might occur soon.

– Read Bitcoin (BTC) Price Prediction 2024-25

Nevertheless, while Bitcoin’s prices are dropping, the continued increase in Long-Term Holder (LTH) ownership might prompt more stockpiling at these current levels.

Over a period of time, investors who keep their assets might help prop up the price. This could result in the price becoming more stable or even rebounding, as the market gradually adapts to the recent decline.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-07 05:11