-

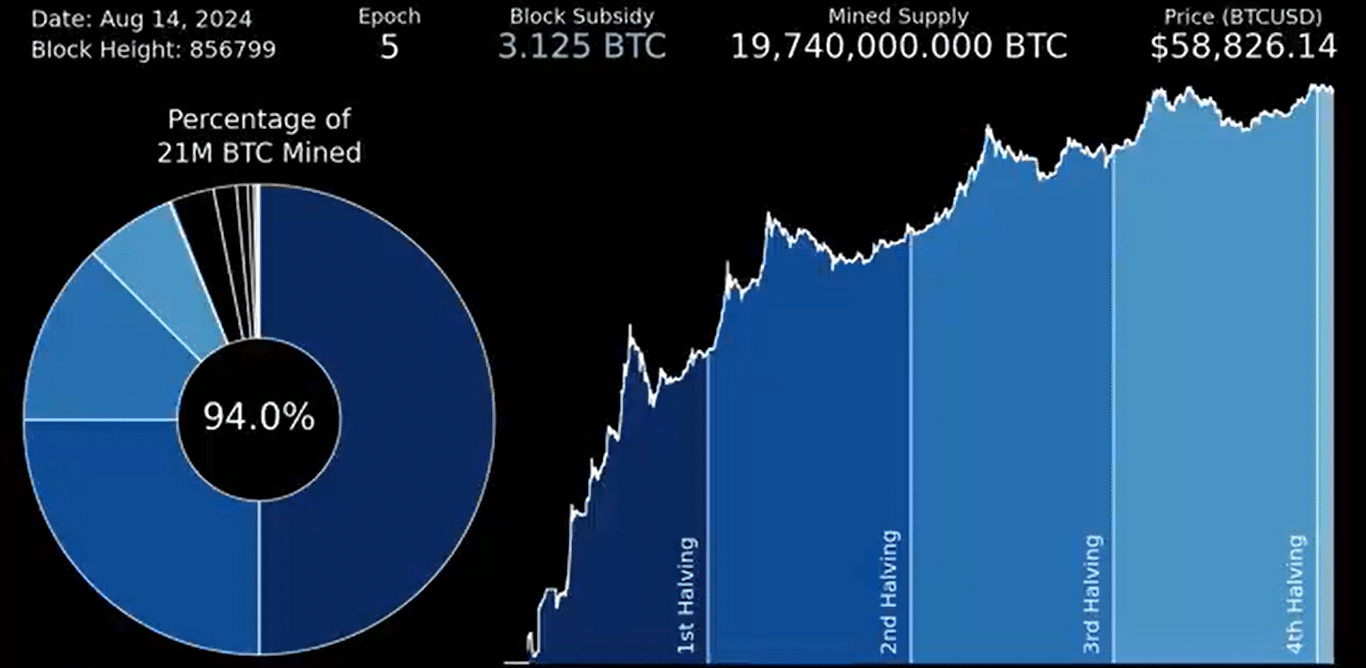

Only 6% of Bitcoin’s total supply remains to be mined, as the U.S. moved 10000 BTC

Bitcoin’s heat map showed the compression as market risk decreased.

As a seasoned researcher with over two decades of experience in the financial markets, I find myself constantly intrigued by the fascinating world of cryptocurrencies, particularly Bitcoin (BTC). The latest developments in the BTC market have piqued my curiosity more than ever.

Growing attention from prominent international governments and substantial financial institutions has significantly fueled the cryptocurrency market, particularly Bitcoin [BTC].

Following the April 2024 halving, the number of newly mined Bitcoins decreased significantly, with only about 6% remaining to be mined, according to a report by Bitcoin News (previously known as Twitter).

By the year 2030, it’s anticipated that only a tiny fraction – less than 1% – of all Bitcoins will remain to be mined. The growing scarcity of this digital currency could lead to an increase in its value, as more people seek to own Bitcoin due to rising demand.

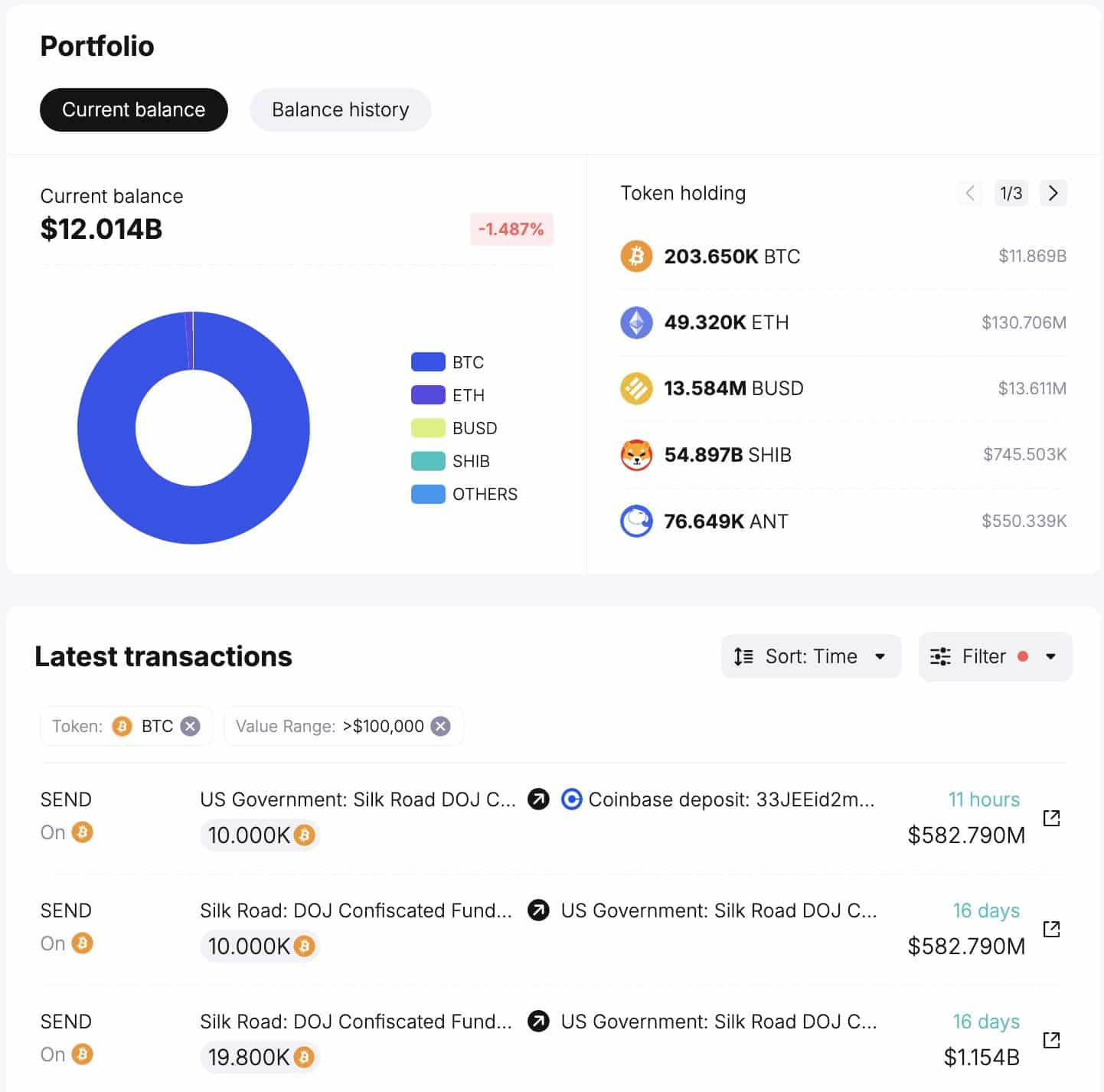

Furthermore, it’s worth noting that the U.S. government has just added 10,000 Bitcoins (approximately $540 million) to its holdings on Coinbase, following the initial deposit of around 15,999 BTC ($966.5 million) earlier this year. The average price at which these Bitcoins were purchased is approximately $60,410 per coin.

As a crypto investor, I’m always keeping an eye on the amount of Bitcoin held by the government. Currently, they control approximately 203,600 BTC, which translates to a whopping $11.9 billion. This significant stash could potentially impact Bitcoin’s price movement, possibly pushing it upward.

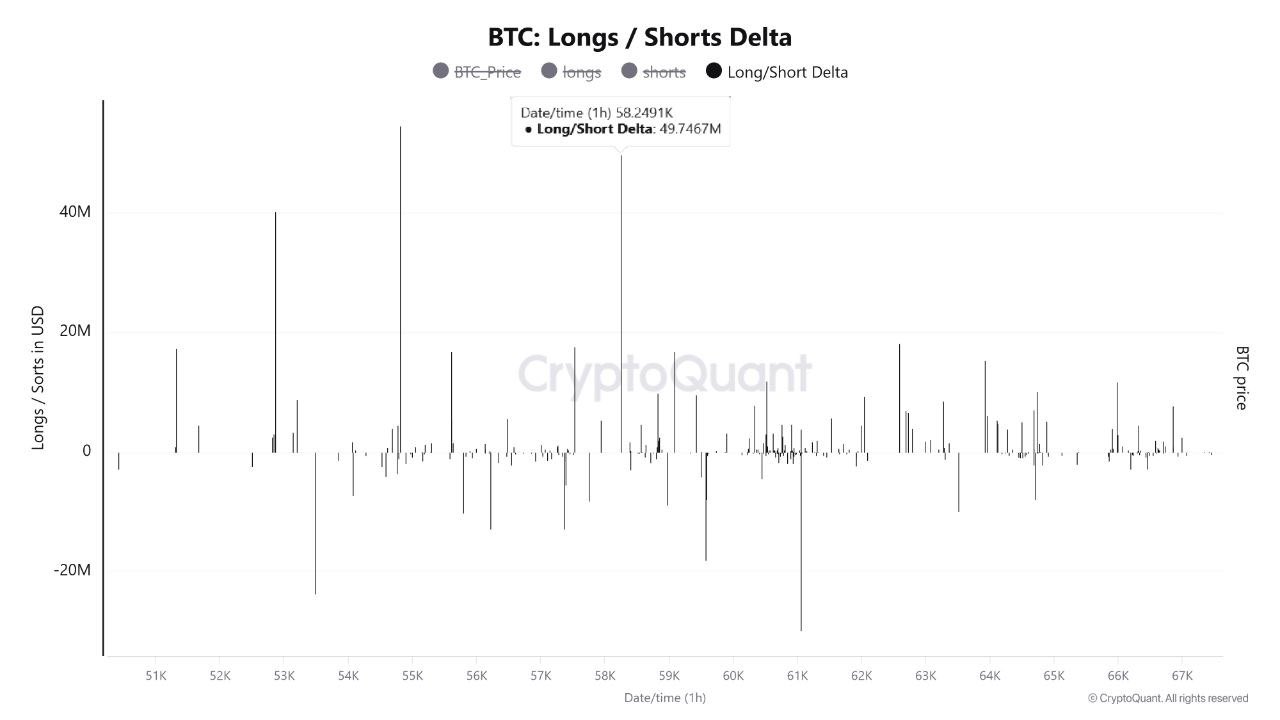

BTC longs/shorts delta

In simpler terms, after a quick drop in the Bitcoin market where many long-term investors sold off their holdings, Bitcoin has now reached its initial level of stability, suggesting a possible downtrend.

After a period of prolonged declines in its value, Bitcoin’s price started bouncing back as lengthy sell-offs subsided. Now, it seemed poised for even more growth.

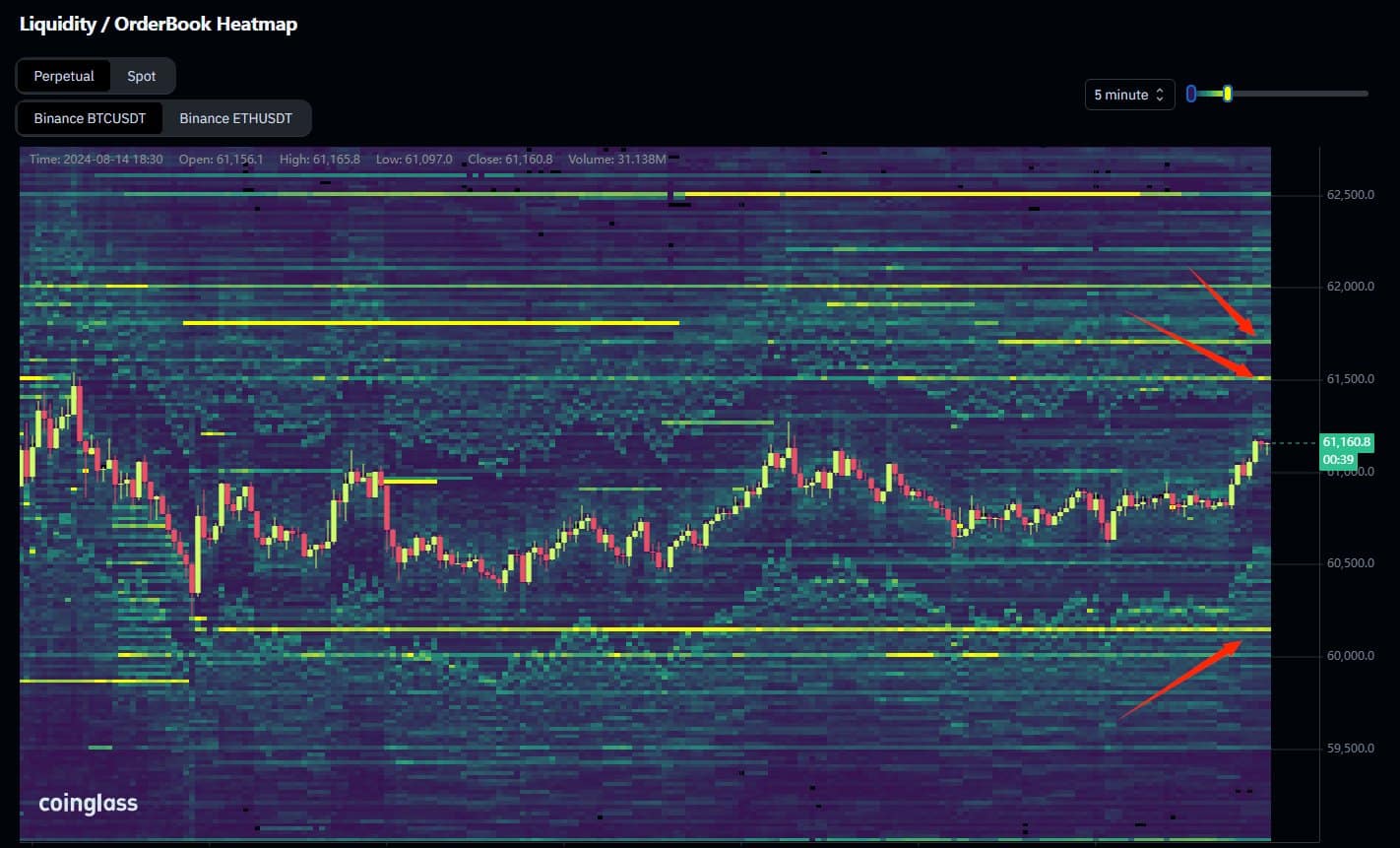

Bitcoin heat map showing the compression

At the moment, the distribution pattern of Bitcoin prices was centered between approximately $58,000 and $61,000, suggesting a narrow range. Meanwhile, the unfavorable Funding Rates hinted at more shorts taken by individual traders, potentially indicating an upcoming price reversal.

As an analyst, I’ve noticed a significant consolidation in Bitcoin’s price action, which could indicate a potential breakout. With Q4 of 2024 fast approaching, I find myself optimistic about the possibility of higher prices, given this historical trend for increased volatility and potential growth during this period.

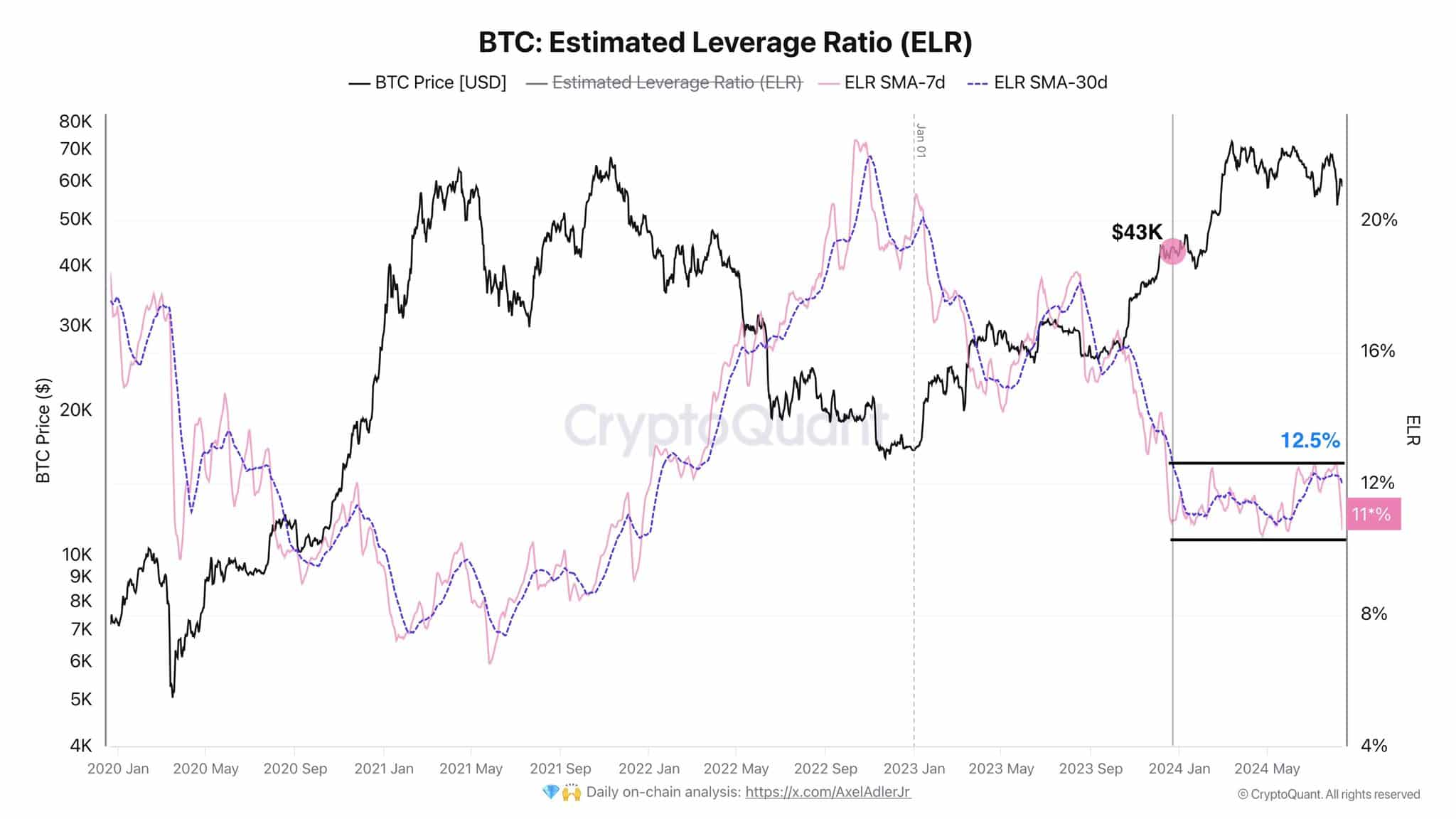

Average weekly ELR shows decrease in market risk

As a crypto investor, I’ve noticed that the average weekly Estimated Leverage Ratio (ELR) – a metric that compares open interest to exchange reserves – has decreased by 1.5%. This implies that there’s been a reduction in the amount of leverage being used in the market, potentially signaling a shift towards less risky trading behaviors.

It appears that the market trend might be indicating a decrease in risk, possibly due to increased caution among traders, which could potentially lead to an increase in Bitcoin’s value.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin repeating 2016’s action?

Around the middle of 2016, Bitcoin experienced a significant rise prior to its scheduled halving event. However, it plummeted dramatically afterwards, hitting record lows and sparking speculation about an impending bear market.

In the final weeks of Q3, Bitcoin initially moved downwards but then switched direction, showing a robust uptrend. As of now, this trend seems to be repeating itself, and predictions suggest that Bitcoin may surge again when liquidity increases towards the end of Q3 or early Q4 in 2024.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-15 21:17