- Popular analyst predicted a breakout to $3 for Optimism (OP) if it surpasses $1.90

- Recent on-chain data showed a 50% hike in active addresses, signaling growing interest in $OP

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull and bear markets. When it comes to Optimism (OP), recent developments have piqued my interest.

It’s anticipated that solutions at Layer 2 will witness significant expansion in the forthcoming months, as per market analyst Michaël van de Poppe. Intriguingly, Poppe posits that Optimism (OP), one of the prominent Layer 2 platforms, is poised for a substantial price surge at present. He asserted this belief in his statement.

“Once it reaches the $1.80-1.90 range, a breakout to $3 is likely.”

Additionally, he highlighted that the continuous buildup and increasing higher lows are initial indicators of an upward trend, suggesting a possible journey towards increased values.

Accumulation phase with a crucial resistance zone

The graph showing the token’s price history suggests that it has generally been declining. Yet, at the current moment, it seems to be forming a support base. Technical analysis points towards an accumulation period, which is typically marked by the development of higher lows – This pattern indicates strong buying activity.

As the cost neared the significant $2.27 region, often referred to as a “key point of resistance,” this zone can serve as an obstacle. If surpassed, it might prompt investors to become more optimistic, potentially leading to a more bullish market attitude.

A rising trendline indicates potential reinforcement for a possible price surge, hinting at a potential breakout. On the price graph, it seems like the buying force is gradually growing, overpowering the selling pressure, thereby laying a solid base for an anticipated upward movement.

Target price and potential resistance levels

If the OP surpasses the $2.27 barrier, it’s likely that the price could climb to a projected range of around $2.68 to $2.80. This potential increase offers a 18% profit chance from its current breakout level. This zone might become a new resistance point, as traders may aim to cash out within this range.

The market is exhibiting indications of growing optimism, since the price remains stable close to the horizontal level where sellers tend to resist.

On-chain data reflects growing network activity

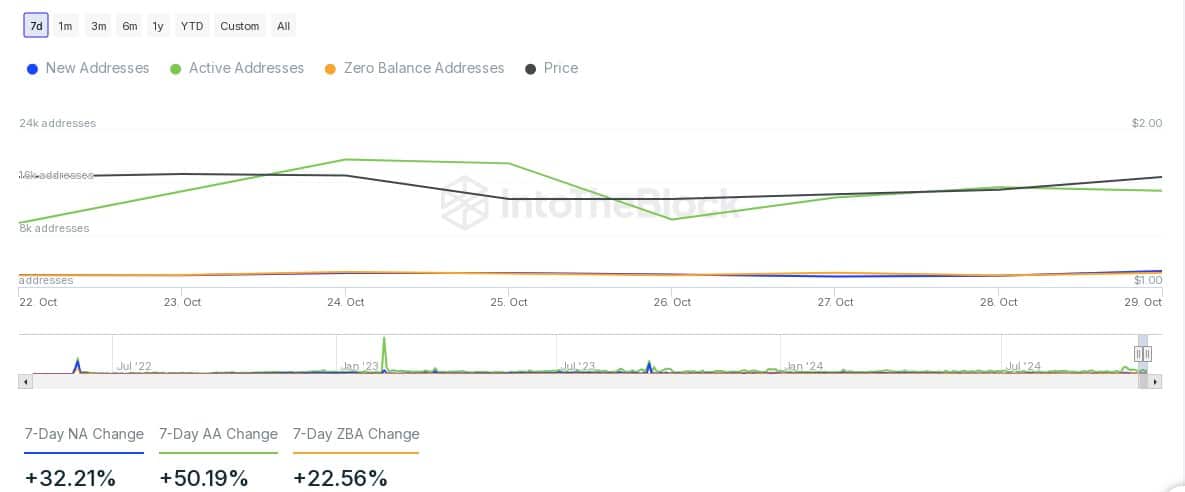

Recent on-chain data from IntoTheBlock supported the optimistic outlook for OP. Over the past week, new addresses have risen by 32.21%, active addresses by 50.19%, and zero-balance addresses by 22.56%, indicating rising network engagement.

Even though it’s growing, the token’s price stays quite steady, implying that the network’s expansion might be preparing the way for an upward trend.

Over the past week, the volume of transactions varied from approximately 1,500 to 2,070, showing a minor decrease as the week progressed.

This pattern shows that significant investors are maintaining their curiosity, however, the decrease could signal hesitation or possible selling for profits.

Exchange netflows and DeFi metrics

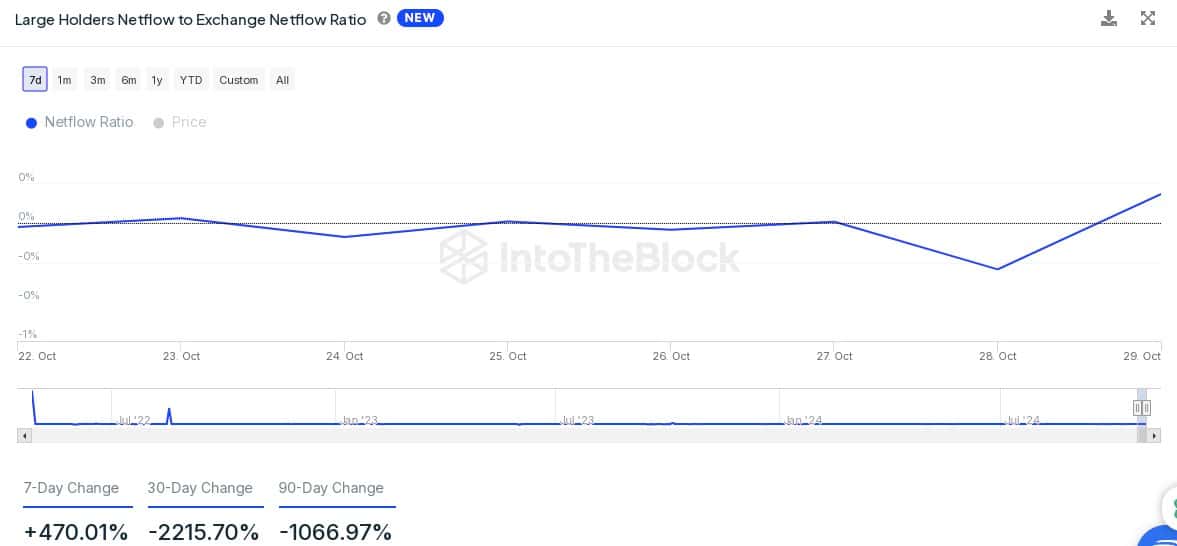

Over the last week, there’s been a 470.01% increase in net outflows for significant OP holders, suggesting an uptick in the transfer of tokens to exchanges. This might be a sign of increased selling pressure in the near future.

Contrarily, the 30-day and 90-day netflows have shown heavy negativity, indicating that there was previous accumulation and a long-term optimistic outlook among investors.

As I checked the latest figures from DeFiLlama, it’s clear to see that my investment in Optimism is growing steadily. At this moment, the Total Value Locked (TVL) for Optimism stands at approximately $684.51 million. Interestingly, the market cap of their stablecoins currently sits at a robust $1.01 billion. It’s exciting to be part of such a thriving DeFi ecosystem!

In addition, within the past day, the network collected approximately $13,070 in fees, generated about $12,901 in income, and received roughly $11.27 million as inflows.

Collectively, these measurements suggest a consistent expansion within the protocol’s environment, fueled by continuous user engagement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-31 11:36