- OP’s $1.80-$1.90 resistance could trigger a rally to $2.50 if broken.

- On-chain data shows rising new addresses and $1.47M net outflows, signaling potential bullish accumulation.

As a seasoned analyst with years of experience navigating the ever-evolving crypto landscape, I find myself intrigued by the current state of OP (Optimism). The $1.80-$1.90 resistance level has been a thorn in its side for quite some time now, but I remain optimistic that this could be the catalyst for a rally to $2.50 if broken.

Optimism [OP] has recently faced challenges at a critical resistance zone between $1.80 and $1.90, identified as a pivotal breakout level. OP tested this area but failed to break above it, resulting in a pullback of over 20% in recent days.

Crypto analyst Michaël van de Poppe remarked,

“OP has tested the crucial resistance but dropped more than 20% in the past few days.”

Currently, the value of one unit (OP) is set at $1.52 in the market. Over the past 24 hours, the trading volume has amounted to around $614.9 million. This gives the market cap an approximate value of $1.9 billion, considering a circulating supply of about 1.3 billion tokens.

Support and consolidation levels

The current fluctuations in OP’s price suggest a phase of consolidation. Important lines of support can be found around $1.50, while resistance is present near $1.60. These key levels are crucial for maintaining short-term balance. If the support at $1.50 remains strong, it may offer a stable base for the next attempt to break out.

The analyst added,

Should a new test occur between $1.80 and $1.90, it’s likely that we will surge higher and potentially reach our All-Time High (ATH) by January.

This perspective suggests that the resistance area could act as a launchpad for increased prices, potentially reaching between $2.50 and $2.60.

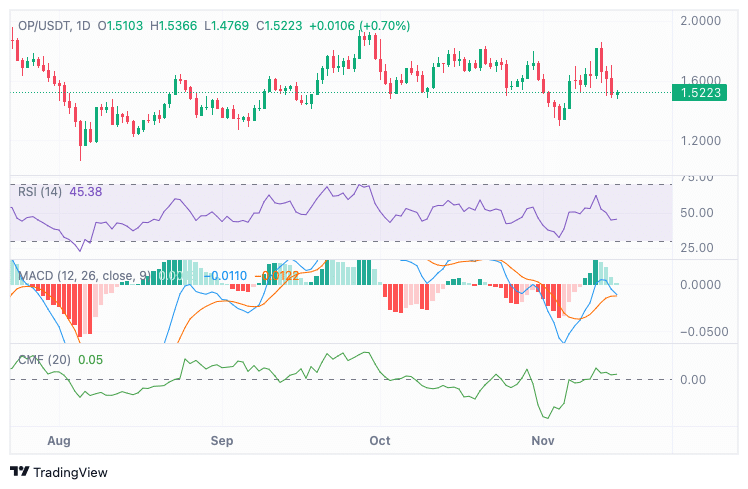

Technical indicators show mixed signals

At the moment of this report, the Relative Strength Index (RSI) stood at 45.38, suggesting a balanced momentum. This means the price trend might appear bearish, but if buying pressure intensifies, there could be an opportunity for a price reversal.

The RSI will need to move above 50 to confirm a stronger bullish trend.

The MACD histogram shows early signs of bullish divergence, although momentum remains weak.

Currently, the Chaikin Money Flow (CMF) stands at 0.05, showing a gentle flow of funds into this market, hinting at modest yet optimistic investor involvement.

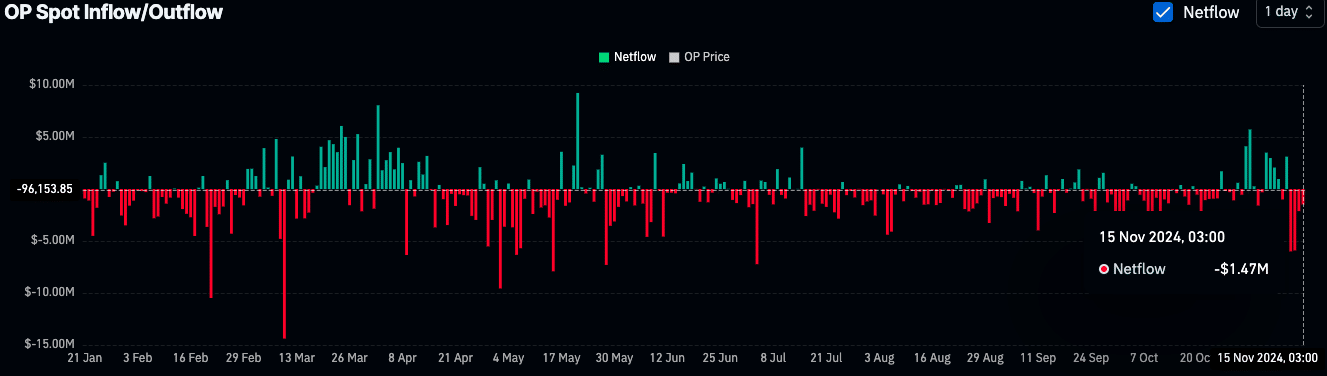

On-chain metrics reflect bullish accumulation

Recent on-chain data from Coinglass shows consistent net outflows, with the latest figure on 15th November reaching $1.47 million.

This pattern indicates that OP tokens are being transferred out of exchanges, an action frequently linked to long-term investing or securing them in personal wallets for safekeeping.

Furthermore, data from IntoTheBlock indicates a 21.03% rise in newly created wallets within the last week, pointing towards a growing level of involvement with the token.

Read Optimism’s [OP] Price Prediction 2024–2025

Contrarily, there’s been a 27.79% drop in the number of active addresses belonging to the original participant, suggesting reduced transactional activity even with an increase in new participants.

Zero balance addresses also rose slightly by 1.77%, showing a minor increase in dormant accounts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-15 17:44