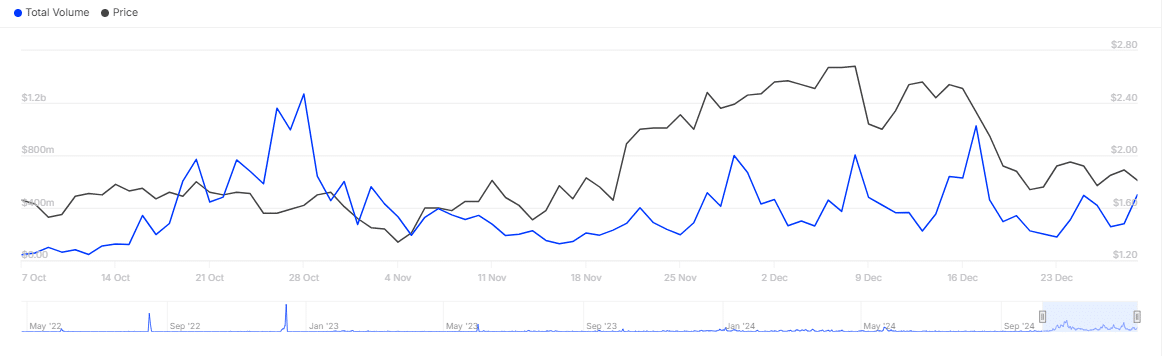

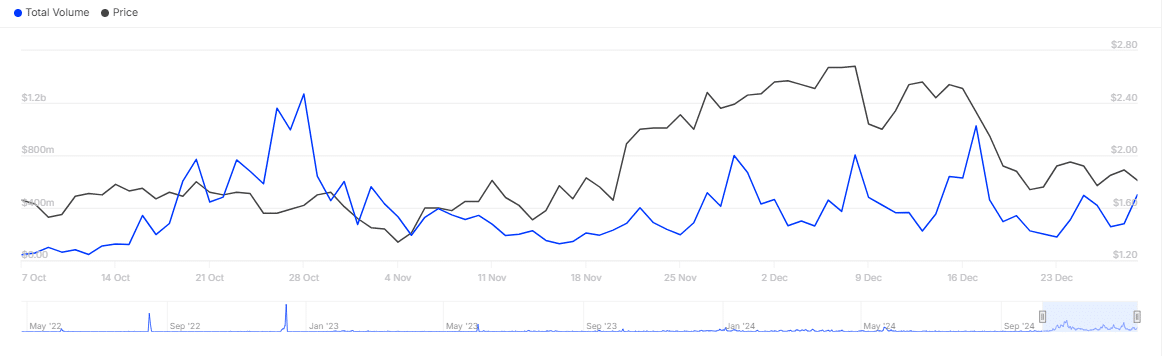

- There has been an increase in accumulation by large investors over the past 24 hours.

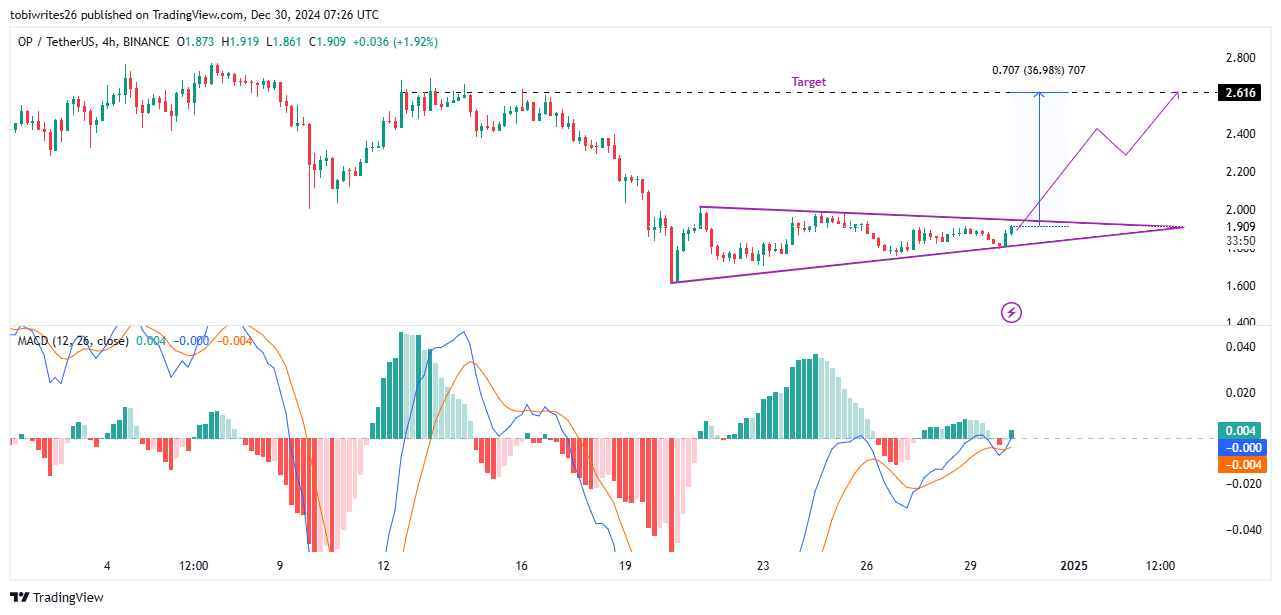

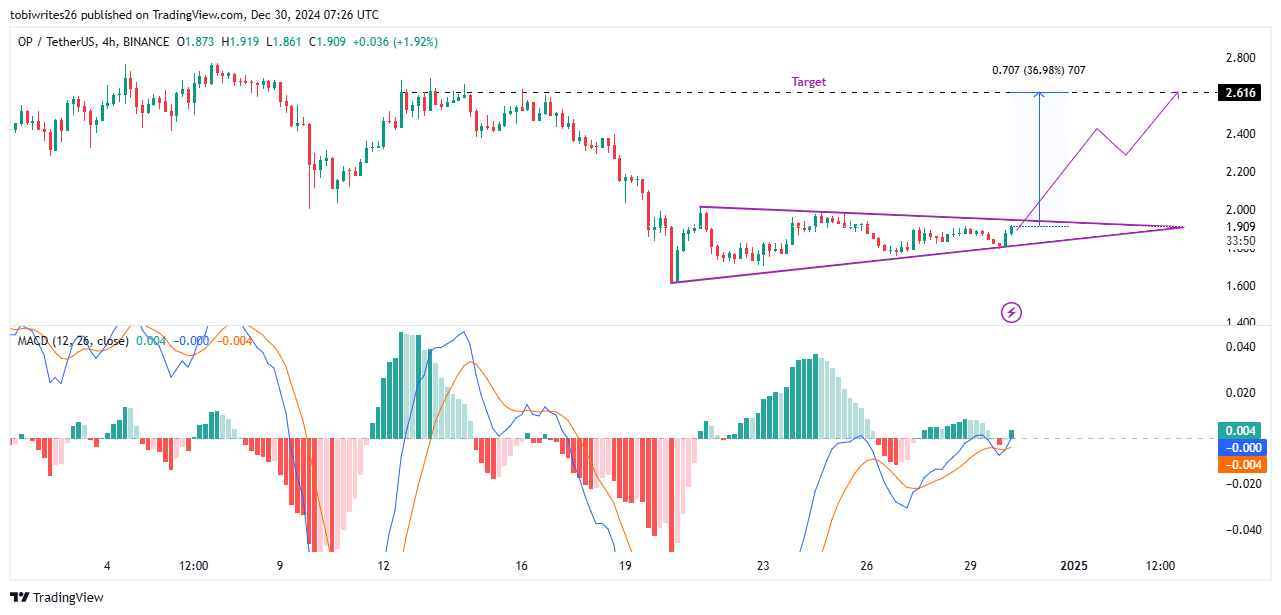

- The technical chart indicates that OP could reach $2.60, supported by the formation of a golden cross pattern.

As a seasoned researcher with years of market analysis under my belt, I find myself intrigued by the recent developments surrounding Optimism [OP].

The surge in large transactions and average transaction size over the past 24 hours is reminiscent of a bull market on the rise. With a price increase and substantial bulk purchases, it seems that OP might be gearing up for a significant rally.

The technical chart further solidifies my optimism, with the formation of a golden cross pattern and a bullish accumulation setup. If the anticipated breakout occurs, we could potentially see OP reaching $2.616—a 36.98% increase from its current price.

Additionally, the rise in buyer interest in the derivative market, as indicated by OP’s positive Funding Rate on Coinglass, further supports my bullish outlook.

Now, I must admit, I’ve seen a fair share of market ups and downs in my time. But if the current trends continue, we might just witness an exciting ride with Optimism [OP]!

Just remember: always buckle up for the rollercoaster ride that is the cryptocurrency market.

Disclaimer: This is not financial advice. Always do your own research and invest at your own risk.

As a crypto investor, I’ve seen Optimism (OP) take a hit recently, plummeting by 22.34%. However, it seems that the coin has started to bounce back, showing resilience with a weekly increase of 7.92% and a daily uptick of 1.70%.

Following increased purchasing interest, especially among big-time investors, and a substantial jump in the typical deal value, it appears that OP could be poised for a major surge.

Large investors step in

I’ve noticed an intriguing pattern in the financial market recently – a significant uptick in large transactions involving OP over the past 24 hours, coinciding with a slight price rise. This isn’t my first rodeo in the world of trading, and such trends often signal potential opportunities for strategic investments. It will be interesting to see how this develops further.

Currently, large investors own approximately 277.17 million Optimal Power Units (OP), with a total value of $501.62 million, having made these purchases as they control a substantial share of the available supply.

This action implies that mass purchasing may have supported OP’s rise, since its price experienced a small increase.

Furthermore, the typical transaction amount has significantly increased, returning to levels not seen since November 4th. Over the last 24 hours, the average transaction size was approximately $20,697.00.

As an analyst, I’ve noticed a significant growth in both typical transaction value and high-volume transactions. This points towards a trend of massive asset acquisitions, which lends a positive, bullish sentiment to the market.

A trade to $2.60 as target

At the current moment, the chart indicates a positive trend for OP. It’s been trading within a consolidation phase that suggests accumulation, and it’s also shaping up to form a ‘golden cross’, a bullish technical indicator.

On the 4-hour chart, our asset (OP) was moving along a symmetrical trend characterized by intersecting support and resistance lines. This pattern, which sometimes emerges, offers a potentially optimistic trading scenario due to its bullish implications.

As a researcher, I anticipate that if an expected surge happens for OP, it might surge by approximately 36.98%, potentially hitting a value of $2.616. This could lead to a reassessment of its price or continued upward momentum.

Concurrently, the emergence of the ‘golden cross’ pattern hints at an imminent surge in price momentum, given that trading activity is on the rise.

In simpler terms, the ‘golden cross’ event happens when a particular indicator’s blue line (MACD line) moves above another line (orange signal line). As I write this, the MACD line is currently at -0.001, while the signal line is at -0.004.

If the MACD line moves into positive territory, it may trigger a major price surge.

Rising interest in the derivative market

As I’m typing this, there seems to be a surge in investor appetite for the derivative market, a trend that is evident from OP’s Funding Rate on Coinglass.

Read Optimism’s [OP] Price Prediction 2025–2026

As a researcher, I examine how the Funding Rate works to adjust pricing differences between the current (spot) and future markets. When the Funding Rate is positive, it signals a bullish market, indicating optimism among traders about the asset’s price increase. Conversely, a negative Funding Rate implies bearish sentiment, suggesting that traders believe the asset’s price will decrease.

Currently, the Funding Rate stands at 0.00132%. This means that more traders are holding long positions compared to short ones, a situation that favors the long side. This imbalance contributes to maintaining market equilibrium and hints that OP’s price might continue increasing from its current point.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

2024-12-30 19:04