-

Analyst sees OP breaking 3000 sats as crucial for a major bullish rally.

Increasing network activity and accumulation suggest OP could be primed for upward movement.

As an analyst with over a decade of experience in the crypto markets, I find the recent performance of Optimism (OP) particularly intriguing. The bullish divergence between price and RSI, coupled with the crucial resistance level at 3000 sats, suggests that OP could be on the verge of a major breakout.

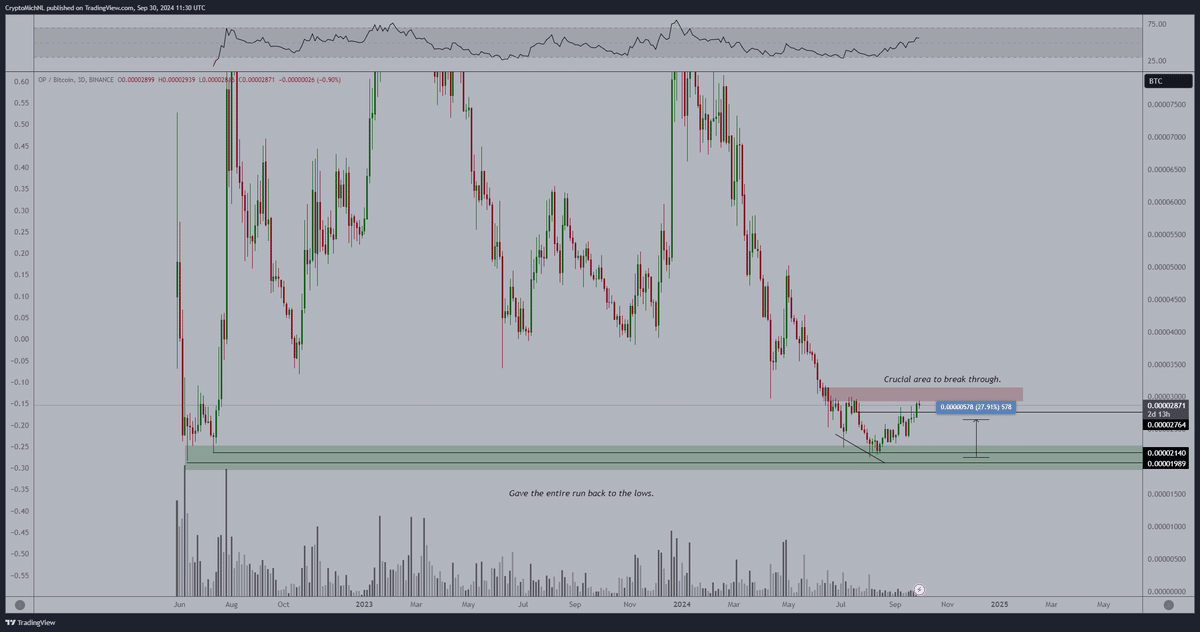

Optimism [OP] has been showing strong upward movement recently, hinting at a possible bullish breakout. Michaël van de Poppe, a crypto analyst, has identified a bullish divergence, where lower lows in price contrast with higher lows in the Relative Strength Index (RSI).

This trend frequently suggests the possibility of further upward movement. According to van de Poppe, overcoming the significant resistance level at 3000 sats is vital for any potential future increases.

If Optimism manages to overcome the current hurdle, it might open up a path for an upward trend towards 4500-5000 sats. However, if we look at the flip side, the 2000-2150 sats region has consistently served as a strong support, with the price frequently rebounding from this area.

After the recent surge, the price has reached important milestones again. If it fails to surpass the resistance point, we might see a period of stabilization or sideways movement instead.

Price action and indicators suggest volatility

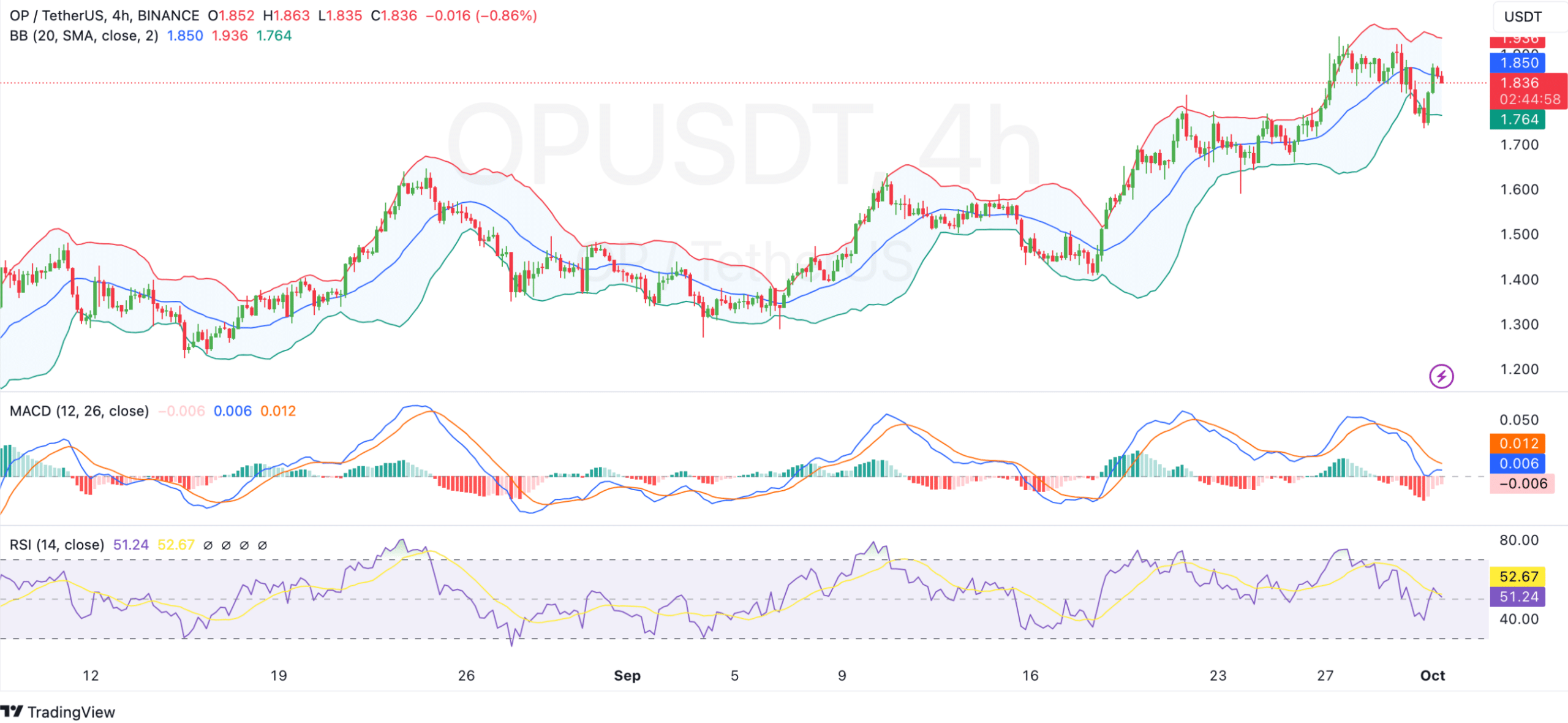

On a 4-hour chart, the fluctuations in optimism’s price movement are quite varied, bouncing between the Bollinger Bands. Lately, the price reached close to the upper band priced around $1.85, serving as an immediate barrier for further price increase. Conversely, the middle band at $1.76 functions as a flexible support level.

The data indicates that although the O.P. is trying to move beyond its current state, it’s encountering substantial obstacles or pushback at present stages.

In simpler terms, the Moving Average Convergence Divergence (MACD) is suggesting a possible downturn in the market, as it shows a decrease in bullish strength. Meanwhile, the Relative Strength Index (RSI) stands at 51.24, indicating that the market isn’t showing signs of being overly bought or sold.

With these conflicting signs, traders could anticipate more stabilization in the market if a decisive surge doesn’t happen promptly.

OP token flow shows accumulation signs

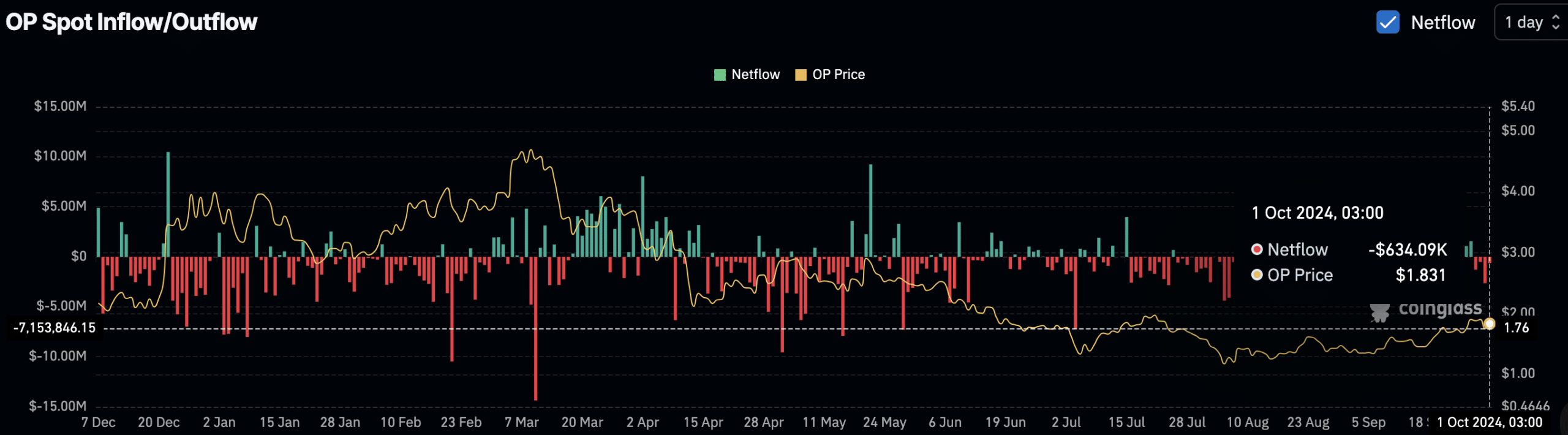

Based on the latest figures, it appears that OP tokens are progressively leaving trading platforms, suggesting potential buying by investors. By October 1st, a net withdrawal of approximately $634,090 was noted from spot exchanges.

It seems like there’s a trend where people are taking out more funds from exchanges than they’re putting in, which could indicate less urgency to sell and perhaps enthusiasm for future profits.

Historically, situations like this, where the outflow is more than the inflow (negative netflows), tend to coincide with phases when investors prefer to keep their investments instead of offloading them, which can lead to periods of price consolidation or accumulation.

An escalation in incoming funds might suggest renewed selling activity, potentially preventing the price from further upward movement.

Increasing network activity

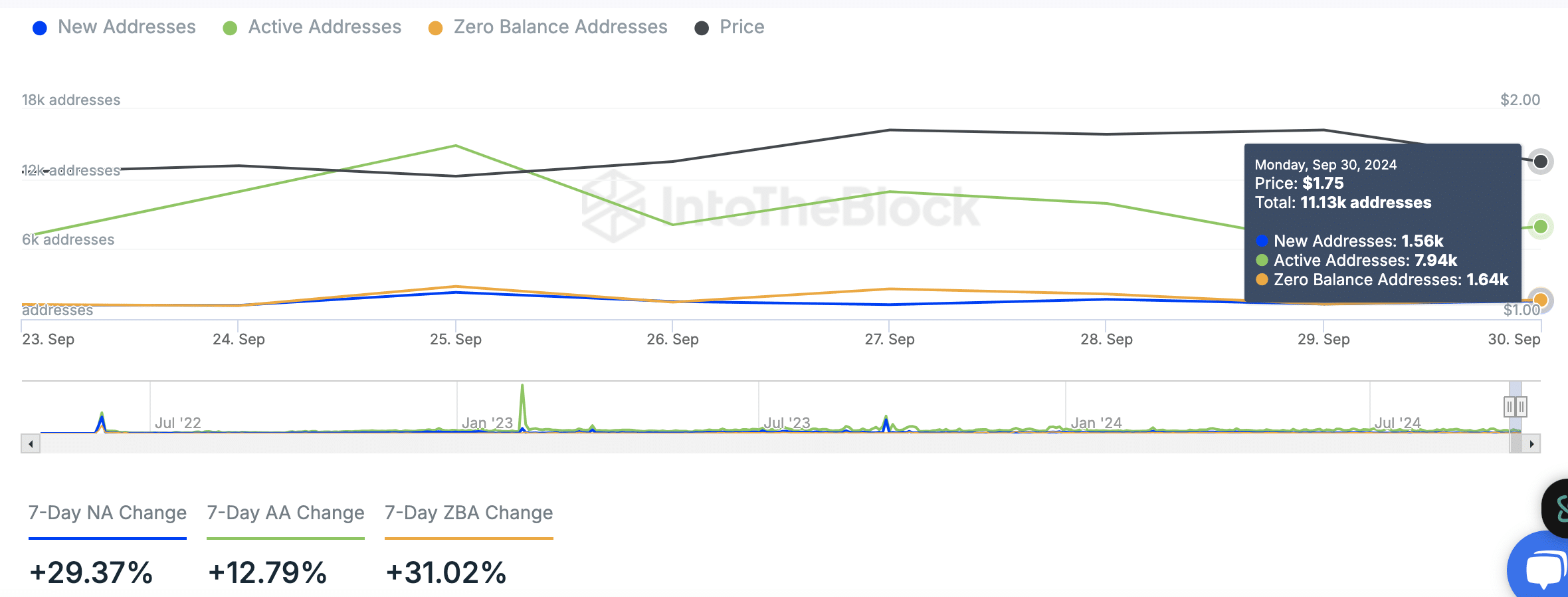

According to data from IntoTheBlock, the number of Opera Protocol (OP) addresses has been on an upward trend. As of September 30th, there were a total of 11,130 addresses, with 1,560 being newly created and 7,940 actively used.

The rise in new addresses by 29.37% over the past seven days reflects growing interest in the OP token.

In a similar fashion, there was a 12.79% rise in the number of active addresses, suggesting that more people are engaging with the network.

Moreover, the number of zero-balance addresses, those without any tokens, increased by 31.02%. This growth might indicate that users are planning for future transactions or transferring their assets to an off-chain storage.

The rise in address usage suggests continuous interaction with the OP network, implying that the token is still drawing in new participants.

Realistic or not, here’s OP market cap in BTC’s terms

Currently, the Open Project (OP) is being exchanged at approximately $1.85 per unit. In the last 24 hours, the trading volume has amounted to around $224 million, marking a 2.28% rise in price. Over the past week, there’s been an impressive 10.77% growth in its value.

It appears that Optimism continues to draw substantial investor attention, even as the broader market experiences significant fluctuations.

Read More

2024-10-02 08:08