- ORDI surged immediately after Bitcoin’s halving

- However, metrics suggest its price rally may be short-lived on the charts

Over the past 24 hours, ORDI cryptocurrency token has experienced a significant price increase of over ten percent. This surge in value can be attributed to two key factors: the completion of Bitcoin’s fourth halving event on the morning of April 20th, and the recent launch of the Runes Protocol. ORDI is closely associated with the Bitcoin Ordinals protocol. (CoinMarketCap reports this price development.)

Casey Rodmarmor, the Bitcoin Ordinals innovator, introduced a fresh method for generating fungible tokens on the Bitcoin blockchain through the Runes protocol. This debut occurred concurrently with the Bitcoin halving, resulting in surging transaction fees as users endeavored to “carve” and mint new tokens within the network.

At the current moment, as reported by Rune Alpha, a total of 1447 Runes were inscribed onto the Bitcoin system, with an accumulated fee expenditure amounting to $16.41 million.

Will ORDI extend its gains?

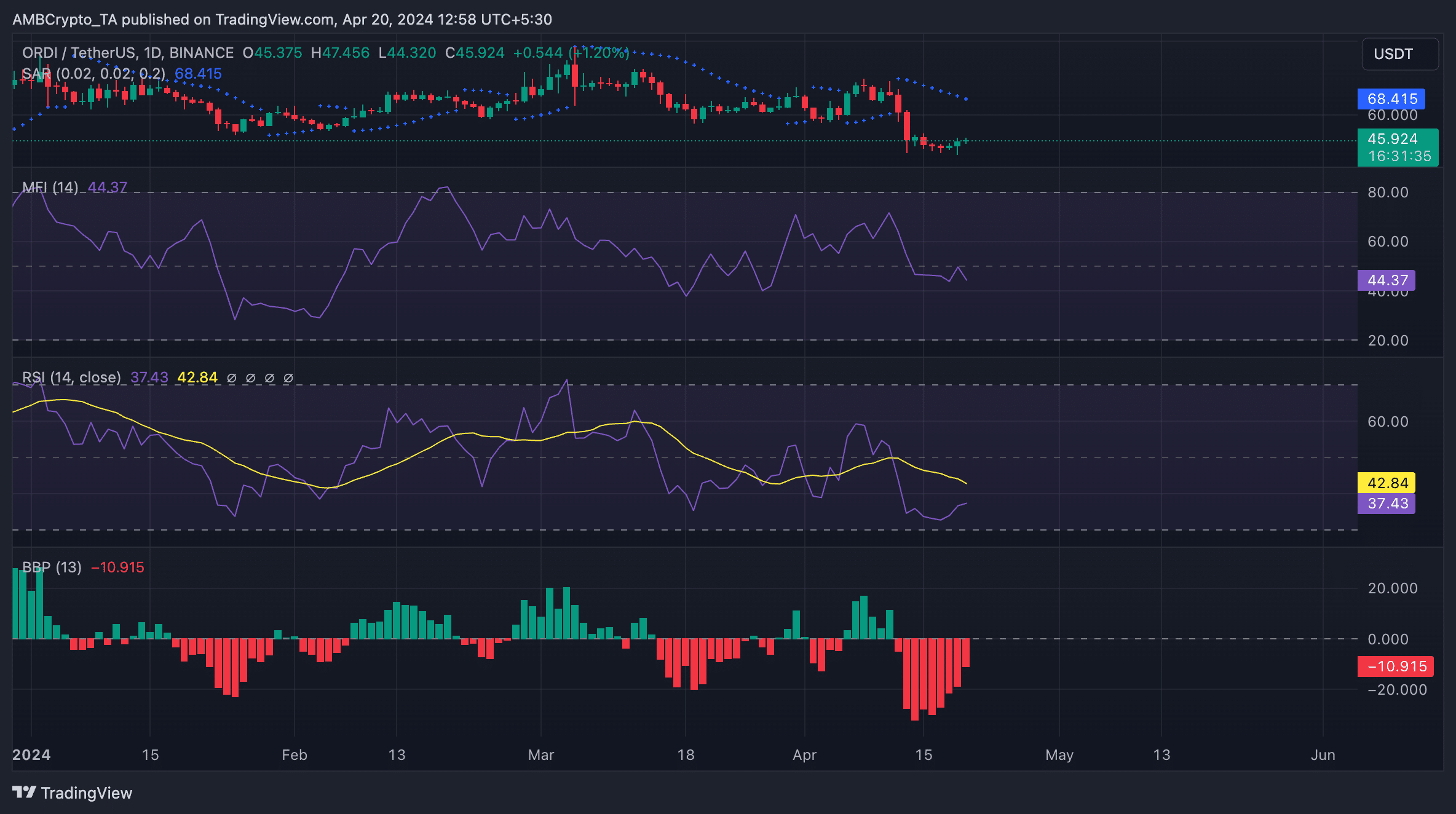

Based on an analysis of ORDI’s crucial metrics on the 24-hour graph, it appeared that any price increases could be temporary due to the token’s insufficient demand. The market conditions suggested that traders preferred selling over buying, as indicated by its technical indicators. For instance, its Relative Strength Index (RSI) was at 37.46 and its Money Flow Index (MFI) stood at 44.36.

At the moment of writing this, the indicators were showing a decrease and revealed that sellers were more active than buyers, causing greater demand for selling than buying.

In addition, the Elder-Ray Index of the token’s Elder Token indicated a strong bearish influence. This index has shown only negative values since April 12. When this index displays such a trend, it generally signals that the market is experiencing a downturn and there’s a likelihood of further decline.

In a similar fashion, the dots representing ORDI’s Parabolic SAR indicator lay above the asset’s current price. This indicator serves to detect the possible direction of an asset’s trend and signify potential reversal points.

If the dots sit above an asset’s price on the chart, this signifies a downward trend in the market. In simpler terms, it means the asset’s value has been decreasing and could potentially drop further.

Shorters take position

According to Coinglass, the open interest in ORDI’s Futures market grew by 10% within the past 24 hours. Presently, the open interest stands at approximately $211 million.

During this timeframe, the exchange funding rates for ORDI were in the red instead. This signaled that traders in the futures market had indeed opened positions, but they were wagering on a decrease in ORDI’s value.

Read More

2024-04-20 16:07