- PAAL crypto experienced a significant 50% rally in the past 24 hours, sparking speculation about further gains.

- Technical indicators are not fully supporting the momentum, signaling caution to traders.

As a seasoned researcher with years of experience navigating the volatile and unpredictable world of cryptocurrencies, I must say that the 50% surge in PAAL within 24 hours has certainly piqued my interest. However, it’s essential to approach this development with caution, as the technical indicators are sending mixed signals.

PAAL’s 50% surge over the past 24 hours marks a strong short-term recovery, but it remains uncertain whether this upward trend will persist enough to offset the token’s 43.45% weekly loss.

As the asset began its rally, AMBCrypto analyzes to see if this rebound has staying power.

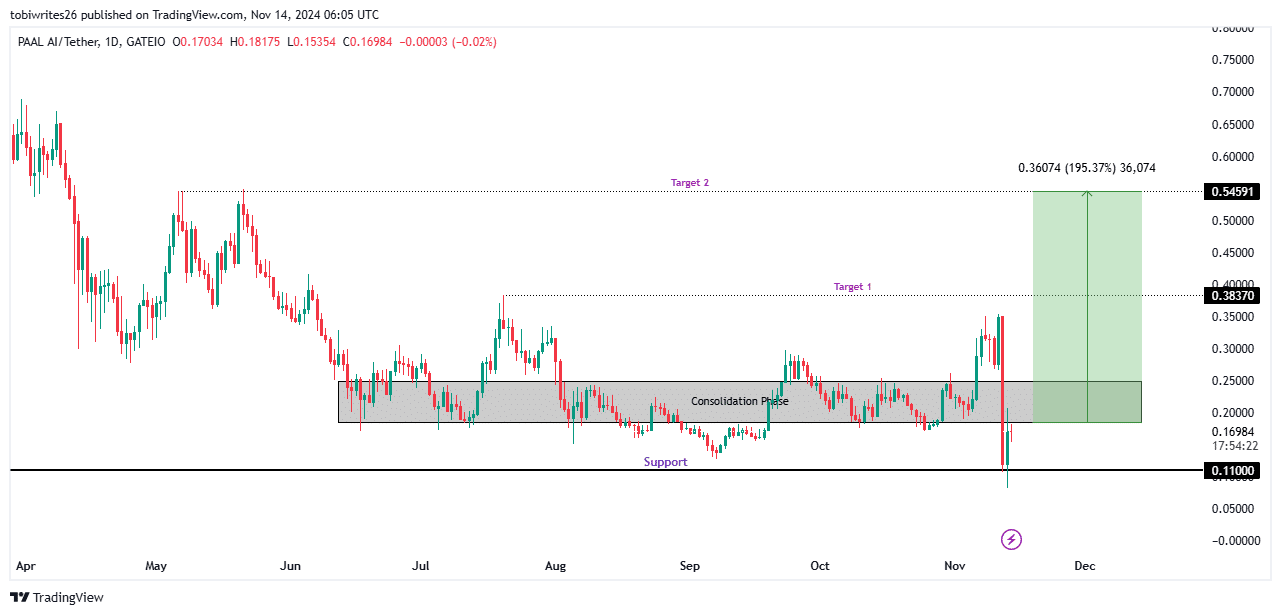

PAAL on track for a 195% gain

After experiencing a 50% increase, the price of PAAL dipped to a significant support point at 0.11000 – an area with a history of initiating uptrends.

Before this downturn, PAAL was moving within a period of sideways trading, which is frequently seen as a sign of investors stockpiling in expectation of an uptrend. If this pattern continues, the current drop might function as a “buying opportunity,” enabling investors to buy at a lower price before a possible surge.

For the upcoming objectives, PAAL is aiming at 0.38370, and then progressively advancing towards 0.54591, which translates to a potential increase of approximately 195.37%.

To sum up, although PAAL appears promising for future growth according to its price trends, the current technical indicators do not strongly suggest a prolonged upward surge.

Indicators show sluggish recovery for PAAL

Based on technical analysis, it appears that PAAL may continue to trend downward, possibly dropping below its current price point due to the indicators suggesting a bearish market.

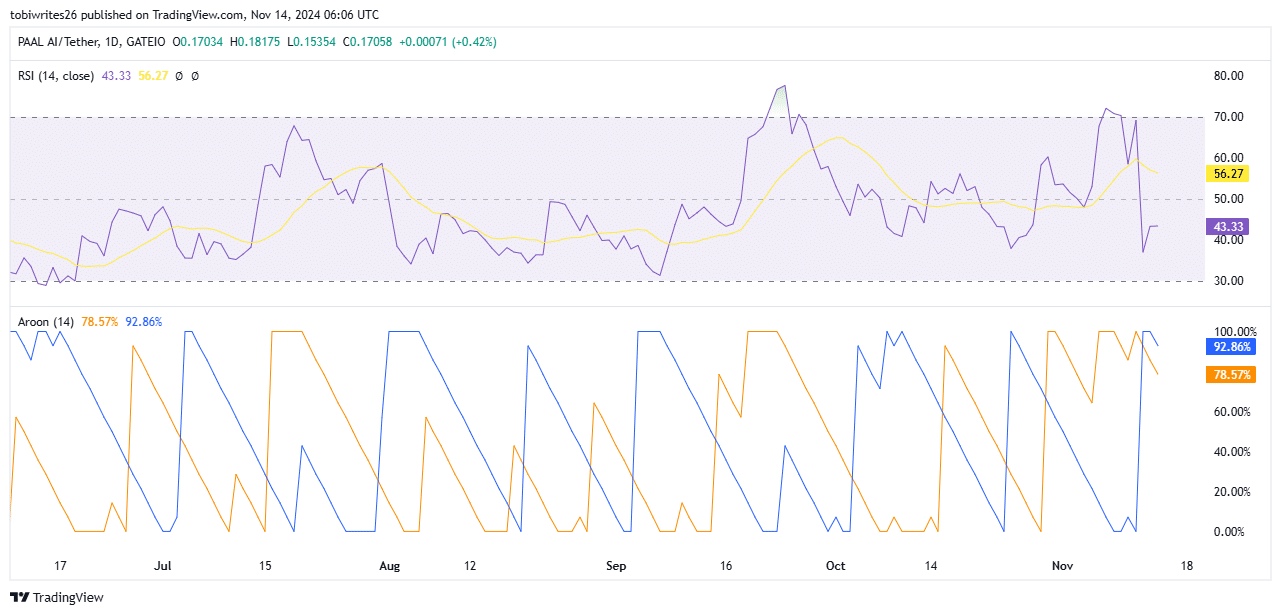

Currently, the Relative Strength Index (RSI) has noticeably dropped to 43.33, suggesting increased selling activity and potentially prolonging the current downward trend.

The Rate of Speculative Interest (RSI) gauges how quickly prices are rising or falling and how much they’ve changed recently, offering valuable information about investor sentiment by analyzing recent trends in market pricing.

Furthermore, the Aroon indicator, which consists of the Aroon Up and Aroon Down lines, is signaling bearish tendencies. At present, the Aroon Up is at 78.57%, whereas the Aroon Down stands at 92.86%. Given that the Aroon Down line is higher, this indicates a dominant downtrend in the market.

The cautious sentiment reflected in PAAL’s indicators aligns with a broader downturn in the crypto market.

As reported by CoinMarketCap, the total cryptocurrency market volume is currently experiencing a decrease of approximately 3.56%, suggesting a reduction in purchasing activity. Similarly, the trading volume for PAAL has decreased by about 8.32%.

If this decline in volume and buying interest persists, PAAL’s anticipated rally could be delayed.

Read More

2024-11-14 20:07