- CAKE was at a critical juncture, with the current pattern as a barrier to further gains.

- A successful break above these levels could reaffirm a bullish trend, while a failure may expose CAKE to further downside risks.

As an experienced crypto investor who has navigated through countless market cycles, I find myself cautiously optimistic about PancakeSwap [CAKE]. The recent bullish momentum is encouraging, but the coin seems to be at a critical juncture with the current pattern acting as a potential barrier to further gains.

Over the past two months, there’s been a consistent rise in the value of PancakeSwap [CAKE], following a 10-month low it reached in August.

Has the latest surge in buying pressure propelled the coin upwards, and will purchasers be able to leverage this push to surmount significant resistance levels?

Recent price action and EMA overview

Over the last two months, the price of CAKE has significantly risen, creating a trendline that has maintained its upward trajectory and preserved the coin’s strong movement.

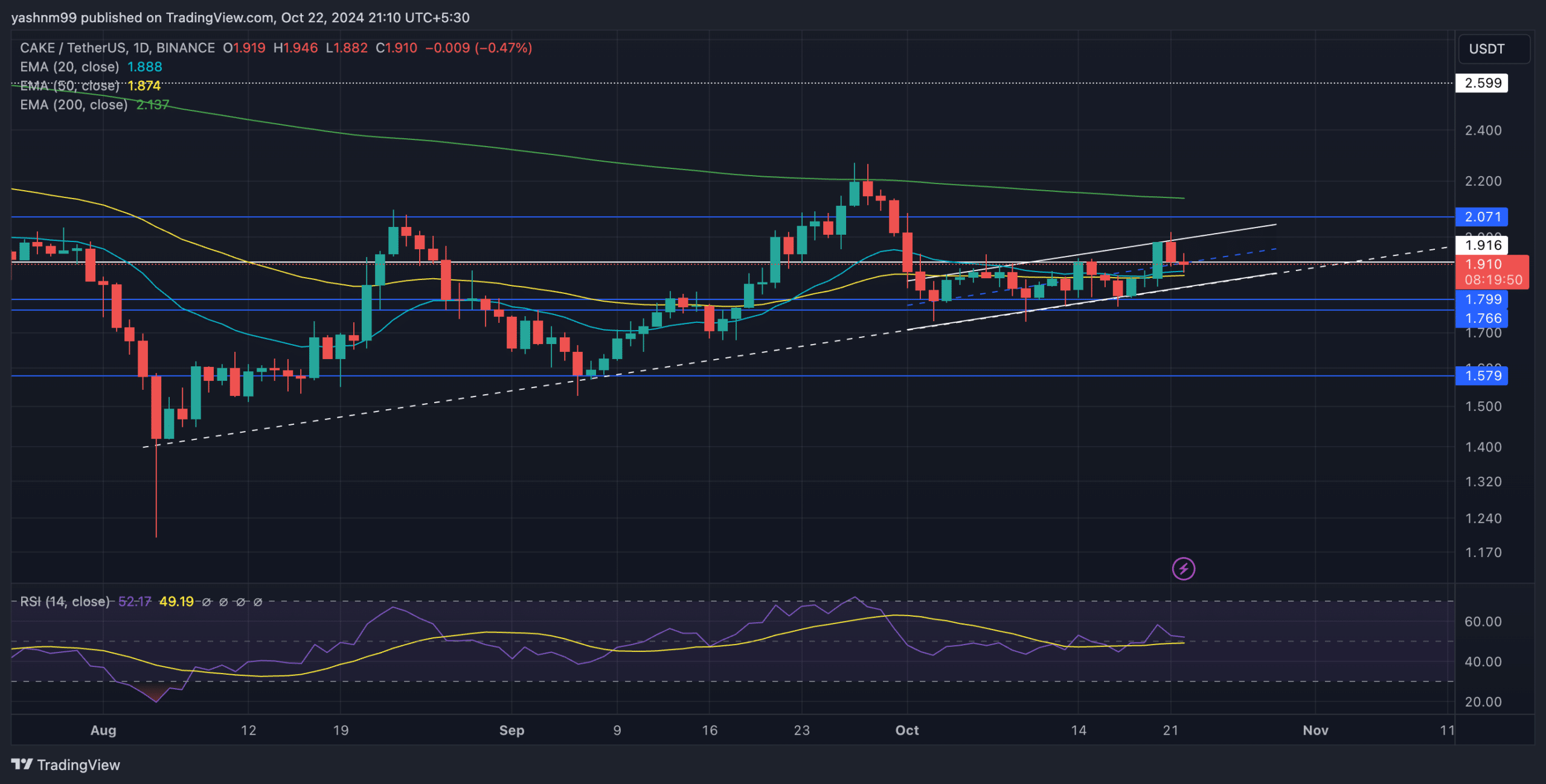

Despite this steady uptrend, CAKE has struggled to surpass the 200-day EMA, currently at $2.137.

Currently, CAKE is being exchanged for approximately $1.90. It’s slightly above its 20-day moving average (EMA) at $1.887 and 50-day EMA at $1.873. These two EMAs served as potential areas of support, with the price fluctuating near them.

On the daily chart, the ongoing price movement appears similar to a typical bearish pennant pattern, which could indicate potential additional declines for CAKE’s price if it cannot maintain above the supporting trendline.

If the price falls below the horizontal lines at $1.7, it might lead the coin’s value to drop towards the $1.5 area.

As a researcher observing market trends, if there’s an unexpected surge in bullish momentum, breaking above the current pattern might provide CAKE with an opportunity to reach even higher price points.

In simple terms, the Relative Strength Index (RSI) was approximately 50, showing an equilibrial market mood where buyers and sellers have roughly similar strength. Moving below 50 could potentially signal a resurgence of bears, indicating a more pessimistic outlook.

As a researcher, I found the $1.7 level to be pivotal, acting as a strong support that coincided with the bottom boundary of the ascending channel. Breaching this level might potentially lead to additional declines for CAKE.

If the price surpasses its current trend, it might encounter the resistance level of $2.071 again, and potentially aim for the 200-day Exponential Moving Average (EMA) at $2.137.

CAKE’s derivatives data and market sentiment

Derivatives data pointed out a cautious sentiment among traders. Open Interest fell by 6.26% to $15.25 million, while the trading volume dropped by 43.37% to $15.28 million, reflecting reduced trader activity after recent volatility.

It’s worth noting that the ratio of long to short positions for CAKE/USDT on Binance was 2.1095. This implies a slightly stronger inclination towards buying among traders, suggesting a potentially bullish trend.

On OKX, the Long/Short Ratio was 2.4095, suggesting that traders are generally optimistic and have a higher number of long positions compared to short ones, implying they anticipate positive returns for the coin in the short term.

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Leading traders on the Binance platform generally hold an optimistic stance, as indicated by their long/short ratio of 1.8477. This implies that these traders are more likely to invest in assets they believe will increase in value, hinting at a possible price rise.

Keeping an eye on overall market trends is crucial for traders because Bitcoin‘s price fluctuations can significantly impact the direction of CAKE.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-23 13:44