- PayPal USD marketcap experienced roughly $300 million worth of liquidity outflows in September.

- A look at the stablecoin’s shift in dominance and address growth.

As an analyst with over a decade of experience in the crypto market, I have seen my fair share of ups and downs, booms and busts. Looking at PayPal USD’s recent performance, it seems we might be witnessing another chapter in this rollercoaster ride.

As a crypto investor, I’ve noticed that PayPal’s USD stablecoin was poised for rapid growth at the beginning of Q3 2024. However, over the past four weeks, it seems to have taken a step back from its earlier successes in terms of performance.

As a researcher, I observed an impressive growth in PayPal’s market capitalization from July to August. Not only did it surpass, but it more than doubled during this period. Towards the end of August, it broke the $1 billion threshold for the first time ever, signifying a significant historical milestone.

The success was largely fueled by widespread excitement and increasing practical applications, particularly within the Solana network. Nevertheless, the initial buzz seems to have waned based on its September performance.

Roughly $300 million was wiped out of PYUSD’s marketcap in the last four weeks. It recently dipped to a local low of $695 million, but has since recovered back above $700 million.

The rise in PayPal’s USD usage can be attributed to its implementation on the Solana platform. Over the course of the last week of July through the end of August, we noticed an increase in its influence and prominence.

On the 28th of August, PayPal’s US Dollar usage on Solana reached a maximum of 65.79%, but by the 30th of September, this figure had decreased to 47.68%. This decrease in dominance on Solana allowed for an increase in its presence on Ethereum, where it now stands at 52.32%.

The declining dominance on Solana aligns with the dip in large transaction in the last 3 months.

On July th, Solana’s daily trading volume reached its all-time high of $342.24 million. In comparison, the maximum daily volume in August was $252.58 million, and it recently peaked at $170.67 million on September 26th.

Over the past three months, the on-chain volume of US Dollars on PayPal has decreased noticeably. This trend indicates a possible decrease in user interest or demand for PayPal services during this timeframe, which could account for the falling market capitalization.

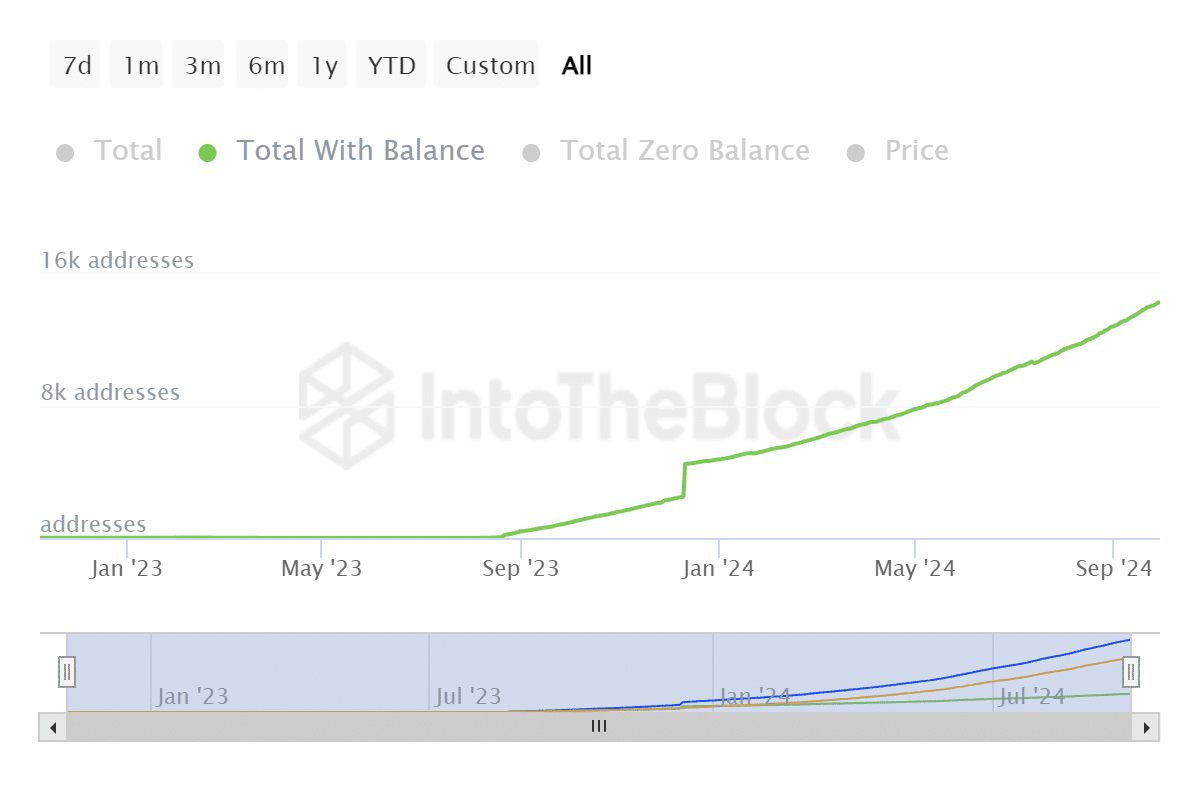

PayPal USD continues winning in address growth

Regardless of its effect on market capitalization, the number of PayPal USD accounts has been increasing, and it just reached a high of 14,290 unique accounts holding a balance.

This is the highest number of addresses that the stablecoin has achieved so far.

A rise in population growth indicates a strong level of acceptance this year, even with the significant decrease observed in August and September.

Could it be possible that the value of PYUSD will rebound to its former peak market caps? Its alluring incentives, particularly the high returns offered on the Solana network, seem to have fueled a strong demand for it.

These kinds of chances could surface during an extended period of rising market prices, commonly known as a bull market. If this happens, it’s possible that there will continue to be increased interest in using PayPal with US Dollars at some point in the future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-10-01 12:07