- Pendle’s TVL stood at $3.392 billion, highlighting renewed market confidence.

- If the price closes above $6.3, the coin could challenge its December all-time high of $7.52.

As a seasoned researcher with years of experience in the cryptosphere, I find myself constantly intrigued by the rollercoaster ride that is Pendle [PENDLE]. This token has shown remarkable resilience and growth this year, peaking at an impressive 600% increase in April. However, it’s not just about the numbers for me; it’s about the potential impact Pendle could have on the future of yield optimization.

To start off the year, PENDLE saw substantial growth, reaching its highest point in April with a staggering 600% surge. However, during the subsequent months, the price dipped back to approximately 75% of that peak increase – a level based on Fibonacci retracement – before bouncing back in August.

Pendle was trading at $5.3 at press time, reflecting a 355% gain year-to-date.

In a notable development, Pendle is undergoing substantial growth, transforming the landscape of yield optimization by converting future profits into digital tokens and striving for maximum returns.

If the price manages to finish the month with a strong upward movement above $6.3, it might aim to reach its record peak of $7.52 by December.

Pendle’s TVL continues uptrend

Starting in February, the total value locked in the coin gradually increased, reaching over $6 billion by June, suggesting significant expansion and high user acceptance.

Yet, there was a significant drop in July, causing the TVL to approach almost $3 billion. This decrease might be due to potential market adjustments or withdrawals of liquidity.

Starting in August, the value held by TVL demonstrated strength and steadiness, hovering near the $3 billion mark, then slowly regaining momentum in October and November.

Currently, as I’m typing this, the Total Value Locked (TVL) of Pendle is approximately $3.392 billion, indicating a surge in market trust and higher involvement within its system.

Price ignites fresh optimism

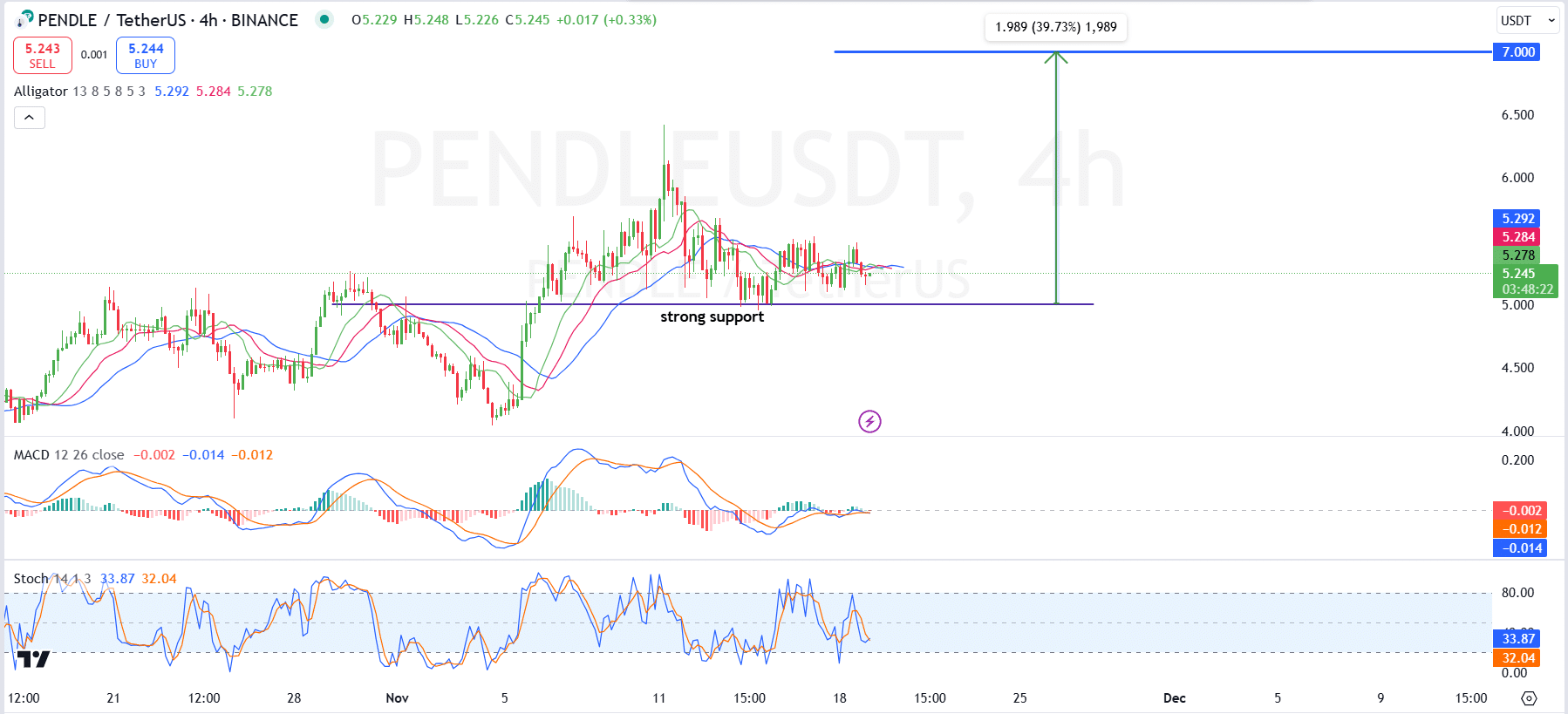

According to PENDLE’s four-hour analysis, the price trend is stabilizing above a robust support at $5.00. If this upward trend persists, a potential breakout could lead to a goal of $7.00, representing a 39.73% increase if the bullish trend maintains its strength.

As an analyst, I’ve observed that the price movement has been confined within a range, and the Alligator lines are converging. This convergence suggests a shortage of strong directional momentum at present, indicating potential sideways movement or consolidation in the near term.

Additionally, the MACD (Moving Average Convergence Divergence) exhibited a slightly negative trend as the lines fell below the signal line, indicating a weaker momentum in the market.

Nevertheless, the histogram indicated a drop in bearish influence, hinting at a potential shift. Simultaneously, the stochastic RSI stood close to the oversold area at 33.87, implying that the price might soon rebound.

Pendle rebounds following funding rate shift

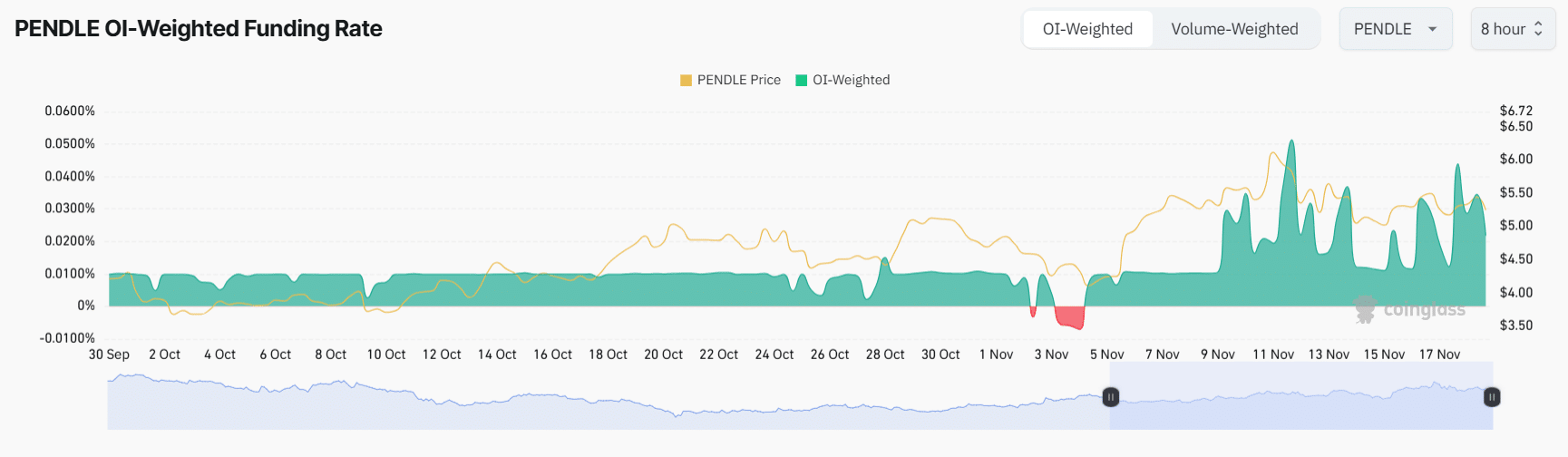

The graph shows how the Pendle’s price, represented by a yellow line, compares with the Open Interest-Weighted Funding Rate, depicted as a green region, across different periods.

Read Pendle’s [PENDLE] Price Prediction 2024-2025

At the start of November, the Funding Rate momentarily dropped below zero, which occurred alongside a slight decrease in price, suggesting a temporary bearish attitude among traders in the short term.

As the Funding Rate settled and became positive, I observed a resurgence of momentum in Pendle, indicating a restored sense of trust among its participants.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-11-20 12:08