-

PEPE’s Open Interest surged to a new high.

The meme coin’s high MVRV ratio put it at risk of decline.

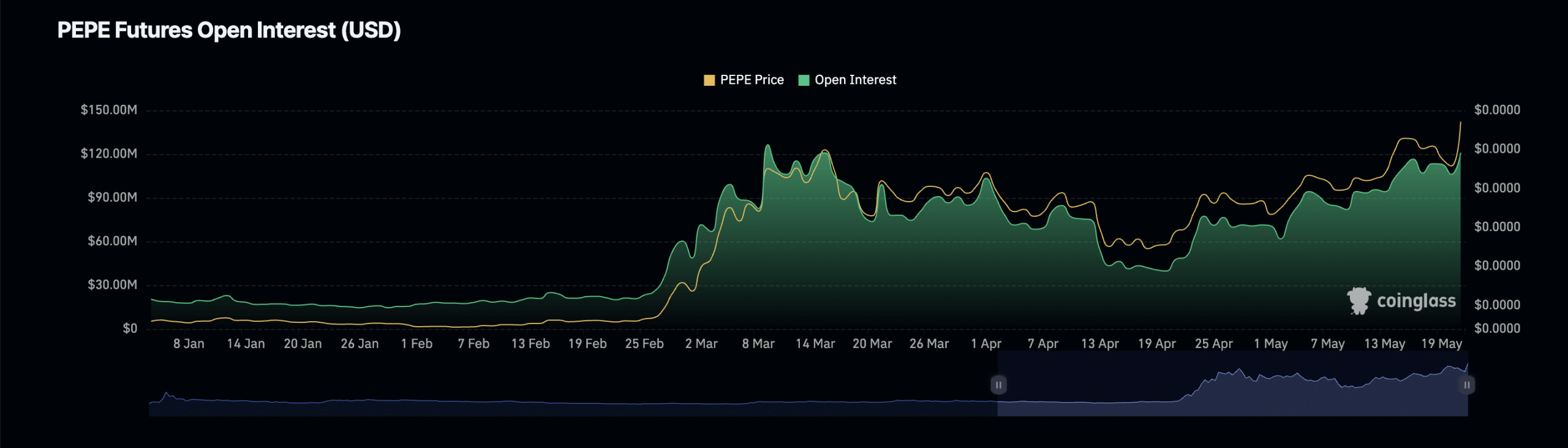

As a researcher with experience in analyzing cryptocurrency market trends, I’m closely monitoring the recent developments surrounding PEPE (Pepe the Frog coin). The surge in PEPE’s Open Interest to a new high is an intriguing observation. This metric tracks the total number of outstanding futures contracts or positions that have not been closed or settled and can indicate a spike in market activity or a positive change in sentiment among traders.

The open interest for PEPE‘s futures contracts on Coingecko has reached a two-month peak, reflecting the ongoing surge in the cryptocurrency market.

As a crypto investor, I’ve noticed an intriguing development with the meme coin. With a market capitalization of $121 million at present, its Futures Open Interest has experienced a significant surge of 14% over the past 24 hours.

PEPE Futures Open Interest represents the current count of active futures agreements that have yet to be concluded or liquidated.

When it increases, it indicates an uptick in trading action or a shift in investors’ optimism, implying that a larger number of market players are initiating fresh positions.

Examining the current funding rates has affirmed the ongoing bullish sentiment for the token. At present, PEPE‘s funding rate stands positively at 0.0156%.

Persistent futures agreements employ Funding Rates as a mechanism to keep the contract’s price aligned with the current market price.

As a crypto investor, when I notice that an asset’s futures funding rates are showing a positive value, I take it as a sign of a robust demand for holding long positions. This bullish indication implies that the asset is expected to continue its price increase in the near future.

PEPE holders book profit

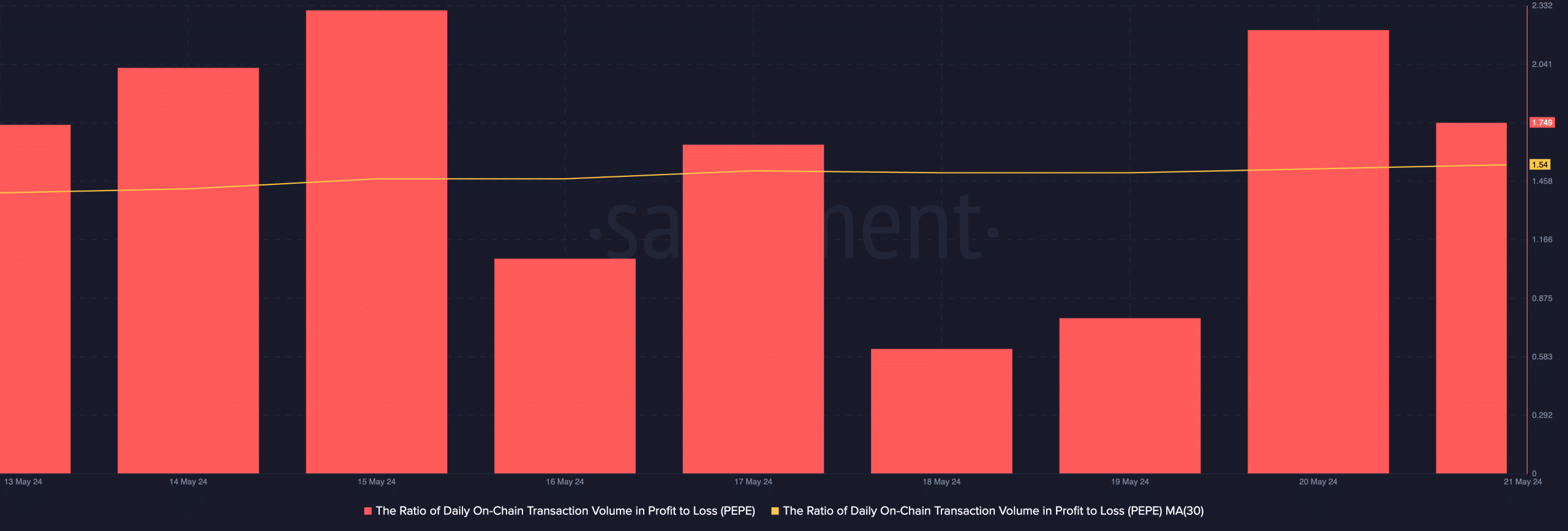

As a researcher examining the PEPE cryptocurrency market, I discovered that the majority of transactions conducted over the past period resulted in profits for PEPE traders.

Based on my analysis of Santiment’s data, I found that PEPE‘s daily transaction volume in profits outpaced losses by a ratio of 1.54 over the past 30-day period.

For each PEPE transaction resulting in a loss over the past month, approximately 1.54 transactions have generated a profit.

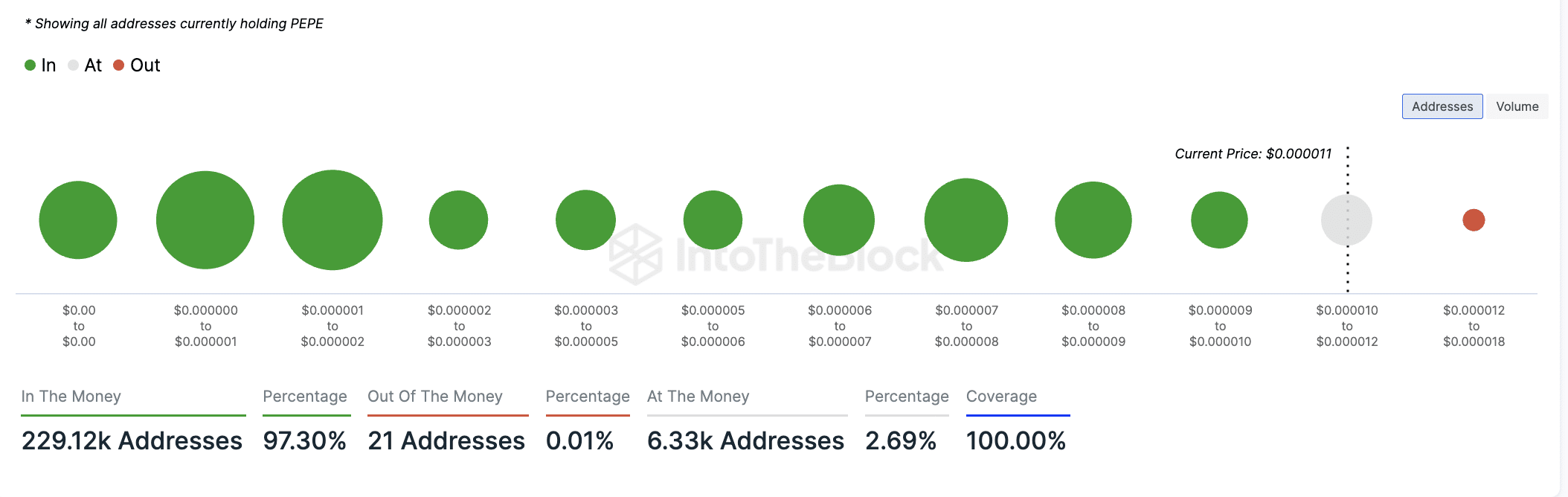

As a crypto investor, I’d interpret that based on IntoTheBlock’s data, approximately 229,120 wallets holding PEPE tokens currently have their investments in the green. That means these addresses bought the tokens at lower prices than their current market value.

On the other hand, approximately 3% of PEPE holders, numbering around 6,330 addresses, purchased the meme coin at a price higher than $0.000012.

As of this writing, PEPE exchanged hands at $0.000011, according to CoinMarketCap’s data.

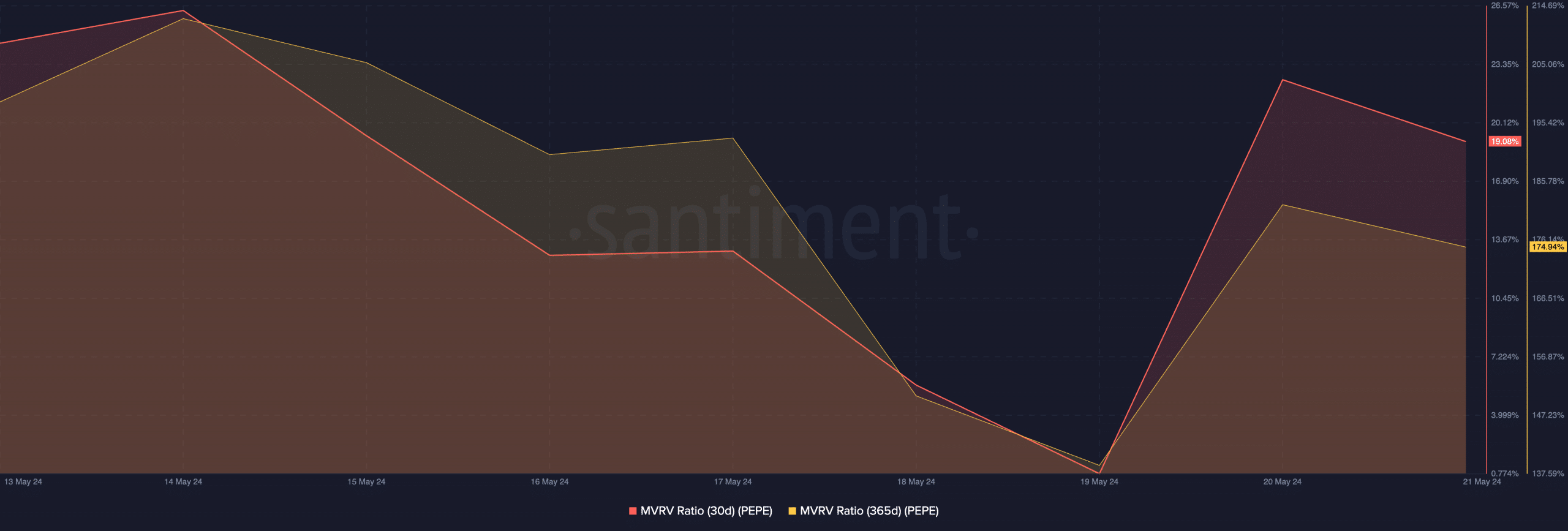

As a cautious investor, I would advise against being too enthusiastic about PEPE‘s significant price surge in the last 24 hours. Based on its current Market Value to Realized Value (MVRV) ratio, this token appears to be overvalued according to my analysis at the present moment.

The given metric represents the comparison of PEPE‘s current market value against the average value of each token it has acquired.

As an analyst, I would interpret a value greater than one as an indication that the market value of an asset surpasses the average purchase price for most investors. This situation implies that the asset is considered overvalued.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The MVRV ratios for PEPE, calculated based on 30-day and 365-day moving averages, were 19.08% and 174.94%. This means that the difference between the current price and the average price over the past 30 days represented a 19.08% gain or loss, while the same calculation based on a year’s worth of data resulted in a ratio of 174.94%.

Historically, when the Market Value Realized Value (MVRV) ratio of cryptocurrencies or other assets reaches significant heights, it may indicate that some investors who purchased at lower prices might consider selling their holdings, leading to a potential wave of profit-taking.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-22 00:07