- The DOGE/Pepe fractal on the 3-day time frame was still in play as of press time.

- The global profitability and long/shorts accounts percentage suggested an uptrend.

As a seasoned crypto investor with a knack for recognizing patterns and trends, I find myself intrigued by the Pepe/Dogecoin fractal playing out on the 3-day timeframe. The global profitability and long/shorts accounts percentage suggest an uptrend that’s hard to ignore.

In simpler terms, it appears that the most popular frog-themed cryptocurrency within the Ethereum network, known as Pepe (PEPE), is mimicking the price trend of Dogecoin (DOGE) from last year.

Over a span of three days, Dogecoin (DOGE) peaked and reached its highest point during the halving phase of Bitcoin (BTC). This surge in DOGE happened simultaneously with an altcoin market cap high, and other cryptocurrencies (OTHERS.D) also followed suit.

It’s clear that the same trend is visible in Pepe’s latest actions. Just like how it surged, Pepe seems to be mirroring this speedy growth in sync with fluctuations in Bitcoin’s value and the overall behavior of the altcoin market.

In January 2021, DOGE saw a significant rise, following closely behind Bitcoin as it set record-breaking heights. Meanwhile, patterns in PEPE hint at its possibility of achieving new maximum values.

Reflecting on Dogecoin’s (DOGE) journey in 2021, I witnessed a remarkable surge from established peaks to unprecedented heights, mirroring the expansion of Bitcoin and the broader altcoin market.

PEPE’s recent price trend seems quite similar to this stage, suggesting it might surpass, and perhaps even outdo, its past peak prices in the upcoming periods under current market circumstances and investor enthusiasm.

Pepe prediction after a new ATH

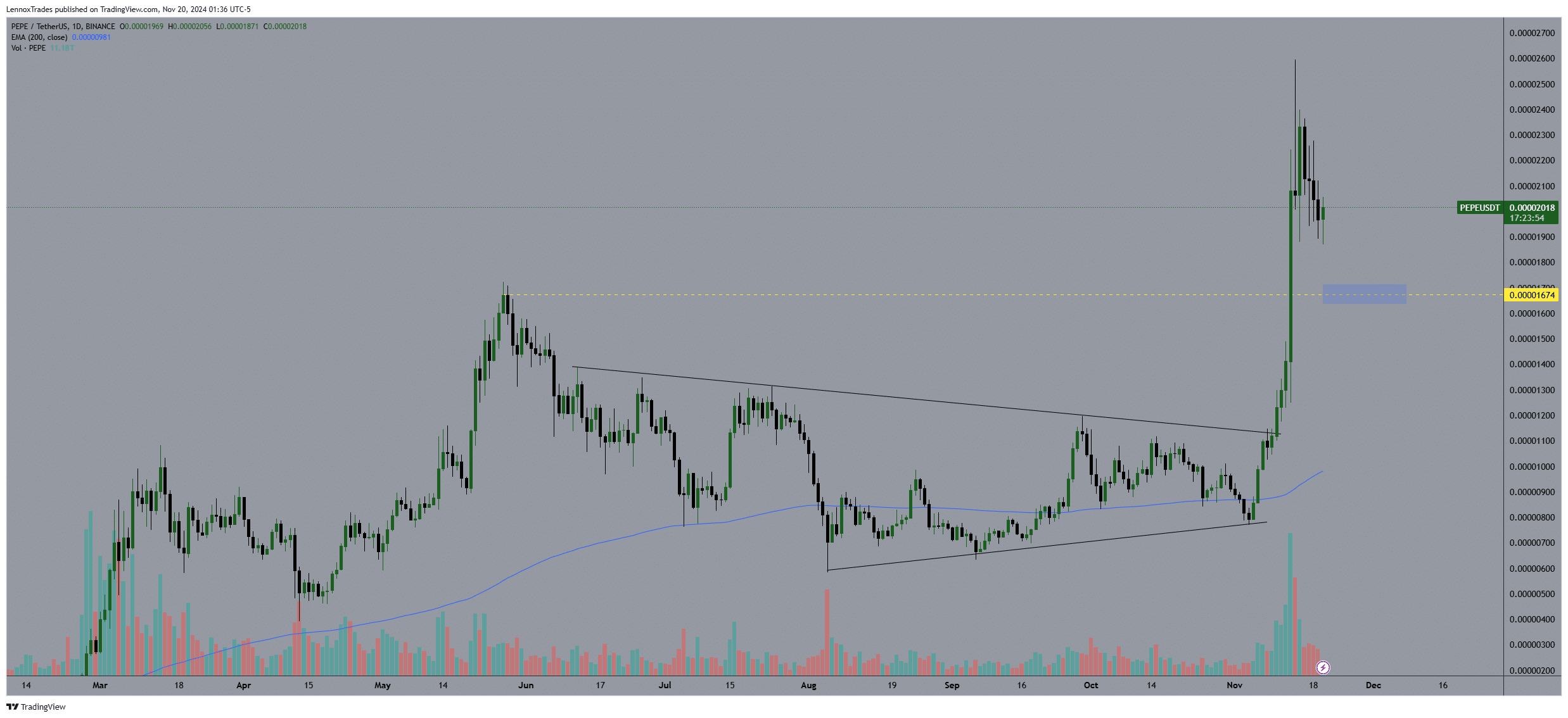

Looking at PEPE’s daily price movements reveals that it has been climbing after breaking out from a falling wedge formation, reaching new record highs in the process.

This breakout was characterized by a spike in trading volume, signaling strong buyer interest.

After reaching those peaks, the level of purchases started to decrease, suggesting a decline in buyer’s enthusiasm.

As a researcher, I’m observing a consolidation period in the PEPE token, currently hovering slightly above a crucial support level at approximately $0.0000167. Maintaining this level is vital for any potential future upward trend.

In more straightforward terms, if a coin like PEPE holds above its current support level, there’s a good chance it will continue its upward trend and possibly reach even higher prices, particularly in markets known for their volatility such as memecoins.

The general feeling towards meme coins in the market remains optimistic, indicating that potential drops could be brief since the pattern of volatility seems to persist.

Global profitability and accounts percentage

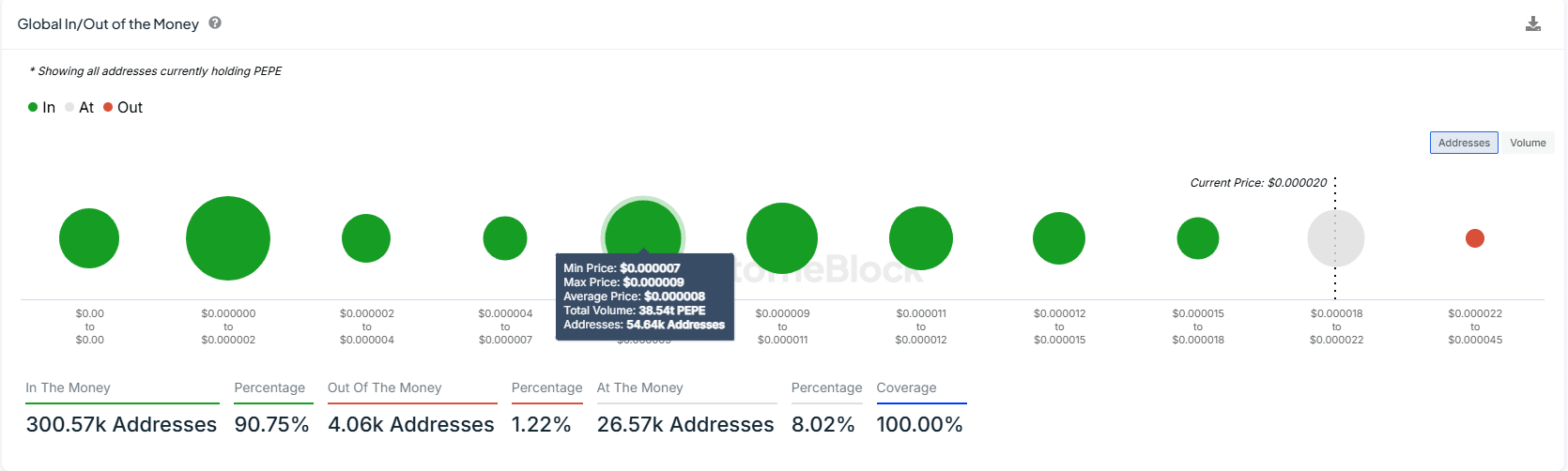

Moreover, a significant number of PEPE investors were in profit, as an impressive 90.75% of wallets had bought tokens below the current market value of $0.000020.

Approximately 90.76% of the addresses analyzed were either “in the money” or “over the money,” meaning they would yield profits or had already realized them due to current price levels, while only 8.02% were “at the money,” indicating a trading situation near the break-even point. A mere 1.22% of addresses showed potential losses based on existing prices.

A significant number of lucrative PEPE address holders might keep pushing the token’s price upwards consistently, since many investors seem motivated to continue holding onto their investments, possibly looking to capitalize on even greater returns by selling at higher price levels.

This strong holder base provided a solid foundation for future price appreciation.

Read Pepe’s [PEPE] Price Prediction 2024–2025

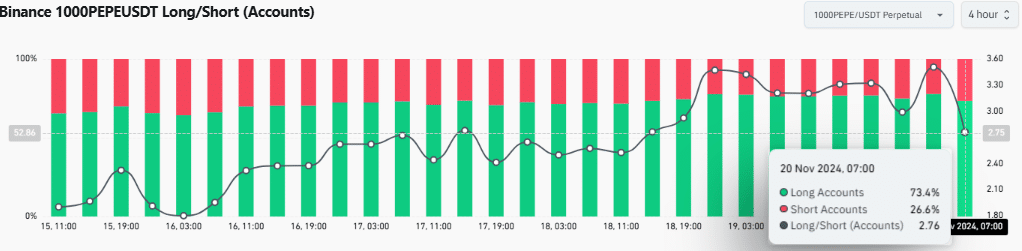

Once more, the distribution among Global Long/Short trading accounts indicated a positive outlook, with long positions significantly outnumbering short ones. Specifically, 73.4% of these accounts were long positions, while only 26.6% were short positions.

With a robust 2.76-to-1 dominance, this suggests an ongoing bullish pattern, implying that Pepe could potentially sustain its surge, buoyed by widespread market enthusiasm.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-11-20 15:36