- Pepe maintained the new price zone despite the decline.

- The number of holders saw a noticeable increase.

As a crypto investor with some experience in the market, I’m keeping a close eye on Pepe (PEPE) as it continues to show promising signs of growth. Despite a recent decline, it has managed to maintain its new price zone, which could indicate that it may remain in this range for a while longer. This is especially significant given that Pepe has become one of the most traded assets on Binance, attracting a large and active community of traders.

🌪️ Storm Brewing: EUR/USD Forecast Turns Chaotic Under Trump!

Discover why the next days could be critical for forex traders!

View Urgent ForecastOver the past three months, PEPE, or Pepe the Frog in full, has consistently hit new record highs, making it a popular asset to trade. Binance [BNB], in particular, has seen significant activity involving this meme coin.

So, Pepe could remain in its current zone for a while longer.

Pepe among the most traded assets

As a researcher examining trading activity on Binance over the past 24 hours, I discovered that Pepe was amongst the top assets in terms of trading volume. Previously, it held the fifth position and reigned supreme as the most actively traded meme coin.

Despite a significant 16% surge in trading activity within the last day, the asset had slipped to seventh position in rankings at the point of composition.

As a researcher examining the latest data, I’ve found that “Bonk” has outpaced its previous rank and now occupies the sixth position, boasting a impressive 22% rise in trading volume during the given timeframe.

Pepe price prediction

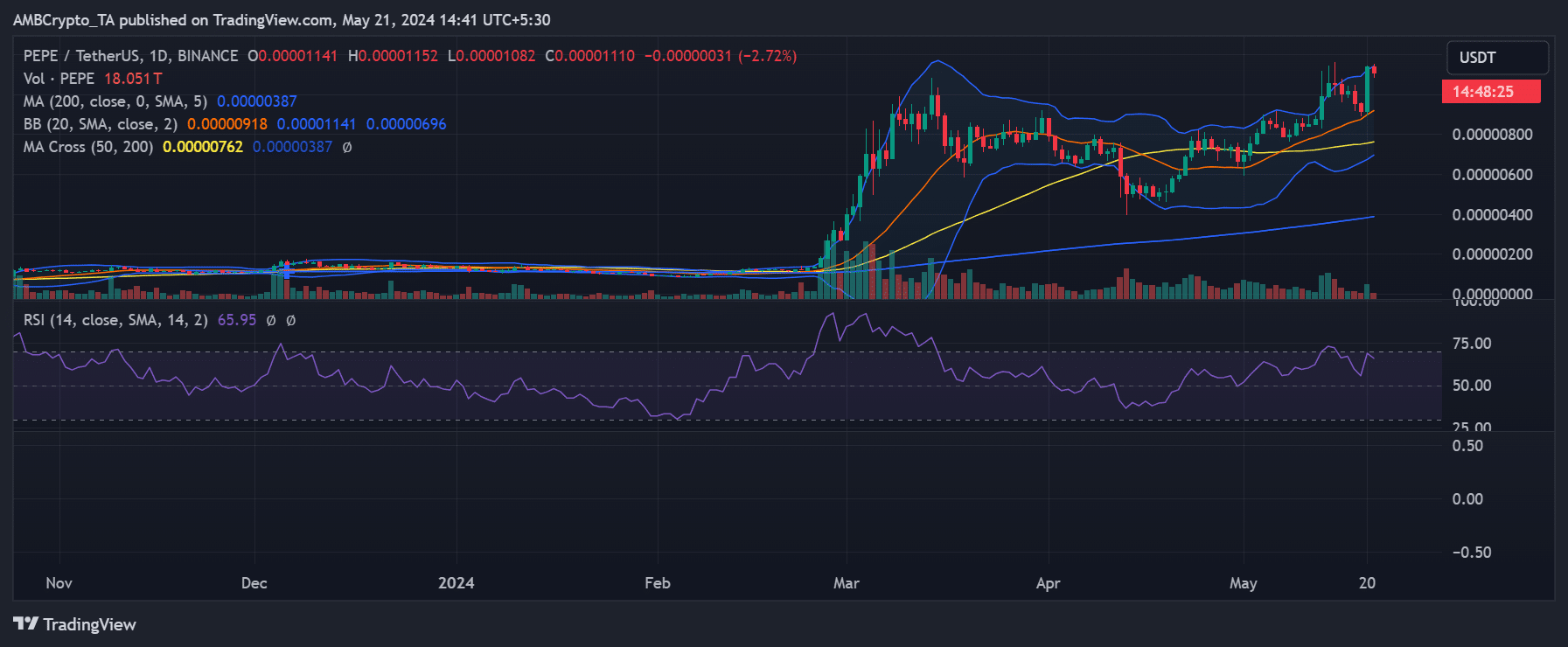

On the 20th of May, Pepe experienced a substantial jump in value, soaring over 20%. This significant rise propelled Pepe into a fresh price territory, representing its most considerable price surge since March.

The price increased approximately 25% from roughly $0.000009 to a record-breaking $0.000011. Currently, Pepe is priced around $0.000011, but it has dropped more than 2.7% since then.

As a financial analyst, I observed that the Bollinger Bands, which are widely used to measure volatility in financial markets, displayed significant width in my recent analysis. This expansion implies heightened market volatility and potentially signals the approach of a notable price movement in the near future.

Additionally, the short Moving Average (yellow line) continued to act as strong support.

The RSI reading, which represents the relative strength of a security’s price action, exceeded 65, signaling a robust uptrend. However, the latest price drop kept it from reaching the overbought territory.

What’s after its ATH?

Based on an examination of data from Coinglass, Open Interest for Pepe has reached a peak level recently.

As an analyst, I observed that the Open Interest on AMBCrypto’s chart had surged past $121 million during my analysis, suggesting a substantial injection of capital into the market.

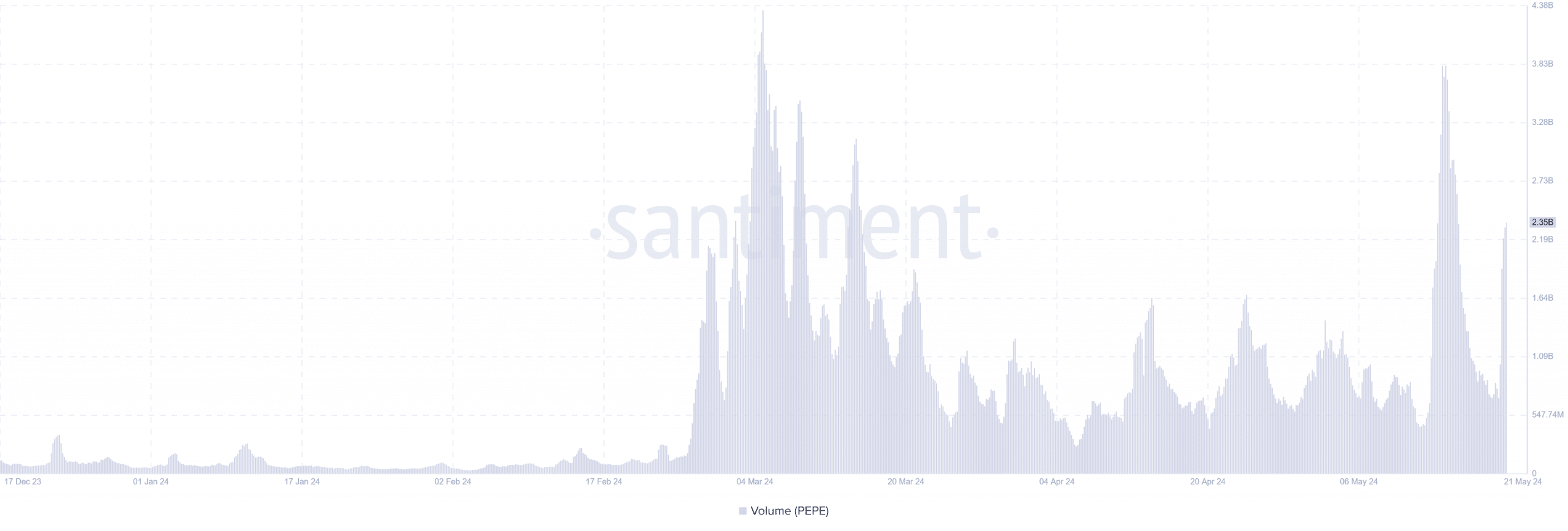

As a researcher studying this particular market trend, I’ve discovered that recent data from Santiment indicates a significant surge in trading volume. Specifically, the volume has escalated beyond the $2.3 billion mark.

Based on the data analyzed, a bullish price outlook can be inferred, implying that there is enough trading activity and financial support to keep the price stable for the time being.

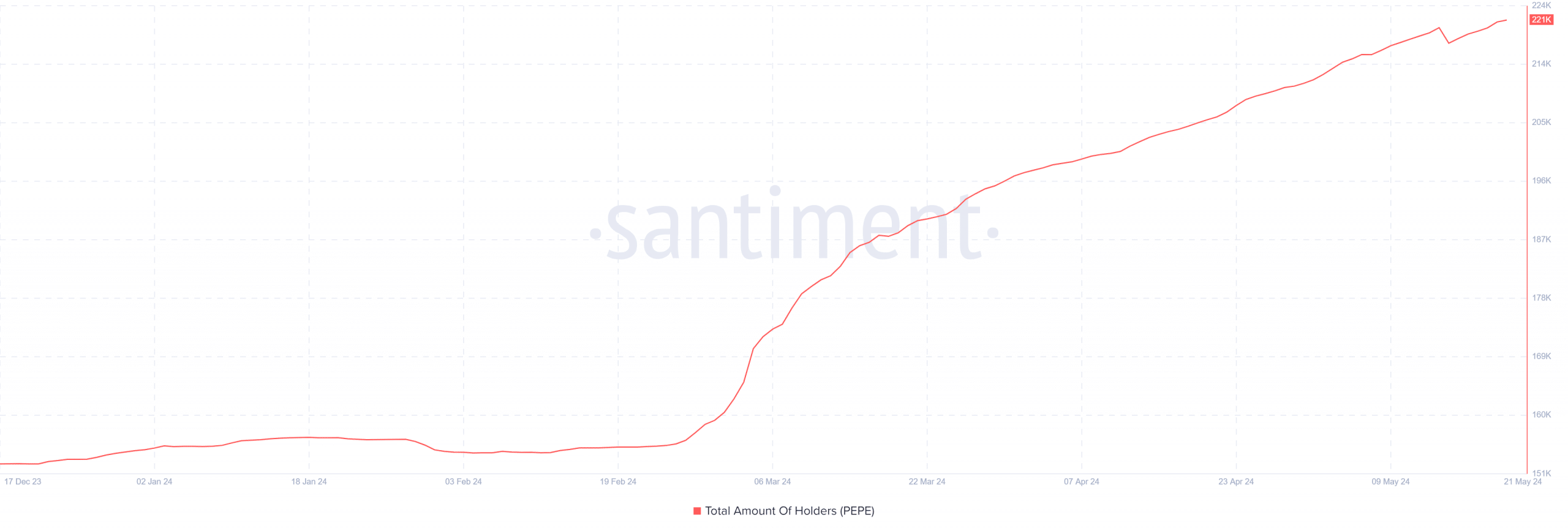

Number of Pepe holders increase

Based on an evaluation of the Santiment chart by AMBCrypto, there was a roughly 270-person increase in the total number of holders over the past 24 hours.

On May 20th, approximately 221,540 individuals held the item. At the moment of composing this text, the number had grown to 221,830 holders.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-05-22 07:03