-

PEPE’s large transactions dropped 26% as active addresses decreased by 7.43% in the last 24 hours.

Price consolidation persisted as PEPE approached a potential breakout.

As a seasoned researcher with years of experience navigating the tumultuous crypto markets, I find myself intrigued by the enigma that is PEPE (PEPE). The recent drop in large transactions by 26% and a decrease in active addresses by 7.43% over the last 24 hours has me scratching my head.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastDespite rough seas, enthusiasm for the PEPE memecoin persisted, with crucial on-chain signals suggesting conflicting trends.

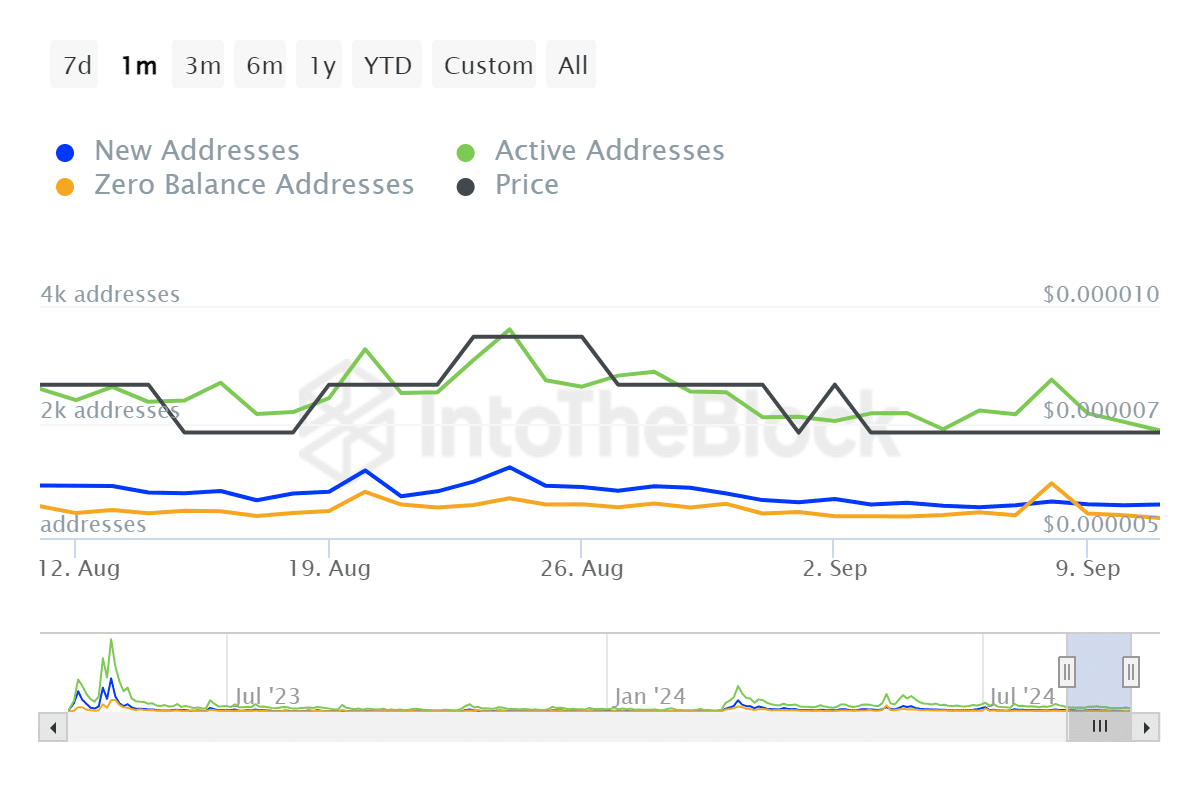

It’s worth noting that recent findings from IntoTheBlock and Santiment suggest potential patterns in the near future price movements of PEPE.

User engagement takes a hit

Primarily, the number of transactions for PEPE has significantly decreased by 26%, which is often associated with whale activity. This decline might imply that major investors are exiting the market.

Over the past day, there was a 7.43% decrease in the number of active whale addresses. Such a decline could suggest a waning user engagement or shifts in investor mood regarding trading.

A reduction in active addresses generally coincides with lower trading volumes, which might impact the availability of assets for trading (liquidity).

Although the data is decreasing, the graph for PEPE seems to follow a symmetrical triangular shape. Typically, this pattern precedes a significant surge in volatility, with the price either rising sharply or continuing its downward trend.

The narrowing down of volatility, shown by fewer large trades, is strongly linked to the previously mentioned period of consolidation.

What’s ahead for PEPE?

As PEPE nears the peak of its symmetrical triangle formation, it’s crucial for market players and investors to stay attentive to the latest updates regarding this memecoin. Particularly, monitoring the activities of major investors (whales) could be quite significant.

This could be an indication that the whales (large investors) are either amassing more assets (accumulation) or distributing their holdings (distribution), based on the prevailing market conditions, due to a drop in both whale and user activity.

Read Pepe’s [PEPE] Price Prediction 2024–2025

So, the ongoing consolidation could be setting the stage for a possible breakout.

However, the direction of the breakout could be determined by the market broader sentiments and the near future development on the memecoin.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-13 04:07