-

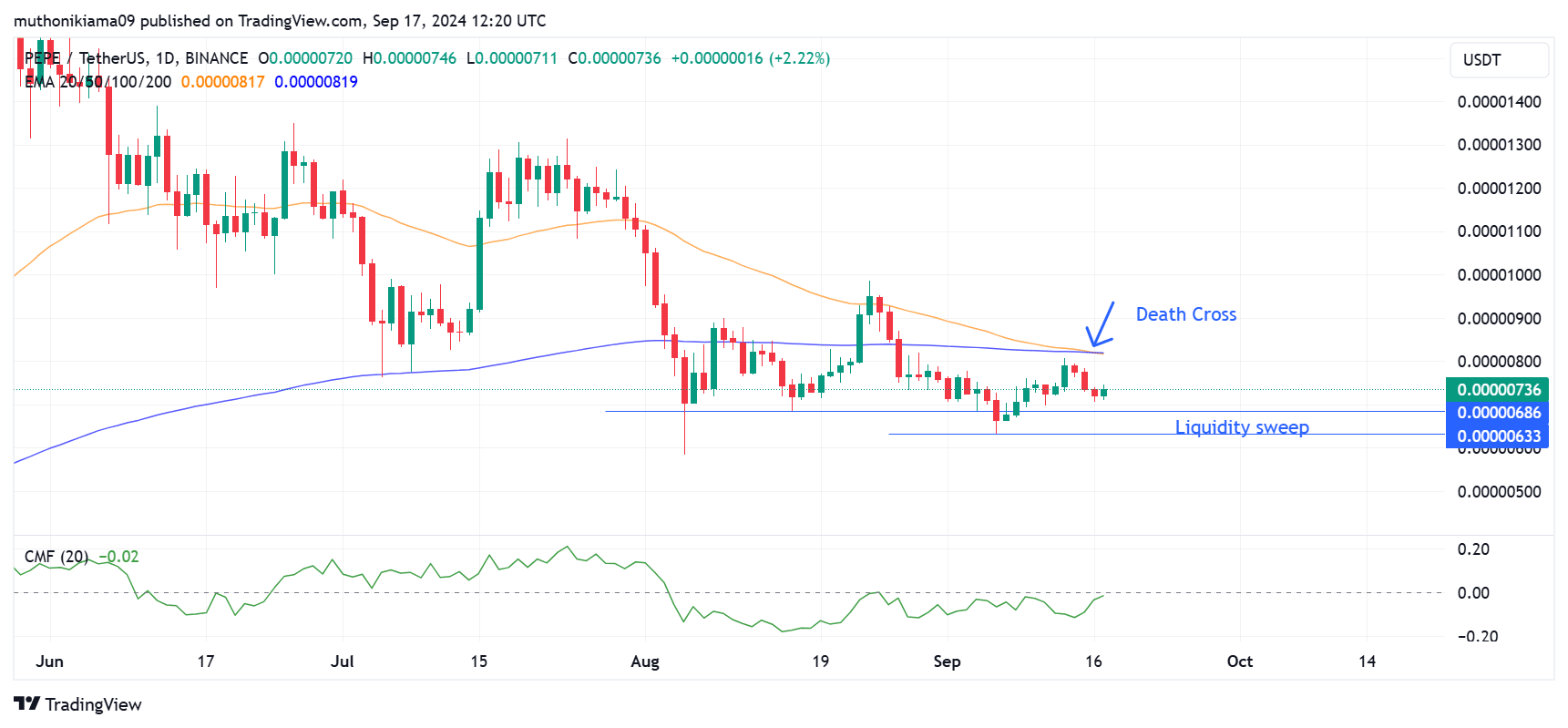

PEPE faced a death cross with the 50-day EMA, converging with the 200-day EMA.

On-chain data showed more bearish signals, but whale accumulation stabilized the price.

As an analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of death crosses and bullish reversals. The current situation with PEPE [PEPE] is intriguing, to say the least.

Pepe (PEPE) ranks as the third-largest meme coin, boasting a market cap of approximately $7.8 billion. In the last twelve months, PEPE has seen an astounding surge of over 1000%, putting it on many investors’ radars as a promising coin to keep an eye on.

At the moment of writing, PEPE was exchanged for $0.00000738, marking a 2% increase over the past day. However, the excitement surrounding memecoins appears to be dwindling, making it challenging for PEPE to maintain its bullish trend. It’s possible that bears may soon regain control of the price movement.

Yesterday’s PEPE price chart showed the emergence of a ‘death cross’ pattern, which occurs when the 50-day Exponential Moving Average (EMA) intersects and moves below the 200-day EMA.

This pattern suggests that the immediate, or short-term, momentum is decreasing more than the overall, or long-term, momentum.

To fully establish the “death cross” pattern, it’s crucial that the 50-day Exponential Moving Average (EMA) drops significantly below the 200-day EMA. At present, these lines are closing in on each other rather than the 50-day EMA crossing beneath the 200-day EMA, which indicates they have not yet formed this pattern.

This suggests that the current state of the market is uncertain, as the price of PEPE stands at a crucial juncture. It’s possible that we might witness a fresh trend, whether it’s an uptrend (bullish) or a downtrend (bearish), unfolding from here.

Purchasers seem prepared to counteract the ‘death cross’ formation, as the Chaikin Money Flow (CMF) has started moving upward. Although it remains below zero, the CMF is gradually approaching 0.

If it flips to the positive region, it will confirm a bullish reversal for PEPE.

Despite the presence of approximately 0.00000633 units of unrealized liquidity, if PEPE‘s price falls below its current support level at $0.00000686, it might continue to decline to collect this liquidity before making a significant price shift.

On-chain data shows more bearish signals

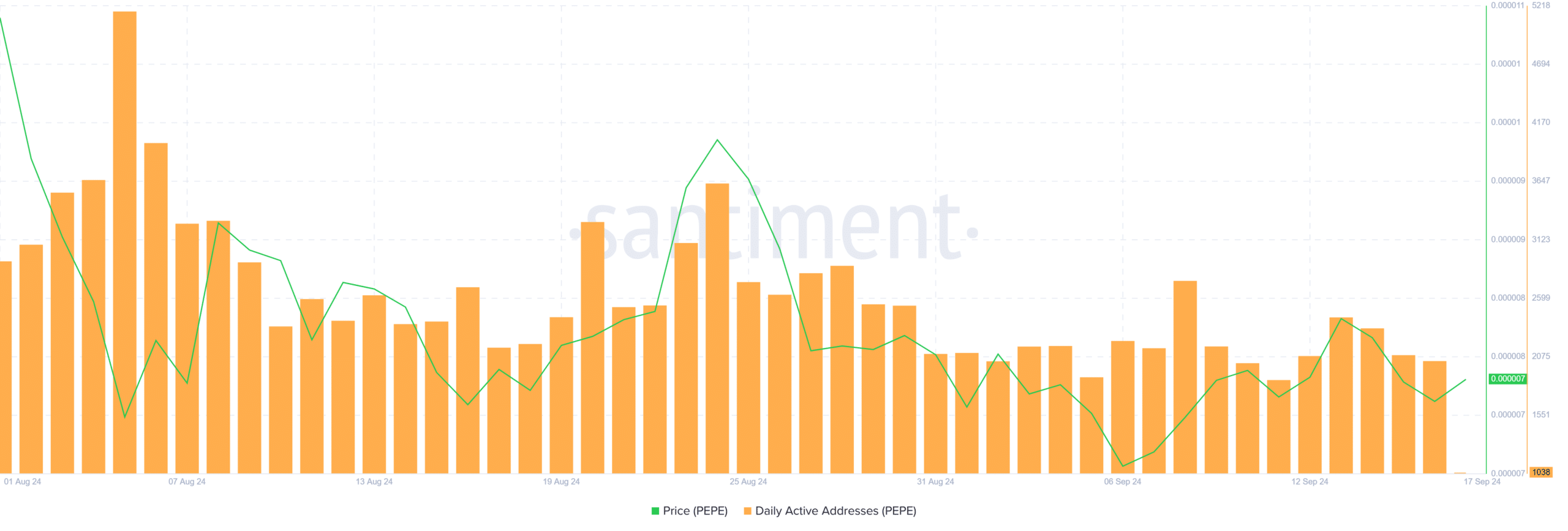

Additionally, more indications of pessimism regarding the cryptocurrency PEPE have surfaced. According to data from Santiment, the number of daily active users interacting with PEPE has reached a five-day minimum.

As an investor in PEPE, I’ve noticed this recent decline, and it seems clear that the minor price increases were largely influenced by a select few traders. To establish a robust upward trend, it’s crucial that we attract broader market participation.

The derivatives market also shows that the sentiment is also bearish. Per Coinglass, PEPE’s Open Interest had increased slightly by 1.2% to $82M at press time.

As a researcher, I observed that the funding rates turned negative during the specified period, implying an uptick in short positions among traders regarding PEPE.

Read Pepe’s [PEPE] Price Prediction 2024–2025

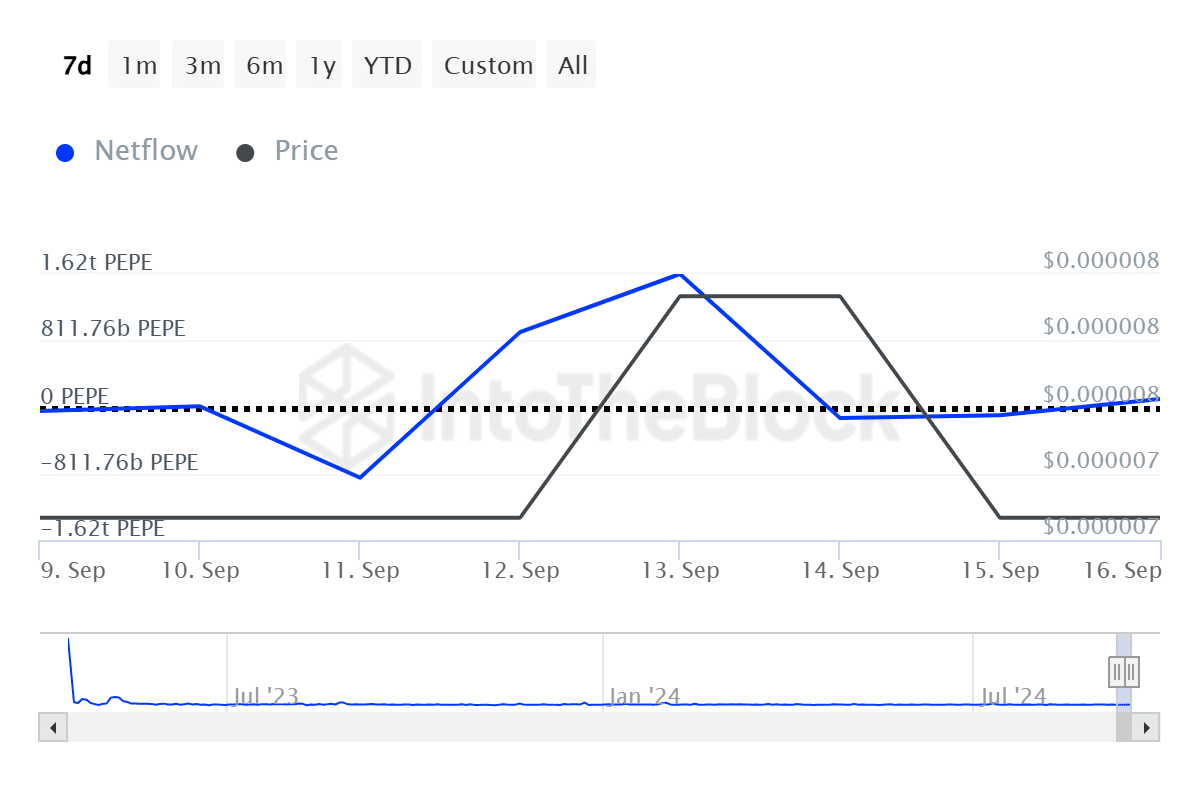

Despite the bearish Death Cross signal, an increasing number of whale investors are pouring into PEPE. It’s possible that these investors might be responsible for the recent weakening of this bearish indicator.

In the past month, there’s been over a thousand percent increase in large investors transferring their PEPE tokens into storage. This accumulation has helped prevent a significant drop in PEPE’s price, even with negative market indicators.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-17 23:35