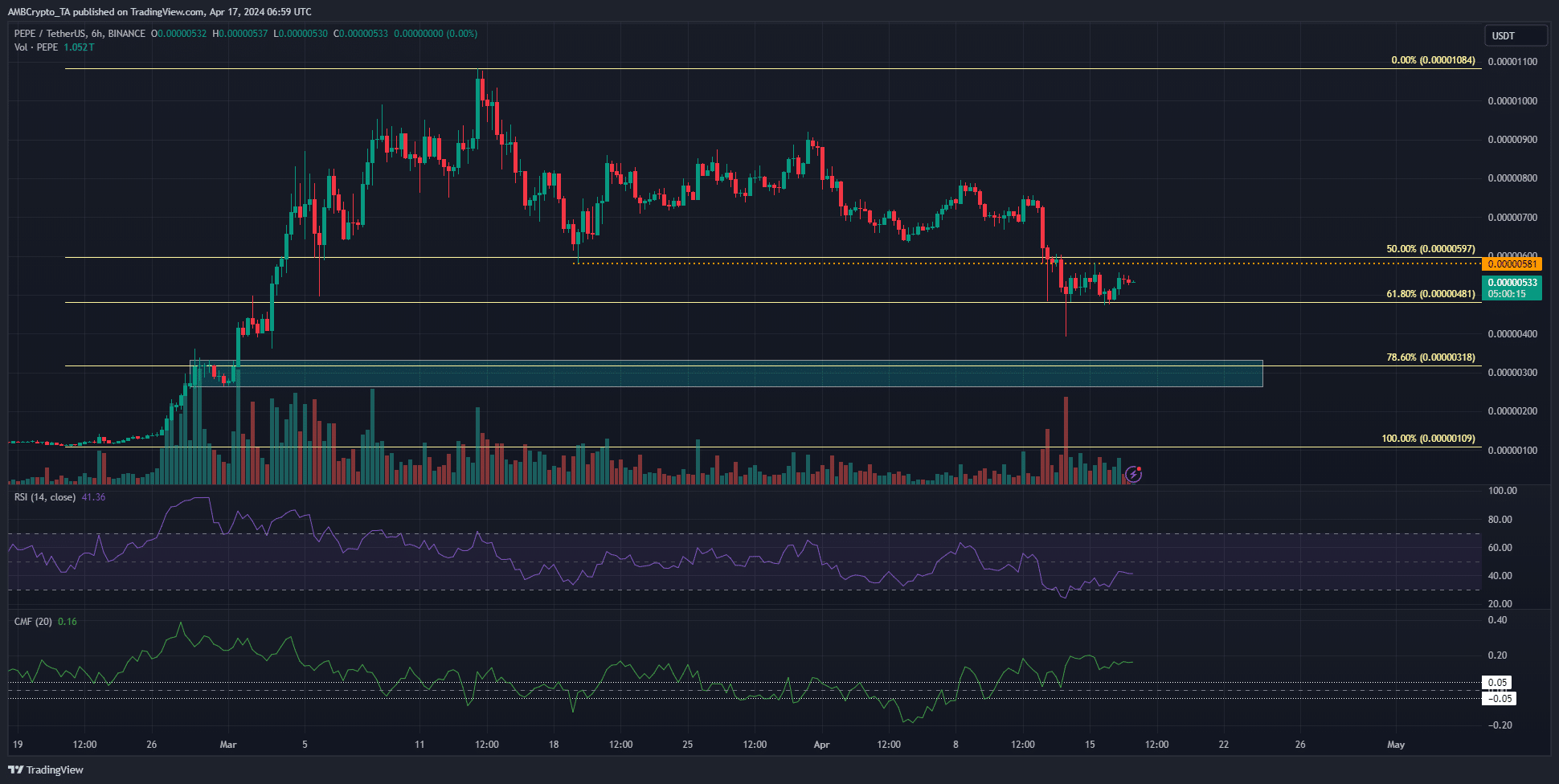

- PEPE has a strong short-term bearish bias based on momentum and price action.

The Fibonacci retracement levels would be pivotal for investors and swing traders.

Pepe (PEPE) traders probably gained from last week’s market turbulence. However, the recent price swings have subsided in the past day. There was a disagreement between the momentum and volume signals.

Based on the price movements indicated on the chart, it seemed that further declines for Bitcoin (BTC) could be imminent. Given the decreasing demand, it would be a challenge for PEPE buyers to prevent the prices from dropping.

The short-term range formation at the 61.8% level

On the 4-hour and 6-hour charts, PEPE displays a pessimistic outlook. However, its long-term trajectory has been upward. The current correction is an inherent component of the ongoing bullish trend.

In simpler terms, traders ought to prepare for more losses in the coming days. The Relative Strength Index (RSI) indicated a value less than 50, suggesting a downtrend with increasing strength.

Interestingly, the CMF was at +0.16, showing strong demand for the meme coin.

Over the last two days, the token’s price remained relatively stable, fluctuating between $0.00000481 and $0.00000581 despite increased short-term demand.

An intriguing aspect to consider is the significant 78.6% Fibonacci retracement point. Right beneath it lies a past demand zone, which dates back to early March. Prices had previously taken a pause for consolidation within this area before initiating their six-week upward trend.

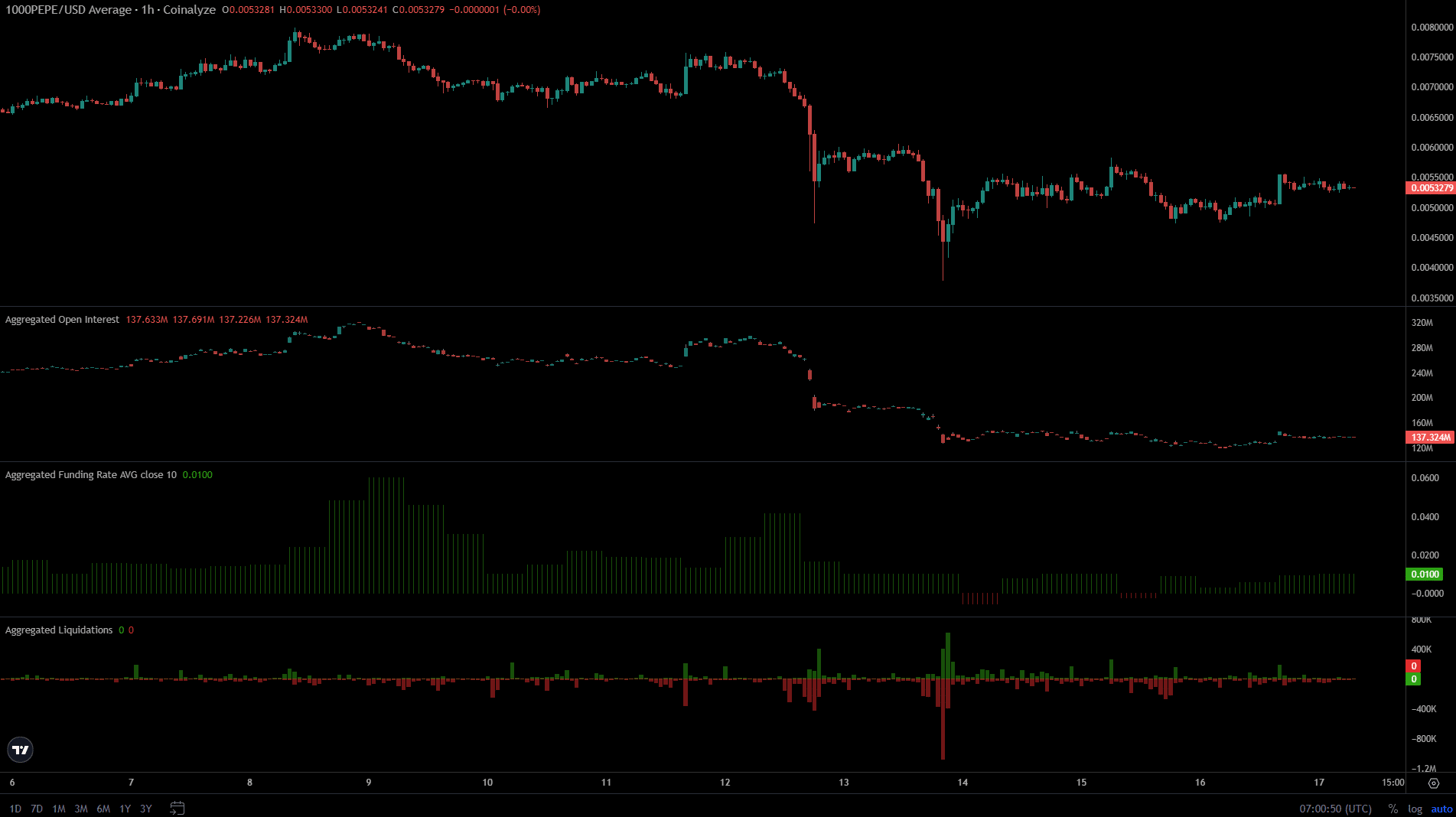

Speculators have been absent recently

Recently, the powerful downturn in the markets led to numerous futures traders being forced to sell their positions, affecting both those who had gone long and those who had shorted. The sudden plunge on April 13th, followed by a quick rebound, has caused hesitation among speculators.

The Funding Rate was slightly positive, but this does not indicate long positions were favorable.

Read Pepe’s [PEPE] Price Prediction 2024-25

Since the 14th, Open Interest has remained unchanged, and significant liquidations continued during the previous day.

They signaled a pessimistic outlook and caution towards the market. If Bitcoin and PEPE fail to rise, investors are likely to stay on the sidelines.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-17 20:07