-

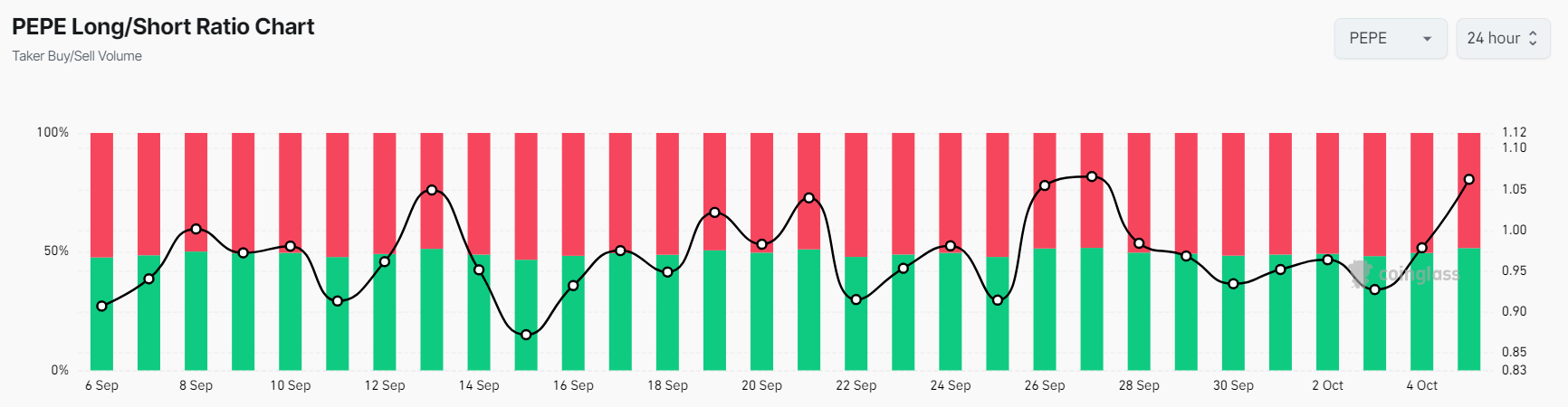

PEPE’s Long/Short ratio, at press time, stood at 1.062, indicating a strong bullish market sentiment

Futures Open Interest jumped by 15% in the last 24 hours

As a seasoned researcher with years of experience in the cryptocurrency market, I must admit that the recent developments in PEPE have piqued my interest. The strong bullish market sentiment, as indicated by its Long/Short ratio and the surge in Futures Open Interest, are clear signs of an impending price rally for this memecoin.

It seems like the well-known meme coin, PEPE, could experience a substantial price surge due to its formation of a bullish chart pattern. Additionally, its internal data is indicating positive market sentiments as well.

After experiencing a significant drop in price exceeding 28% in the past few days, it appears that PEPE may be preparing for a bullish turnaround. Given these circumstances and various other influencing factors, there’s a strong possibility that PEPE will show an upward trend on its charts in the near future.

PEPE technical analysis and key levels

As a crypto investor, I’ve noticed an encouraging development in my PEPE investment. Based on AMBCrypto’s technical analysis, PEPE managed to retest its downward trendline breakout, which is a significant bullish signal. This retest formed a ‘bullish engulfing candlestick’ at the 200 Exponential Moving Average (EMA) and the support level of $0.0000085. This combination suggests a positive outlook for PEPE, making me optimistic as a holder.

As a researcher studying the current market trends, I find it plausible that the PEPE token might surge by an impressive 35% and potentially hit the 0.0000125 mark within the near future.

As an analyst, I’ve noticed that the memecoin is currently trading above its Exponential Moving Average (EMA) of 200 days, suggesting a positive trend. Furthermore, the Relative Strength Index (RSI) hints at a possible surge in its value.

Bullish on-chain metrics

PEPE’s optimistic stance could be reinforced by examining its blockchain data. For example, the Coinglass PEPE Long/Short ratio currently stands at 1.062, indicating a robust bullishness among traders, suggesting they are more likely to buy PEPE than sell it.

Furthermore, its Futures Open Interest increased by 15% over the past 24 hours and an additional 7.65% during the previous four hours. This escalation in Open Interest suggests that traders are growing more optimistic and confident about potential price increases in the near future.

Frequently, investors and speculators employ the strategy of increasing Open Interest along with a long/short ratio exceeding 1 when taking on long trades. As it stands, about 51.51% of leading traders are currently in long positions, while around 48.49% are in short positions.

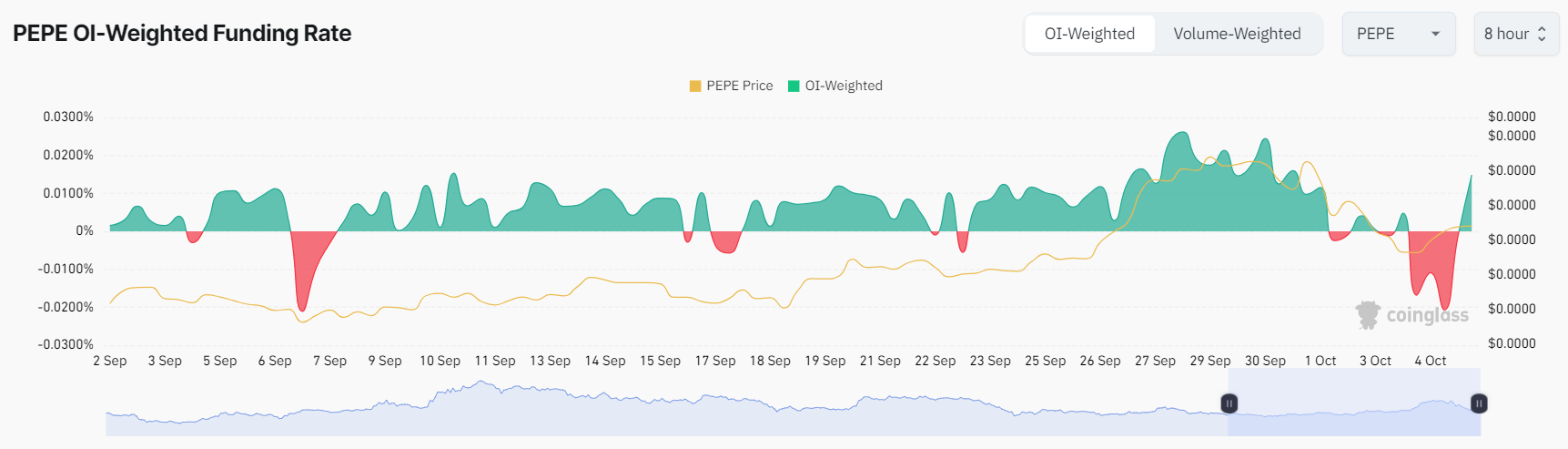

Moreover, the OI-weighted funding rate for PEPE was positive, amounting to 0.0149%. In simpler terms, this implies that long positions were compensating short positions, which is another encouraging indication of a bullish trend.

Current price momentum

As we speak, PEPE is close to being valued at $0.0000094 per unit, after experiencing a rise of more than 4.5% over the last day. Simultaneously, its trading activity decreased by approximately 7.5%, suggesting reduced engagement from traders and investors, possibly implying less market interest.

As a crypto investor, I’ve noticed that not only PEPE but also other popular meme coins like Dogecoin (DOGE), Shiba Inu (SHIB), and DogeWifhAT (WIF) have experienced favorable rate fluctuations over the past 24 hours. It’s clear that the recent trading sessions have been quite beneficial for the market’s meme coins.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-06 01:11