- PEPE could soar by 20% to hit the $0.0000132 level if it closes a daily candle above $0.0000111

- On-chain metrics, together with technical analysis, suggested that bulls have been dominating the asset

As a seasoned researcher with years of experience navigating the cryptocurrency markets, I must say that the current bullish sentiment around PEPE seems quite compelling. The technical analysis and on-chain metrics are pointing towards a potential breakout, with PEPE nearing its “buy the dip” level.

Following a reasonable drop in prices, the overall cryptocurrency sector began rebounding on the graphs. At the same time, the well-known meme token PEPE displayed a bullish trend on its daily chart through its price movements.

Given the recent price rise and the positive chart pattern mentioned earlier, one analyst thinks this could be an ideal moment for investors to consider purchasing at a dip.

Expert hints at buy the dip opportunity

As per the latest post from InvestingHeaven regarding X (previously known as Twitter), the price of PEPE is getting close to a good buying opportunity, referred to as “buying the dip”. This level is significant because it’s near the 50% Fibonacci retracement. Traders and investors frequently employ this 50% retracement when planning long positions or investing in an asset.

PEPE technical analysis and key levels

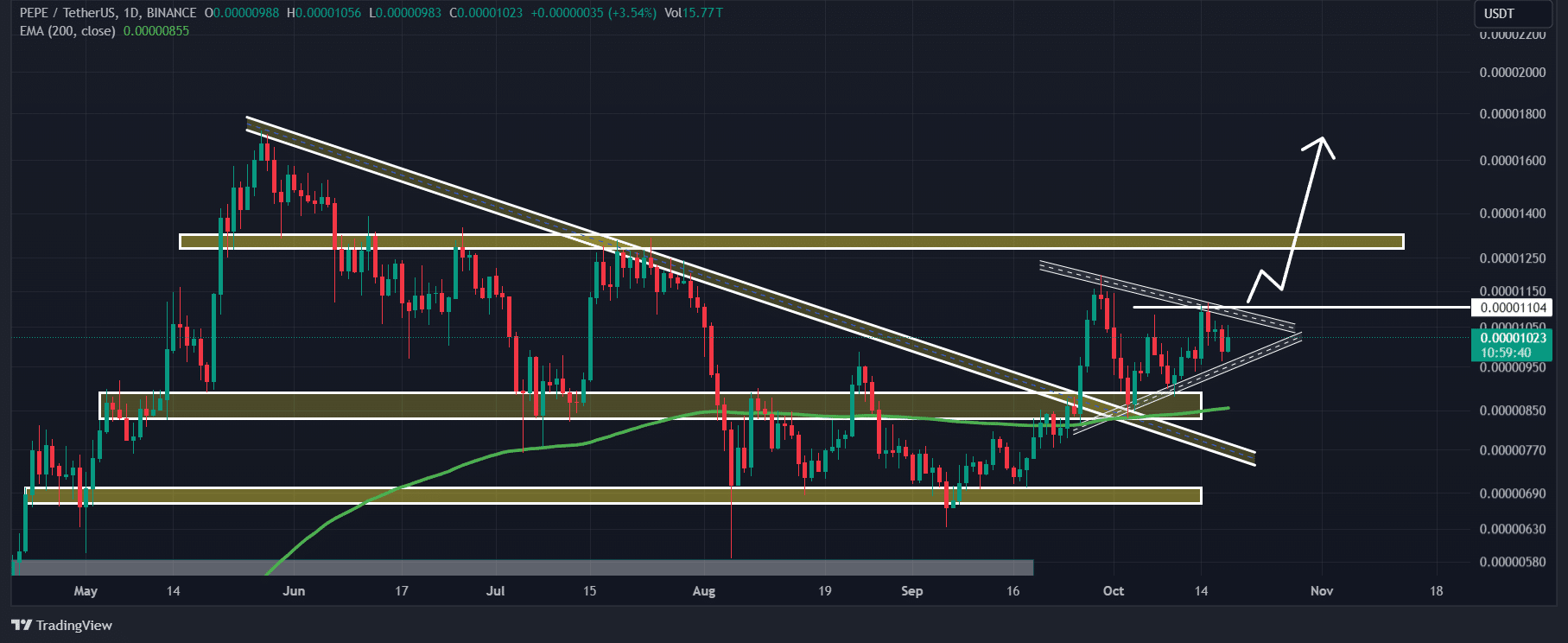

Based on the technical assessment by AMBCrypto, the cryptocurrency PEPE is shaping a symmetrical triangle in its price movements after it burst through the falling trendline.

PEPE appears to be in a confined area within the pattern, suggesting that a breakout might occur on either side imminently.

According to current market trends, there’s a good chance PEPE could experience a significant price increase. If PEPE manages to close above $0.0000111 for the day, it might surge by around 20% and potentially reach $0.0000132 in the near future.

It’s noteworthy to mention that the Relative Strength Index (RSI) and the 200-day Exponential Moving Average (EMA) of PEPE suggest a possible upward trend in its performance.

Bullish on-chain metrics

PEPE’s optimistic perspective can also be reinforced by examining on-chain data, as it appears that many traders are quite optimistic about the memecoin. According to the on-chain analytics firm Coinglass, the Long/Short ratio for PEPE, at the current moment, stands at 1.039. A value greater than 1 suggests a strong bullish sentiment among traders, which is a promising sign.

As an analyst, I’ve noticed a noteworthy increase in PEPE’s Futures Open Interest. Over the past day, it has surged by 4.3%, while in the last four hours alone, it has climbed by 2.3%. Essentially, traders appear to be actively accumulating positions as PEPE has shown signs of recovery on the charts.

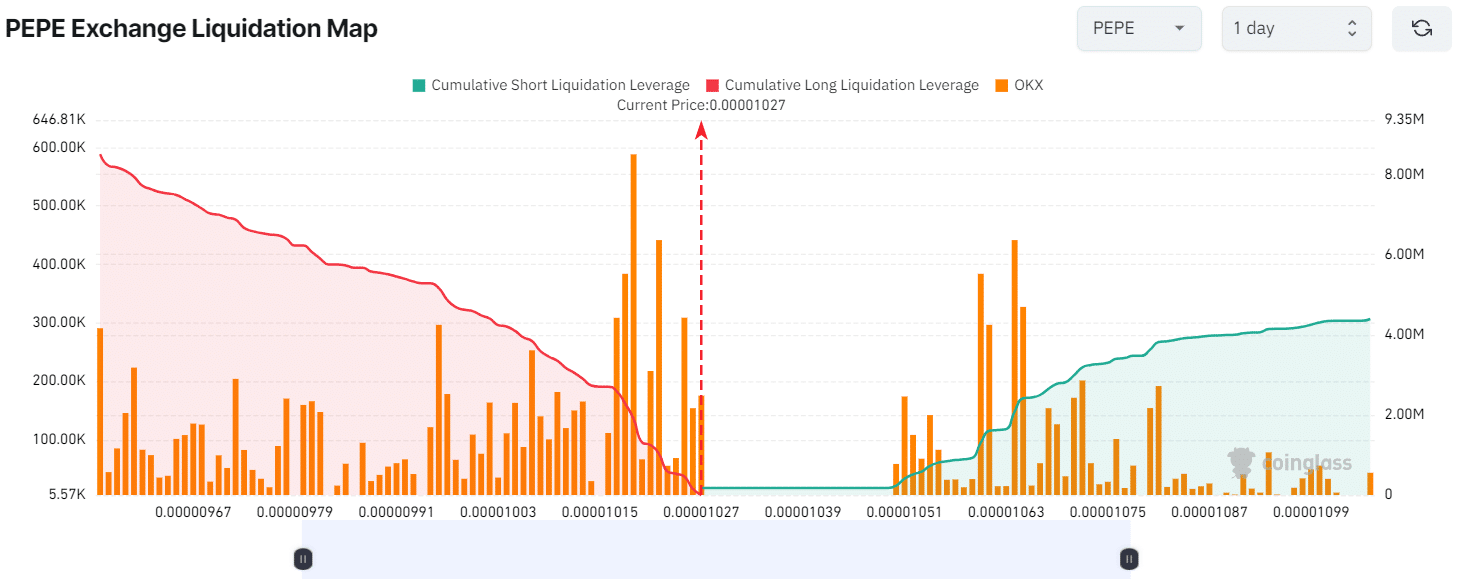

Major liquidation levels

Currently, the primary liquidation points are approximately $0.0001019 (on the lower end) and $0.00001051 (on the higher end). Traders find themselves heavily leveraged at these price ranges.

If PEPE exceeds the triangle pattern and reaches the $0.00001051 mark, around $407,910 in short positions will be closed out. On the other hand, if it doesn’t and falls to $0.00001019 instead, approximately $1.90 million in long positions could be terminated.

By taking into account these various on-chain indicators along with traditional technical analysis, it seems that buyers, or bulls, are presently holding sway over this asset. This situation may potentially lead to a surge in its value within the near future.

Current price momentum

Currently, PEPE is close to $0.00001024 per unit in trading, after experiencing a 1.5% increase over the past 24 hours. This growth was accompanied by an 8.9% surge in trading volume, suggesting increased engagement from traders and investors, as the market shows signs of recuperation.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-10-19 09:12