-

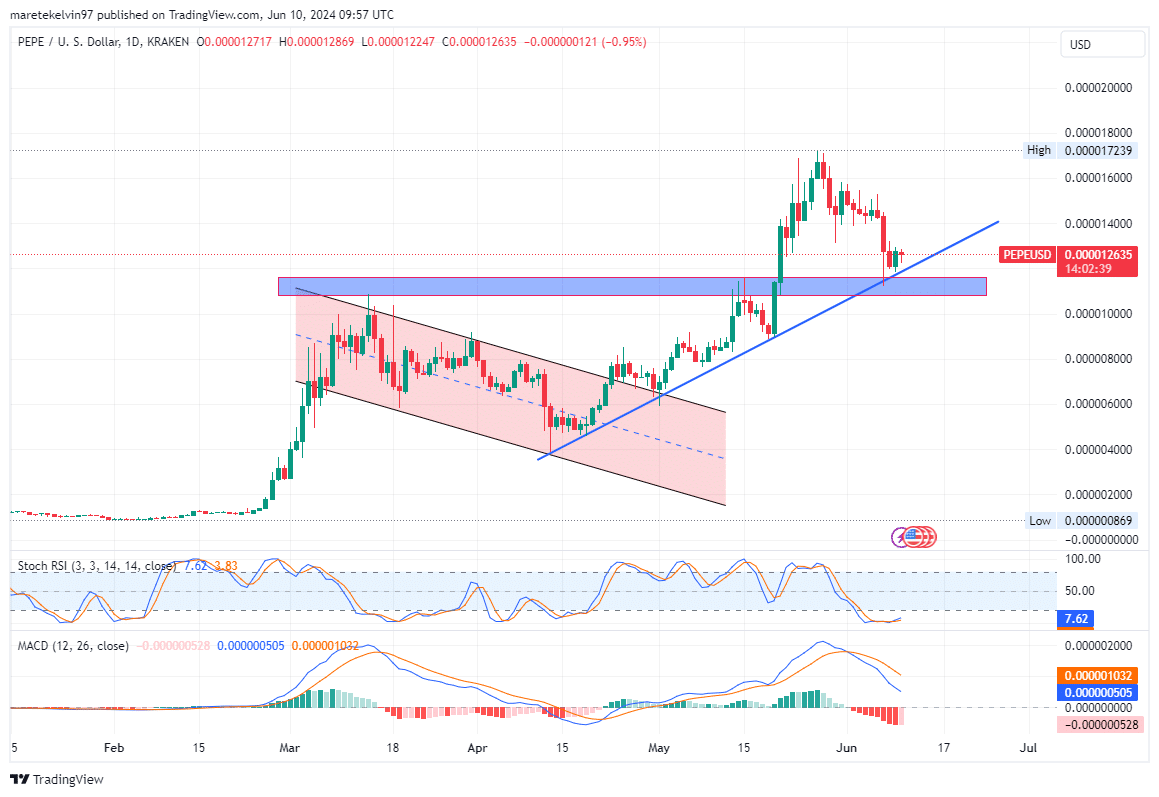

PEPE retraced after hitting a $0.00001724 high.

PEPE was rejected at a key trendline support level, and a price reversal was on the cards.

As a researcher with experience in analyzing cryptocurrency markets, I believe PEPE‘s recent retracement presents an intriguing buying opportunity. The sharp drop from $0.00001724 to $0.00001131 represents a 32.6% decline, but the support level at $0.00001131 is significant. This price point serves as a confluence of both the current trendline and past resistance levels.

Pepe (PEPE), which had previously reached an all-time high of $0.00001724, has seen a substantial 32.6% price decrease and is now trading at $0.00001131.

PEPE has retreated to a convergence area at the $0.00001131 mark, serving as both a key support level and an ascending trendline anchor. This point has been significant in the past two months, having been tested multiple times before.

Traders seeking to profit from market fluctuations may find this pullback an attractive buying chance, preparing their positions for the expected uptrend.

At present, PEPE had a value of $0.00001264 according to CoinMarketCap, marking a 3.17% increase within the past 24 hours but a 16.74% decrease over the last week.

As an analyst, I’ve observed that the market capitalization reached a value of $5.3 billion during the previous day, representing a 3.17% increase. On the other hand, the market volume saw a significant decrease, amounting to 35.8%, and was recorded at $860 million.

PEPE: Increased user activity

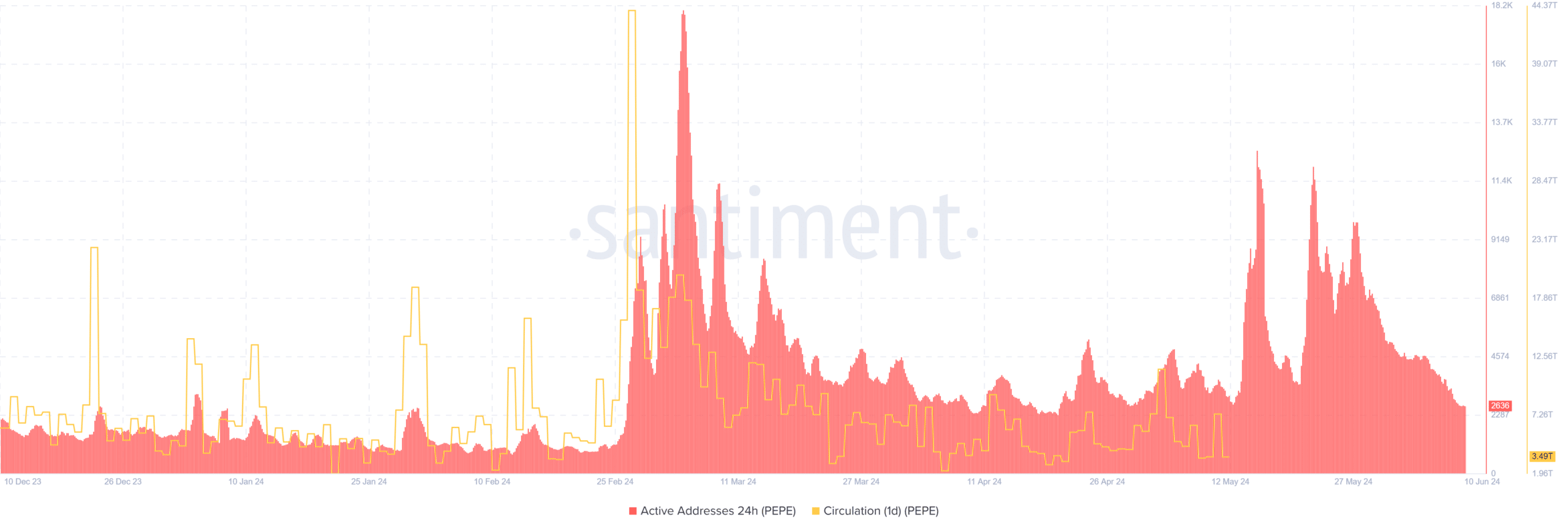

AMBCrypto then analyzed the Santiment’s Active addresses and circulation data.

As a researcher studying cryptocurrency trends, I’ve discovered some intriguing data regarding PEPE. Over the last few weeks, there has been a significant increase in the number of daily active addresses and transaction volumes associated with this cryptocurrency. This observation could potentially indicate an upcoming bullish rally for PEPE.

In a 24-hour span, the count of operational addresses experienced numerous upward surges, exceeding the 200,000 mark on several occasions.

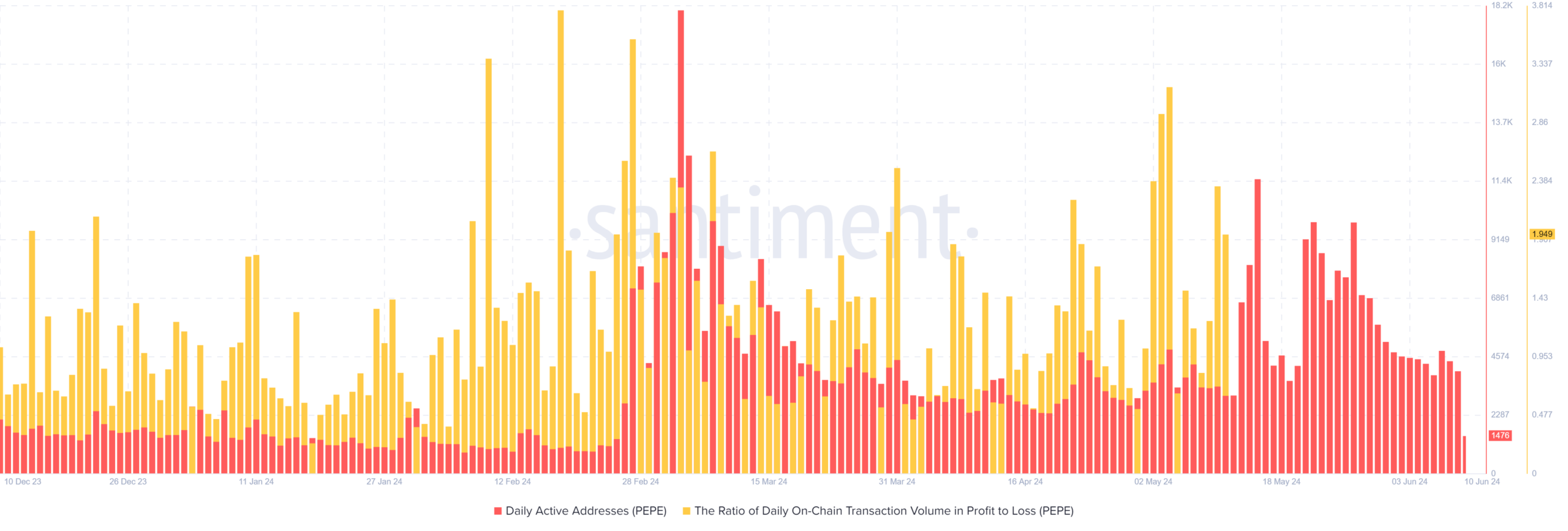

An in-depth examination by AMBCrypto revealed that Santiment’s metric for the daily transaction volume in profits versus losses showed a significant tilt toward profits. This trend implies heightened user engagement and could potentially indicate accumulation behavior.

Additionally, the PEPE/USD daily chart indicates that the recent downturn has encountered resistance at an upward-sloping trendline. Consequently, a resumption of the uptrend could be imminent.

At the current moment, the Stochastic RSI indicates that the asset was undervalued based on past price and volume trends, which could be an early indicator of a price increase. Furthermore, the MACD histogram has risen above its signal line, suggesting a possible bullish trend shift.

Is it worth diving into the dip?

The recent drop in PEPE‘s price level could be an attractive prospect for buyers. The significant increase in the number of active addresses and trading activity serves as a strong indication of a potential bull market.

Read Pepe’s [PEPE] Price Prediction 2024-25

The robust backing present along the rising trendline, coupled with subdued selling indications on the Stochastic RSI, reinforced the bullish outlook. This implied that an increasing number of investors were contemplating purchasing at the price dips.

However, If this fails to hold, the memecoin may see further dips in its price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-10 19:03