-

PEPE’s open interest has increased by 9% in the last 4 hours, suggesting growing investor interest.

PEPE could experience a 40% rally to $0.000021 if it closes a daily candle above the $0.0000090 level.

As a seasoned crypto investor with battle-scarred fingers from the rollercoaster rides of this market, I find myself intrigued by the recent developments surrounding Pepe [PEPE]. The whale’s repeated purchases during dips are reminiscent of an experienced fisherman casting his net when the waters are rough – knowing that the catch will be all the sweeter when calm returns.

On August 12th, there was intense selling activity in the cryptocurrency market, likely triggered by a substantial drop in the price of Bitcoin [BTC].

In the midst of economic slowdown, an astute investor seized a favorable moment to buy large quantities (nearly 120 billion) of PEPE, the third-largest meme coin globally.

PEPE whale buys the dip

On previous instances, it’s been observed that this whale has made substantial purchases of PEPE, the memecoin. After experiencing a significant drop in price on the 5th and 11th of August, this whale has consistently taken advantage of these dips to make their purchases.

As reported by the firm Spotonchain, on those two instances, a significant sum of approximately $3.13 million USDT was used by a whale to acquire a staggering 420 billion PEPE tokens.

It seems like this whale is trying to buy the dip whenever the market falls. Additionally, the whale has now made a decent profit of $170k.

PEPE price-performance analysis

Currently, PEPE is approximately valued at $0.00000817 per unit, marking a 5.7% drop over the past 24 hours.

Despite the drop in price, PEPE‘s trading activity surged by 50% within the same timeframe. This heightened trading activity implies greater involvement from traders and investors.

Over the past day, PEPE‘s open interest decreased by 5.5%. Yet, fueled by increased activity and investors seeking to capitalize on the dip, there has been a 9% surge in the last 4 hours and an additional 6.5% rise within the last hour, as reported by CoinGlass, a leading analytics firm for on-chain data.

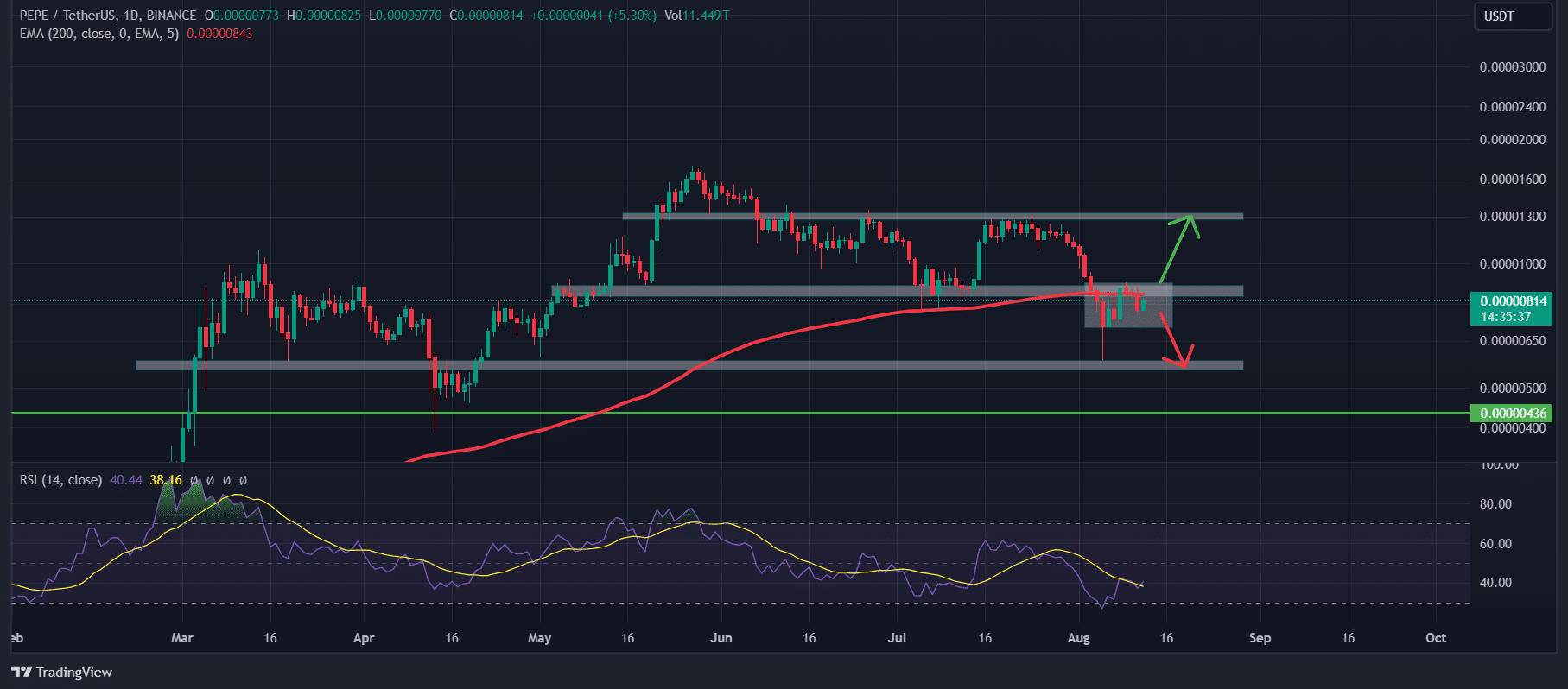

Based on professional technical assessment, PEPE appears to be headed downwards since it dropped beneath the 200 Daily Exponential Moving Average (EMA), indicating a potentially bearish trend.

If PEPE‘s cost falls beneath its Exponential Moving Average (EMA), this often indicates a bearish trend. Conversely, the Relative Strength Index (RSI), another technical tool, hints at a potential turnaround since it’s in the oversold territory, suggesting a possible change in direction.

If PEPE‘s daily chart closes above the $0.0000090 mark, it has the potential for a significant surge of around 40%, potentially reaching $0.000021.

If fear persists in the market, it’s possible that PEPE might decrease by another 25% over the next few days as well.

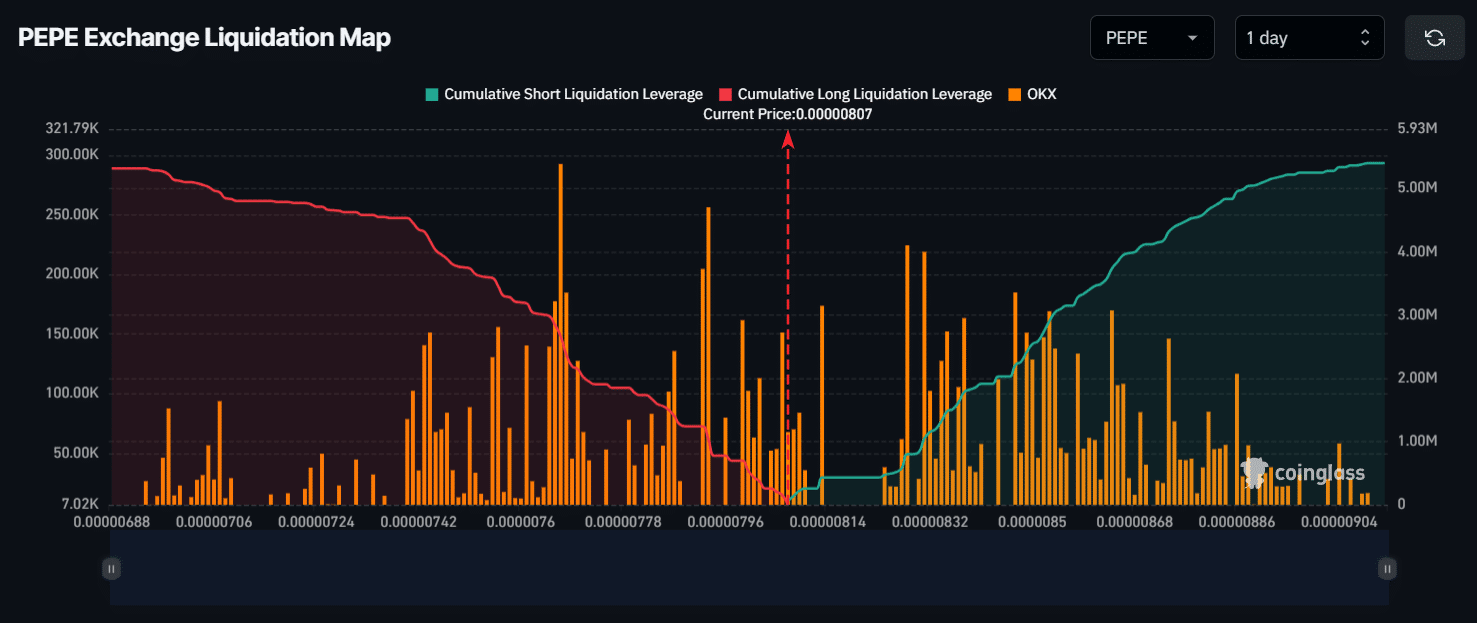

Major liquidation levels

At present, the primary support and resistance levels for this liquidation are approximately $0.00000767 (on the lower end) and $0.00000828 (on the higher end).

Read PEPE’s Price Prediction 2024 – 2025

Should the trend persist and the price of PEPE drops down to 0.00000767 dollars, approximately 2.67 million dollars’ worth of long positions will face liquidation.

If the sentiment shifts and the value of PEPE increases to approximately $0.00000828, it would lead to around $800,000 worth of short positions being closed out based on information from Coinglass. In simpler terms, if PEPE’s price goes up to $0.00000828, over $800,000 in short positions will be forced to close due to the increase in price.

Read More

2024-08-12 15:36