-

PEPE had bullish momentum and price structure on the charts

On-chain metrics continued to flash a buy signal too

As an experienced analyst, I’ve been closely monitoring PEPE‘s performance and its underlying metrics. Based on my observation and analysis of its price structure and on-chain indicators, I believe that PEPE’s bullish momentum is here to stay.

As a crypto investor, I’ve noticed that PEPE has been defying the market trends lately. While other altcoins were struggling to hold their ground or plummeting during temporary downturns, PEPE managed to surge. In particular, since its low on 1 May, this altcoin has rallied by an impressive 35%.

As a crypto investor, I’ve noticed an impressive surge in the network growth of this memecoin recently. This expansion suggests increased usage and demand, which is a positive sign for me. The data analyzed by AMBCrypto revealed some noteworthy trends from the previous week. There was a noticeable increase in accumulation, meaning more coins were being bought than sold. Additionally, sell pressure reduced significantly during that period, indicating a stronger buying sentiment among investors.

Is the PEPE buy signal still on?

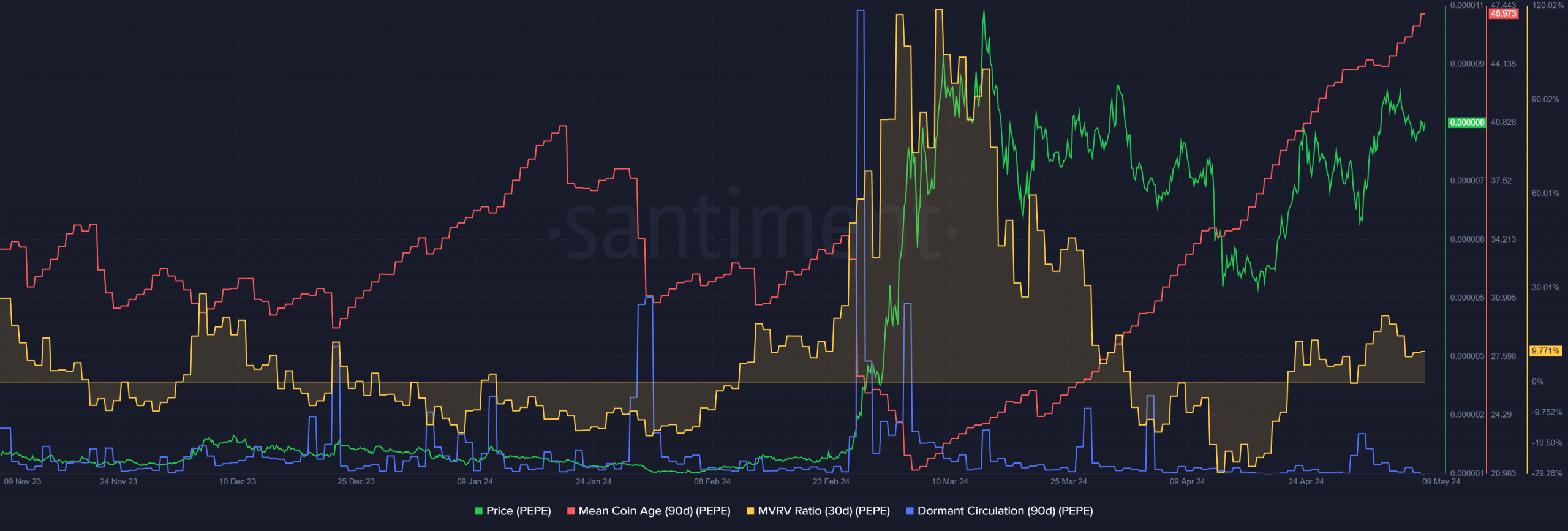

In the middle of April, the 30-day MVRV ratio for PEPE dipped below zero, while the mean coin age metric showed a significant upward trend. This occurred around the time PEPE reached its lowest point at $0.0000048. Following this, PEPE’s price experienced a surge of approximately 65%. The MVRV ratio has since improved slightly and is now only slightly positive.

Currently, the average age of coins in circulation for this memecoin has continued to rise rather than decreasing at the time of reporting. By examining the 30-day MVRV (Money Value Ratio) in contrast to its behavior in late February, it appears that significant price increases could be on the horizon for this coin, assuming Bitcoin holds above crucial support thresholds.

As a researcher studying market trends, I’ve observed that the buy signal remains robust. However, there have been no significant increases in circulation activity in recent weeks, with only two minor spikes on 4 April and 1 May. This pattern indicates a decrease in token transfers between addresses, implying less selling pressure.

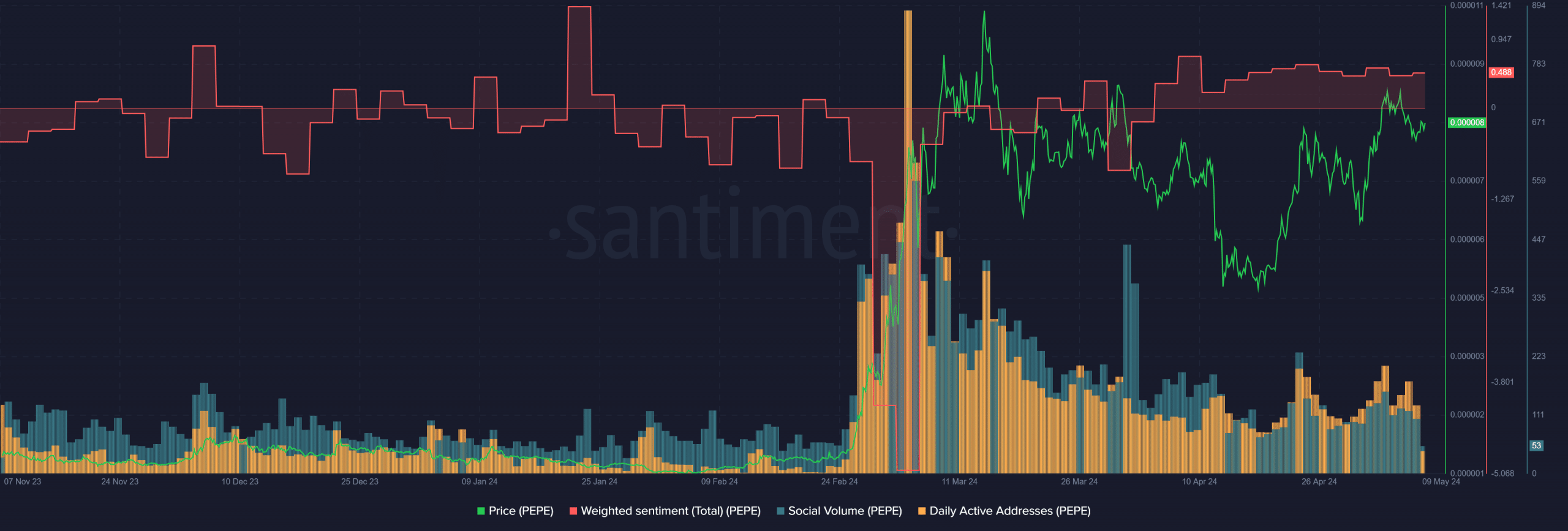

As a crypto investor, I’ve noticed an intriguing trend in PEPE‘s sentiment and social volume over the past month. While the 3-day interval weighted sentiment has remained positive, the social volume behind PEPE has been on a downtrend since early April. This conflicting information indicates that PEPE enjoys a decent online presence with more bullish engagement than bearish. In simpler terms, there’s more positivity around PEPE in the crypto community than negativity, despite a decrease in overall social media chatter about the token.

It’s intriguing to note that the number of daily active addresses has gradually increased over the past twenty-one days. Simultaneously, network expansion is on the rise, potentially signaling heightened demand and a promising development.

Memecoin going strong, but…

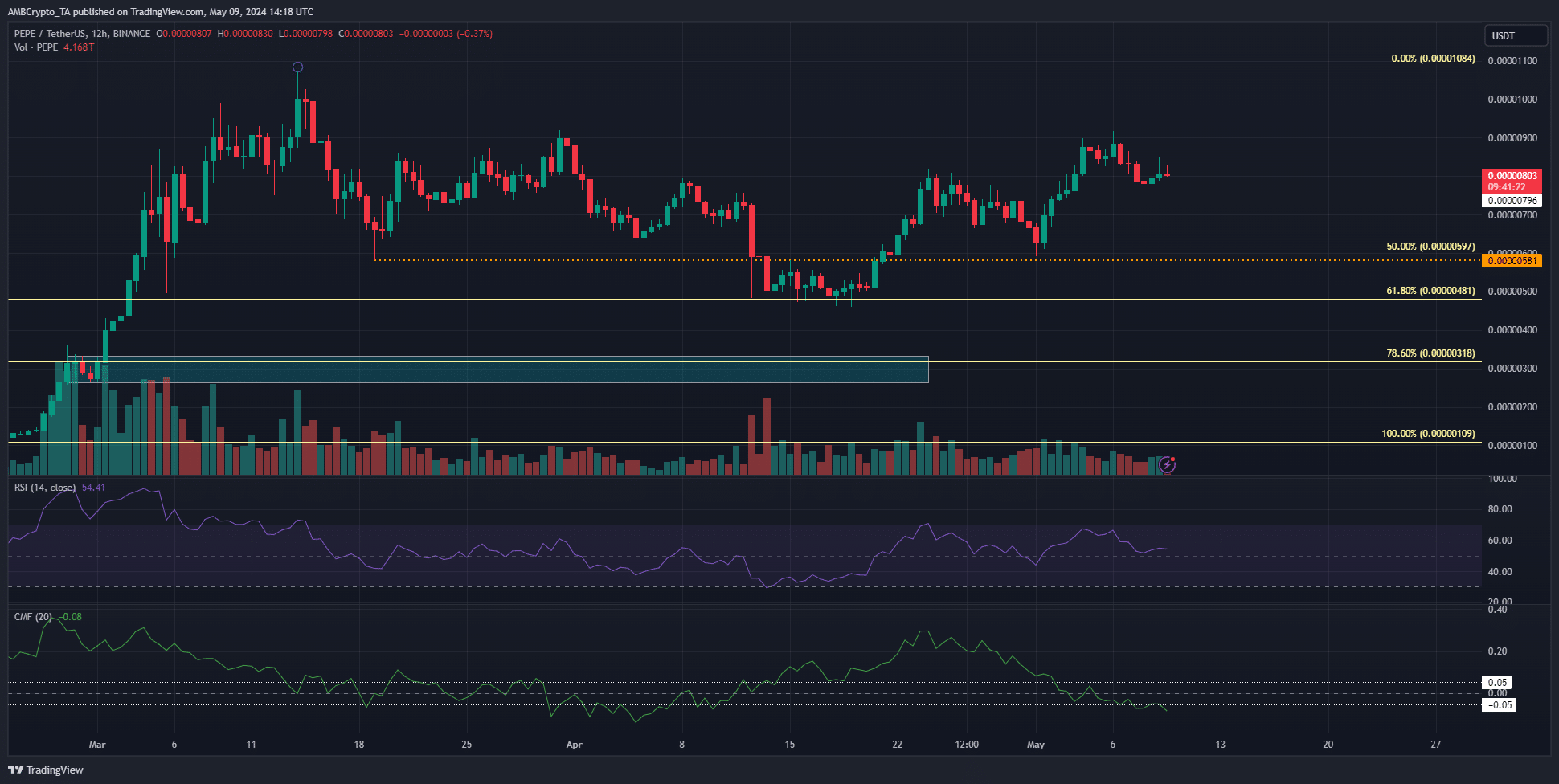

As a researcher examining the 12-hour price chart, I identified a bullish trend. The previous local high at $0.000008 was surpassed and now functions as support. Additionally, the Relative Strength Index (RSI) remained above the neutral threshold of 50, signifying that upward momentum was prevailing.

Is your portfolio green? Check the PEPE Profit Calculator

Despite a bullish market structure, there’s been a gradual decrease in the Cash Market Flow (CMF), reaching a level of -0.08 as of now. This negative reading signals substantial withdrawal of capital from the market.

Taking everything into account, the token is expected to experience growth on the price charts.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-10 12:07