-

PEPE hit a new all-time-high (ATH) and outperformed BTC.

Bulls had market leverage, but a short-term pullback couldn’t be overruled.

As a researcher with experience in cryptocurrency markets, I’ve observed the recent explosive rally of PEPE, a meme coin that outperformed Bitcoin (BTC) and hit a new all-time-high (ATH) in May. The bulls had market leverage, but a short-term pullback couldn’t be overlooked. The meme coin’s price action has been driven by the “supercycle” narrative, with memes dominating the price charts.

In this market cycle, the idea that meme coins are following a super trend of price increases is gaining traction. The price graphs of these meme assets have shown remarkable explosiveness.

During the initial portion of May, PEPE displayed superior performance compared to Bitcoin, registering a 65% increase contrasted with Bitcoin’s minimal 2% growth.

As a researcher examining PEPE‘s price movement in May, I’ve discovered that over half of its significant gains occurred within the last two days. This surge can be attributed to the recent turbulence in GameStop’s (GME) stock prices.

The significant surge propelled PEPE to reach a new peak price of $0.00001146, surpassing its previous record high. However, will the bulls be able to drive prices even higher?

PEPE price prediction: Bulls possible playbook after new ATH

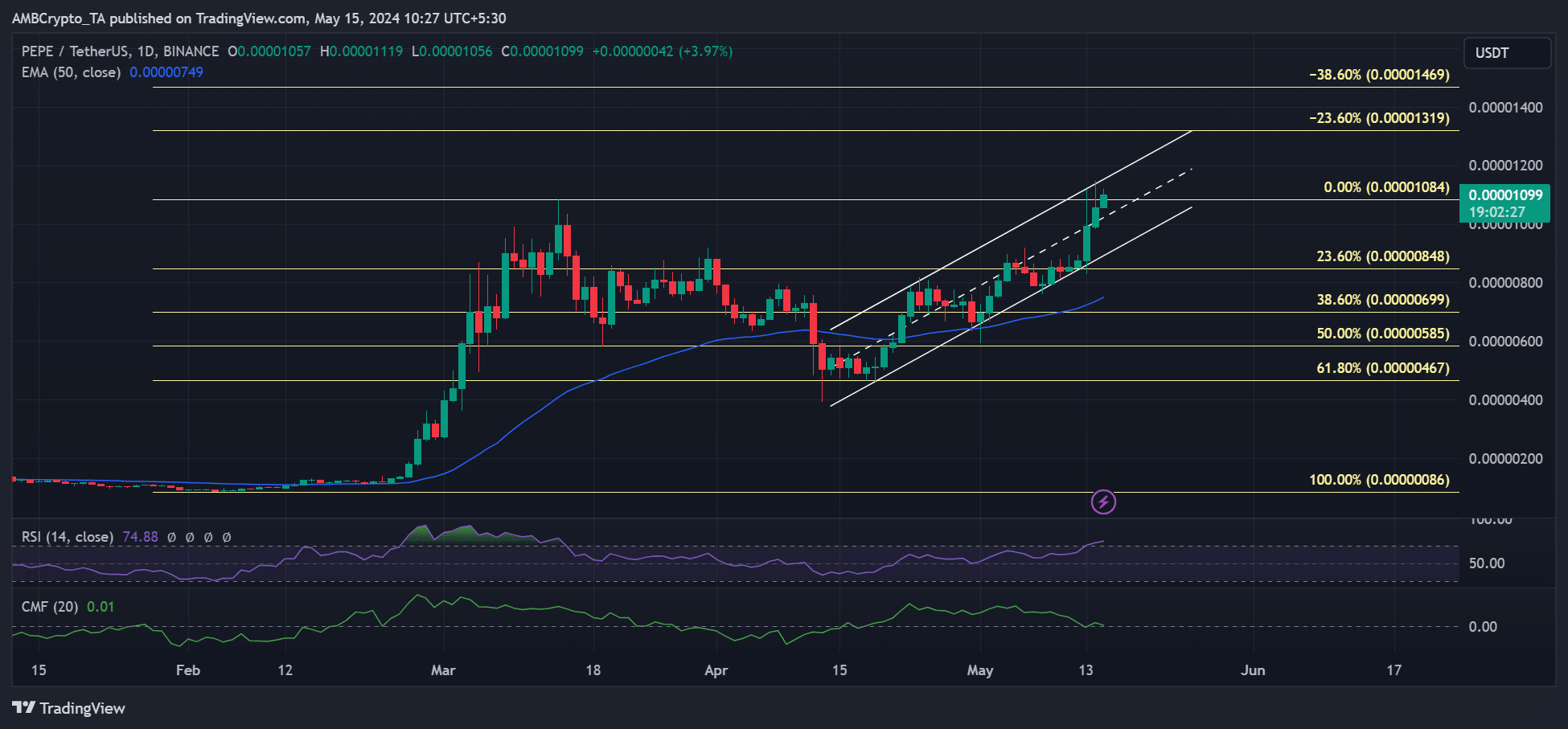

As a market analyst, I would recommend utilizing the Fibonacci retracement tool drawn in yellow on the daily chart. This particular tool helps identify potential support and resistance levels by referring to key price points in an asset’s previous trend. In this instance, those price points are the 2024 lows and the previous all-time high at $0.00001084.

In the second quarter, the meme with a frog theme began to bounce back gradually starting around mid-April. This trend is evident in the upward sloping channel depicted by the white line.

As a researcher studying market trends, I would describe it this way: In the first half of the year, there was a significant drop in value from the all-time high (ATH). However, with the subsequent upswing to a new ATH, all previous losses were erased. This fortunate turn of events allowed most investors to realize profits on their holdings.

PEPE encountered two instances where the price was turned down at the upper boundary of the rising trendline (represented by the white line), suggesting that certain traders, among them possibly large-scale investors, had cashed in their profits.

Despite PEPE maintaining a bullish market structure, there’s potential for an additional surge to $0.000013, which would result in a 21% increase in profits. However, if a significant number of investors decide to sell at the present price level, PEPE’s price action may experience a correction.

In this situation, the mid-range and lower end of the channel, along with the 23.6% Fibonacci retracement level, may hold significant importance for late entrants to the market.

Pepe price prediction: Why a 25% pullback can’t be overruled

At the current moment, bulls are in control of PEPE‘s price trend. However, unexpected bearish conditions might cause a 25% decrease in PEPE’s value according to liquidation thresholds.

Based on Hyblock Capital’s 7-day liquidation heatmap, the $0.08 region emerged as a significant attraction point, indicated by the orange color.

As a crypto investor, I’m keeping a close eye on the market as a significant price drop could potentially push the coin’s value down to around $0.08. This level aligns with the 23.6% Fibonacci retracement marker on the chart. This represents a potential 25% decrease from current pricing.

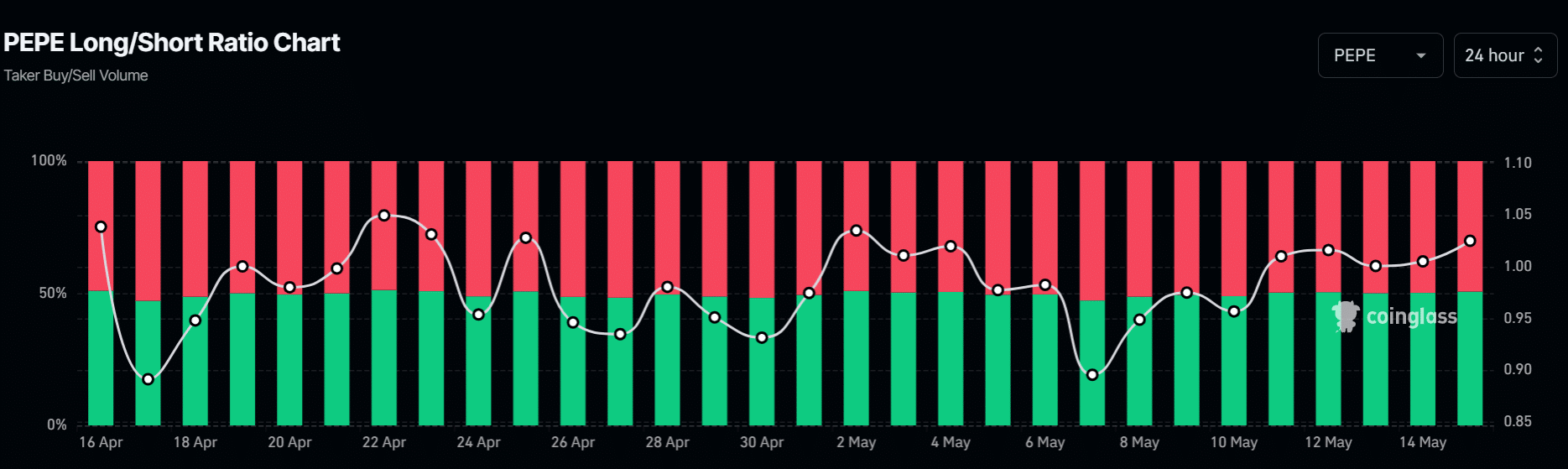

Despite the data from Coinglass’s Long/Short Ratio indicating a bullish market sentiment for PEPE, numerous traders have continued to buy or go long on PEPE as early as the 7th of May.

From the 7th of May, there was a notable increase in the number of traders taking long positions, rising from 47% to 50.6% by the mid-morning Asian trading session on the 15th. This shift indicates a prevailing bullish sentiment among short-term market players.

As an analyst, I would assess that PEPE has the potential to surge by an additional 20% should the bullish trend continue unabated. Yet, it’s essential to acknowledge that a potential pullback of up to 25% cannot be disregarded if market conditions shift bearishly.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-15 16:08