-

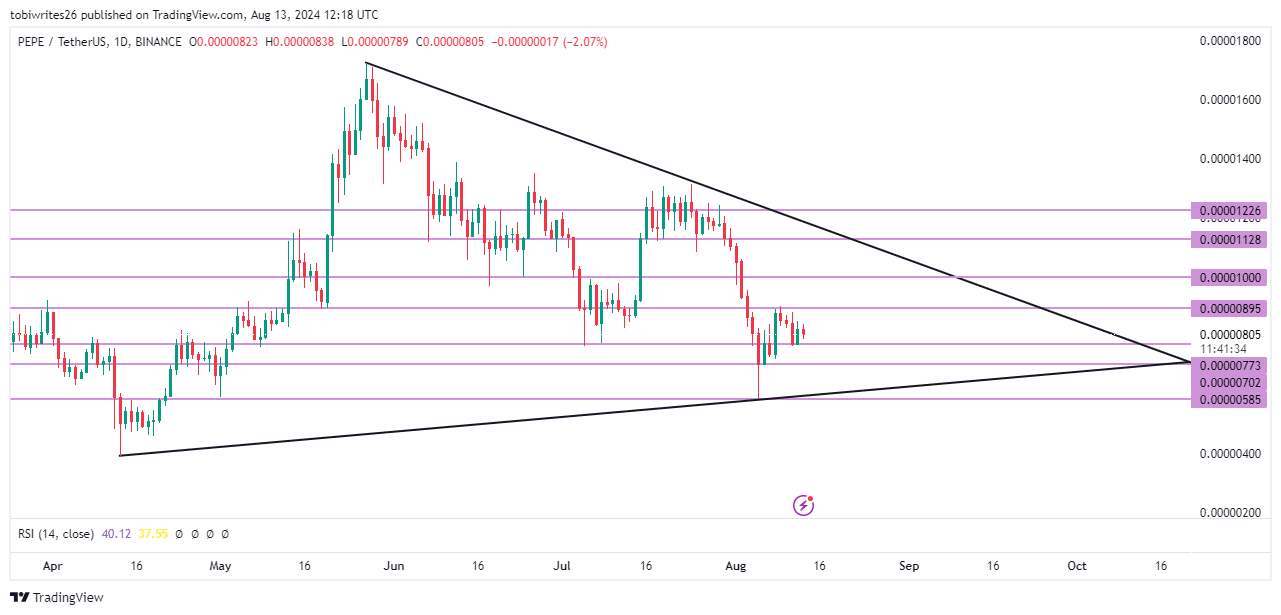

PEPE was trading within a descending triangle at press time, suggesting a potential rally toward the $0.00001000 mark.

The growing buyer interest in PEPE was supported by multiple technical indicators.

As a seasoned crypto investor with battle-scarred fingers from the 2017 bull run and the subsequent bear market, I find myself intrigued by the current situation of PEPE. The descending triangle it’s trading within suggests a potential rally, which is music to my ears after seeing it stumble at the previous support level.

After the recent market slump, PEPE (PEPE) was unable to bounce back from its support level at $0.00000773, instead experiencing additional drops.

As a crypto investor, I’ve been watching this digital asset closely, and it seems to be gearing up for an uptrend. Currently, it’s moving within a descending triangle pattern, but interestingly, it’s responding favorably to a support level that previously failed. This could potentially signal a shift in the market sentiment.

As an analyst, I delve into the question: Could this serve as a catalyst to spur a bullish trend for PEPE‘s price in the near future? In my analysis with AMBCrypto, I examine the possibility of such a scenario unfolding.

Where can a descending triangle take PEPE?

In simpler terms, a descending triangle pattern suggests that the price of PEPE has been moving up and down between two specific points – the highest and lowest prices.

Based on this pattern, the market could either surge past its current high (rally) or it might keep declining below its current low (falling).

As a researcher studying PEPE‘s market behavior, I’m observing a trend that points toward an upward breakout. Currently, at the time of this analysis, PEPE has bounced back from its support level at $0.00000773, reaching $0.00000805.

As a researcher examining the data, if this current support level is maintained, it appears to have the potential to drive the price upwards. This could push the price towards the next identified resistance level at approximately $0.00000895, and potentially even beyond that, reaching the subsequent resistance level around $0.00001000.

If the support weakens due to a decrease in price, it’s possible that PEPE could find stable prices at approximately $0.00000702 or $0.00000585.

Bullish hints from technical indicators

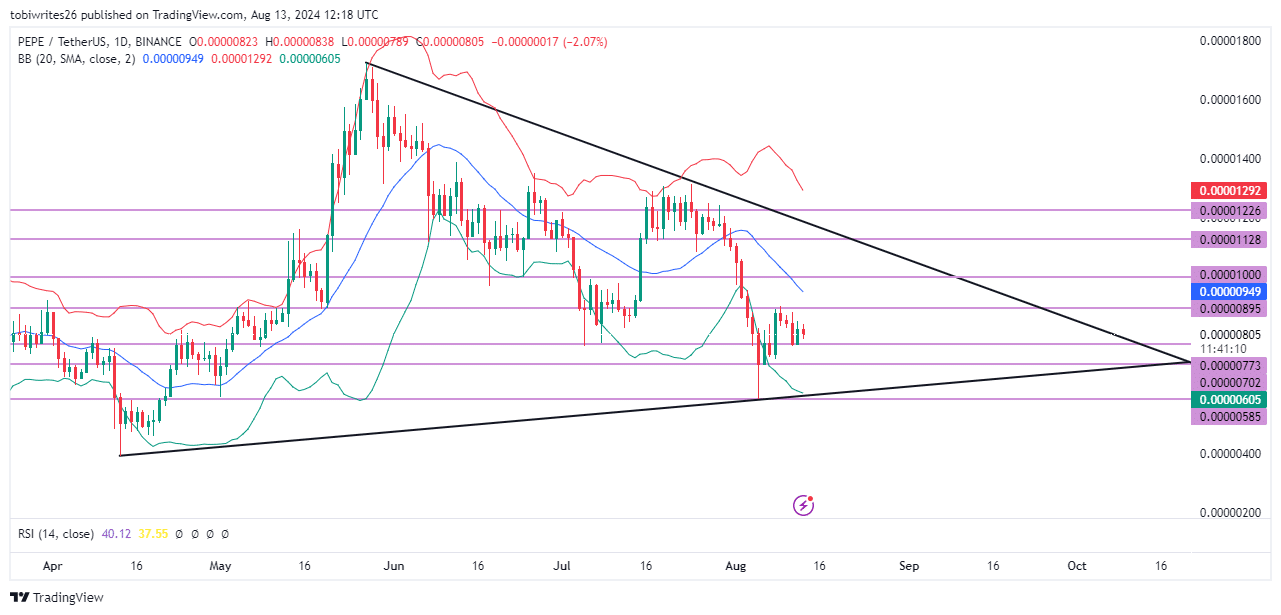

Based on the Bollinger Bands – a technical analysis tool made up of a moving average enclosed by two lines representing two standard deviations – it appears that PEPE may have been oversold, indicating potential buying opportunities.

Preparations are in place for a possible upward trend that could lead us to the median line around 0.00000949, potentially reaching as high as 0.00001000.

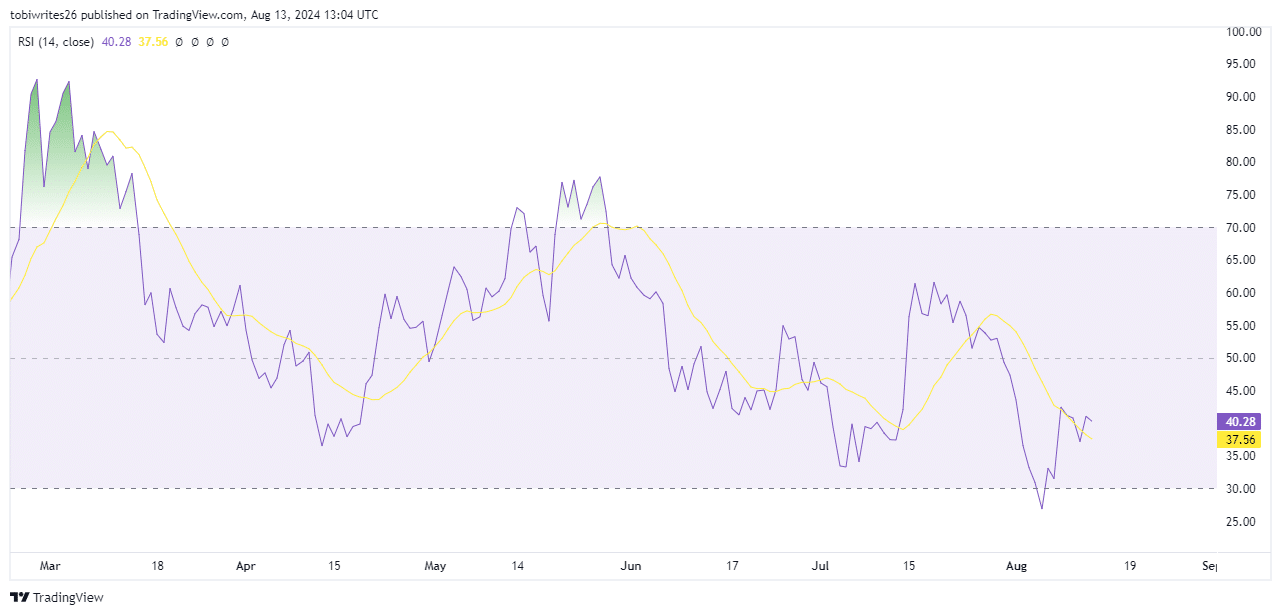

In simpler terms, the tool called the Relative Strength Index (RSI) backed up this perspective as it gauges both the speed and size of price fluctuations in a particular direction.

With a press time reading of 40.28, it indicated that momentum may be building for an upward move.

Bullish sentiment rises

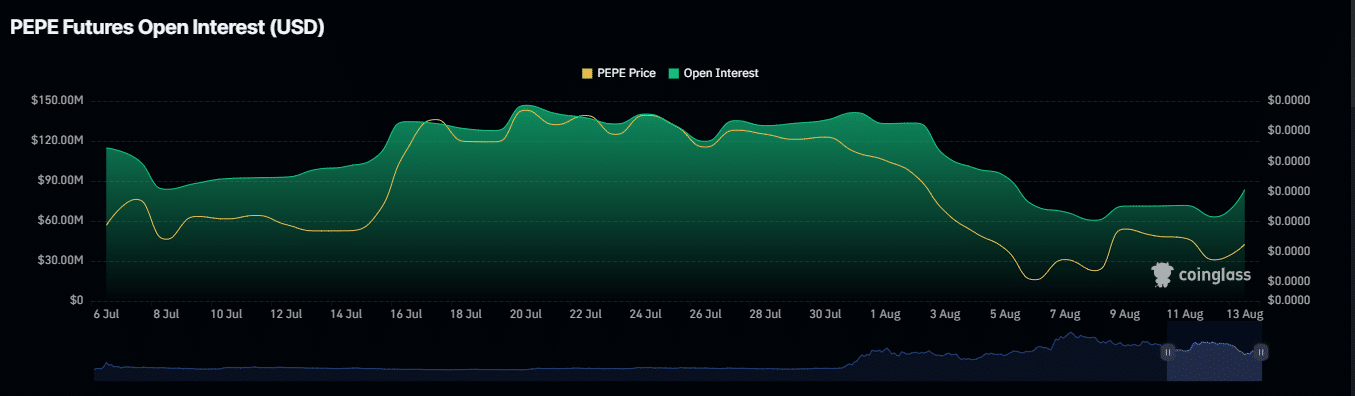

As reported by Coinglass, the Open Interest for PEPE derivative contracts has hit an all-time high of $83.46 million – a level not seen since August 6th.

Read PEPE’s Price Prediction 2024 – 2025

A high level of open interest suggests active market involvement, potentially leading to an increase in PEPE‘s price as a result of enhanced liquidity.

To put it simply, the current market setup and technical signals suggest that PEPE could experience an upward trend, possibly reaching unprecedented highs soon.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- 7 Chilling Horror Films Born from The Twilight Zone’s Dark Legacy

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

2024-08-14 11:36