-

PEPE’s recovery faced an overhead obstacle at $0.00009.

Further recovery prospects beyond $0.00009 depended on Bitcoin’s move.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines when it comes to cryptos like PEPE. The recent recovery has been nothing short of impressive, but the $0.00009 overhead obstacle is a cause for concern.

1. PEPE (PEPE) played a significant role in the rebound of popular meme coins, following the turmoil in the market. Despite a drop of more than 40%, the digital currency with a frog theme suffered a decline from late July to the 5th of August.

At the moment I’m analyzing, the meme coin experienced a 17% surge from the 6th to the 7th of August. Considering the intense buzz surrounding the meme coin narrative as I write this, it seems plausible that this upward trend might continue.

On August 7th, as per Coinglass data, meme-based trades occupied the second spot in terms of Open Interest rates, experiencing a rise of approximately 9%. This puts the Solana ecosystem in the lead position.

In short, memes attracted significant liquidity, which could boost PEPE’s ongoing recovery.

But there was one problem.

Can PEPE clear its overhead obstacle?

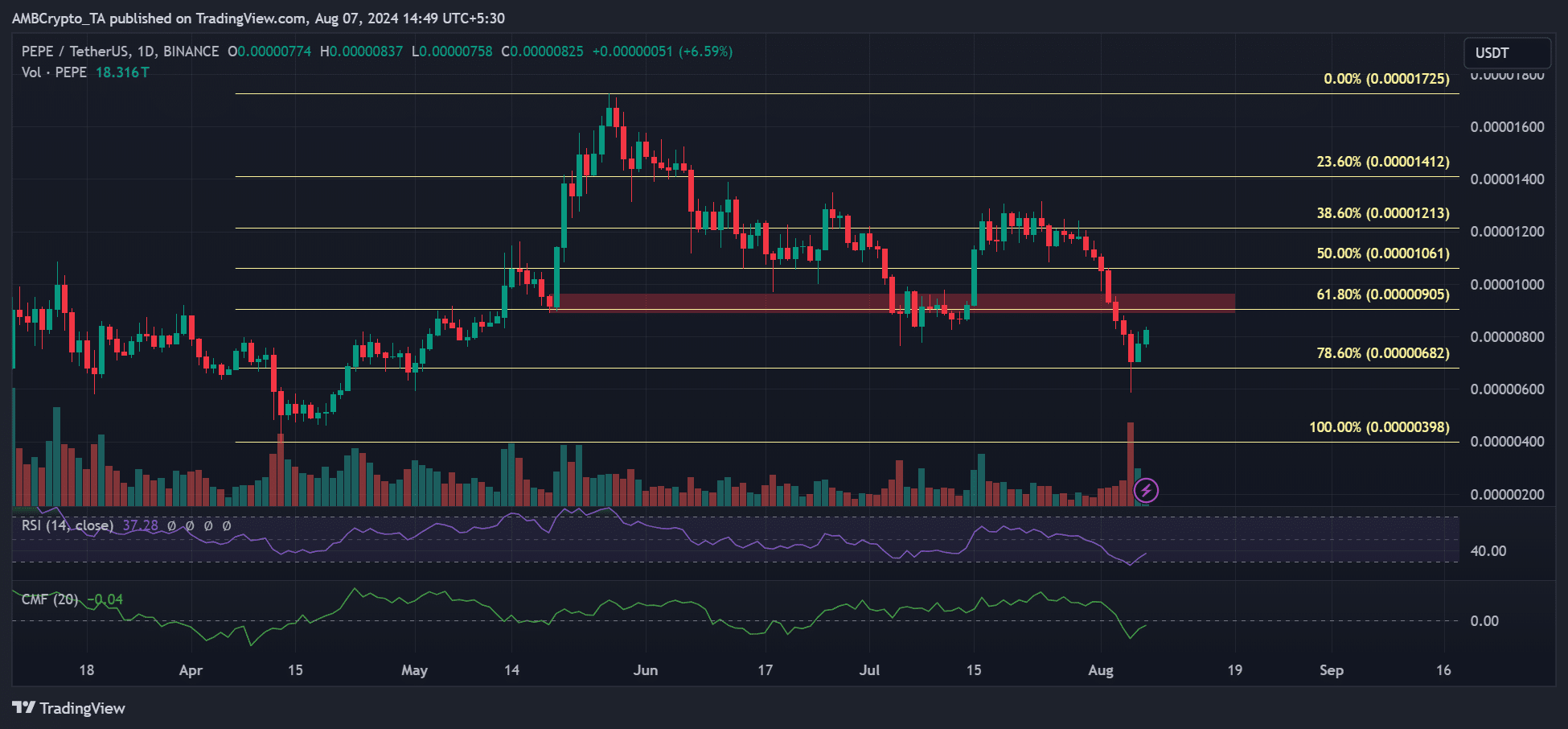

As a researcher, I find that the vicinity around $0.0000905 might serve as a significant hurdle in the ongoing recovery process. This area represents an intersection of a notable resistance (marked red) on the daily chart and the 61.8% Fibonacci retracement level.

Using the Fibonacci retracement tool, we positioned it between the peaks of May and troughs of April. Notably, the most recent price drop halted near the 78.6% Fibonacci level.

The recovery must mount above the 61.8% Fib level to show bulls’ conviction to extend the rally.

Testing the resistance above the 61.8% Fibonacci level could potentially limit the upward progress of the recovery, keeping it around 33% higher than the 78.6% Fibonacci level.

Yet, surpassing the 61.8 Fibonacci resistance level might prove difficult considering the subdued indications from the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) at the moment.

This meant that buying strength and capital inflows recovered, but weren’t strong enough.

XRP buying volumes increase, but…

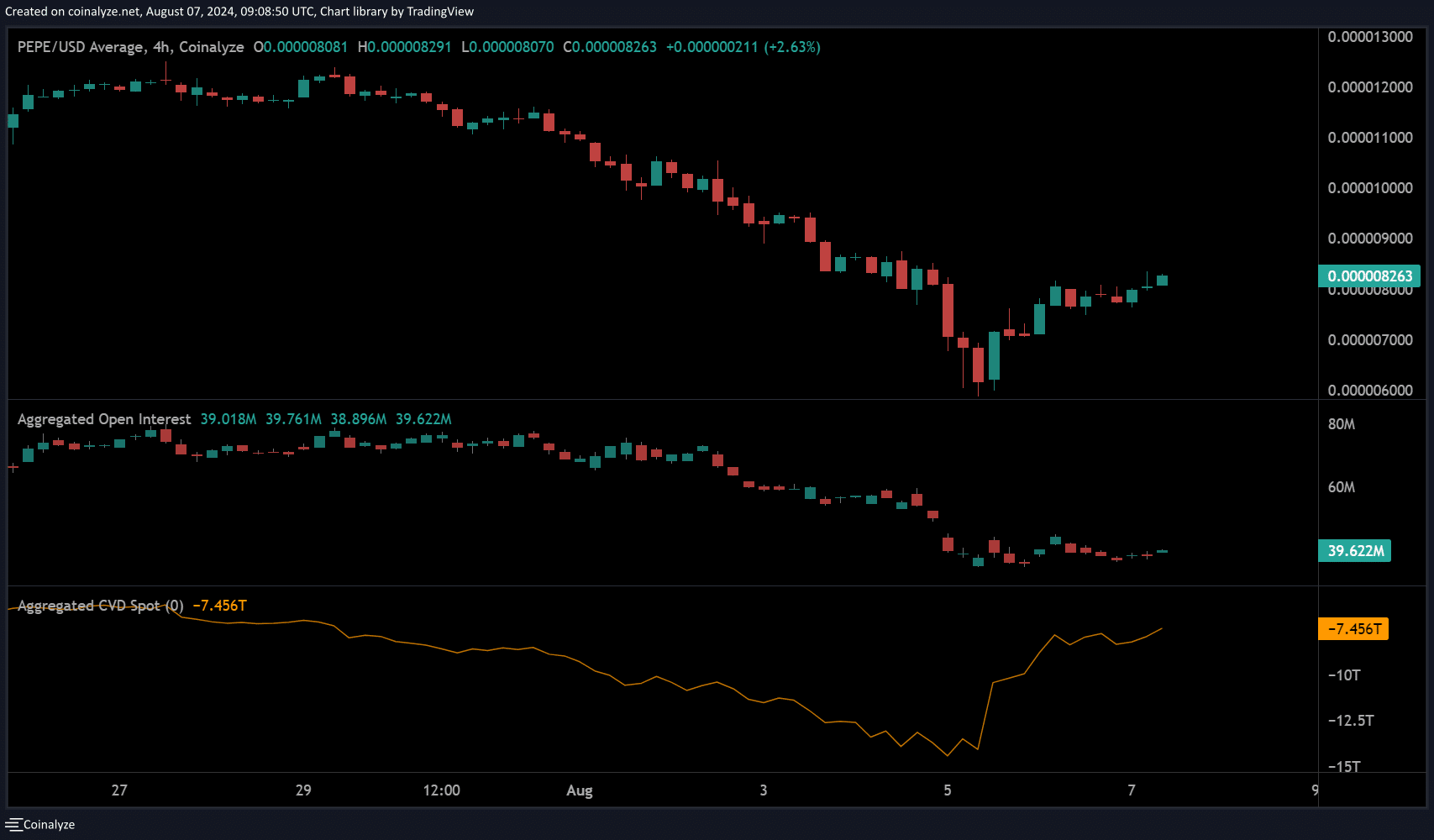

The above recovery was supported by higher buying volumes than sell orders, as shown by the uptick in spot CVD (Cumulative Volume Delta).

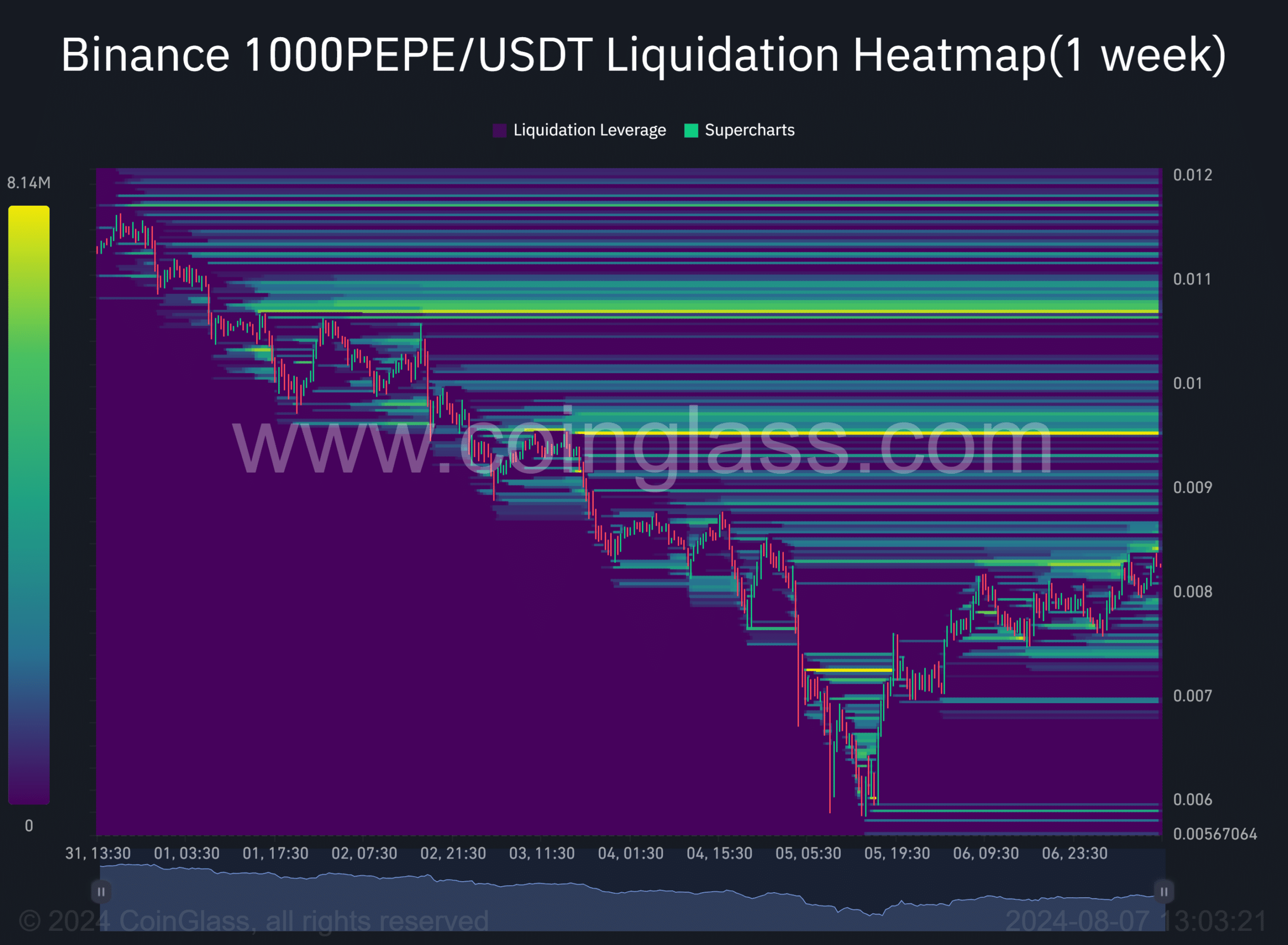

As an analyst, I’m examining the sustained buying volumes and the current price recovery trend. Based on the liquidity data from Coinglass, the next significant liquidity point lies at approximately $0.000090. This suggests that if the market maintains its current trajectory, it might encounter resistance around this level, indicating a potential limit to the buying volumes and price recovery. However, it’s essential to note that further analysis and additional factors should be considered before making definitive conclusions.

Read PEPE’s Price Prediction 2024 – 2025

Interestingly, the cluster level was similar to the overhead resistance seen on the charts.

Consequently, a strong accumulation of funds might help the price reach the 61.8% Fibonacci level. Yet, if Bitcoin fails to surpass $60k, the buying momentum for PEPE could start to wane.

Read More

2024-08-07 20:07