-

PEPE’s short-term holders in profit could impede uptrend recovery attempts

Rising MDIA metric underlined network stagnancy

As a seasoned crypto investor with a knack for deciphering market trends and a portfolio that includes a mix of blue-chip and meme coins, I find myself intrigued by the recent performance of PEPE. While it’s always exciting to see my investments yield gains, the current situation presents a unique challenge.

Over the past ten days, PEPE experienced increased price fluctuations. The market and general opinion about it dipped significantly as Bitcoin [BTC] suffered an 8.4% decline between October 7th and 10th. Interestingly, among the top five trending memecoins, PEPE had the second-best performance over the last week.

Among the listed entities, Dogwifhat saw the most significant increase, climbing up by an impressive 17.7% over a span of 7 days. On the other hand, PEPE experienced a more modest rise of 5.5% during the same duration. Maintaining its bullish trend on the daily chart, the question remains whether buyers will continue to push Dogwifhat forward.

Network growth and activity fueled by price gains

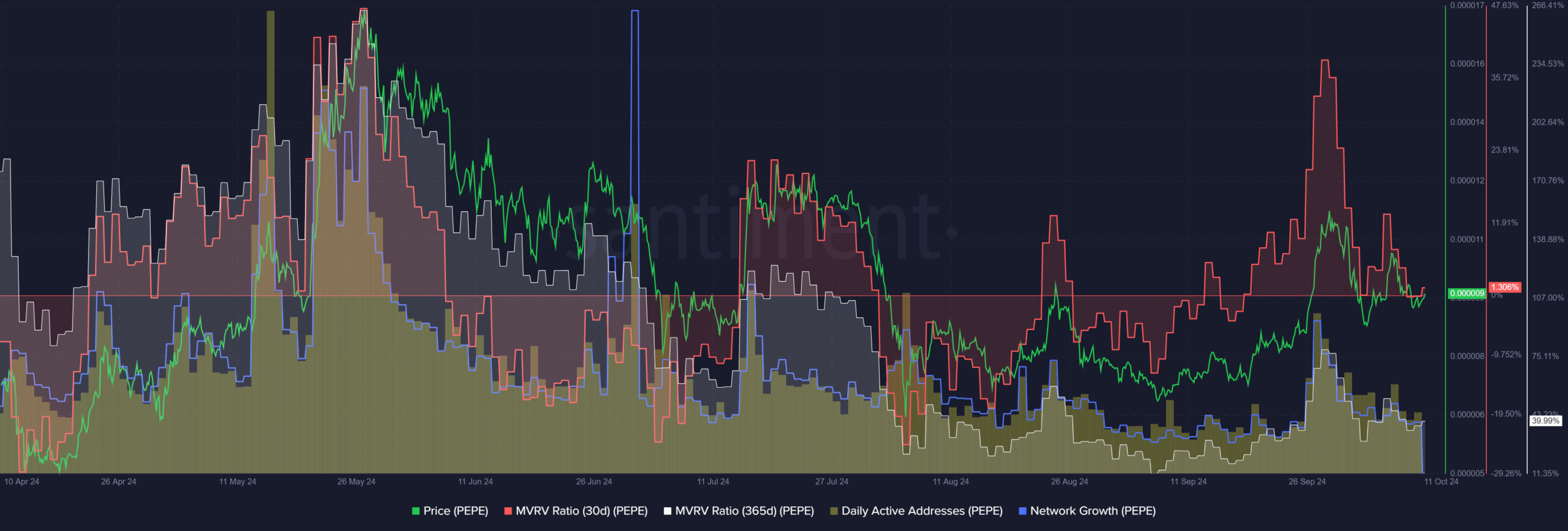

Due to the fact that the value and activity of meme coins mostly depend on their popularity, the recent drop in price has led to a decrease in the number of daily active addresses. Additionally, the expansion of the network experienced a slowdown in October.

In simpler terms, it’s possible that the current selling trend may continue for a while yet, especially in the near future. The 30-day MVRM (Market Value to Realized Value) ratio is still close to zero, even after the recent price dip over the last fortnight. Therefore, any further price increases might trigger more profit-taking and additional selling activity.

In simpler terms, we’ve seen the Multi-Vintage Return-to-Value (MVRV) remaining positive over the long term, which is good news and not something to be concerned about. This trend started back in October 2023. Essentially, this means that the PEPE has provided a reasonable return for its holders, even amidst all the market turbulence.

Concerns of market stagnation

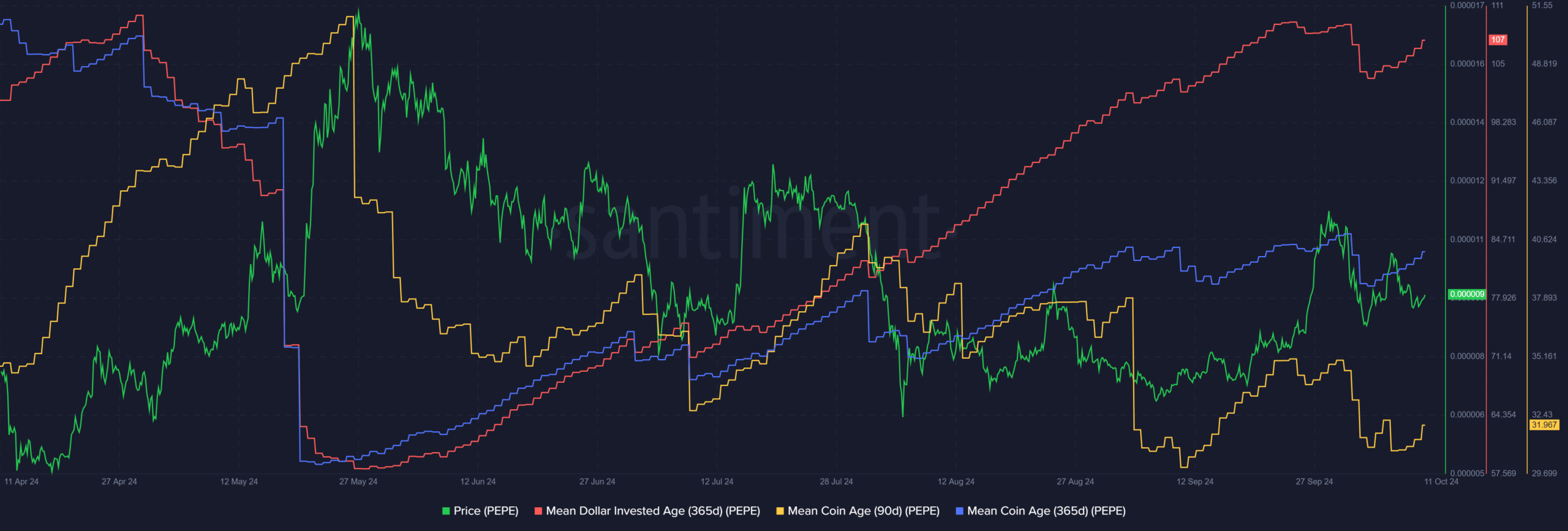

Since July, the average age of coins held for 90 days has consistently decreased, indicating a period of distribution by those who have held the coins for three months. Additionally, since late August, the average age of coins held for one year has failed to increase, suggesting that this longer-term group may also be distributing their holdings.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

As I’ve observed, there seems to be a consistent shift in the token movement from one address to another, which could potentially indicate selling activity. Simultaneously, the average dollar invested age has been on an upward trend. This rising pattern suggests that more and more coins, both new and old, are being held in the same wallets, indicating a potential increase in coin stagnation.

If cryptocurrency begins moving into additional wallets, the metric could begin to decrease, which might be an initial indication of increasing demand or a bullish trend.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-12 10:15