-

PEPE has a bullish market structure on the higher timeframes.

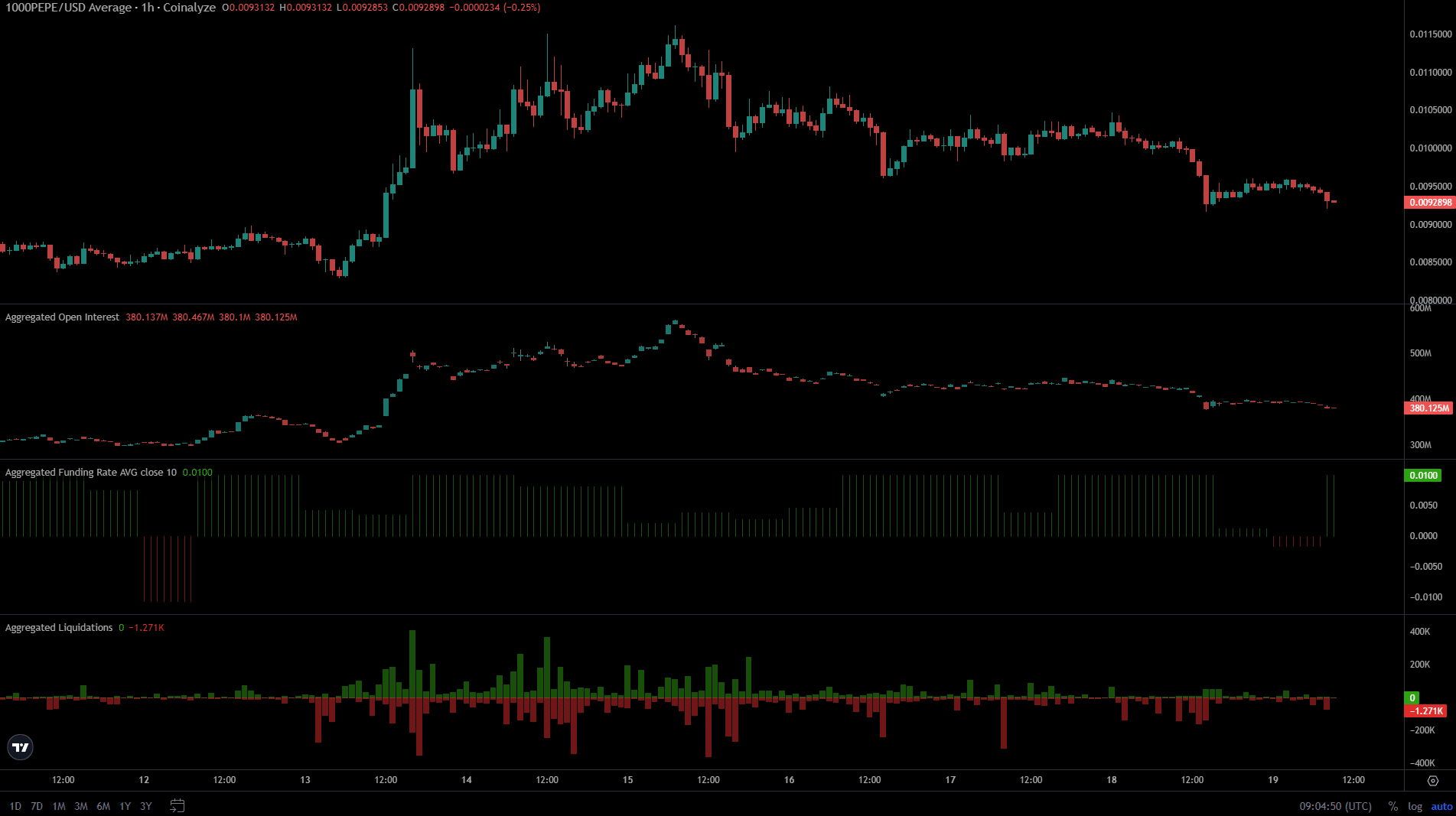

Futures traders were likely sidelined and waiting for a consolidation phase.

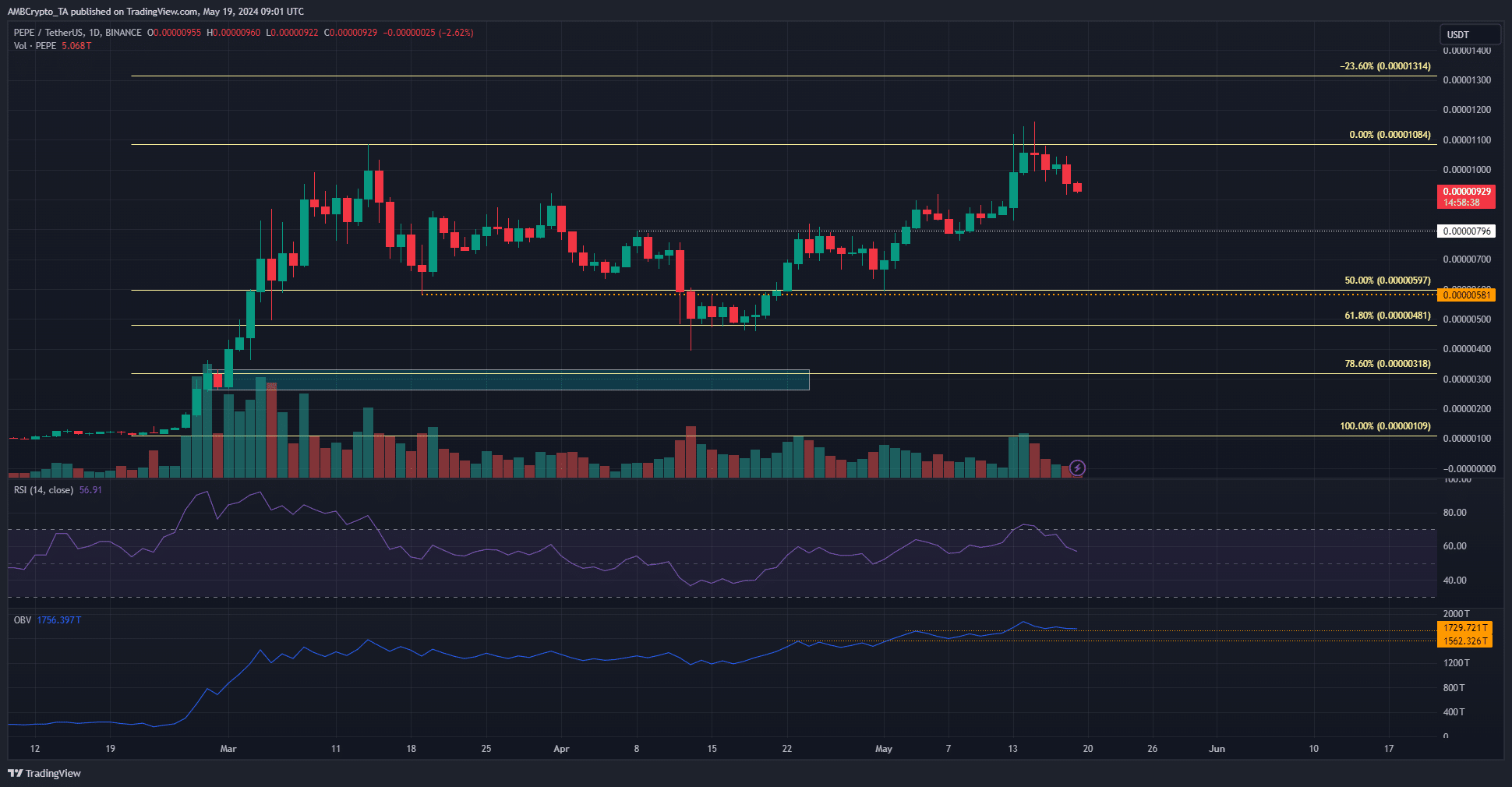

As an experienced analyst, I believe that PEPE‘s market structure is still bullish on higher timeframes despite the recent dip. The technical indicators remain bullish as well, with the OBV in an uptrend and above two key short-term levels, and the RSI showing momentum in favor of buyers.

As a PEPE investor, I observed last week as my token made an attempt to break through a local resistance level. Regrettably, it was met with strong selling pressure and retreated instead, resulting in a 20% decrease since May 15th. However, the overall trend on longer timeframes remains bullish.

Prices would likely surge higher once again.

Instead of “But when and where will a bullish reversal for PEPE start? Contrarily, as many investors currently enjoy profits, there is a possibility that selling pressure could push the price of PEPE back down to its April lows,” you could say:

Which scenario is more likely, and how should traders respond?

Technical indicators remained bullish despite the dip

PEPE hit its daily peak at $0.0000108, but failed to finish above this mark. The very same hurdle from March prevented the buyers once more.

However, some factors were in bullish favor.

On the 1-day chart, the OBV (On Balance Volume) was moving upward and surpassed two significant short-term thresholds. This signified that selling forces hadn’t taken control yet, suggesting that potential price increases might still occur. The overall market configuration on this timeframe remained bullish.

Within just a week, the Relative Strength Index (RSI) dropped from 72 to 56, reflecting a significant price decline. However, the daily chart indicated that buying momentum was gaining traction as well.

Despite the recent decline, PEPE is predicted to continue climbing towards the 23.6% Fibonacci extension at a price of $0.0000131.

If Bitcoin (BTC) starts to weaken and drops below $67k, it’s possible that the $0.0000087 and $0.0000078 levels could serve as strong support points where a price reversal might occur for Pepe. In this scenario, Pepe may experience further declines if Bitcoin continues to slide.

Sentiment has been weak recently

Starting from May 15th, PEPE experienced a price rejection at its local highs which led to a decrease in Open Interest, with the price subsequently sliding downwards as well.

The Funding Rate was at +0.01% with occasional dips that reflected increased short positions.

Over the past 48 hours, liquidation actions were taken predominantly by optimistic investors. These compelled sales intensified the existing downward trend in the market.

Read Pepe’s [PEPE] Price Prediction 2024-25

On that day, the market wasn’t as unstable as it had been on the 15th, leading to the liquidation of larger long and short positions.

As an analyst, I believe we’re approaching a potential local bottom in the market. Following this, a phase of consolidation may ensue. To stay informed, traders should monitor lower timeframe charts closely for any signs of recovery.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-20 00:07