-

PEPE breaches the major support level of $0.00001075; analysts hint at another 20% fall in the coming days.

$13.8 million in short positions will be liquidated if PEPE soars to the $0.0000118 level.

As a seasoned researcher with years of experience navigating the ever-changing crypto market, I find myself intrigued by the recent movements of Pepe (PEPE). The whale’s strategic maneuvers, as reported by Lookonchain, are a testament to the shrewdness that exists within this sphere.

As we approach August, the general feeling among investors seems pessimistic, with a strong trend of selling rather than buying.

During the economic slump, a significant figure in the cryptocurrency world, known as a ‘crypto whale’, transferred a substantial quantity of Pepe (PEPE) to Binance, according to the findings of a blockchain analysis firm called Lookonchain.

Pepe whale moves 400 billion tokens

On the Lookonchain platform, they recently shared an update (originally posted on Twitter): A significant crypto investor transferred approximately 400 billion tokens valued at around $4.22 million over to Binance.

As someone who has been actively trading cryptocurrencies for several years now, I find myself closely watching the recent developments surrounding PEPE. With my extensive experience in the market, I can see that this massive transaction seems to be a strategic move aimed at partial profit booking amid the current bearish sentiment. The breakdown of the major support level at $0.00001075 is a clear indication of the prevailing market conditions, and experienced traders like myself often make moves such as these in response to such signals. It will be interesting to see how this plays out in the coming days.

Based on available information, it is reported that a whale removed approximately 795.92 billion PEPE tokens valued at around $2.55 million from the Binance platform on March 1st.

Although there was a recent addition, the whale maintains an impressive PEPE stash totaling approximately 395.93 billion, valued at roughly $4.18 million. Prior to this large transaction, the whale’s potential profit stood at around $5.85 million, representing a potential return on investment of about 230%.

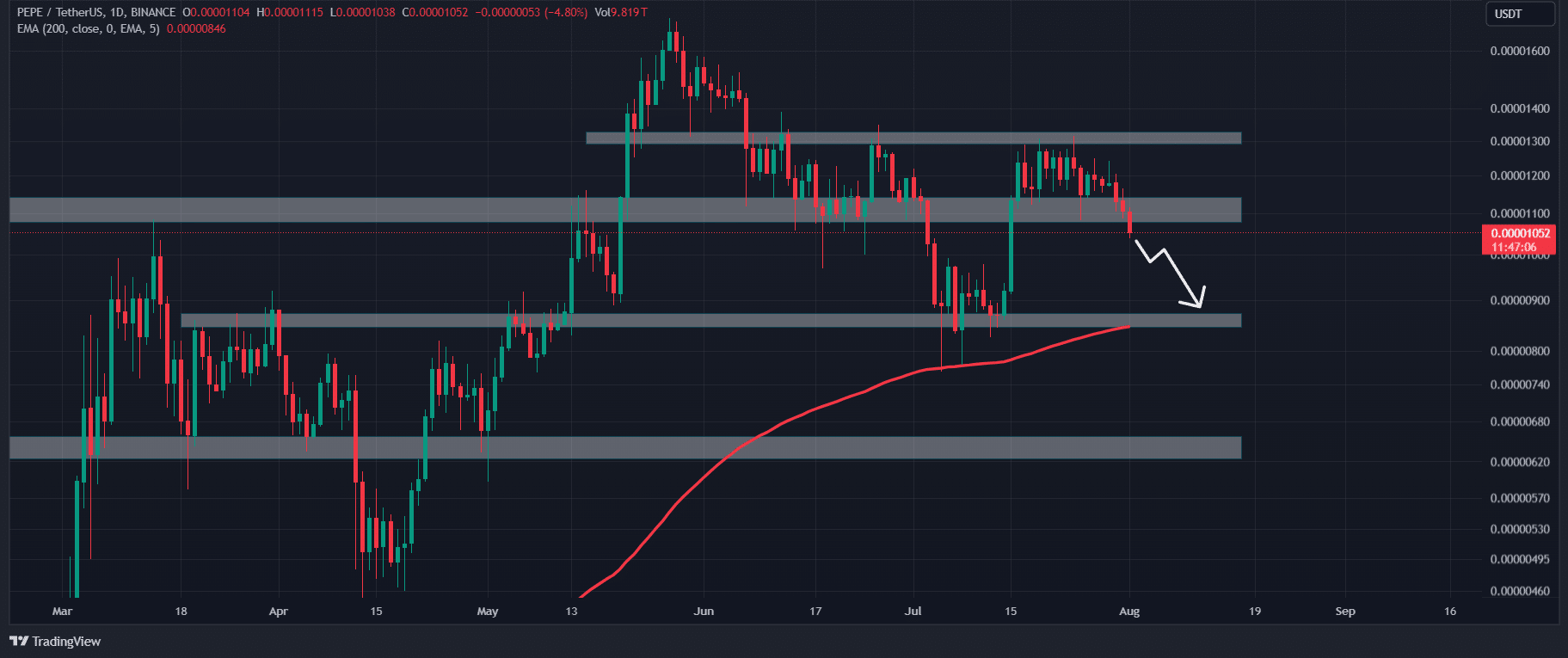

PEPE price-performance

As I write this, PEPE is hovering around approximately $0.00001051 in current market value. Over the past 24 hours, there’s been a 7.5% decline in its price. Concurrently, the trading volume has seen a notable uptick of 14%.

An increase in trading volume signals a higher level of participation from investors and traders.

Based on professional technical assessment, it’s anticipated that PEPE could exhibit a downward trend, potentially decreasing by around 20% in the near future. This prediction is due to the current market mood and the recent breach of a crucial support price of $0.00001075.

According to historical trends in pricing patterns and movements, it’s possible that the PEPE token could find its next price floor around $0.0000852. This is because this level aligns with the position of the 200 Exponential Moving Average (EMA).

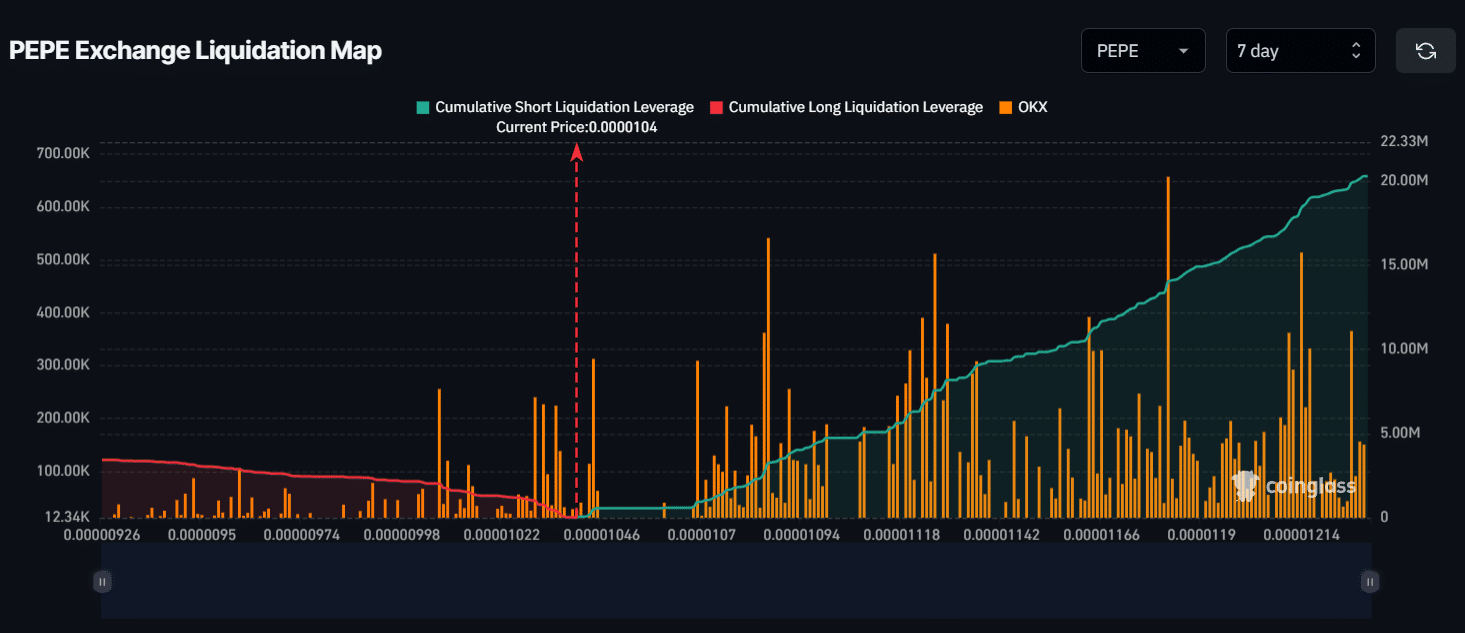

Major liquidation levels

In addition to examining its technical aspects and market trends, it’s worth noting that the key support (lower) and resistance (higher) levels for PEPE are around $0.000010 and $0.0000118 respectively. This means if the price falls below $0.000010, it might be a strong indication of a downtrend, while reaching or surpassing $0.0000118 could suggest an upward movement.

The current liquidation levels show buyer and seller bets on PEPE over the last 7 days.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

Should the prevailing market opinion not shift, the price of PEPE might drop down to approximately 0.000010 dollars. This decrease could potentially lead to the liquidation of around 2.04 million dollars worth of long positions.

As a seasoned investor with years of experience in the cryptocurrency market, I have witnessed the incredible volatility that can occur when sentiment shifts dramatically. In my career, I have seen numerous instances where a coin like PEPE, which currently trades at a relatively low price, could skyrocket if sentiment changes. For example, if positive news or hype surrounding PEPE were to spread, its price could surge to $0.0000118 – a significant increase for such a low-priced coin. Such an event would not only generate substantial profits for investors but also lead to the liquidation of nearly $13.4 million worth of short positions. The potential impact on the market and individual portfolios could be immense, highlighting the importance of staying informed and making strategic investment decisions based on market trends and sentiment.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-08-02 00:40