- Pepe consolidates as Bollinger Bands signal potential breakout.

- The funding rates turn green as whales accumulate.

As a seasoned crypto investor with battle-scarred fingers from the 2017 bull run and the infamous ‘Crypto Winter’, I’ve learned to read between the lines of market trends and technical indicators. Pepe [PEPE] has caught my eye as an intriguing investment opportunity in Q4 2024.

As a crypto enthusiast, I find myself intrigued by the promising prospects of PEPE, a memecoin, in Q4 2024. Following an impressive leap of more than 1000% after its consolidation period, this cryptocurrency has garnered substantial interest and attention from investors like me.

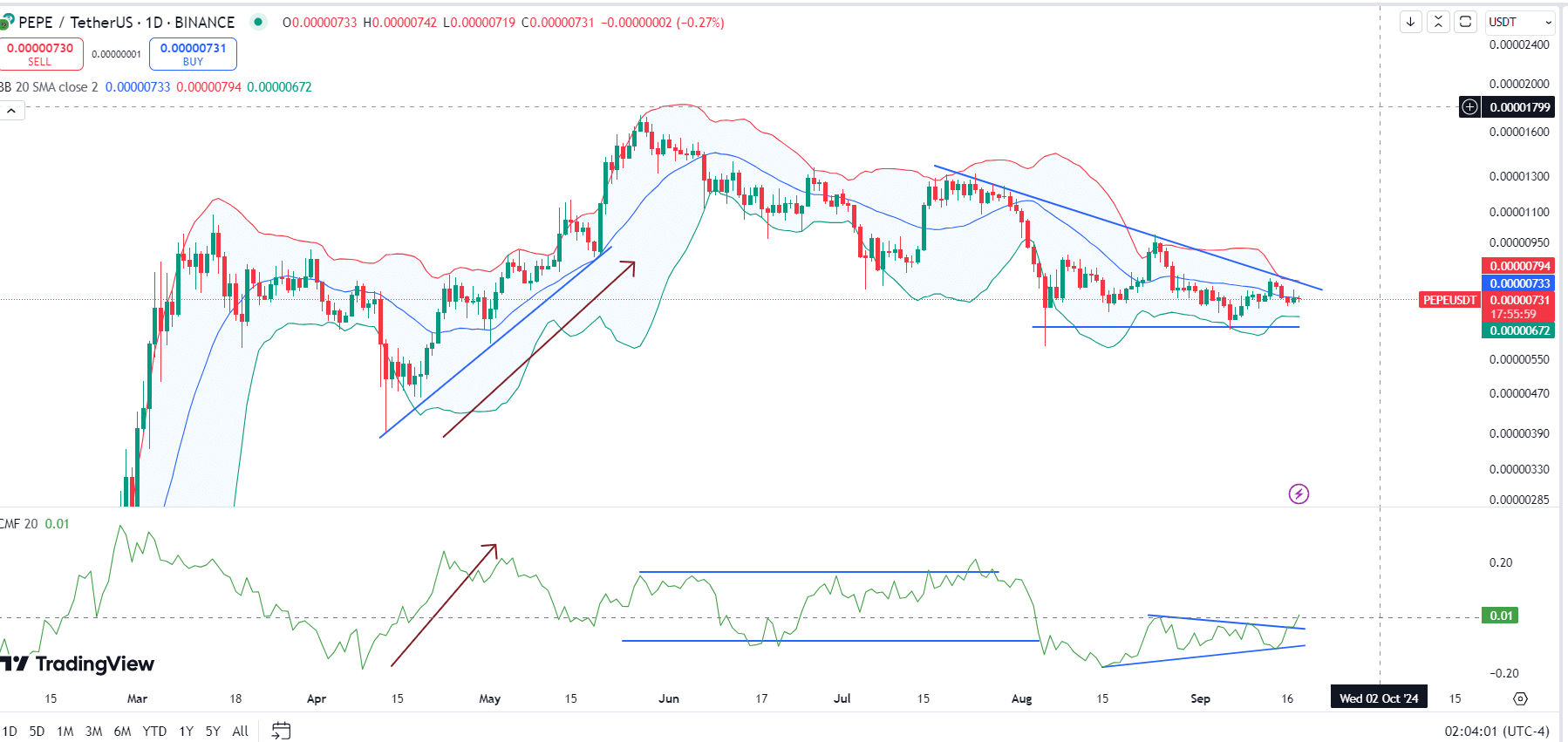

Originally finding itself treading water within an unyielding horizontal market following its debut on the Ethereum network, I’ve noticed that PEPE/USDT is currently shaping up into a triangle formation.

As a researcher, I’m observing a significant convergence in the data, coupled with a narrowing of Bollinger Bands. This pattern hints at an upcoming breakout that might be just around the corner. With historical trends in mind, traders are gearing up for what could be a bullish climax to this year.

At the moment, it’s forming a triangle shape, with Bollinger Bands becoming narrower. Such a pattern usually indicates an imminent breakout in the short term.

Historically, similar configurations have typically been followed by substantial changes in pricing. Furthermore, the Chaikin Money Flow has surpassed its triangle-like trend, suggesting that the accumulation stage may be coming to a close soon.

As the cost of the memecoin increases with more people wanting to buy it, this increased demand might cause a substantial rise in the value of the memecoin.

An extended period of stability since May adds credence to the possibility of a robust price surge, should market circumstances be advantageous for alternative cryptocurrencies (altcoins).

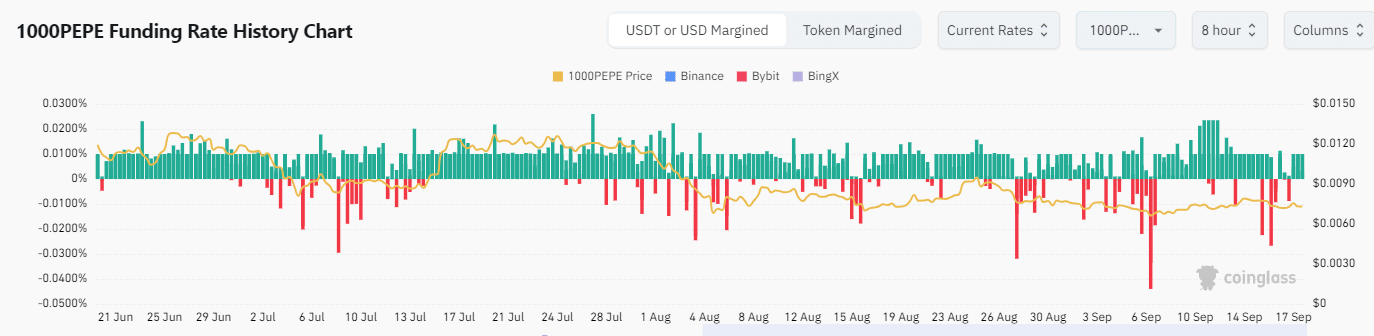

Pepe funding rates turn green

Funding rates have turned green, providing further support for a bullish outlook on Pepe memecoin.

When funding rates are green, it indicates that more traders are going long, reflecting a positive sentiment.

In this scenario, long-term investors are essentially compensating short-term investors for maintaining their trades. This frequent occurrence typically boosts the desire for assets and can cause prices to rise.

However, it also raises the risk of liquidation for long positions if the market shifts.

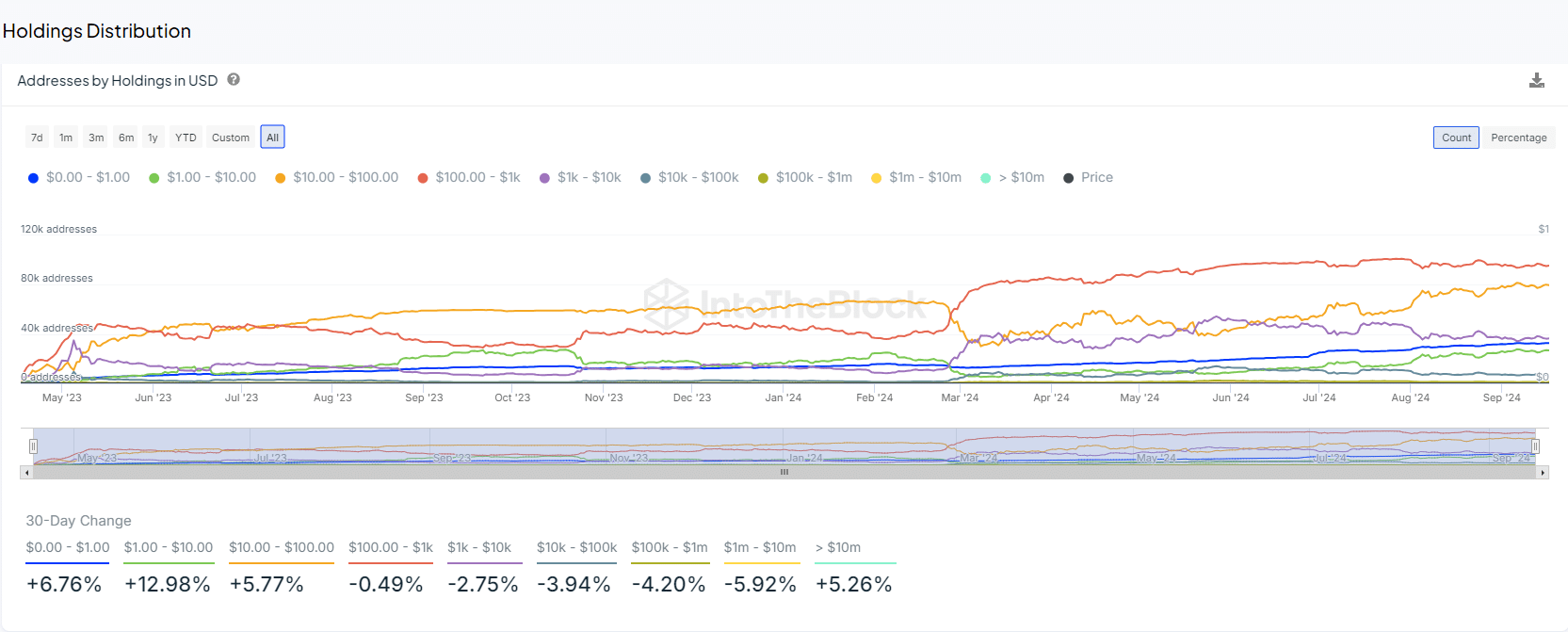

Address holdings and whales

Examining the distribution of US dollar-denominated holdings reveals that large investors, often referred to as ‘whales’, are growing their PEPE investments. The number of traders owning over $10 million in PEPE has increased by approximately 5.26%.

Smaller retail traders are on the rise, but there’s been a modest dip in the number of medium-sized traders participating in the market.

Regardless, the persistent purchases made by ‘whales’ indicate a high level of belief in PEPE‘s future prospects.

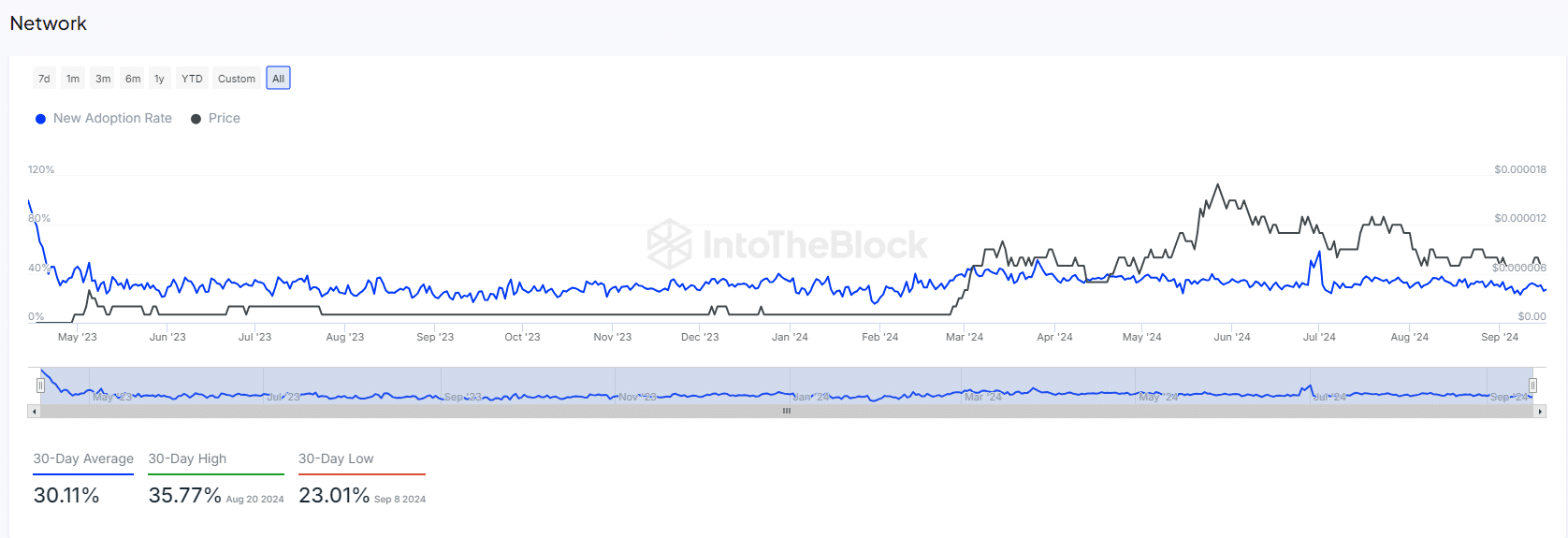

New adoption rate

The current acceptance of Pepe is holding strong at 26%, suggesting a consistent pattern rather than a drop. This stable growth suggests an increase in traders joining, albeit not at the speed that some eager supporters may anticipate.

Is your portfolio green? Check the Pepe Profit Calculator

Nevertheless, a constant adoption rate is generally bullish and suggests growing interest in PEPE.

In summary, it appears that PEPE could be on the verge of an upward price trend. Favorable factors such as positive funding rates, increased whale involvement, and consistent user adoption are all pointing towards a potentially bullish market scenario as we move into Q4 2024.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-19 11:04