-

PEPE’s prices will surge when Spot Ethereum ETFs start trading

Metrics pointed to a balanced market with a slight bullish tilt

As a seasoned analyst with extensive experience in the cryptocurrency market, I have witnessed firsthand how the approval of Spot Bitcoin ETFs led to a surge in prices for not only Bitcoin but also altcoins and memecoins like PEPE. Given this historical precedent, I firmly believe that the upcoming launch of Spot Ethereum ETFs will result in a similar price surge for PEPE.

In the USA, Ethereum Exchange-Traded Funds (ETFs) have been granted approval at last. This development is projected to generate a surge in institutional investment towards Ethereum, possibly influencing its price and even impacting the values of meme coins such as PEPE.

Observing Bitcoin‘s behavior is enlightening. Following the approval of a Spot Bitcoin ETF, Bitcoin reached a new all-time high (ATH) on the price charts within a short time frame. Moreover, this upward trend extended to other cryptocurrencies in the market, including altcoins and memecoins.

Within a month, approximately $3.75 billion flowed into Spot bitcoin exchange-traded funds (ETFs) daily. This substantial influx was an encouraging sign of things to come for Bitcoin’s performance over the following months.

PEPE gained significantly from the approval of the Spot BTC ETF, increasing by 86.56% in a mere seven-day period. A similar trend may emerge when Spot Ethereum ETFs begin trading, potentially even more so given Ethereum’s strong correlation to assets like PEPE.

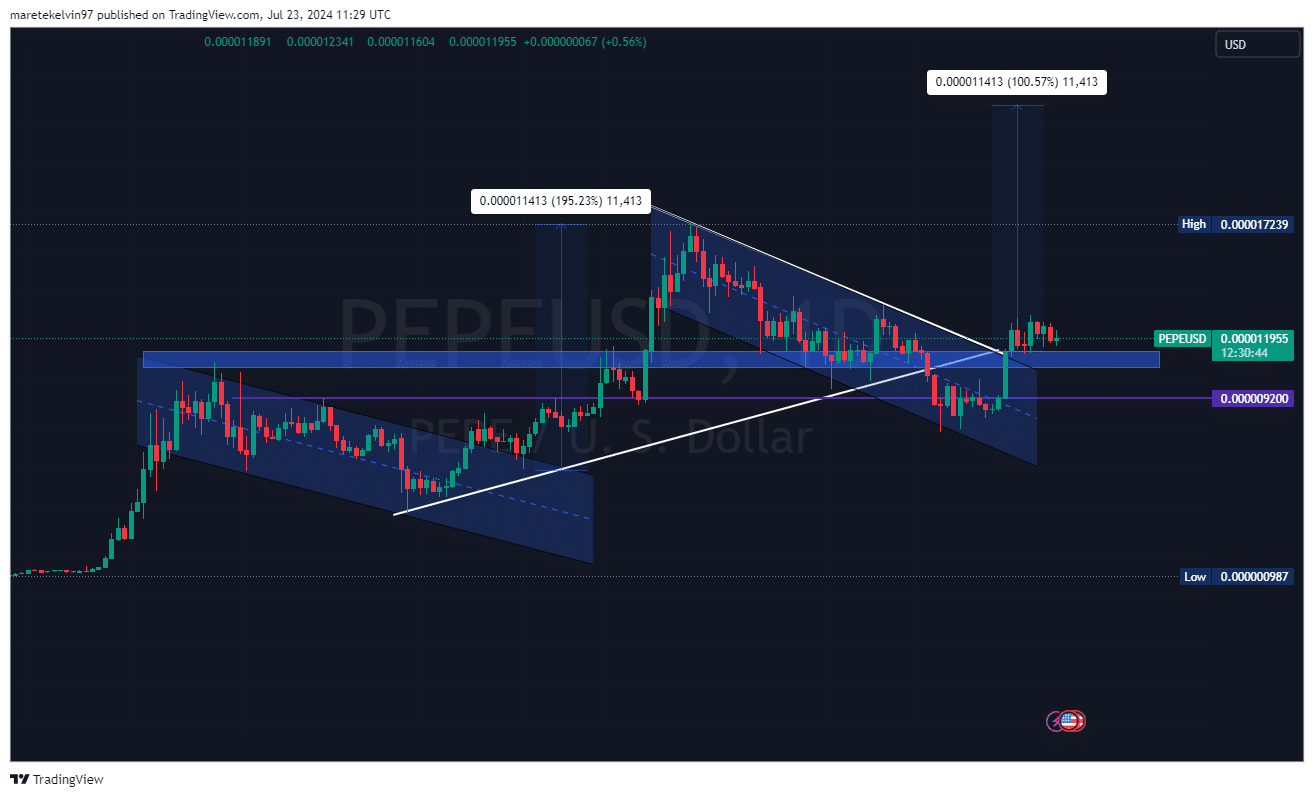

At the moment when this statement was published, PEPE‘s price was fluctuating following a bullish flag formation on the charts. Such price action often signals that a bullish trend could resume in the near future.

The price of PEPE at $0.0000015 appeared to function as a robust support. However, PEPE has refused this level on multiple occasions, suggesting that it could pave the way for an upcoming bullish trend.

It’s important to mention that PEPE exhibits a typical pattern with a seasonal fluctuation, a period of stabilization, and then a strong upward price movement following a bullish breakout. Since the price has just broken out of a bullish flag, there’s a good chance we could see a substantial price increase.

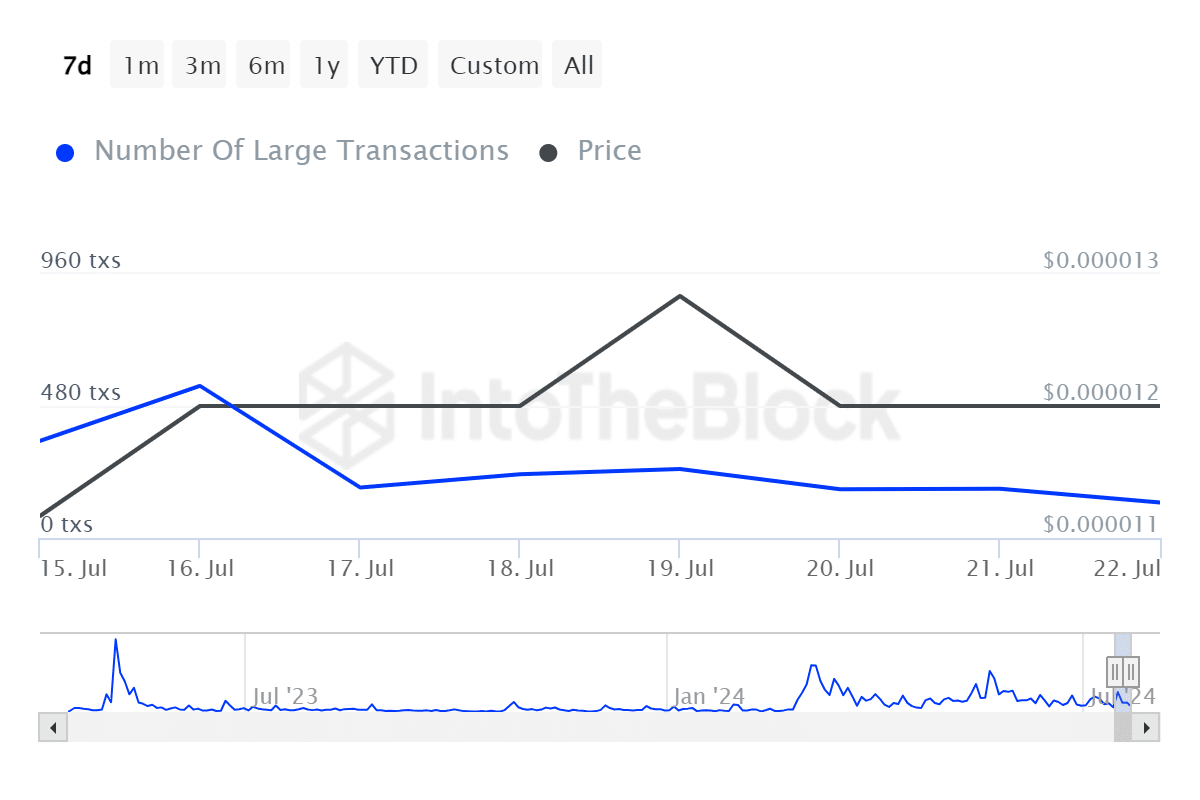

PEPE whales taking a breather

According to AMBCrypto’s examination of IntoTheBlock statistics, there has been a significant decrease in large transactions from 179 to 129 over the past week. This represents a decline of approximately 27.93% within just the previous 24 hours.

A substantial decrease in the number of major market participants could be an early indicator of notable price fluctuations on the charts.

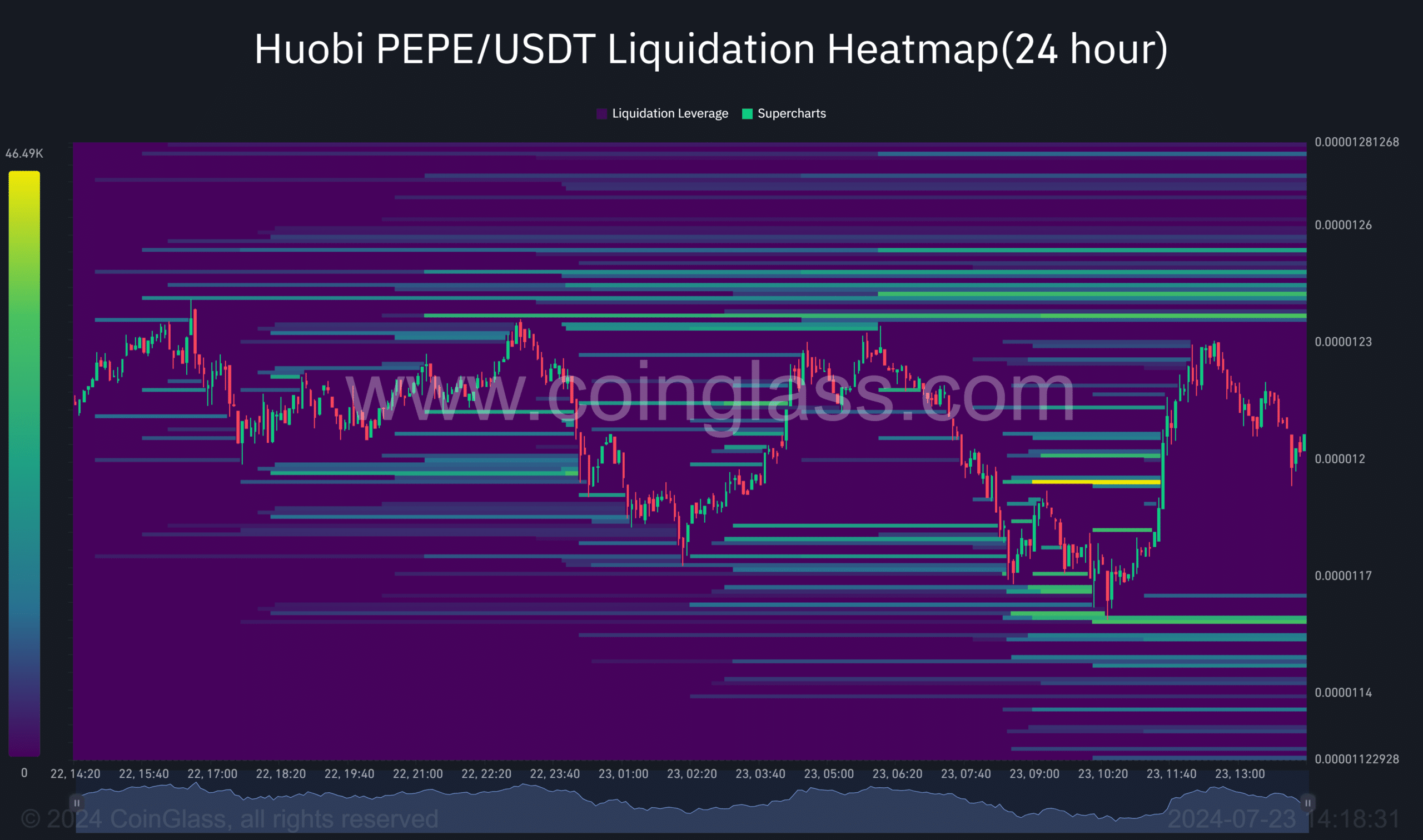

As a crypto investor, I closely monitor market conditions and recently checked out the liquidity assessment provided by AMBCrypto using Coinglass data. The findings suggested a well-balanced market where the bulls held a slightly stronger position in terms of leverage.

In simpler terms, there’s growing optimism among investors that the memecoin will experience a price increase soon, which increases the possibility of an upcoming surge.

The current market conditions favor PEPE and other memecoins closely linked to Ethereum, as indicated by their strong correlation with Ethereum’s price movement. With Ethereum-based Spot ETFs set to begin trading soon, there is a high likelihood of these coins experiencing significant gains in the near term.

Only time will tell how long that rally lasts though.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-07-24 08:07