-

Open Interest and volume of PEPE plunged, indicating a dearth of new liquidity for the token.

Data revealed an increase in HODLing, suggesting a possible short-term recovery.

As a seasoned crypto investor with a keen interest in the memecoin market, I’ve witnessed various trends and price movements. The recent decline in open interest and volume of PEPE is concerning, but not necessarily a death sentence.

As an analyst, I noticed that the trading volume for contracts associated with PEPE, as reported by AMBCrypto, had taken a dip. Based on data from Coinglass, the derivatives information platform, PEPE’s trading volume decreased by 5.10% or approximately $764.63 million within the past 24 hours.

As an analyst, I would rephrase this statement as follows: The Open Interest (OI) decreased to $158.02 million. Open Interest refers to the total number of contracts that have not been closed in the market. When the Open Interest rises, it signifies that traders are expanding their positions and fresh capital is being injected into the market.

Are sellers taking over?

When this happens, buyers are aggressive, and price could move higher.

In contrast, a decrease in open interest implies that traders are progressively closing their positions and withdrawing liquidity. Consequently, sellers are exhibiting heightened aggression in the market.

The drop in PEPE‘s performance in this aspect may be attributable to its meme coin’s fluctuating price. In the past, the token’s price reached remarkable peaks, inciting traders to invest and profit from the price swings.

If PEPE‘s price drops further to $0.000014, marking an 8.78% decline over the past week, there’s a possibility that the token’s popularity may wane as well.

Holders may not grieve for long

From a researcher’s perspective, if the token experiences a rebound, it could lead to a significant surge in contract openings. However, the question remains: Will the price indeed bounce back?

Based on an evaluation by AMBCrypto using exchange data from Santiment, PEPE‘s exchange inflow amounted to approximately 5.28 billion.

Within the last week, this amount represents the quantity of tokens transferred to exchanges for potential selling. On the other hand, there was an exchange outflow of 14.71 billion, indicating that a greater number of market participants chose to keep their tokens rather than offloading them for profits.

As a market analyst, I would interpret this situation as follows: If PEPE‘s price experiences further decreases, it could potentially alter the current trend. However, this outcome would depend on whether the selling pressure (outflow) persists more than the buying pressure (inflows).

If we look ahead over the coming days or weeks, there’s a possibility that PEPE‘s price may return to around $0.000017. Some investors remain skeptical about the prospect of a rebound, despite bullish signs in the market.

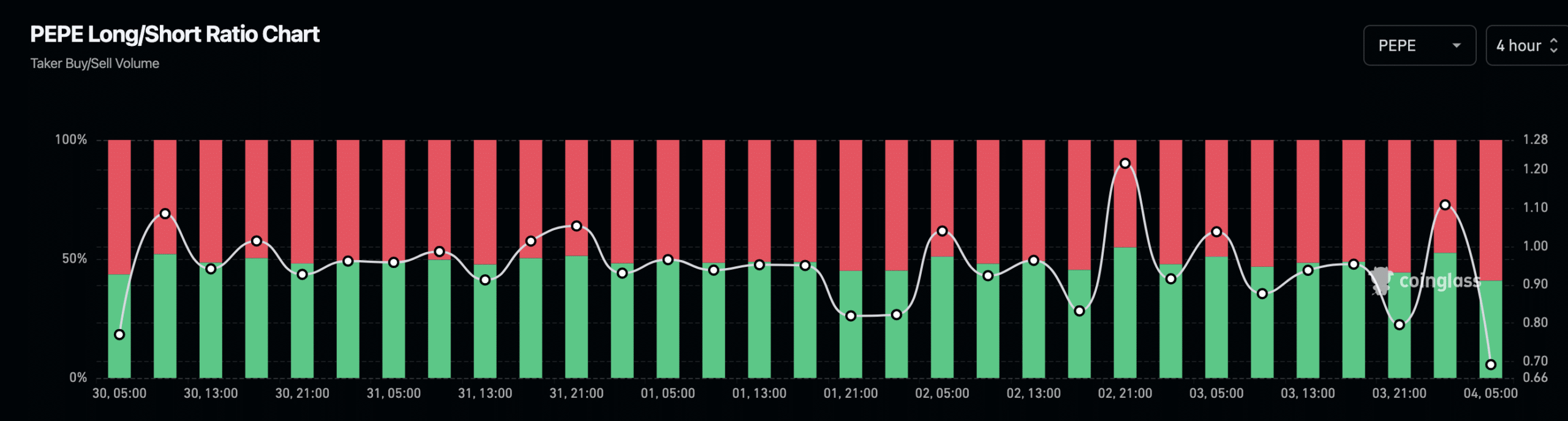

The Long/Short ratio clearly reflected traders’ bias towards buying, as the number of long positions exceeded short positions. A Long/Short ratio greater than 1 signifies this imbalance, with traders holding more bullish bets than bearish ones.

In contrast, a 4-hour Long/Short ratio of 0.69 or less implies that traders are more pessimistic than optimistic about the market’s direction. At present, this ratio suggests that investor sentiment is bearish.

Read Pepe’s [PEPE] Price Prediction 2024-2025

When there’s strong negative feeling towards PEPE, historically, its price has tended to rise further instead of declining.

As such, a notable upswing could be in the work for the token.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-04 12:08