- Two of the leading memecoins had little on the price charts and metrics to separate them.

- There was evidence for a shift in short-term momentum and slow accumulation for one of them.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned that every coin has its unique characteristics and market dynamics. Pepe [PEPE] and Shiba Inu [SHIB], two popular memecoins, presented an intriguing dilemma for me as they showed little difference in their price charts and metrics.

For a ten-day span, Pepe (PEPE) and Shiba Inu (SHIB) reached the pinnacle of their respective price ranges. Notably, the Shiba Inu team unveiled plans for a groundbreaking marketplace set to disrupt Web3 commerce, generating buzz in the news. However, no definitive launch schedule was announced.

Recent rejections at a significant resistance level for PEPE have left its bulls with limited reasons to be optimistic. In contrast, what can be considered more promising for the memecoin market in July?

The range and the hurdles ahead

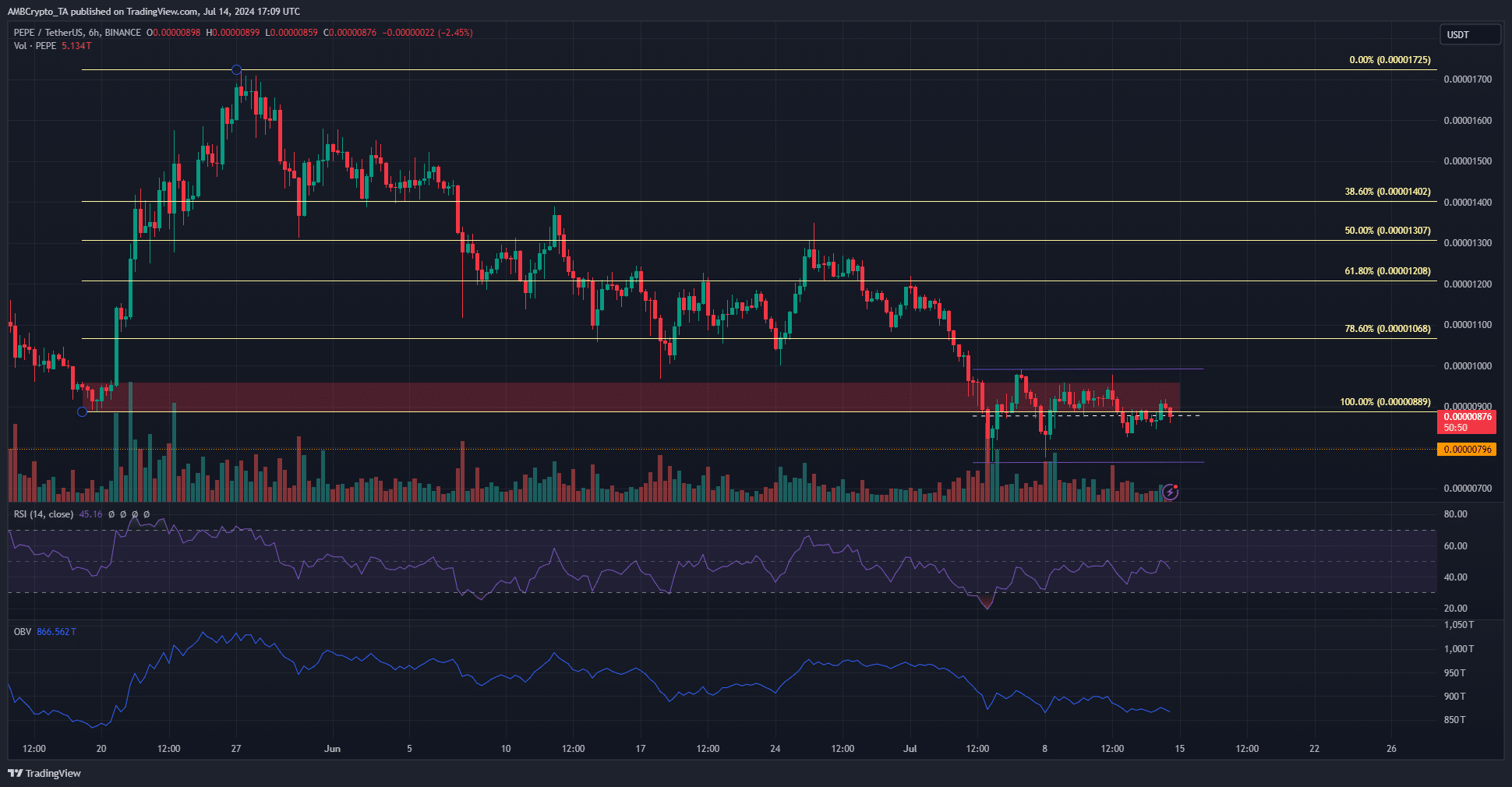

PEPE’s trading price has fluctuated between a low of $0.0000076 and a high of $0.0000099. Currently, the middle point at $0.0000088 is serving as support. Previously strong support levels at $0.000009 to $0.0000096 have now become resistance points.

On the 6-hour chart, the Relative Strength Index (RSI) hadn’t surpassed the neutral 50 mark yet, while the On-Balance Volume (OBV) was showing a downward trend. This implies that buying pressure was absent, and it’s expected that losses may continue.

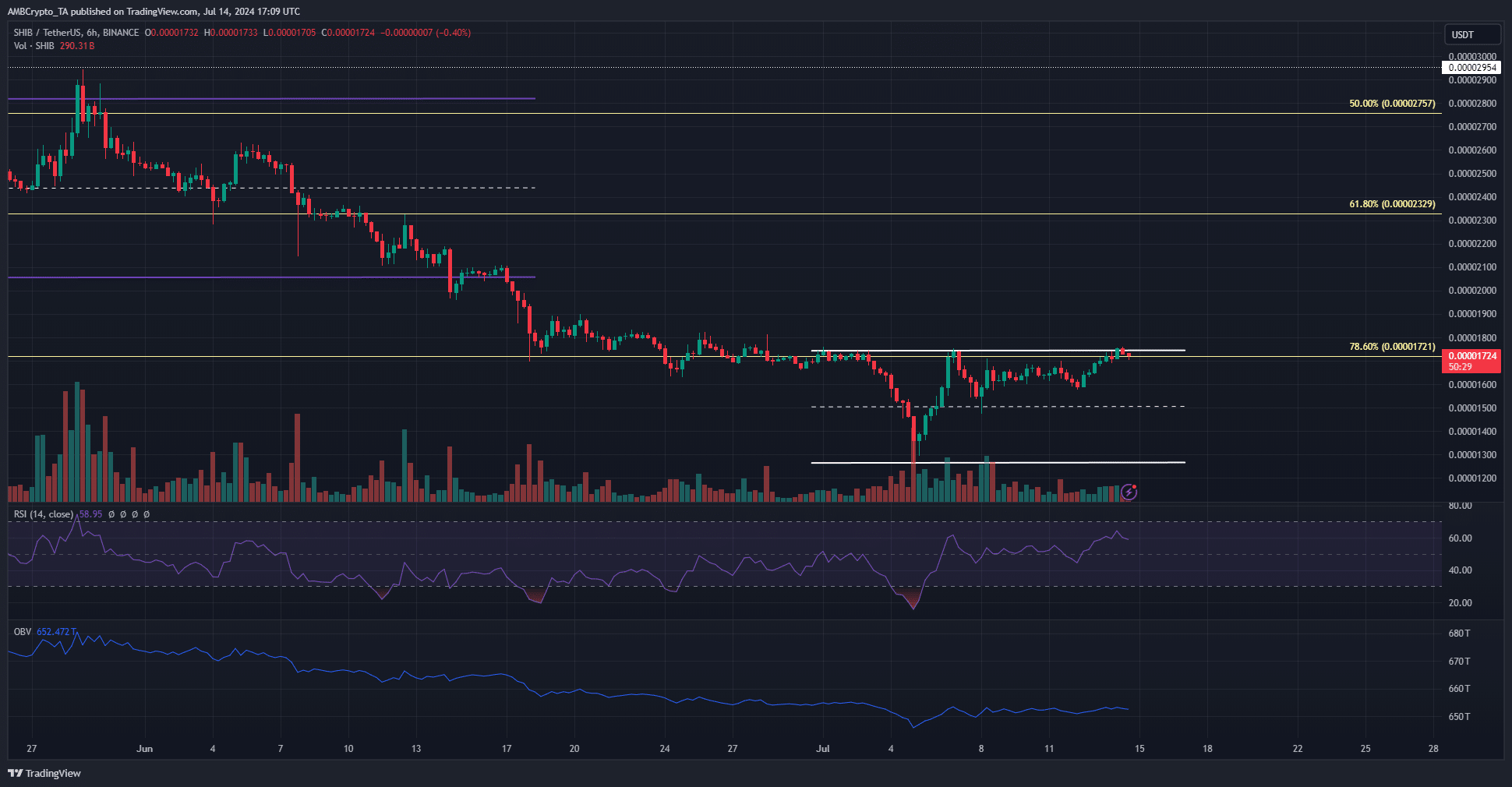

As a crypto investor, I’ve observed that Shiba Inu’s price action formed a two-week range between $0.0000174 and $0.0000127. Contrary to Pepe’s bearish trend, the On-Balance Volume (OBV) of Shiba Inu remained stable instead of declining during this period. This suggested a more optimistic short-term outlook for Shiba Inu.

From a technical perspective as a researcher, I’ve observed that the Relative Strength Index (RSI) of Shiba Inu has been above the neutral 50 level, signaling upward momentum. Additionally, the price is currently at the range highs and the indicators are suggesting a bullish trend. Consequently, based on this analysis, I believe Shiba Inu holds a more optimistic short-term outlook.

Clashing overvalued signals with one conclusion

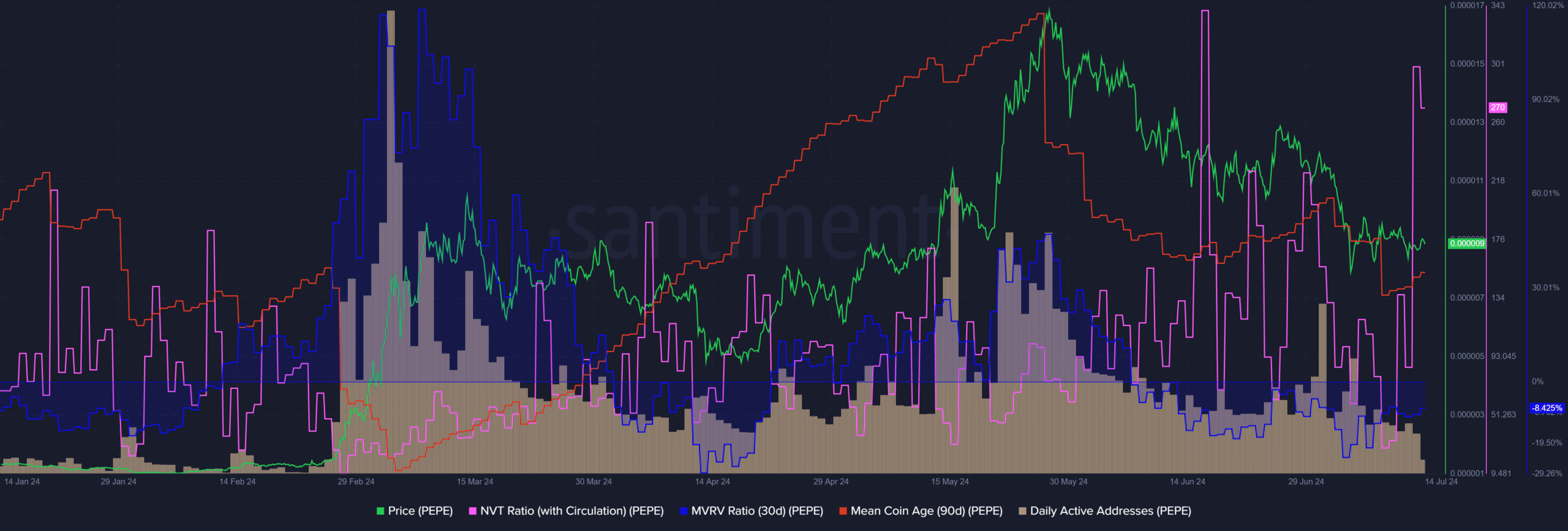

As a financial analyst, I’ve observed that PEPE‘s Network Value to Transactions Ratio reached unusually high levels lately. This means that the value of the network supporting this digital asset was disproportionately higher than the number of transactions taking place on it. In simpler terms, PEPE seemed relatively overvalued based on this metric.

Despite a 30-day MVRV (Moving Average Value Realized) showing a negative result, implying an undervaluation based on circulating value, this asset may in fact be overvalued when considering its short-term price action. In other words, the token appears to be cheaper than its actual worth in the short term for investors, but its overall value remains underestimated.

The organic interest in cryptocurrencies was waning as the number of daily active wallet addresses declined. Additionally, the average age of coins in circulation indicated a significant distribution trend towards younger coins.

Together, the on-chain metrics further reinforced PEPE’s weakness in the short term.

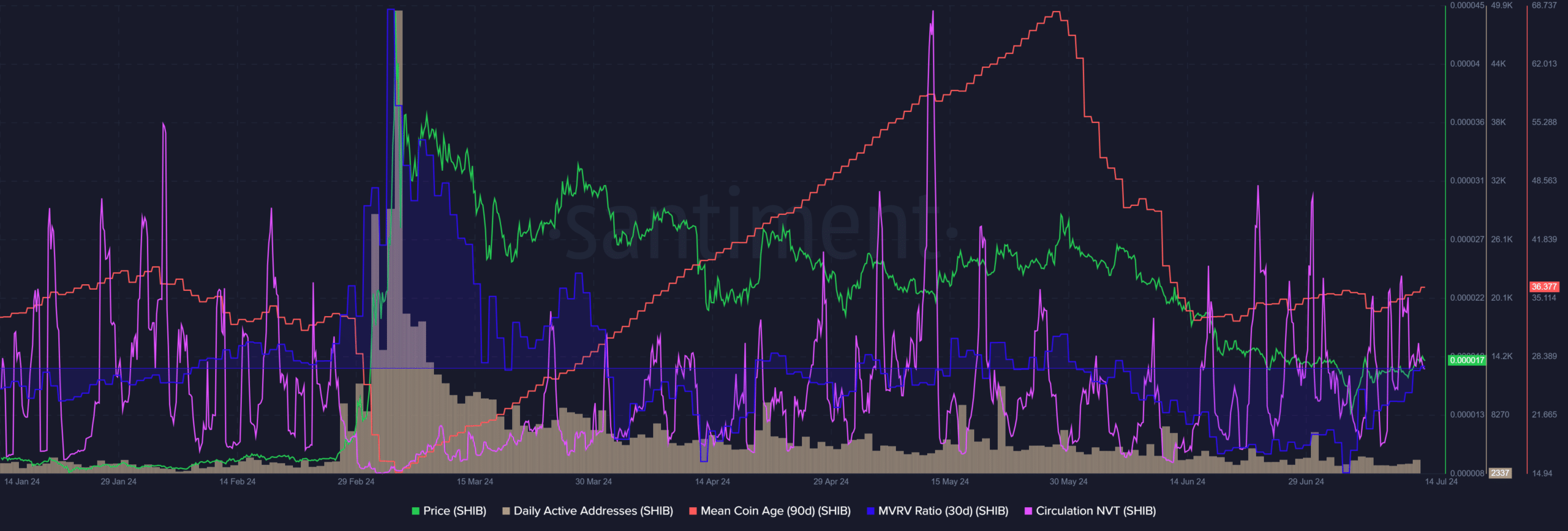

In simpler terms, the NVT (Network Value to Transactions Ratio) wasn’t reaching the levels seen in late April, but the 30-day MVRV (Market Value to Realized Value Ratio) started showing a positive trend.

Read Pepe’s [PEPE] Price Prediction 2024-25

The mean coin age has slowly increased over the past month, signaling accumulation.

On the 13th of July, SHIB saw more daily active addresses with a count of 2325 compared to PEPE‘s 3738. Additionally, Shiba Inu presented stronger technical and on-chain indicators, bolstering optimistic outlooks for its price movement.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-07-15 10:15