-

Whales have recently accumulated 828.8 PEPE from Kraken.

Will the whale actions ignite a price rebound for PEPE?

As a seasoned analyst with years of experience in the cryptocurrency market, I have seen whales come and go, but the recent accumulation of 828.8 PEPE by these whales has certainly piqued my interest.

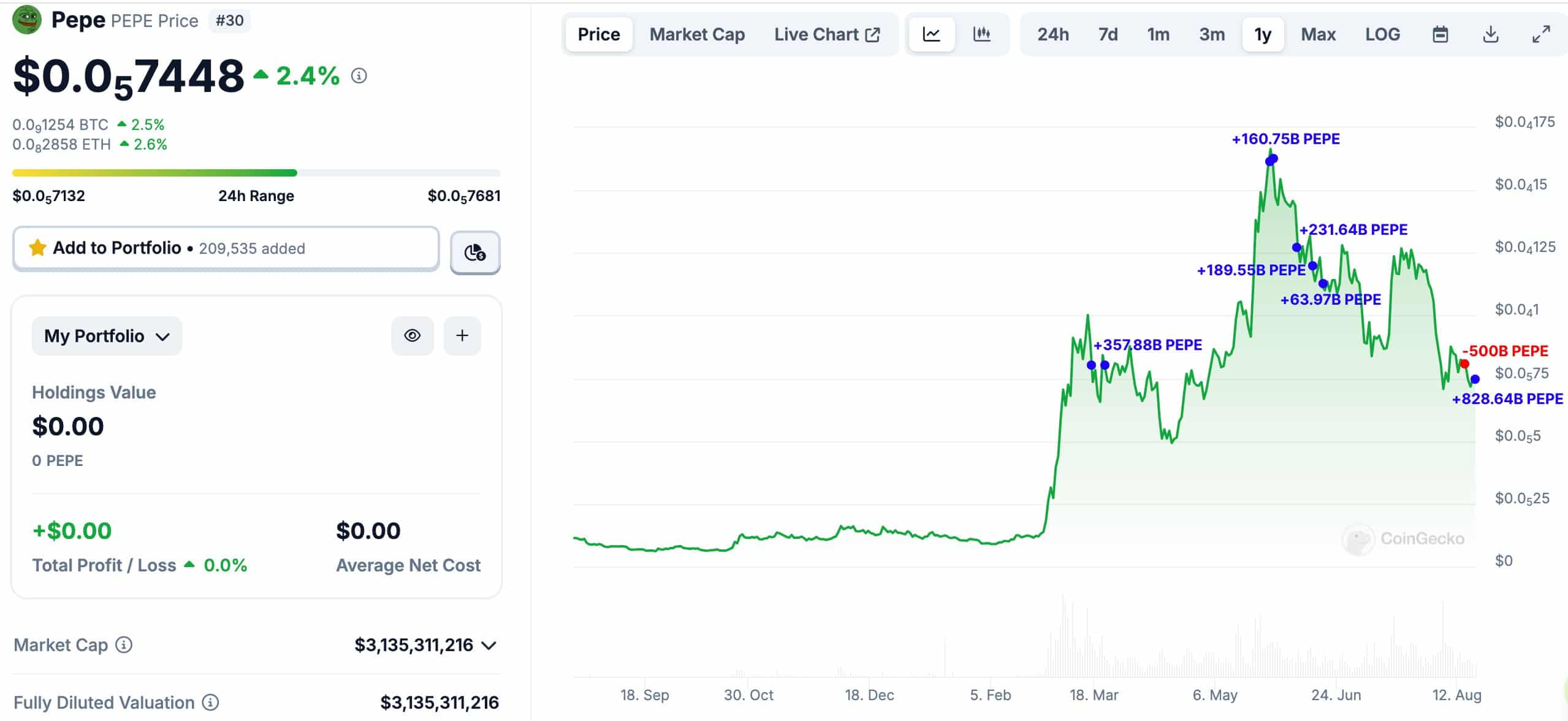

Despite the current low prices of PEPE [PEPE], there’s renewed interest among whales, as indicated by recent transactions. On August 17th, two large wallets (whales) acquired approximately 828.8 billion PEPE, equating to around $6.2 million, from Kraken, according to Spot On Chain.

The whale wallets, believed to belong to a single person, recently sold 500B PEPE before grabbing more 828.8B PEPE at the recent low of $0.0000074.

Three days past, as a researcher observing the PEPE market, I executed a transaction: selling 500 billion PEPE tokens at a price of $0.000008 and purchasing 828.64 billion PEPE tokens at a lower price of $0.0000074. Currently, my PEPE holdings stand at a staggering 1.33 trillion tokens (approximately $9.93 million worth), yet I find myself in a position where I’ve incurred a loss of approximately $3.3 million on this particular cryptocurrency.

Is PEPE’s whale action a buy signal?

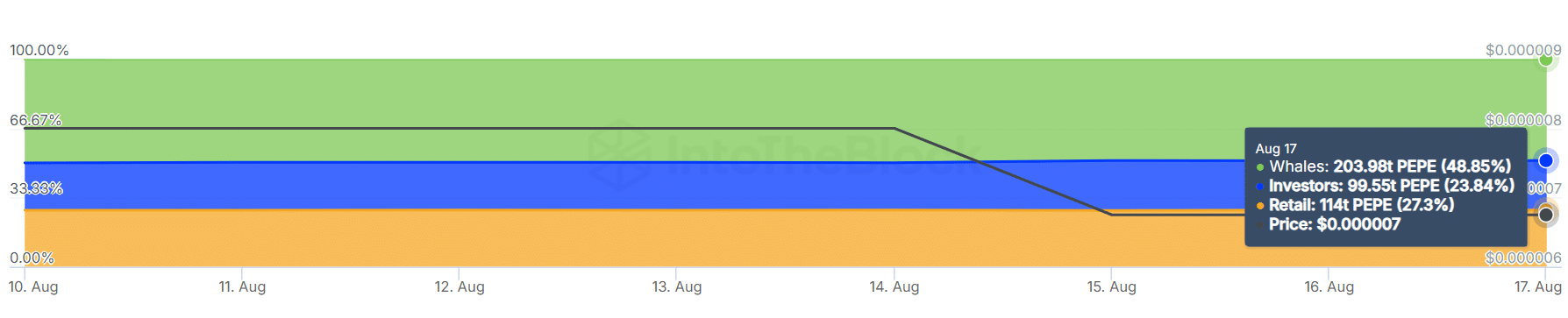

The distribution of PEPE memecoin is largely controlled by large investors, or ‘whales’, according to data from IntoTheBlock. Given this, significant actions taken by these whales, such as the one mentioned earlier, can influence the price of PEPE.

Over the last seven days, I’ve noticed that a significant portion of the PEPE supply – roughly 49% – is in the hands of what we call ‘whales’. This group is closely followed by the retail investors holding about 27%, and institutional investors accounting for around 23%. To put it simply, the actions of these whale investors in PEPE are hard to ignore.

Was the whale’s purchase of the cryptocurrency at $0.0000074 considered a bargain or an opportunity for other hesitant investors to jump in?

Yes, the whales snagged PEPE at a ‘cheaper’ value.

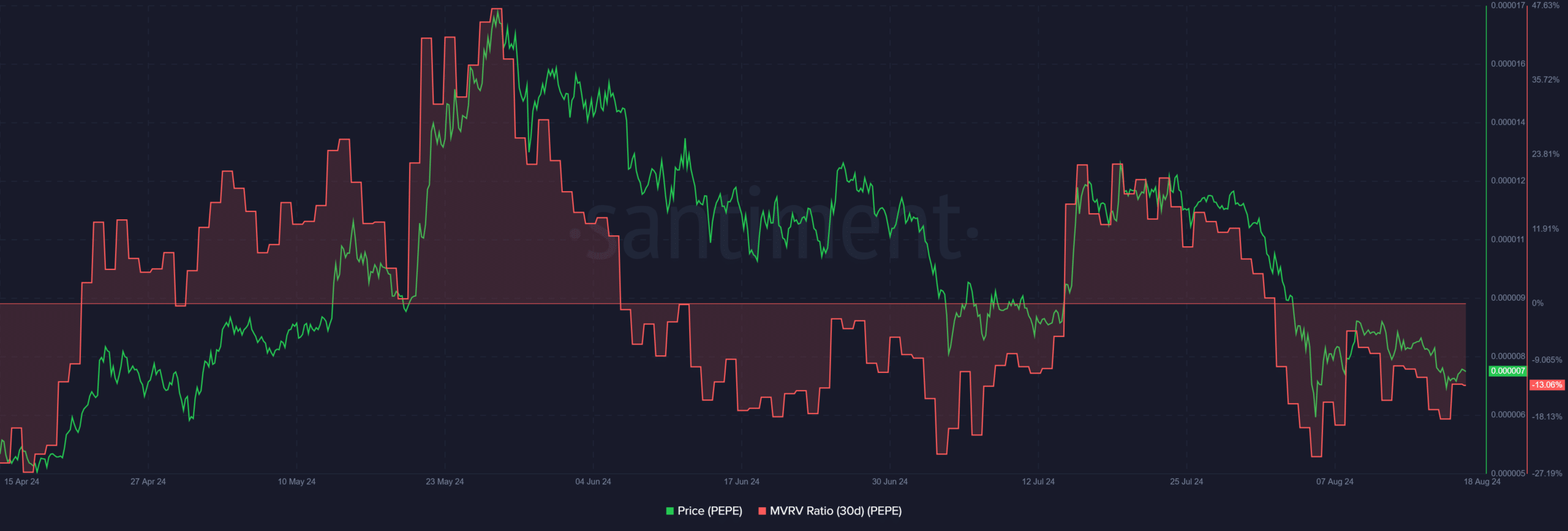

As an analyst, I observed a significant decrease (-13%) in the MVRV (Market Value to Realized Value) ratio for PEPE. This indicates that the token is potentially undervalued at its current market value, implying it may be a good investment opportunity at these relatively low prices.

It meant that short-term PEPE holders (held for the past 30 days) held the meme coin at a loss.

In other words, if the MVRV (Market Value to Realized Value) of PEPE is positive, it suggests that PEPE might be overpriced. Furthermore, such a positive MVRV implies that holders have potential profits they haven’t cashed out yet, which could motivate them to sell for realized gains.

Over the weekend, PEPE memecoin led in Open Interest (OI) among its peers, possibly as a result of large-scale purchases by whales. This trend indicates an increase in liquidity within the memecoin, which could serve as a favorable factor driving up its price.

What’s next for price action?

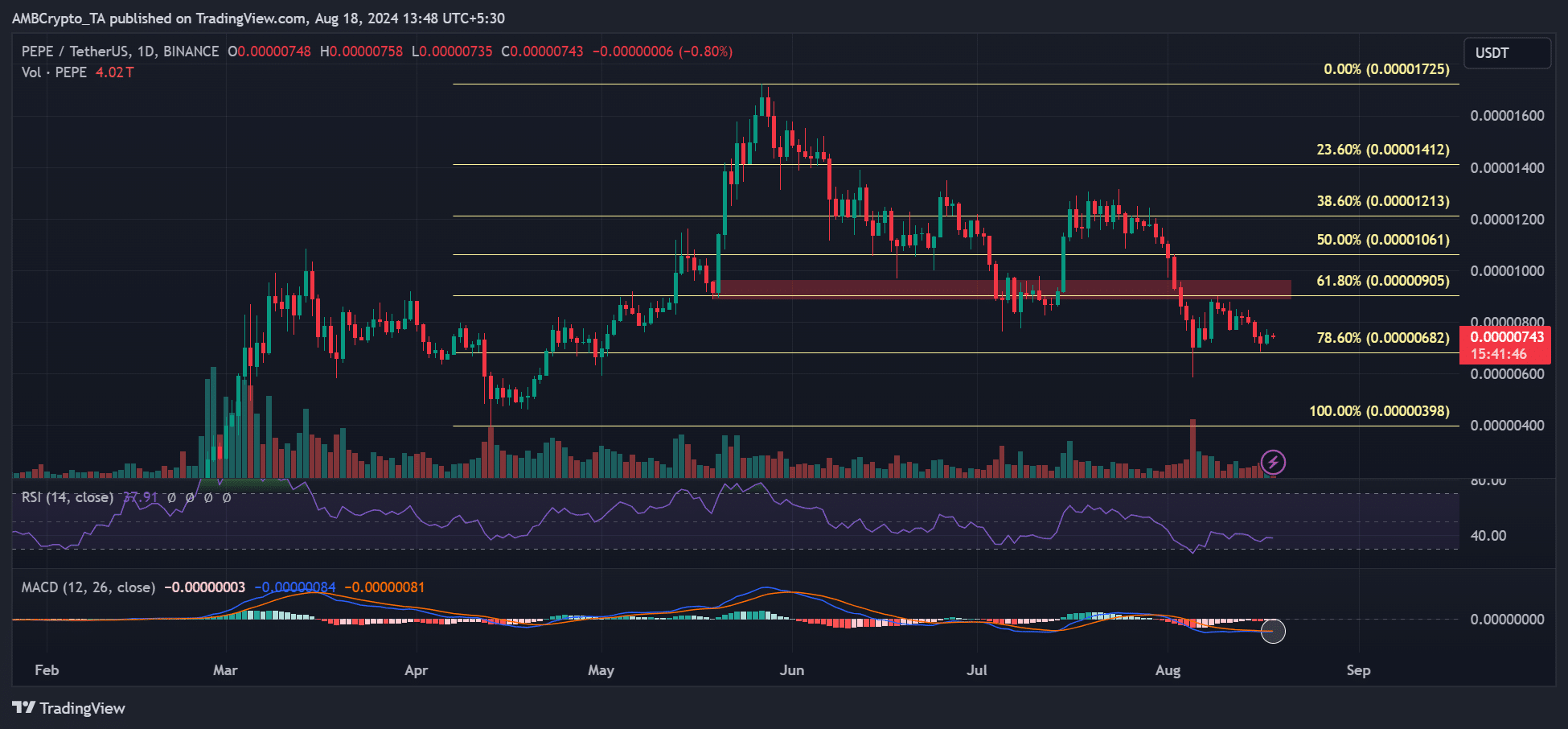

On the daily graphs, the Moving Average Convergence/Divergence (MACD) is nearly ready to cross over in a bullish manner. This potential move might indicate the beginning of an upward trend or a market rebound.

As a researcher, if the trend persists, my prediction is that the nearest bullish objective for PEPE investors lies at the 61.8% Fibonacci level, which equates to approximately $0.000009. Notably, the 78.6% Fibonacci level, or $0.0000068, served as a crucial short-term support on the lower end of the spectrum.

Read PEPE Price Prediction 2024-2025

Currently, the market remains bearish at the moment of reporting, and unfortunately, the interest in PEPE hasn’t seen much growth either. The Relative Strength Index (RSI) indicates this lack of demand, as it lies sideways and is beneath the neutral threshold.

As a crypto investor, I’d be on the lookout for a strong push beyond the supply barrier at $0.000009 for PEPE. If this happens, it could change the market dynamics to bullish, indicating a prolonged period of potential recovery ahead.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-18 21:12