- PEPE’s MVRV ratio has declined from 1.96 to 1.74 despite the price gaining by nearly 10% in 24 hours.

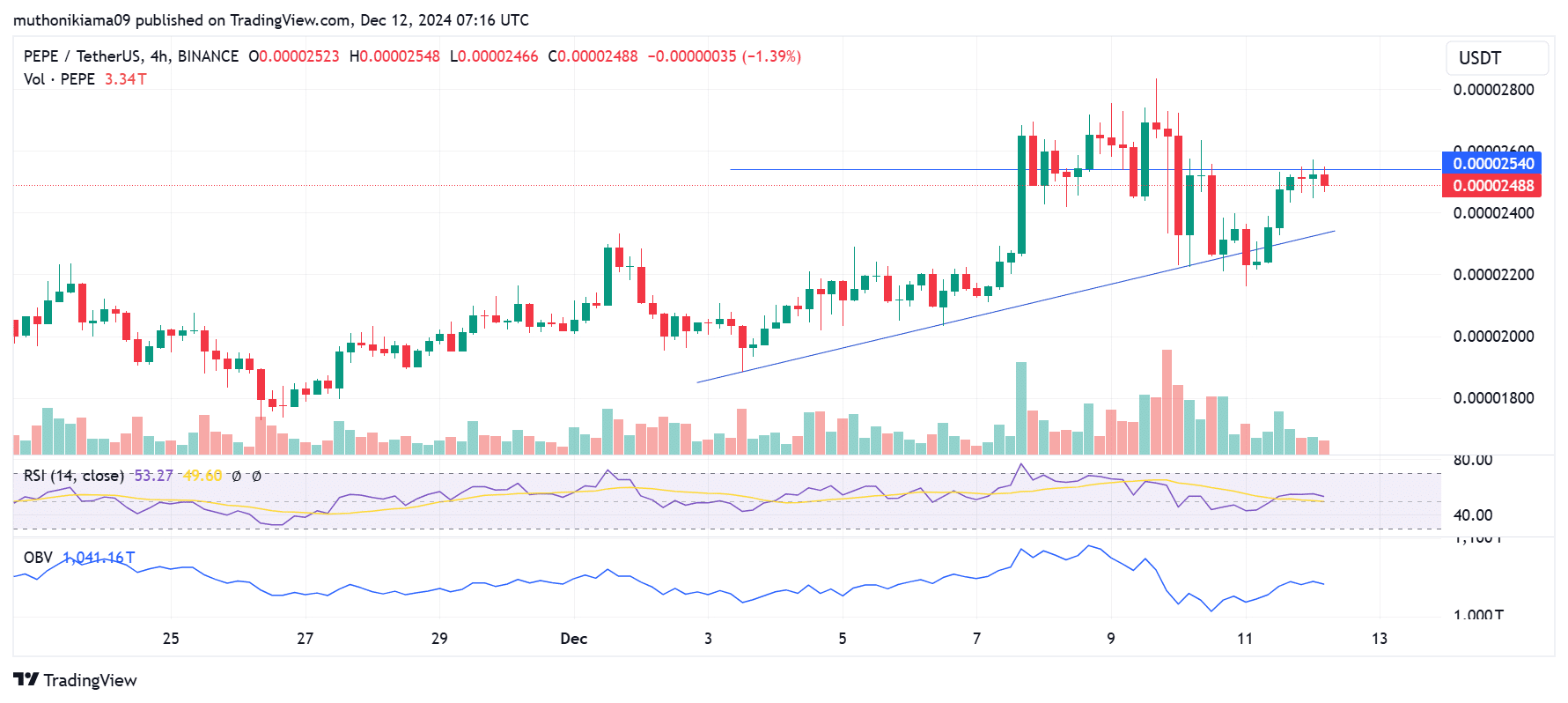

- An ascending triangle pattern suggested that PEPE was poised for more gains.

As a seasoned analyst with over a decade of experience in the crypto market, I must say that PEPE’s recent performance has been quite intriguing. The memecoin staged a remarkable recovery, gaining nearly 10% in just 24 hours, yet its MVRV ratio dropped from 1.96 to 1.74 – an interesting paradox indeed!

Pepe [PEPE] staged a bold recovery at press time after a nearly 10% gain to trade at $0.0000249.

The increase in value was similar to that of many meme-based cryptocurrencies, as their combined market capitalization surpassed $138 million following a 24-hour rise of 8%.

PEPE has excelled in the cryptocurrency sector this month, reaching a fresh peak of $0.000028 on December 9th, establishing a new record high.

While it has since dropped by 9%, several signs pointed towards a healthy correction.

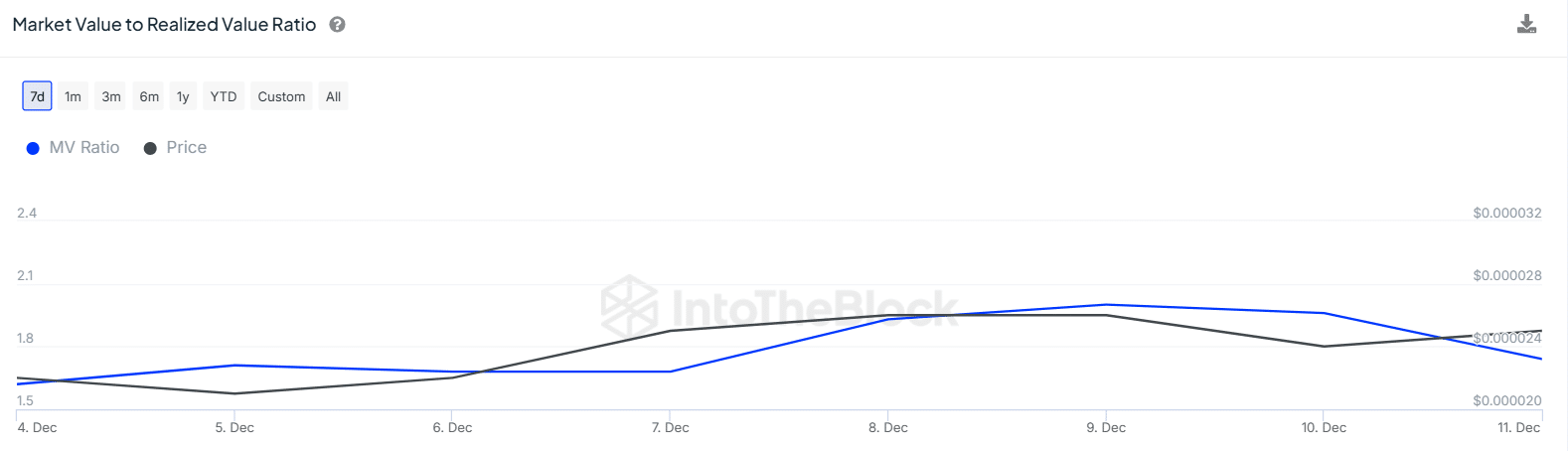

PEPE MVRV hints at further upside

PEPE’s Unrealized Profit Ratio, represented by Market Value to Realized Value (MVRV), decreased from 1.96 to 1.74 over the past 24 hours, indicating a decline in potential profits that have yet to be realized.

Even though PEPE’s value is increasing, a decrease in its holding ratio indicates that traders prefer to keep PEPE rather than selling it.

PEPE’s decreasing MVRV ratio suggests that even though it has recently increased, the memecoin may still be underpriced compared to its realized value, implying potential for further price increases.

Even though nearly all PEPE holders are currently making a profit according to IntoTheBlock data, the MVRV ratio isn’t showing signs of extreme levels. This implies that traders are more inclined to keep holding onto their assets rather than cashing out, indicating a generally optimistic outlook.

Bullish continuation?

On its four-hour chart, PEPE displayed an ascending triangle structure, a pattern that typically indicates a bullish trend may continue.

A bullish breakthrough over the upper trendline at approximately $0.0000254, an area of significant resistance, hinges upon increased buying actions.

The Relative Strength Index (RSI) currently reads 53, indicating a mildly weak bullish trend. Moreover, the RSI line appears to have leveled off, suggesting that purchasers are uncertain about their next move.

After leveling off following a strong upward trend earlier this week, the outlook indicated by the On-Balance Volume (OBV) is also stabilizing in a comparable manner.

The bullish surge for PEPE, as indicated by its ascending triangle, hinges on fresh investors joining the market to sustain the upward trend.

If it flips resistance at $0.0000254 with high buying volumes, it could lead to more gains.

But should the upward trend begin to falter and sellers cashing out drive the price under the resistance point at $0.0000223, this might trigger a downward shift in the market trend.

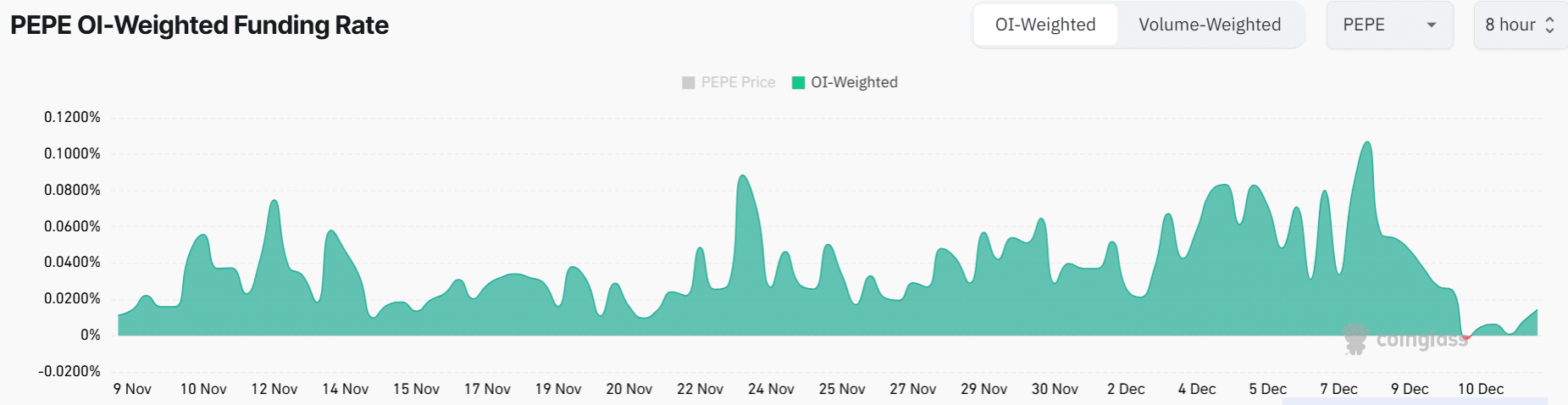

PEPE’s Funding Rate drops

According to data from Coinglass, the Funding Rate for PEPE experienced a significant decrease, dropping down to 0.0144% after peaking at a record high earlier in the week.

It’s clear that even though bulls continue to pay for keeping their positions, the quantity of long positions has decreased.

If derivative trading slows down, it might lead to less market turbulence, thereby offering more opportunities for PEPE’s expansion. But, if Funding Rates persistently decline and become negative, it may foster a pessimistic outlook.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Will PEPE form a new ATH in 2024?

PEPE is nearly 90% of its record peak. As we approach the final three weeks of the year, this popular memecoin is displaying optimistic trends. The decreased leverage provides an opportunity for a robust rebound.

If PEPE manages to surpass the resistance at $0.0000254, which marks the upper boundary of the ascending triangle pattern it’s currently within, it may continue its upward trajectory and potentially set a new all-time high (ATH) before the end of the year. However, a spike in selling activity might trigger a downward trend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-12-12 17:44