-

Data revealed that the memecoin’s strong ties to ETH could stall further growth

High exchange outflows might help PEPE

As a crypto investor with some experience under my belt, I’m keeping a close eye on the memecoin PEPE‘s recent price action and market trends. Based on the available data, it appears that PEPE’s strong correlation with Ethereum could pose a challenge to its further growth.

As a researcher studying the cryptocurrency market, I’ve noticed that Pepe (PEPE), the memecoin with a frog theme, was among the top-50 digital assets to experience growth in the past 24 hours. At present, PEPE is priced at $0.000011, marking a 3.35% increase from its value on June 21st.

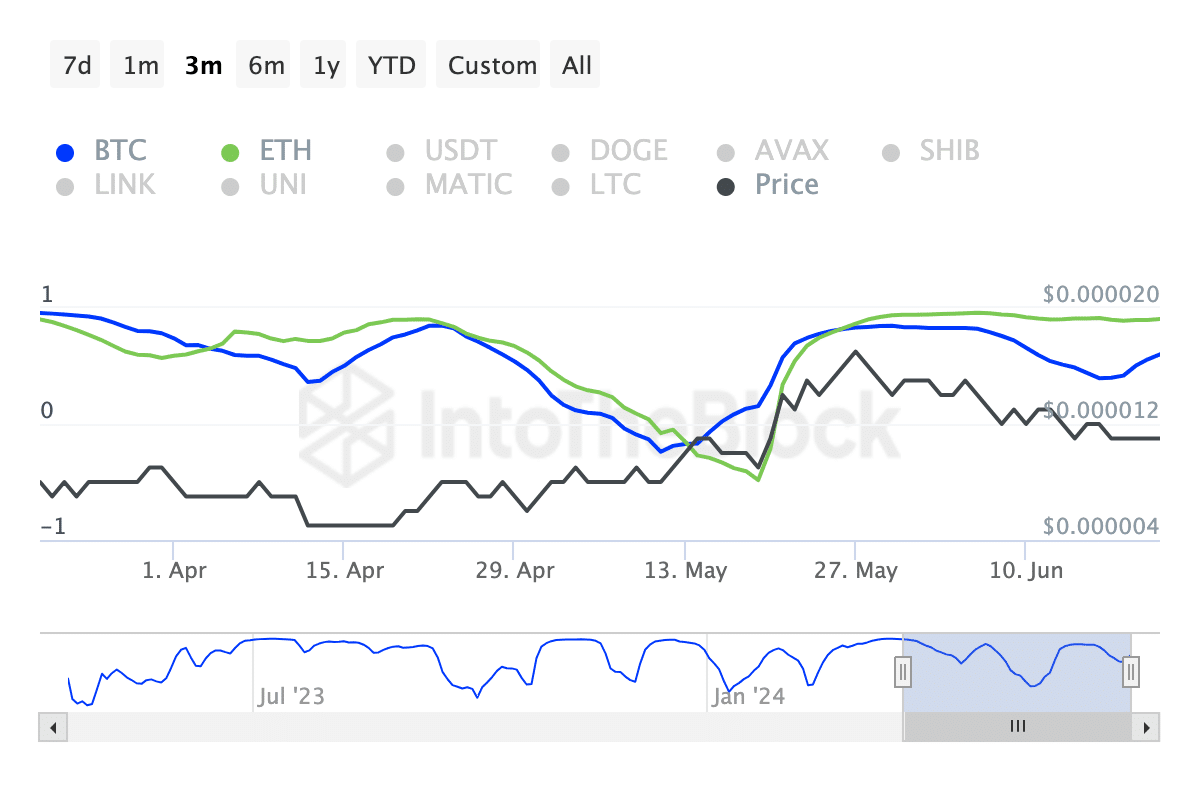

Yet, AMBCrypto noted that the upward trend for PEPE might be short-lived. A potential explanation could be its strong connection to Ethereum [ETH], as indicated by IntoTheBlock’s correlation metric of 0.91 at present.

ETH has strong links with PEPE

The previously mentioned figure had a correlation with Bitcoin [BTC] that was significantly higher than the indicated 0.60. Correlation values span the range between -1 and 1. A value near -1 implies infrequent price alignment.

As a researcher examining price trends, I’ve found that when the difference between two assets is nearly 1, their price movements tend to align more often than not. This was true for Ethereum (ETH) and Pepe (PEPE) in my analysis.

As a crypto investor, I’ve noticed that unlike PEPE, Ethereum (ETH) didn’t experience significant appreciation on the price charts. Instead, ETH remained relatively stable and was trading around $3,502 at the time of reporting.

As a researcher studying the cryptocurrency market, I have observed that if the price of altcoin PEPE continues to consolidate or experiences a decline, it’s likely that PEPE’s price may follow suit and retreat as well. Additionally, only a few memecoins have seen significant jumps in value recently, indicating that there has been limited inflow of capital into this category so far, which might hinder the potential rally for memecoins in general.

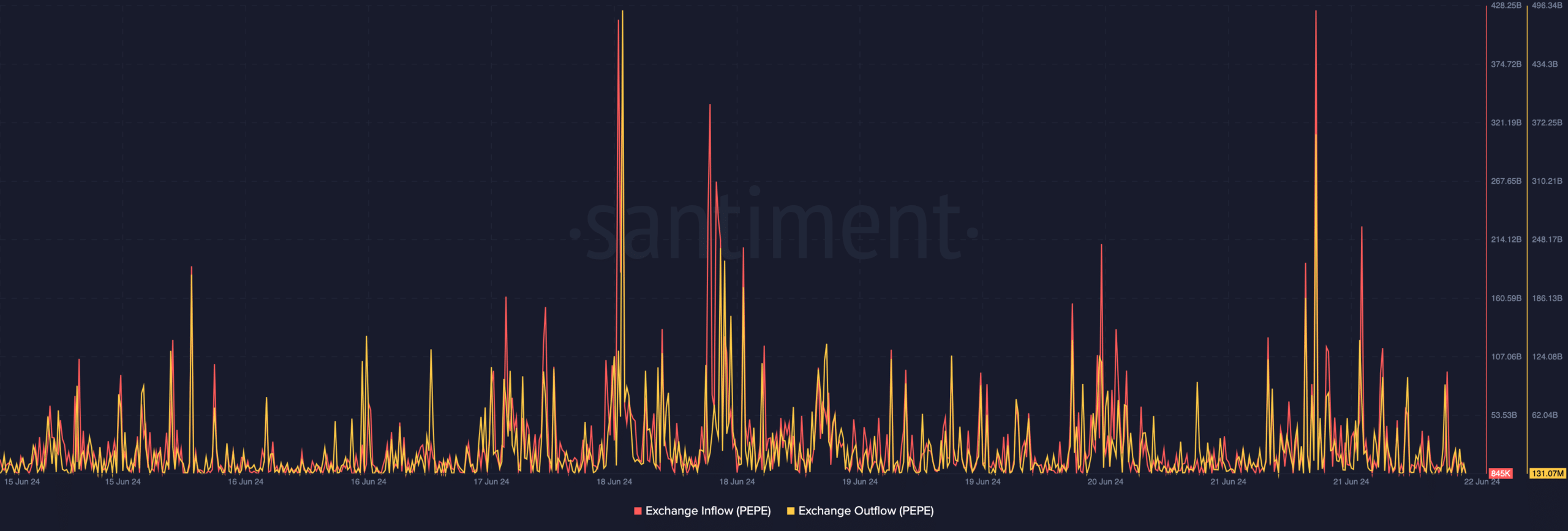

Instead of “On the contrary,” you could use “Contrarily” or “In contrast.” For paraphrasing the second part, you might consider: “Exchange flows indicated a contrary trend for ETH, implying it might not be able to halt the uptrend. At present, PEPE‘s exchange inflows stood at 845,000.”

Memecoin is in a tight spot

The volume of incoming tokens into an exchange represents inflows. A large inflow signifies significant selling activity, potentially indicating a downward trend in prices.

Instead of “On the other hand,” you could say “Contrarily,” or “However, contrary to.” In paraphrased form, “The Santiment data indicated significantly larger exchange outflows at 131.07 million. This increase suggests that holders are choosing to withdraw their tokens from exchanges rather than keeping them there.”

If they continue holding PEPE tokens in non-custodial wallets instead of keeping them in custodial ones, PEPE’s connection to Ethereum (ETH) might be underestimated. Consequently, PEPE’s value could potentially increase on price charts.

Should the situation hold true, the value of the token may plummet to approximately $0.000013 in the near future. Yet, traders might find it unnecessary to exercise excessive caution.

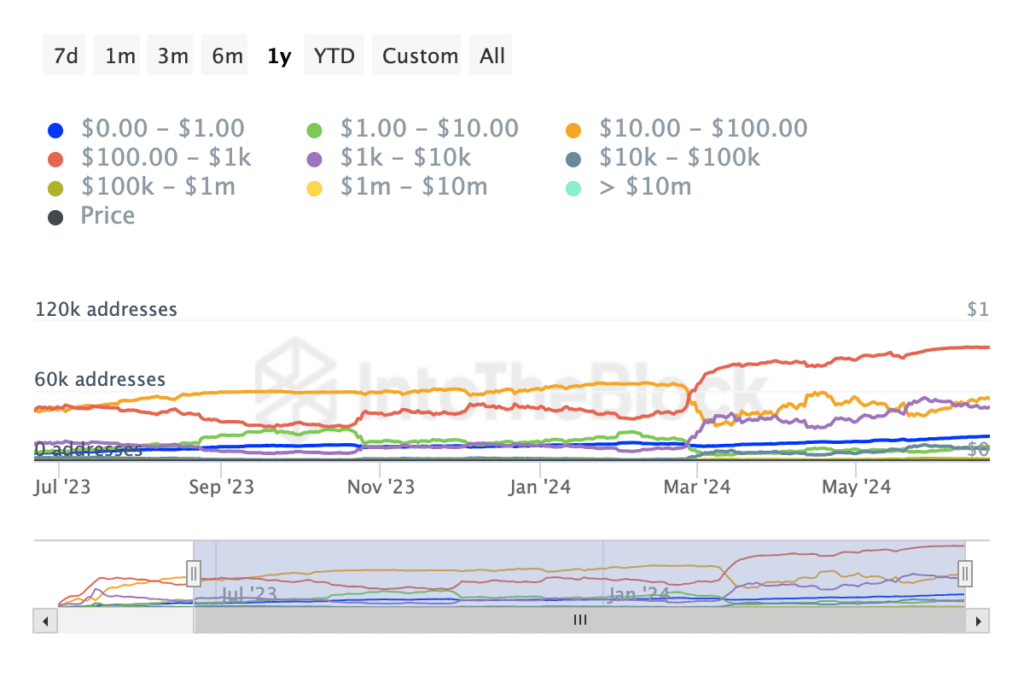

The distribution of holdings provided insight into the behavior of token buyers over the past 30 days, specifically revealing an increase in the number of participants purchasing more of a particular token above a certain threshold.

As a crypto investor, I’ve noticed that in the majority of situations, the collective buying power of individual investors, also known as the retail cohort, doesn’t significantly influence price movements like larger institutional investors do. And right now, there’s been a decrease in the number of wallets holding between $1,000 and $10 million worth of this token at the current market price.

As a crypto investor, I’ve noticed the recent market sell-offs and I can’t help but wonder if PEPE‘s bullish momentum may have taken a hit as a result.

Realistic or not, here’s PEPE’s market cap in ETH terms

As a researcher, I’ve made a prediction that if certain events occur, the price of PEPE would drop to $0.000013. However, should these events not materialize, my forecast could be called into question. Consequently, PEPE’s price may align more closely with Ethereum’s and remain in the vicinity of $0.000011 instead.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-22 20:07