- Pepe has entered a new accumulation phase, where investors steadily increase their holdings in anticipation of a major rally.

- Despite signals that a rally could be imminent, on-chain data shows that active addresses still need to commit to buying fully.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The current trajectory of PEPE is particularly intriguing, given its recent surge and the formation of a double bullish pattern.

Over the last four weeks, PEPE has been particularly noteworthy in the memecoin market, achieving a 30.13% growth. More recently, it has maintained this upward momentum, adding another 3.90% to its rise.

There’s a good chance that PEPE‘s value might rise significantly, possibly reaching up to $0.00001725 per token. If this happens, it would mean a potential boost of around 60% from its current price level.

Double bullish pattern could trigger PEPE’s rally

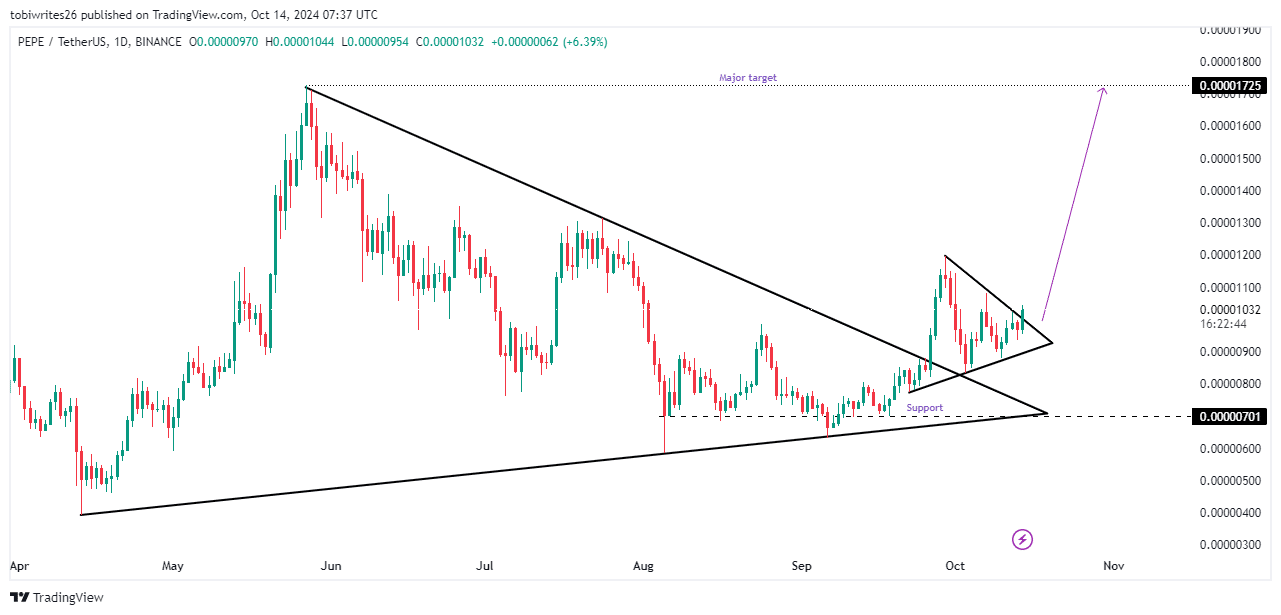

PEPE’s chart shows it’s once again displaying a bullish pattern, this time in the form of a symmetrical triangle. This pattern follows the breakout from a larger symmetrical triangle that was established previously.

This latest development indicates that PEPE is now accumulating more, as investors are slowly building up their positions, hinting at a possible upcoming surge.

Should a breach of this established pattern take place, we can anticipate that the price of PEPE could potentially reach $0.00001725. However, if it doesn’t break out, PEPE may continue to trade within the confines of this symmetrical pattern for an extended period.

Based on AMBCrypto’s evaluation, it appears that the technical signs are pointing towards a potential breakout from this period of accumulation happening quite soon.

PEPE breakout appears imminent

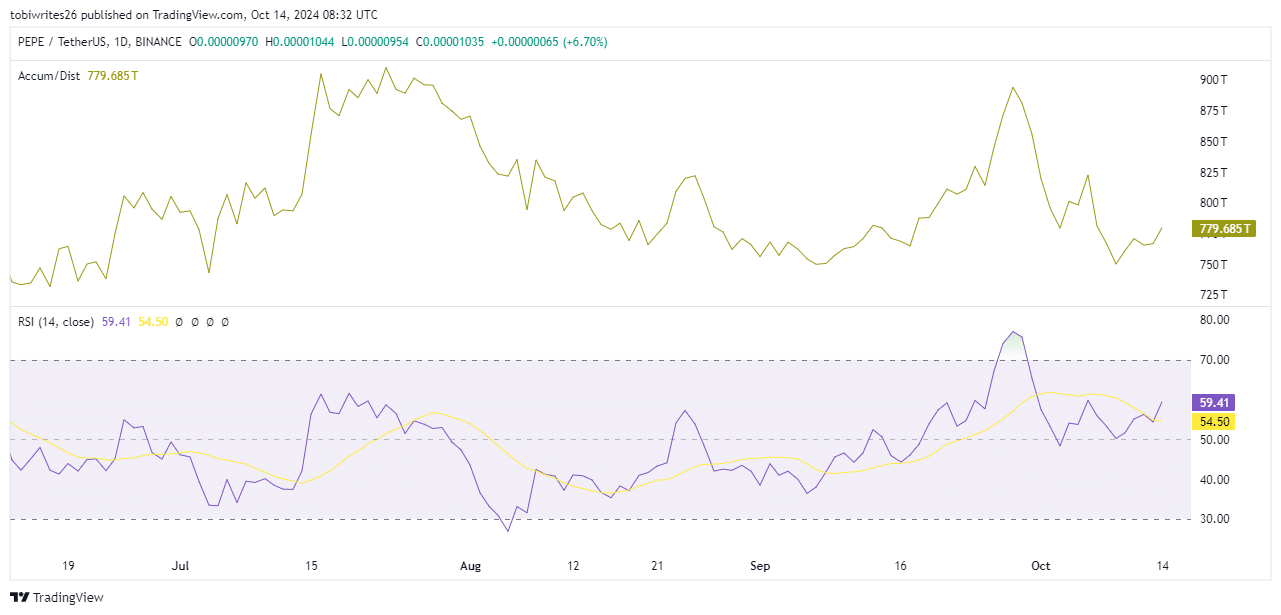

The Accumulation/Distribution (A/D) indicator, which monitors if investors are purchasing or offloading, indicates that the market for PEPE is experiencing a buying trend.

This rise in the A/D line indicates accumulation and a positive market outlook. This optimistic behavior might push the price towards the next anticipated level.

Additionally reinforcing this upward trend is the Relative Strength Index (RSI), which is now climbing, suggesting a significant number of buyers in the market. Currently, the RSI stands at 59.41, implying that buyers are asserting their influence, causing PEPE to venture further into bullish territory.

The Relative Strength Index (RSI) determines both the rate and direction of price changes, and a consistently rising RSI often indicates that an asset’s price is likely to keep increasing.

Sharp decline in active addresses may stall PEPE’s breakout

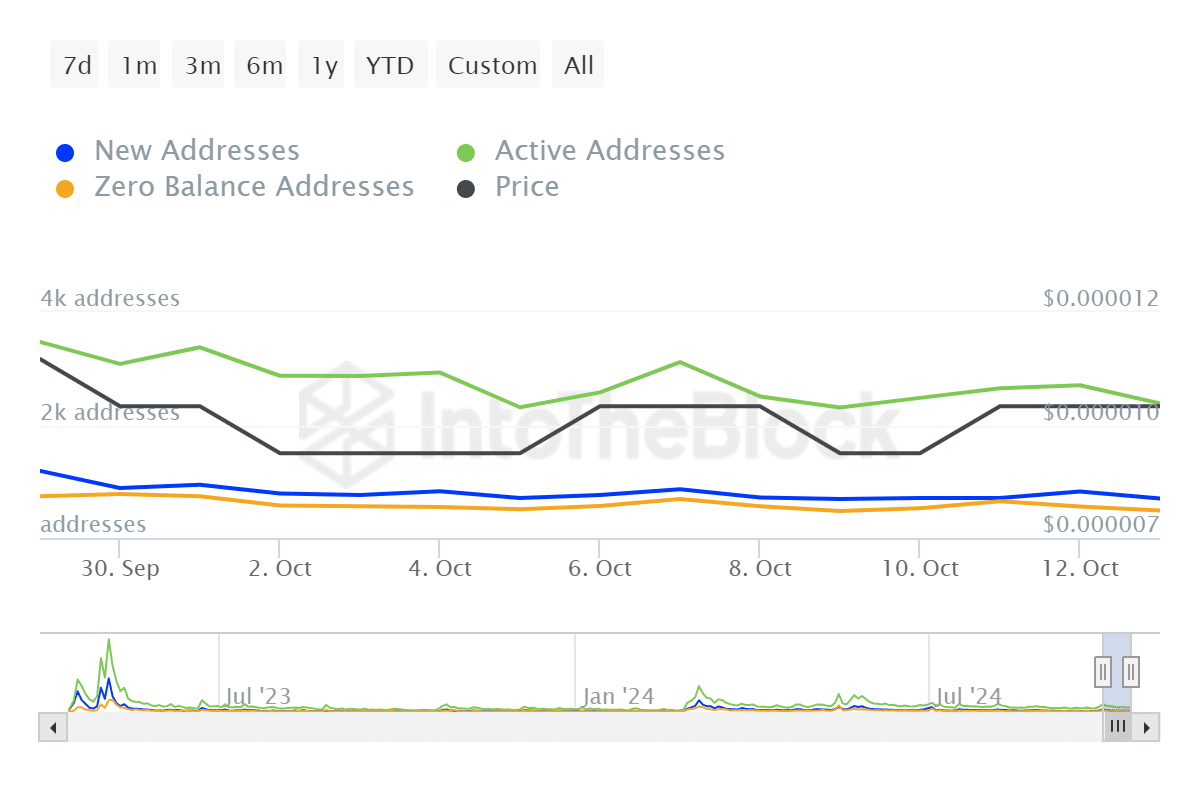

Based on information from IntoTheBlock, there’s been a decrease of approximately 7.89% in the number of active addresses engaging with the memecoin during the last seven days.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The AA metric measures trader engagement with an asset and a decline like this indicates reduced buying activity despite the bullish trajectory.

A drop in active involvement seems to imply that the expected surge might be postponed or may not have enough forceful push to trigger substantial changes in price.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- How to Get to Frostcrag Spire in Oblivion Remastered

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-10-15 04:07