- Pepe has a bearish structure and slipped below a key Fib retracement level

- The decline in network activity pointed toward a sustained bearish trend in September

As a seasoned crypto investor with a knack for identifying market trends and patterns, I find myself cautiously bearish about PEPE [PEPE]. The recent slide below the key Fib retracement level and the decline in network activity point towards a sustained bearish trend in September. The correlation of PEPE’s price movement with Bitcoin and other major meme coins like Shiba Inu [SHIB] suggests that the broader market’s bearish sentiment is impacting the meme sector significantly.

After a brief period of upward trend on August 23rd for PEPE (PEPE), the coin’s momentum shifted back to a downtrend. This change was triggered when Bitcoin [BTC] dipped below the $56k support level, causing the market structure to become bearish once more on a daily basis.

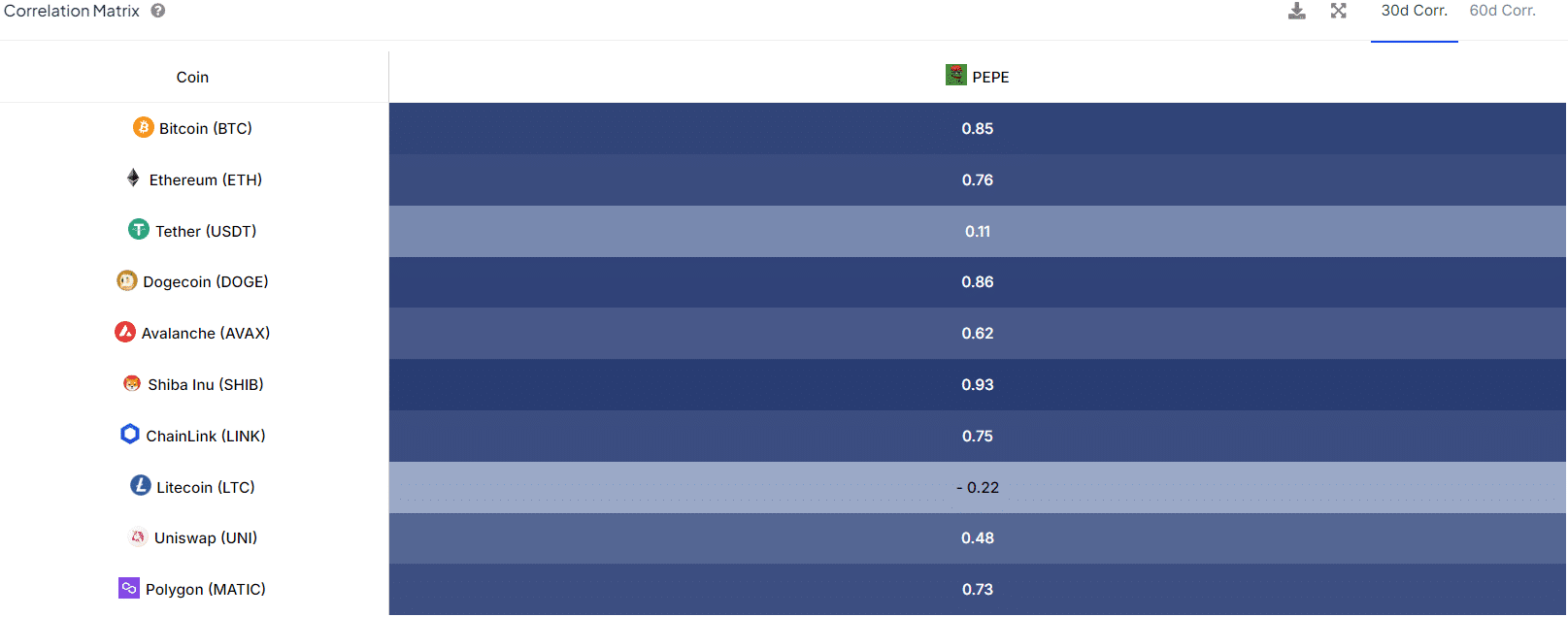

The correlation matrix highlights how closely the price movement of PEPE correlates to Bitcoin but also the other major meme coins, especially Shiba Inu [SHIB].

In simple terms, this suggests that meme coins have struggled to escape the downward trend of Bitcoin over the past month.

Network activity statistics will dull bullish hopes

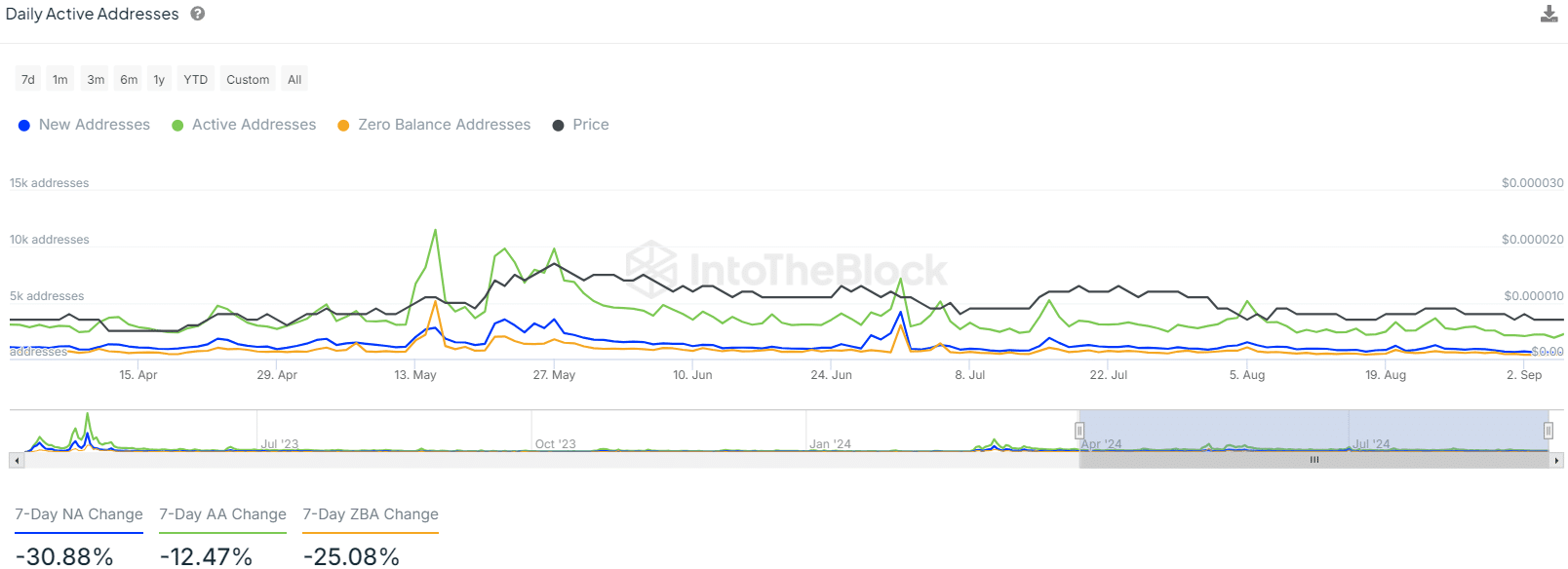

According to AMBCrypto’s analysis, the number of new and active daily addresses has decreased by 30.88% and 12.47% over the past week. This indicates a drop in user engagement and growing interest or adoption.

It’s important to note that this increase in Pepe metrics wasn’t a fleeting phenomenon. Back in May, we saw a significant peak, as active addresses hit approximately 9,850. Since then, though, there has been a continuous downward trend, and the current figure stands at around 2,220.

As a researcher, I’ve noticed an interesting trend in our network: while the number of zero balance addresses has decreased, this typically indicates improved network health and higher user engagement. However, in this case, it seems that other network metrics are overshadowing this positive sign.

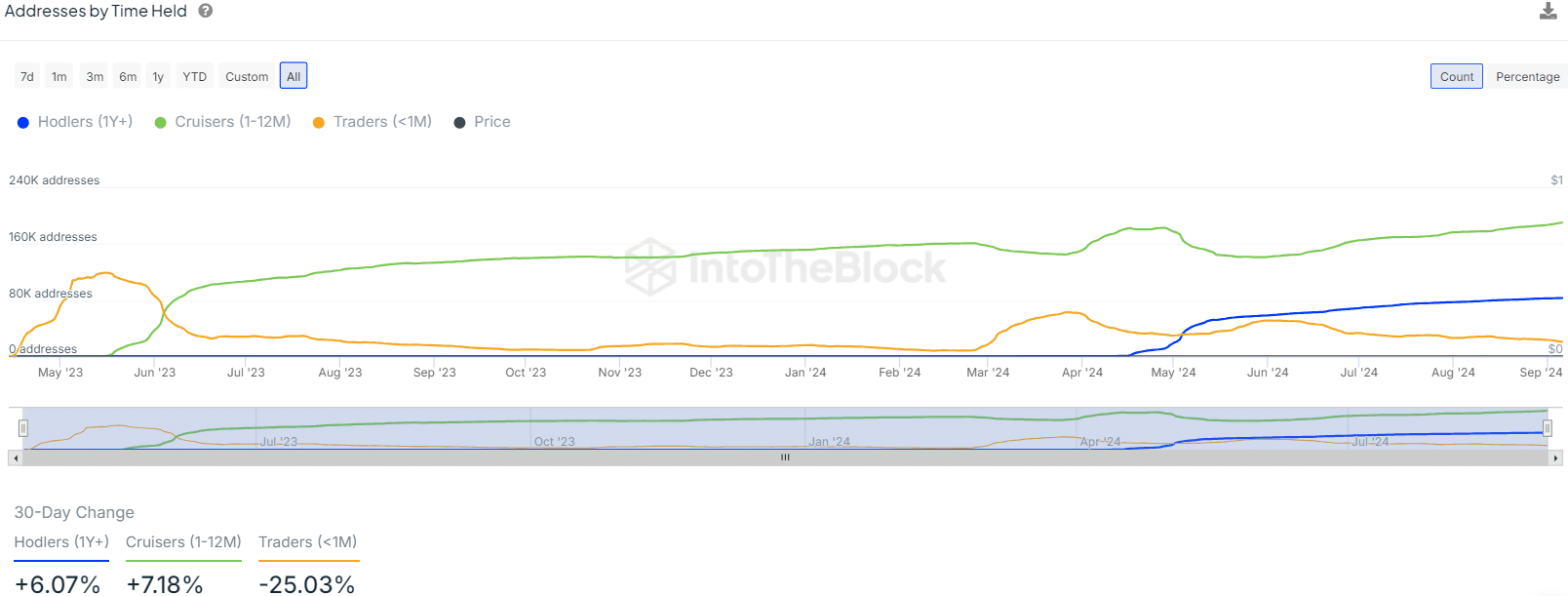

Over the last month, there’s been a 25.03% drop in the number of short-term PEPE holders, often referred to as traders. A minor uptick in the overall number of holders served as a small boost.

Liquidity targets for PEPE

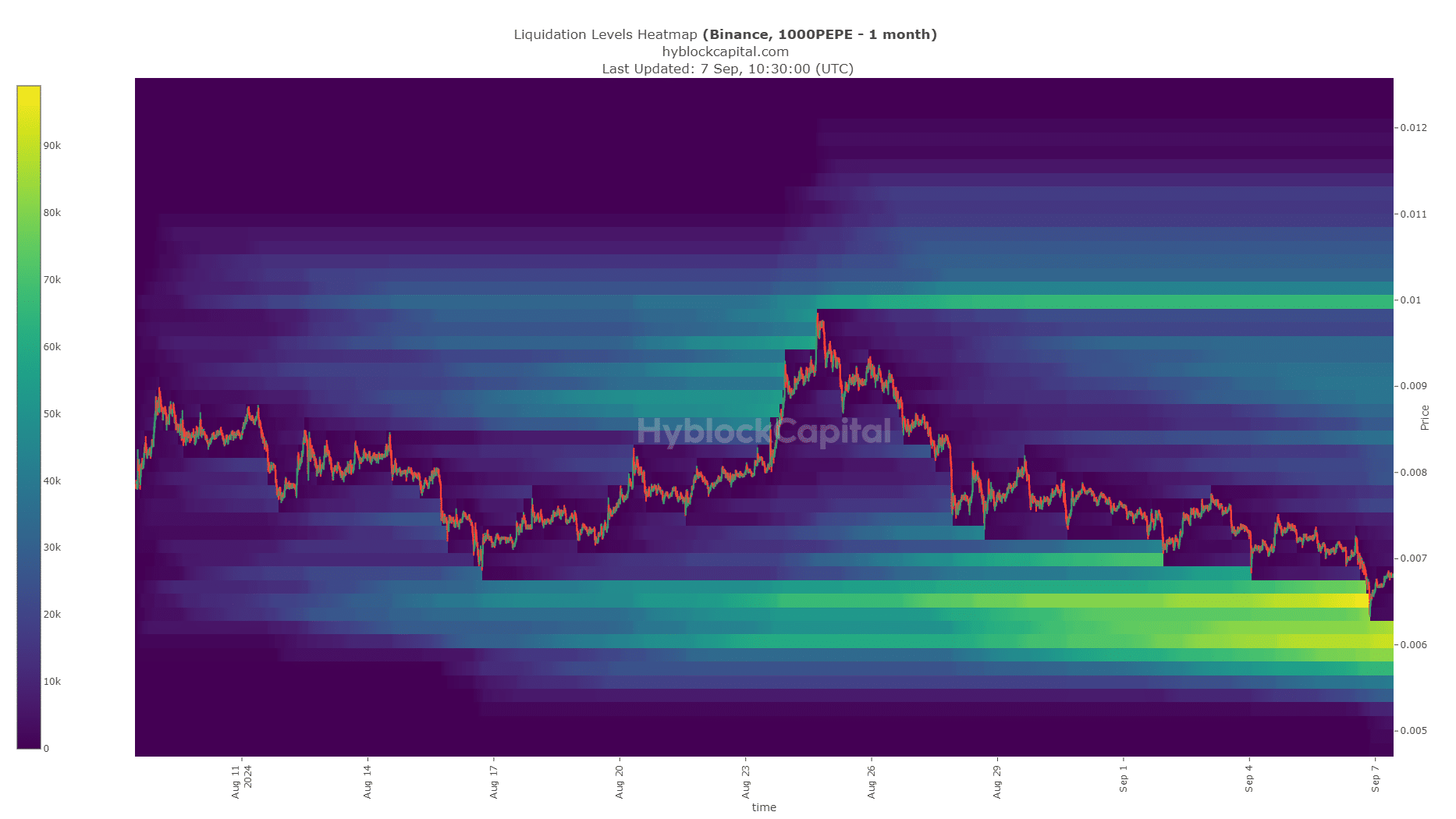

The liquidation heatmap showed that the $0.00000588-$0.00000619 zone is a target for September.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

Revisiting this liquidity pool could potentially show a shift in direction, making it an attractive option for investors to consider buying.

If Bitcoin’s losses persist without a change in sentiment in the next few weeks, it’s possible that these liquidity groups may not be strong enough to prevent the downward price trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-08 09:11