-

PEPE price dips by 23% after resetting a key resistance level.

Metrics indicate a potential reversal.

As a researcher with extensive experience in analyzing cryptocurrency markets, I closely monitor the trends and metrics of various coins, including PEPE. Based on my analysis of recent developments, here’s my take:

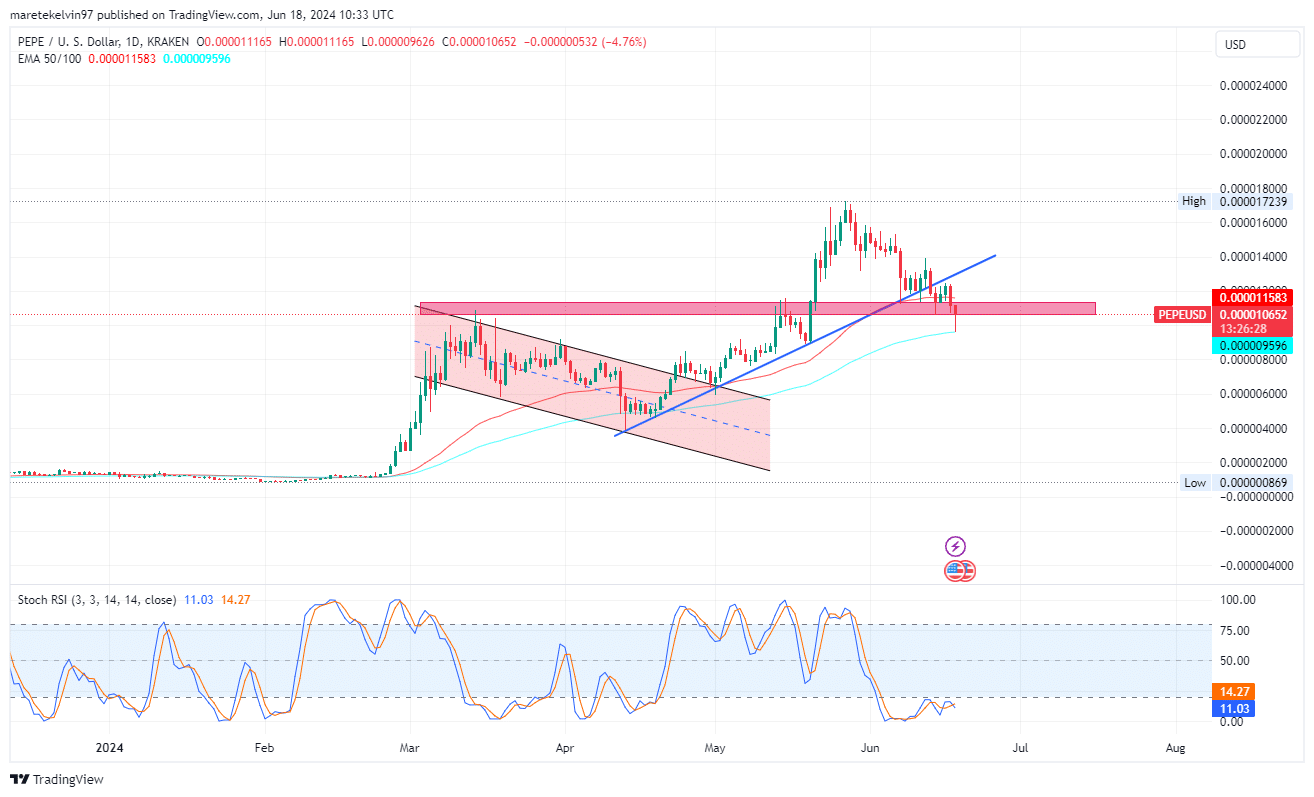

The cryptocurrency market as a whole has seen a significant drop, causing most coins to fall below their important thresholds. PEPE (Pepe) was no exception, experiencing a decline of approximately 23% following a failed attempt to surmount its resistance level at $0.00001240.

At approximately $0.000010652, the price was flirting with a significant support area. This crucial point had previously functioned as a robust resistance level before eventually transitioning into a supportive role.

At present, this moving average is functioning as a robust line of defense for potential price rebounds.

As a researcher examining financial data, I’ve noticed that the stochastic RSI for PEPE suggests an oversold condition based on its current values. Consequently, there’s a likelihood of a price reversal for PEPE in the near future.

Can the whales overcome the tide?

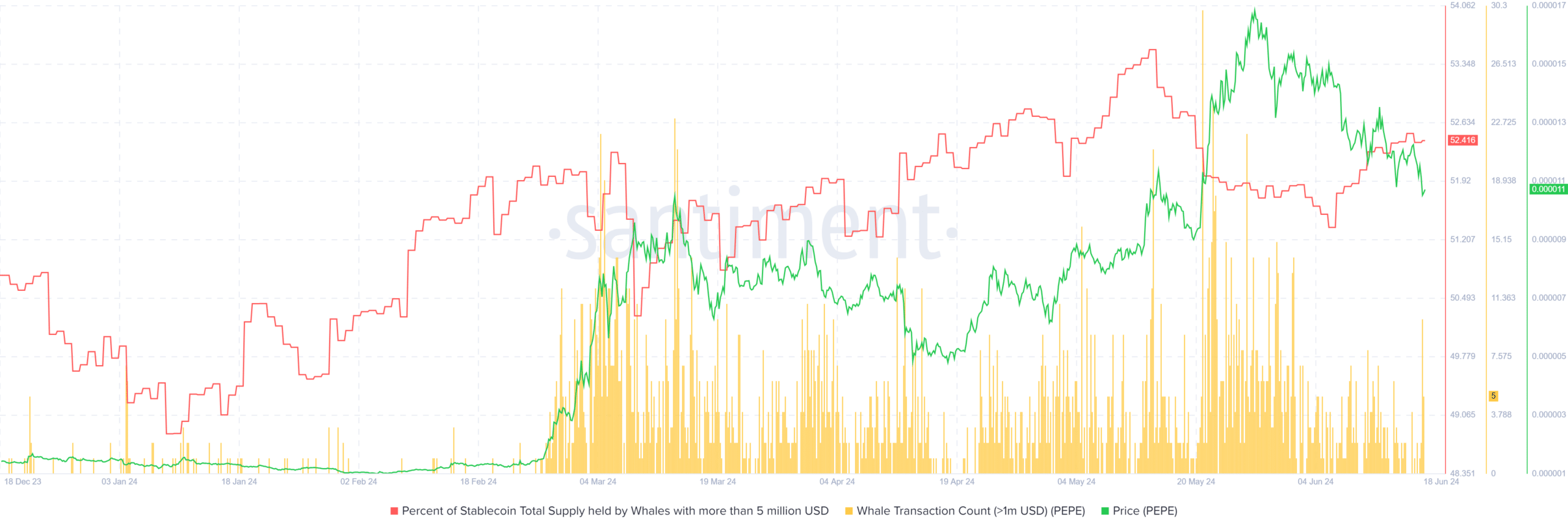

Based on an analysis of Santiment’s data by AMBCrypto, it was determined that the proportion of stable cryptocurrency reserves controlled by large investors (whales) has risen to 52%.

The dominance of large stakeholders over stablecoin supply translates into greater sway over price movements. This correlation implies an augmented purchasing capacity, potentially bolstering a supportive price level.

As a researcher observing the PEPE market, I’ve noticed an uptick in the number of whale transactions involving this cryptocurrency. This heightened activity suggests that investors are actively engaging with PEPE, potentially signaling a shift in sentiment and increasing the likelihood of a price reversal.

What liquidation has to add

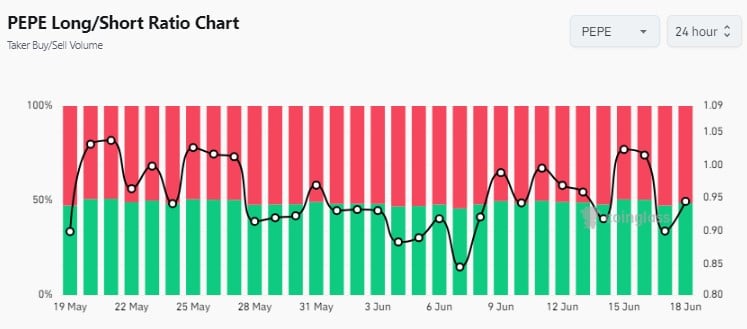

Based on Coingecko’s data, the total liquidation of PEPE suggests an increase in price volatility. There have been significant fluctuations in both buying and selling orders since last February, which can be attributed to market speculation and shifting investor sentiment.

In the beginning of March, substantial sell-offs occurred which correspondently led to PEPE‘s price decline. This implies that potential market adjustments toward a more bearish trend might be imminent.

Based on the latest data from Coinglass, there have been noticeable increases in the long-to-short ratio. In simpler terms, this indicates that more investors are holding long positions than short ones. This trend could lead to heightened bullish sentiments and potentially cause a rise in prices.

What’s next for PEPE?

As a researcher observing the financial markets, I’ve noticed an increased rate of asset sales, leading to market instability. Yet, there are signs of underlying support. Major investors have been active in buying large quantities of assets, as indicated by “whale” transactions. Additionally, the percentage of stablecoin supply in circulation remains relatively steady, suggesting that these digital currencies continue to function as a safe haven during market turbulence.

Read Pepe’s [PEPE] Price Prediction 2024-25

Based on the current data, the PEPE price may experience a significant increase once it reaches a vital turning point indicated by the metrics.

However, if PEPE bearish momentum breaks the support level, the price may dip further.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-19 13:59