- PEPE has continued its positive uptrend after its decline on 05 December

- Memecoin’s market remains torn between longs and shorts

As a seasoned researcher who has weathered countless market storms, I must say that the memecoin market, represented here by PEPE, is a fascinating study in volatility and speculation. The past 24 hours have been particularly intriguing, with PEPE’s funding rate seeing dramatic shifts reminiscent of a rollercoaster ride.

Over the past 24 hours, I’ve noticed some significant fluctuations in Pepe’s funding rate, which reflects the intense volatility that seems to be dominating its meme coin market right now.

As I analyze the token’s performance, despite the volatility, I notice a generally upward trend in its price as depicted on the charts. To forecast its future actions, I am keeping a keen eye on factors such as funding rates, Open Interest (OI), and the broader market sentiment. These elements will likely influence its next steps.

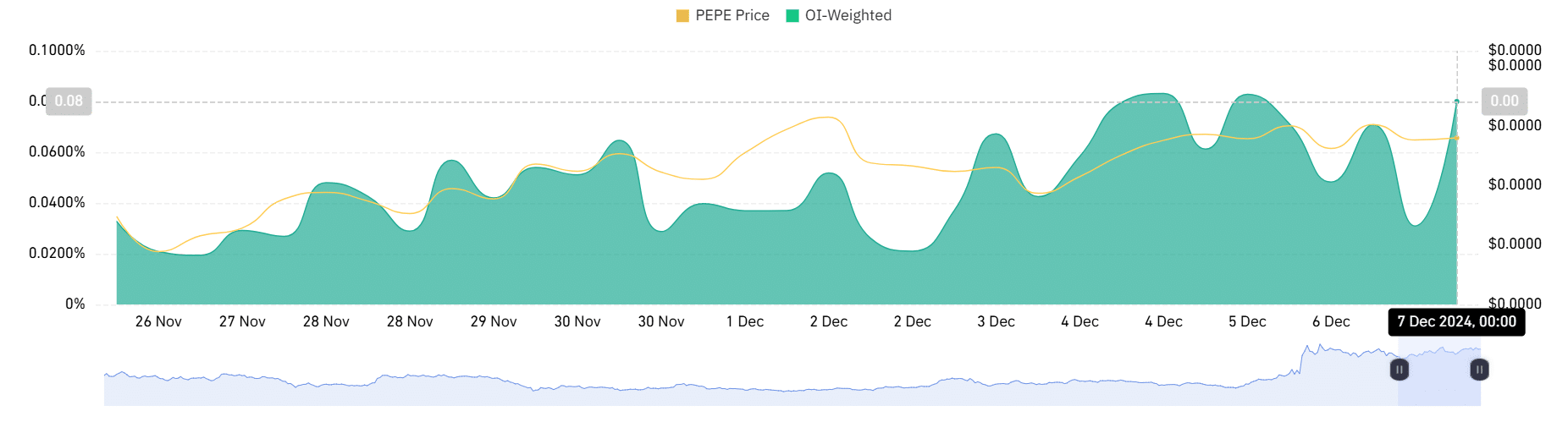

PEPE’s funding rate swings and price correlation

Examining PEPE’s funding rate figures uncovered notable surges, happening when its price was close to the $0.000002200 level. The graph demonstrated that after a dramatic decline to approximately 0.0309% during the previous trading day, it suddenly increased to 0.0800% at the current time.

These sharp movements often indicate a tug-of-war between long and short positions.

Historically, significant changes in funding rates tend to occur before price adjustments or growth, based on the current market attitude. As of now, the funding rates indicate an environment that’s more prone to speculation.

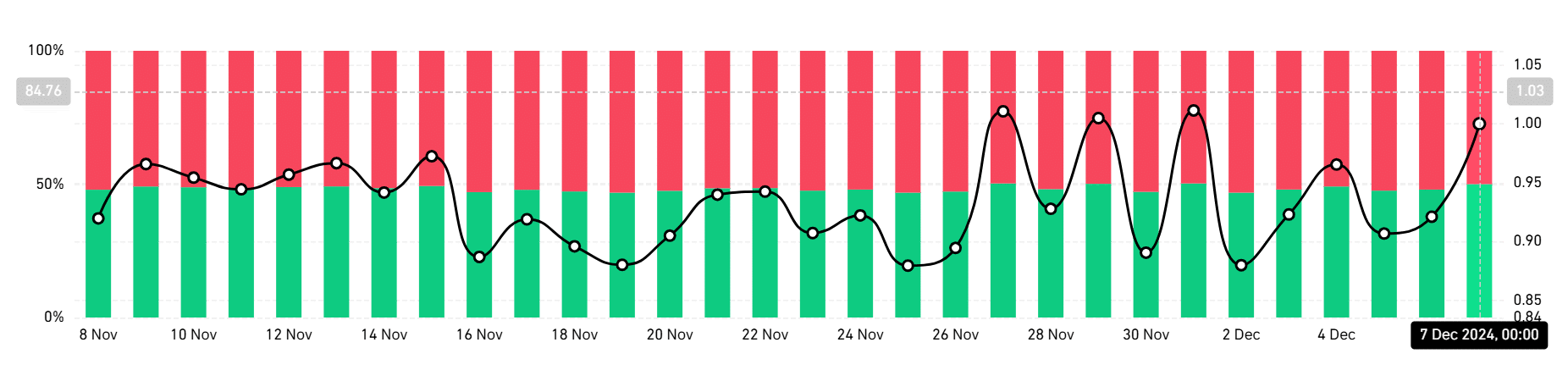

Moreover, the Long/Short Ratio’s chart analysis showed that long and short positions were almost equal, with a slight edge towards long positions at approximately 1.03. This suggested a fragile balance, as neither bullish nor bearish forces appeared to dominate decisively.

In the past, even small shifts in this balance and fluctuations in funding rates have frequently been followed by significant changes in prices.

Open Interest and its implications

The analysis further indicated that PEPE’s Open Interest (OI) increased to $459.71 million, suggesting an uptick in investments towards derivatives trading. While it didn’t reach its all-time high, its current levels were significantly higher compared to the previous months.

In my research, I frequently observe a correlation between increasing trends and heightened volatility, as market participants prepare for anticipated price fluctuations. High open interest (OI) and volatile funding rates can create a risky landscape for over-leveraged traders, potentially triggering liquidations that might exacerbate these price movements.

PEPE’s price performance and technical outlook

The price of the meme coin is climbing back up on the graphs, showing optimistic feelings among investors even with market instability. Interestingly, it just managed to surpass the significant $0.000002000 mark and currently trades above its 50-day moving average at $0.000001531. This suggests that the positive trend may persist.

Besides providing temporary support at approximately $0.000001913, the Ichimoku cloud also fortified a positive outlook for the immediate future, suggesting a potential uptrend.

Despite the RSI suggesting a potential overbought condition at 62.91 for PEPE, it’s advisable to exercise caution. If the price continues to stay above the Ichimoku support and the funding rates show signs of stabilization, there’s a possibility that PEPE might target the $0.000002500 resistance area.

In other words, if it doesn’t hold its current price levels, there might be a retreat back towards the $0.000001800 area, which could coincide with general market adjustments.

The behavior of the meme coin’s market suggested a continuous struggle between investors taking speculative positions, shown by frequent changes in funding rates and a relatively even distribution of long and short positions. An increase in open interest and consistent price rebound signaled increased investor confidence, yet this also indicated elevated risk levels.

The future direction of PEPE – whether it continues to rise or experiences a downturn – will be influenced by how these key indicators develop over the coming days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-08 08:07