- Pepe saw positive trends for four consecutive days.

- The memecoin’s price was becoming more volatile with this trend.

As an analyst with over two decades of experience in the cryptocurrency market, I have witnessed countless bull runs and bear markets. The recent trend of Pepe [PEPE] has caught my attention due to its persistent upward movement and increased investor interest.

Recently, the cryptocurrency PEPE (Pepe) has generated quite a stir because of its changing price pattern, capturing the interest of numerous investors. Given its current price movement and increased market action, some analysts are questioning if a surge in prices, or a breakout rally, might be imminent.

This article analyzes the current price action, market sentiment, and key metrics to provide insights into PEPE’s next potential moves.

Pepe’s price action and key indicators

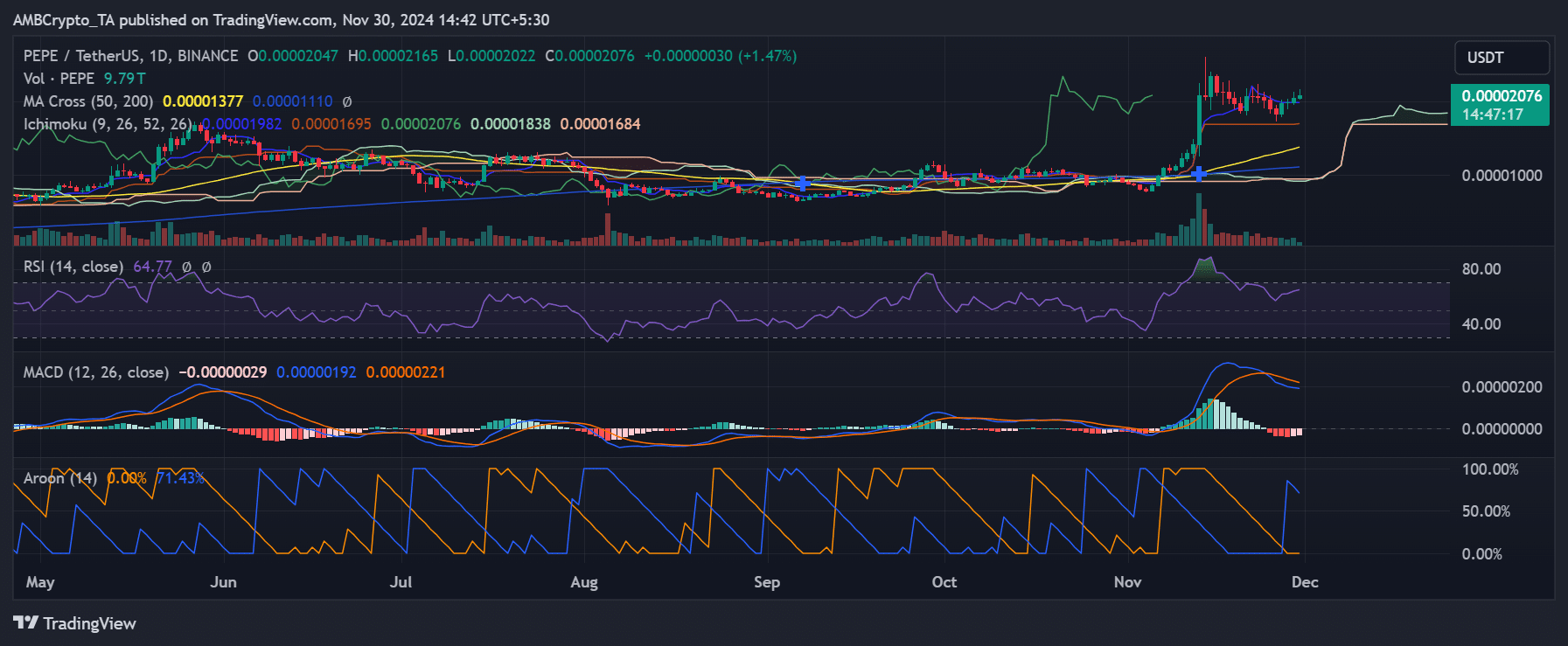

Pepe’s daily graph indicates a steady climb over time. At the moment of this writing, the price stands roughly at $0.000002076. Moreover, the Moving Average Cross (50, 200) suggests a bullish golden cross formation, which typically signals additional upward movement.

In simpler terms, the Relative Strength Index (RSI) was almost in the zone that suggests the market is heavily bought, standing at 64.77. While this shows significant buying activity, it’s important to exercise caution as there may be upcoming price decreases or pullbacks.

Furthermore, the Moving Average Convergence Divergence (MACD) indicates strong upward trend supported by a bullish divergence.

As a crypto investor, I’ve been closely watching the Ichimoku Cloud, and it has signaled potential support zones around $0.00000184. This suggests that there might be opportunities for me to jump back in at these price points, even if the market corrects slightly.

Market sentiment and daily active addresses

There was significantly increased interaction with the cryptocurrency Pepe, as indicated by Santiment’s data. This activity surge was particularly evident in the number of daily active users, reaching its peak earlier in November. A graph showing this trend displayed a sharp increase to more than 28,000 around November 14th.

Lately, we’ve noticed a minor dip in the number of active wallets, potentially suggesting that certain investors are cashing out their profits. Currently, the count stands at approximately 2,800.

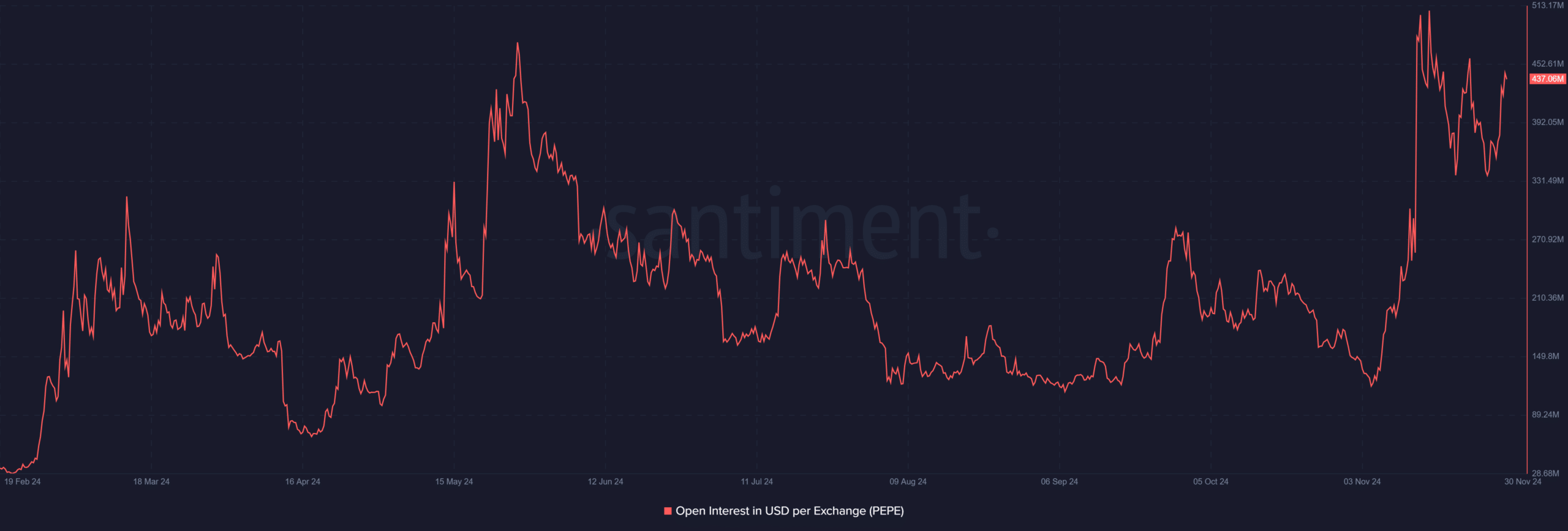

Regardless of a momentary decrease, the Open Interest (OI) graph continues to be robust, suggesting ongoing engagement from derivatives traders. Specifically, the OI graph experienced a minor uptick, exceeding $437 million.

As a researcher examining this data, I find a fascinating blend of enthusiasm and caution. In the immediate future, there seems to be high engagement, which I interpret as strong short-term participation. However, when considering the medium term, I sense a need for caution due to potential market volatility.

The bull and bear case for Pepe

The bullish case for Pepe revolves around its consistent momentum and increasing volume, suggesting a possible continuation of the uptrend.

Should Pepe manage to break through the barrier at 0.00000211, it may set its sights on the subsequent notable level at approximately 0.00000250.

On the other hand, the argument against (bearish) suggests that the market is overextended (overbought) and there’s a decrease in the number of daily active addresses.

If we don’t keep up the existing price support, there’s a possibility that the price might dip down to $0.00000184 or even lower values.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-11-30 18:15